Elias=Jerome, the JC family's iron law of trade warfare (cannot be overemphasized):

Winning in the falling market; winning in amplitude; winning in boldness; winning in wisdom; winning in open-mindedness; winning in learning; winning in change; winning in adapting; winning in mathematics; winning in physics; winning in models; winning in function; winning in vibration; winning in quantification; winning in framework; winning in moderation; winning in probability; winning in technology; winning in psychology; winning in dexterity; winning in the long term; winning in oscillation; winning in the long term; winning in investing: winning in mentality; winning in tolerance for error.

Losing to oneself; losing to oneself; losing in solidification; losing in abandonment; losing in self-reliance; losing in pursuit of strength; losing in rushing; losing in stagnation; losing unilaterally; losing in gambling; losing in protecting positions; losing in full position; losing in financing; losing in reversal; losing in Yongdong; losing in gambling; losing in complaining; losing on excuses; losing in scolding; losing in dreaming; losing in planning; losing in prediction; losing in the short term; losing in a hurry; losing in a hurry; losing in a hurry; losing in a hurry; losing in a hurry; losing in a hurry Greed; losing mentality.

98% of people will never be happy to rise, lose, or anticipate, and there are no plans of any kind with a certain percentage of treasury fund battle sequences as strong backing, so 98% can only end up in failure. Doing investment transactions is about making a living, not being a shareholder, not a battle of opinions (JC doesn't participate in opinion fights; he has no interest.) Instead, invest in a deal to win.

Alarm bells are ringing: The first and last chapters of the Book of Wisdom both read “There is no empty lunch in the world.” Don't expect to read other people's post-market review chart analysis; you can make money without effort on your own. Here, at this moment, all of JC's posts are private pre- and post-market personal statements, research and exploration. There is no passionate struggle of opinions, stock recommendations, and even less spiritual soup. They cannot be used as a basis for trading. The resulting trading profits and losses can only be borne by oneself. Regardless of profit or loss, all blame is taken by oneself.

We have never known each other in the first place. What's more, even if you have any financial skills, it's easy to be treated as a scammer in this financial market where you play with money. Therefore, JC will not use research results as a vehicle for free money delivery at all, because there is no need for this. What are the so-called true friends in the financial markets? There is a long road ahead. Everyone walks their own way, and if they don't want to, then it's just that. If JC doesn't eat your meal, if you don't eat that kind of thing, you don't need to look at your face. Except for Jesus Christ (who is actually God, Father, Son, and Holy Spirit in one.) No one is afraid of JC.

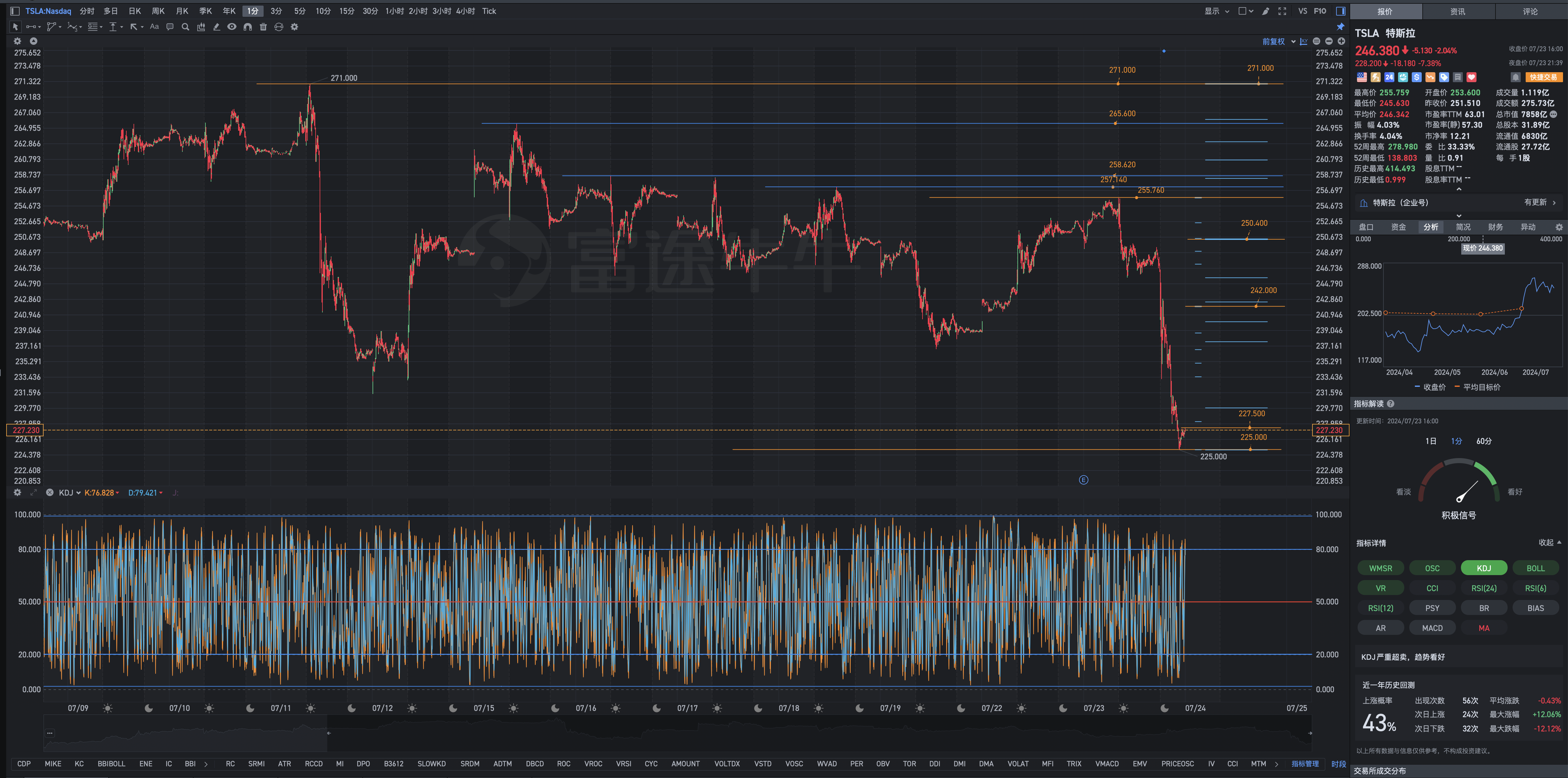

Disclaimer: There are a lot of neuroses in the securities market, so it's better to be clear about what needs to be clarified. This article is a personal trading log, not an opinion or individual stock recommendation. This is a well-structured US securities market, not an A-share securities market. Bloggers are a long-term operating style. However, in special circumstances, such as large markets, are particularly good. When the profit chip ratio exceeds 80-90% for a long period of time, bloggers will choose to sell and close positions to redeem part of the floating profit. Large markets and individual stocks are bad, especially weak to extremely bad. For example, when the profit chip ratio is less than 21-7%, JC will choose a planned and step-by-step layout, divided into gradients, batches, and discrete random variables, so ordinary traders cannot imitate this operation.

71383005 : Can Tsla hold 193 until Friday?