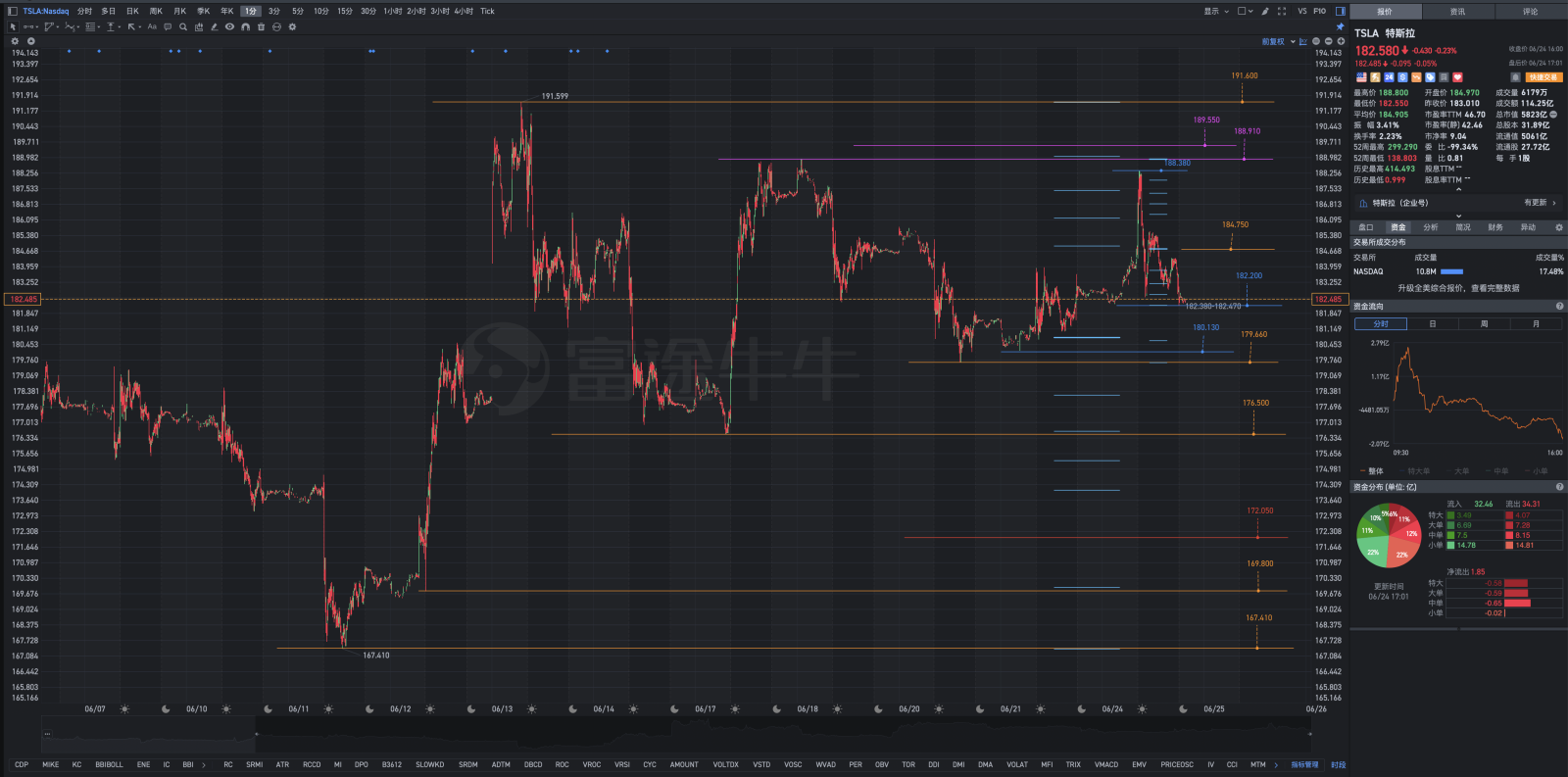

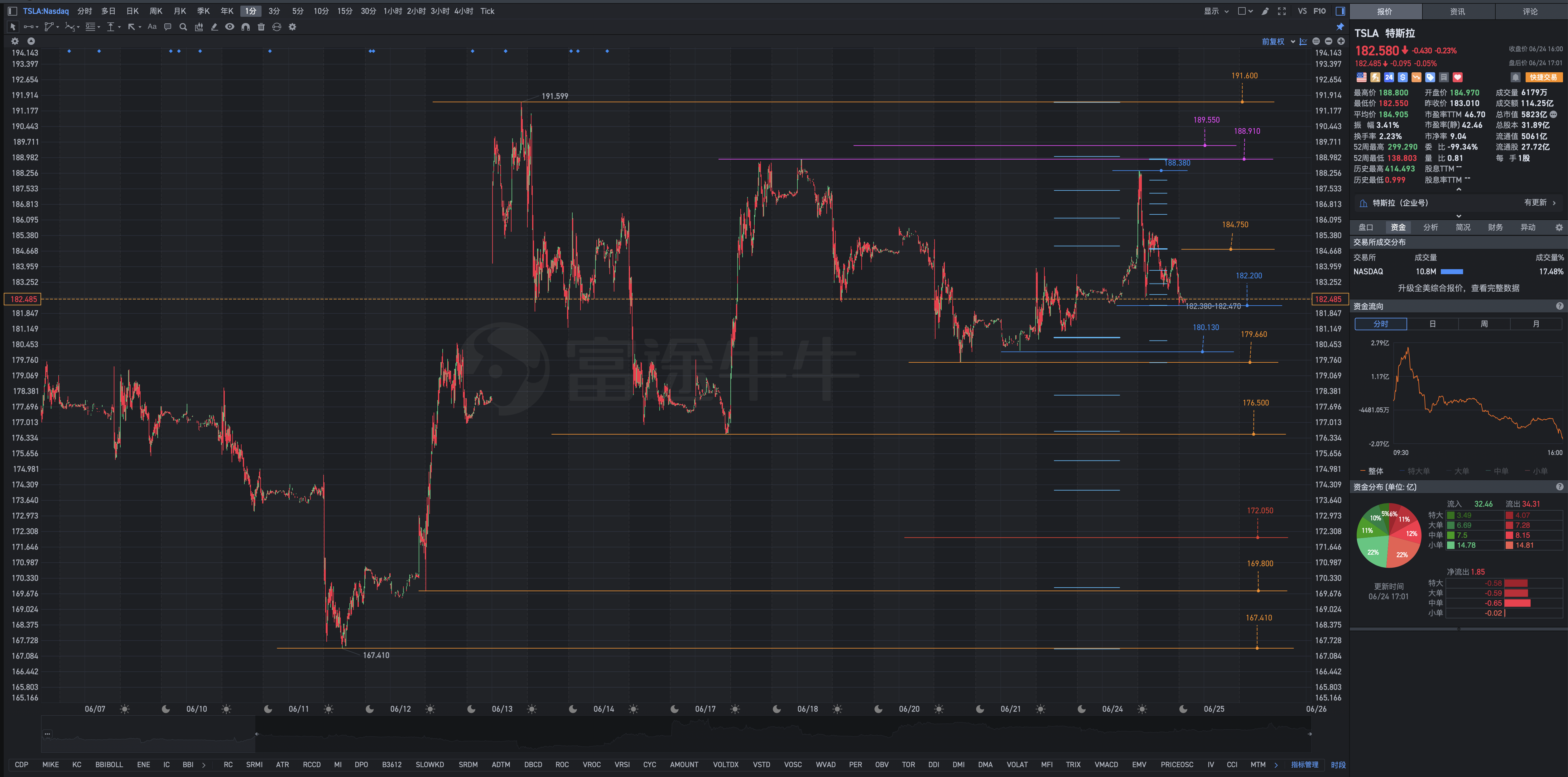

Analysis of Tesla's after-market retrading chart for Monday, June 24

The hardest people to communicate with aren't literate people, but people who have been indoctrinated with standard answers.

There are no hurdles you can't overcome, make your posture more beautiful, and work a little harder.

The general framework blueprint for Tesla's trend: Tesla's stock price first crossed the 182.800-187.420 region. The prudent side set up positions in this region. The so-called “not seeing rabbits” does not throw eagles. In the second step, Tesla's stock price crossed 187.420-191.300 and continued to rise. Step 3: Tesla's stock price rises👆It floated out of the strong resistance zone of 198.870-205.600, opening the prelude to Tesla's spectacular gains. The stock price effectively standing at 220.800 will start the main upward trend. Due to the vastness of these three regions, the rise in stock prices depends more on the gold pits made up of relatively low chips that appeared after the decline, so Tesla's strategic investors are willing to build up their overall positions. It is not until there is a major breakthrough in Tesla's fundamentals and signs of financial profit bookkeeping, that the situation of long-time stock price swings will evolve into a pattern of continuous rise.

The stock price entered the anti-aircraft fire ambush zone of 179.660-172.050, and the position layout was 176.500, with a median value of 176.500.

JC=Elias family investment transaction fighting iron law (cannot be overemphasized):

Winning in the falling market; winning in amplitude; winning in boldness; winning in wisdom; winning in open-mindedness; winning in learning; winning in change; winning in adapting; winning in mathematics; winning in physics; winning in models; winning in function; winning in vibration; winning in quantification; winning in framework; winning in moderation; winning in probability; winning in technology; winning in psychology; winning in dexterity; winning in the long term; winning in oscillation; winning in the long term; winning in investing: winning in mentality; winning in tolerance for error.

Losing to oneself; losing to oneself; losing in solidification; losing in abandonment; losing in self-reliance; losing in pursuit of strength; losing in rushing; losing in stagnation; losing unilaterally; losing in gambling; losing in protecting positions; losing in full position; losing in financing; losing in reversal; losing in Yongdong; losing in gambling; losing in complaining; losing on excuses; losing in scolding; losing in dreaming; losing in planning; losing in prediction; losing in the short term; losing in a hurry; losing in a hurry; losing in a hurry; losing in a hurry; losing in a hurry; losing in a hurry Greed; losing mentality.

98% of people will never be happy to rise, lose, or anticipate, and there are no plans of any kind with a certain percentage of treasury fund battle sequences as strong backing, so 98% can only end up in failure. Doing investment transactions is about making a living, not being a shareholder, not a battle of opinions (JC doesn't participate in opinion fights; he has no interest.) Instead, invest in a deal to win.

Warning bells are ringing: The first and last chapters of the Book of Wisdom all read “There is no empty lunch in the world.” Don't expect to read someone else's after-market review chart analysis geometry; you can make money without hard work yourself. Here, at this moment, all of JC's posts are personal expressions of personal feelings, research and exploration before, during, and after the market. There are no passionate opinions, stock recommendations, and no spiritual recipes. They cannot be used as a basis for trading. The resulting trading profits and losses can only be borne by oneself. Regardless of profit or loss, they are all responsible for it.

We have never known each other in the first place. What's more, even if you have any financial skills, it's easy to be treated as a scammer in this financial market where you play with money. Therefore, JC will not use research results as a vehicle for free money delivery at all, because there is no need for this. What are the so-called true friends in the financial markets? There is a long road ahead. Everyone walks their own way, and if they don't want to, then it's just that. If JC doesn't eat your meal, if you don't eat that kind of thing, you don't need to look at your face. Except for Jesus Christ (who is actually God, Father, Son, and Holy Spirit in one.) No one is afraid of JC.

Disclaimer: There are many “stock gods” in the securities market. The abbreviation for stock market neurosis is everywhere. They are not in psychiatric hospitals. They exist in the stock market. They return to normal as soon as they leave the stock market. They pursue a win-win situation where they can switch between long and short, that is, win twice. They are capable of everything; they are underhanded; they are misguided; they are beautiful; however, they have no plans, no funds to protect, and go all out. ALL IN is their strong point. So it's better to be clear about what needs to be stated.

This article is a personal trading log, not an opinion or individual stock recommendation. This is a well-structured US securities market, not Tianchao's A-share securities market. Bloggers are a long-term operating style. However, in special circumstances, such as large markets are particularly good. When the profit chip ratio exceeds 80-90% for a long period of time, bloggers will choose to sell and close positions to redeem floating profits. Large markets and individual stocks are bad, especially weak to extremely bad. For example, when the profit chip ratio is less than 21-7%, JC will choose a discrete random variable position layout in gradients and batches, so ordinary traders cannot imitate this operation. The level of bloggers is average. When large individual stocks are bad, they make a series of mistakes. I hereby state this.

Winning in the falling market; winning in amplitude; winning in boldness; winning in wisdom; winning in open-mindedness; winning in learning; winning in change; winning in adapting; winning in mathematics; winning in physics; winning in models; winning in function; winning in vibration; winning in quantification; winning in framework; winning in moderation; winning in probability; winning in technology; winning in psychology; winning in dexterity; winning in the long term; winning in oscillation; winning in the long term; winning in investing: winning in mentality; winning in tolerance for error.

Losing to oneself; losing to oneself; losing in solidification; losing in abandonment; losing in self-reliance; losing in pursuit of strength; losing in rushing; losing in stagnation; losing unilaterally; losing in gambling; losing in protecting positions; losing in full position; losing in financing; losing in reversal; losing in Yongdong; losing in gambling; losing in complaining; losing on excuses; losing in scolding; losing in dreaming; losing in planning; losing in prediction; losing in the short term; losing in a hurry; losing in a hurry; losing in a hurry; losing in a hurry; losing in a hurry; losing in a hurry Greed; losing mentality.

98% of people will never be happy to rise, lose, or anticipate, and there are no plans of any kind with a certain percentage of treasury fund battle sequences as strong backing, so 98% can only end up in failure. Doing investment transactions is about making a living, not being a shareholder, not a battle of opinions (JC doesn't participate in opinion fights; he has no interest.) Instead, invest in a deal to win.

Warning bells are ringing: The first and last chapters of the Book of Wisdom all read “There is no empty lunch in the world.” Don't expect to read someone else's after-market review chart analysis geometry; you can make money without hard work yourself. Here, at this moment, all of JC's posts are personal expressions of personal feelings, research and exploration before, during, and after the market. There are no passionate opinions, stock recommendations, and no spiritual recipes. They cannot be used as a basis for trading. The resulting trading profits and losses can only be borne by oneself. Regardless of profit or loss, they are all responsible for it.

We have never known each other in the first place. What's more, even if you have any financial skills, it's easy to be treated as a scammer in this financial market where you play with money. Therefore, JC will not use research results as a vehicle for free money delivery at all, because there is no need for this. What are the so-called true friends in the financial markets? There is a long road ahead. Everyone walks their own way, and if they don't want to, then it's just that. If JC doesn't eat your meal, if you don't eat that kind of thing, you don't need to look at your face. Except for Jesus Christ (who is actually God, Father, Son, and Holy Spirit in one.) No one is afraid of JC.

Disclaimer: There are many “stock gods” in the securities market. The abbreviation for stock market neurosis is everywhere. They are not in psychiatric hospitals. They exist in the stock market. They return to normal as soon as they leave the stock market. They pursue a win-win situation where they can switch between long and short, that is, win twice. They are capable of everything; they are underhanded; they are misguided; they are beautiful; however, they have no plans, no funds to protect, and go all out. ALL IN is their strong point. So it's better to be clear about what needs to be stated.

This article is a personal trading log, not an opinion or individual stock recommendation. This is a well-structured US securities market, not Tianchao's A-share securities market. Bloggers are a long-term operating style. However, in special circumstances, such as large markets are particularly good. When the profit chip ratio exceeds 80-90% for a long period of time, bloggers will choose to sell and close positions to redeem floating profits. Large markets and individual stocks are bad, especially weak to extremely bad. For example, when the profit chip ratio is less than 21-7%, JC will choose a discrete random variable position layout in gradients and batches, so ordinary traders cannot imitate this operation. The level of bloggers is average. When large individual stocks are bad, they make a series of mistakes. I hereby state this.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment