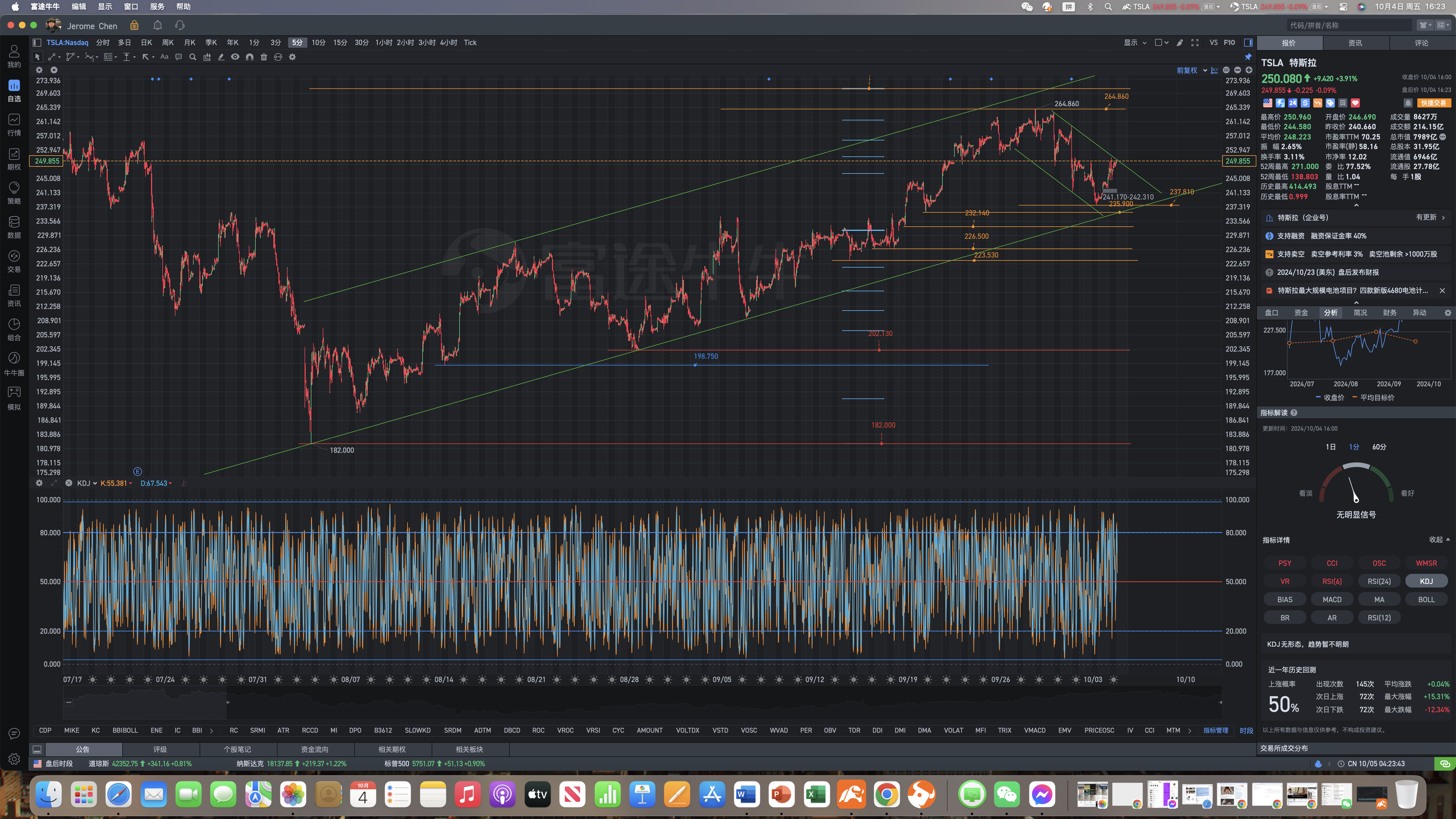

October 4th, Friday, Tesla's post-market review chart analysis: blue mountains can't hide it, after all, it flows to the east.

Transitioning from an electric auto manufacturersArtificial Intelligence deep development application company+Energy storage company+Self-driving FSD+RoboTaxis (siasun robot&automation rental car) software company+Optimus (Optimus Prime) humanoid robot company.On Monday, September 23, whether during the main trading hours or in the post-market otc trading hours, the stock price remains unchanged. Any further drop is an opportunity for establishing positions, just a matter of cost. Preventing small losses and missing out on the main uptrend is the biggest regret and mistake. On Friday, September 20, Tesla's stock price closed at 239.000Above is the following.Tesla's transformation into an Artificial Intelligence deep development company, heavily investing in the field of Artificial Intelligence, is the determination of Tesla led by Elon Musk to change the world, and also the belief of the bullish camp that the world will be changed.Significant meaning.You have the right to continue to believe that Elon Musk is building castles in the air and only looking to raise money. However, once Tesla perfects its self-driving FSD+RoboTaxis (robot taxis) software, it will be the beginning of Tesla's skyrocketing stock price. When you cannot coexist with uncertainty, deny, and reject emerging things that are still in their infancy, you also lose the future. Investors and traders can handle it according to their own situation, especially now, they need to prevent themselves from caring too much about secondary trends and arbitrage and losing out on Tesla's main uptrend. Take care of your own stock account's investment and trading, just like Vanguard handles individual retirement accounts (IRA) and 401(K) funds. Tesla's valuation system is about to undergo a stunning upgrade, and the dynamic PE ratio (TTM) of 61.12 and static PE ratio of 50.56 in the fiscal years 2024 will decrease due to the valuation system upgrade, and the profit expectations for the fiscal years 2024 and 2025 will regain momentum. A person without long-term planning and who doesn't value the psychological well-being of investment trading will not go far, even if Tesla has the potential to make an impact.You have the right to continue to think that Elon Musk is making pie and opening a bakery to raise money. However, once Tesla perfects the self-driving FSD+RoboTaxis (robot taxis) software, it will be the beginning of Tesla's soaring stock price. When you cannot coexist with uncertainty, deny, and refuse to accept emerging new things that are still in a vague stage, you also lose the future. Investors can handle it according to their own situation, especially now to prevent being too concerned about the secondary trend's movements and arbitrage and losing the main upward trend of Tesla.

Like Vanguard, manage your individual retirement account (IRA) and 401(K) fund account well, just like you would with your stock trading account. Tesla's valuation system is about to undergo a jaw-dropping upgrade, with a dynamic price-to-earnings ratio (TTM) of 61.12 and a static price-to-earnings ratio of 50.56 for the 2024 fiscal year set to decrease due to the upgrade. Profit expectations for the fiscal years of 2024 and 2025 are set to rebound. A person without long-term planning and who does not prioritize the psychological health of investment trading will not go far, even if Tesla has the potential to make a significant impact.The range is 271,000-299,290-314,800., and even higher-level.The range is 414,490-515,000.Even if you have the potential to take advantage of it, you won't be able to hold onto the floating profit chips in your hands.

The greatest luck in life is not picking up money or winning a lottery, but having someone who can lead you to a higher platform. In reality, what limits people's development is not intelligence or education, but the social circles and work environments they are in. A so-called noble person is someone who broadens your horizons and introduces you to a new world. The brilliance of tomorrow depends on your choices and actions today!

The greatest luck in life is not picking up money or winning a lottery, but someone who can take you to a higher platform. In fact, what restricts people's development is not the IQ degree, but your life circle, work circle, the so-called noble person: it is to broaden your horizons and bring you into a new world. Whether tomorrow is brilliant depends on your choices and actions today!

Ten years ago, Nvidia's stock price was $0.50 per share. Yes, only fifty cents. And this early summer, the price reached over $130 per share, an absolute increase of over 250 times. If you are attentive, look through the operators of the American individual retirement accounts (IRA) and 401(K) fund accounts, The Vanguard Group, nearly investing in all U.S. stocks they consider worth trying, especially some high-potential high-tech growth stocks. The strength of Americans' retirement pensions is by no means comparable to hedge funds or even mutual funds.

If you could go back in time, would this be the most worthwhile stock to repurchase? At least in such a short period of time, it definitely is, right?

There is also Berkshire Hathaway, the iconic conglomerate founded by Warren Buffett in 1965. Looking back to 60 years ago, Berkshire's stock price hovered around $19 per share (adjusted for inflation). Not bad; I will buy the shares you offered me, see you in 2024, when BRK.A's stock is close to $689,000 per share. This means every $100 I invested back then is now worth over $3 million.

But what about the super-rich? They spend their whole lives planning for their great-grandchildren's wealth, able to buy almost any stocks or assets they desire. Yet, even they cannot be sure which modest, low-profile company trading at $0.50 today will become a trillion-dollar giant 60 years later. Of course, the super-rich hold a vast amount of stocks, but to some extent, most of their wealth is held in the form of assets. Therefore, to truly increase their net assets over time, they tend to seek exclusive tangible assets that appreciate over time, such as luxury real estate, classic cars, and exquisite artworks.

In the long run, art is an interesting investment because the art market's performance differs significantly from stocks or bonds. A report by Citibank in 2022 cited Masterworks' research, showing that certain categories like post-war and contemporary art (artists like Picasso and Warhol) actually had a negative correlation with the stock market from 1995 to 2022. This makes art an ideal diversification tool in your investment portfolio, along with its huge appreciation potential, definitely worth going back in time and taking down that painting by Picasso or Basquiat from the wall before it dries.

In fact, the art investment platform Masterworks allows ordinary investors to access securitized investments in the asset class of wealthy artists like Banksy, Warhol, and Picasso.

Past performance does not guarantee future returns, but each of the 23 exits in Masterworks' trade have been profitable, providing investors with an annualized net return on assets held for one year at +17.6%, +17.8%, and +21.5% (excluding unsold products). The best part is, you can start investing without needing any special knowledge or degree in art history.

Tesla: With a starting price of $1.13 per share on June 29, 2010, experiencing losses and no profits, ...

For a long time, the stock price of Tesla lingered at low levels, leading to over 90% of the original participants selling cheap Tesla stocks with overwhelming disappointment. It was not until August 26, 2018, about 8 years later, that Tesla surged to a peak of $371.

Is it difficult to hold stocks for 6-8 years? (Do what you like or what you should do.)

This is almost a 33,000% increase...

Turning every $5,000 into $1.6 million. Faced with such results, it is enough to overshadow the world's profit leader of the legendary Medallion Fund, led by the world-class mathematician, investor, and philanthropist James Harris Simons, whose average annual ROI of 71.8% is put to shame (with no significant errors allowed during the period).

What is the success rate of day traders and swing traders?

The failure rate is very high. Why is it so high? Because those who attempt day trading are not mentally prepared and are looking for a 'get rich quick' scheme. Success in day trading requires two key factors: lack of emotions and cash management.

By mastering these two things, through extensive practice and patience, you may have a chance to succeed. If you do not grasp these two things, you are destined to fail.

Please note that I did not mention finding good setups, understanding strategies, or having a deep understanding of the market. That's because these are not crucial to your success. Of course, we want to know these things, but if we assume that everyone attempting day trading knows this, and the failure rate is 95%, how important are these things to your success?

This is a major secret of day trading. You must change your perspective on success and failure, focusing on what you can control. You cannot view losing trades as failures and winning trades as successes. Keep reading, and you will understand this better.

We can only control our own losses. Only you can determine the size of the loss. Loss is the most important part of a day trading plan. It is one of the few things we can control, while you can't control how much money you can make in a single trade. Market forces determine this.

You cannot say, I will make $2000 profit on the next trade, and it will happen. But you can say, I will only lose $500 or less on the next trade, and it will happen.

Therefore, if 95% of traders fail, and they control the amount of losses, then they must have done something wrong... and they indeed have. They let losers continue losing instead of controlling the losses. They sometimes have a high win rate but still don't make money because they close trades early... This increases their win rate, making them feel successful, but their profits per trade are very low.

Comparing two traders. One trader has a win rate of 80%, and the other trader has a win rate of 40%.

One person averages a profit of $300 in 8 trades, and an average loss of $1000 in 2 trades. The low profit amount and high percentage are because they closed each trade early. Therefore, they net $400 in 10 trades, averaging $40 per trade before deducting fees.

If a person has a 40% win rate, it means only 4 out of 10 trades are winning, but their average profit is $1500 and average loss is $500, so you would earn $3000. Therefore, win rate percentage can be highly misleading and often does not result in higher profits. I know a very successful trader whose win rate is approximately 40%, but some of his profits are so significant that one of them can offset all losses from 60% of his trades.

Effective money management is part of learning how to lose. Losses are part of day trading; either you accept it as part of the process and control it, or you ignore it and focus on the winners and become part of the 95%. The choice is yours, and yours alone.

Intraday trading, also known as day trading, refers to buying and selling financial instruments within the same trading day. Although many critics believe that day trading is not profitable for most participants, there are several reasons why people continue to engage in day trading:

1. High profit potential: Day traders can profit from small price fluctuations, and if done correctly, it can bring substantial profits. The allure of making money quickly is very enticing.

2. Market volatility: Day traders typically profit in volatile markets, as price fluctuations can create profit opportunities. Many traders use technical analysis and chart patterns to make informed decisions.

3. Leverage: Many brokers offer leverage to day traders, allowing them to control larger positions than just with their own capital. This can amplify profits but also increases risks.

4. Flexibility and Control: Day trading allows individuals to be their own boss and manage their own time. This independence is very appealing to those who like to make their own trading decisions.

5. Access to Technology and Information: With technological advancements, day traders can use sophisticated tools, real-time data, and trading platforms to facilitate quick decision-making.

6. Community and Culture: There is a strong community of day traders who share strategies, skills, and insights. This sense of belonging can motivate individuals to participate actively.

7. Skill Development: Some traders enjoy the challenge of developing their skills and strategies, viewing trading as a mental exercise or game rather than just a financial activity.

8. Psychological Factors: Despite the risks, the thrill of trading and the excitement of rapid profits may provide psychological satisfaction for certain individuals.

Despite these reasons, it is worth noting that many day traders do incur losses, especially those who lack experience or discipline. Successful day trading often requires a profound understanding of market dynamics, clear strategies, and strict risk management practices.

One day, Jeff Bezos asked Warren Buffett why no one could replicate his strategy, because it's very simple, but well known.

Warren Buffett's answer was very simple:

"Because no one is willing to get rich slowly".

Nowadays, everyone wants to get rich quickly. However, success in the stock market is built up slowly. You must be patient, but also stick to your choices. For Warren Buffett, 99% of people are unable to replicate his strategy simply due to lack of patience.

Warren Buffett's lifelong strategy was inherited from his mentor Benjamin Graham, who detailed it in his favorite book 'The Intelligent Investor'.

Warren Buffett's personal wealth over the years.

The amounts in this chart are in millions of US dollars and have been adjusted for inflation.

Warren Buffett had a fortune of 0.105 million US dollars at the age of 20. By the age of 30, this fortune had reached 9 million US dollars. Ten years later, his fortune reached 0.265 billion US dollars. Warren Buffett's progress was slow but steady.

To apply such a strategy, Warren Buffett must have patience. This is the secret to Warren Buffett's success in the investment world.

Warren Buffett was not yet a billionaire at the age of 50. This happened when he was just over 50. For him, the pace of developments accelerated significantly, as between the ages of 60 and 90, his wealth rose from 8 billion US dollars to today's 83 billion US dollars.

If you want to be a successful stock market investor like Warren Buffett, you need to develop patience as a fundamental quality. Those who do so will reap huge rewards, as Warren Buffett's statement reveals: "The stock market is designed to transfer funds from the active to the patient."

Therefore, to make money in the stock market, one must have patience.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment