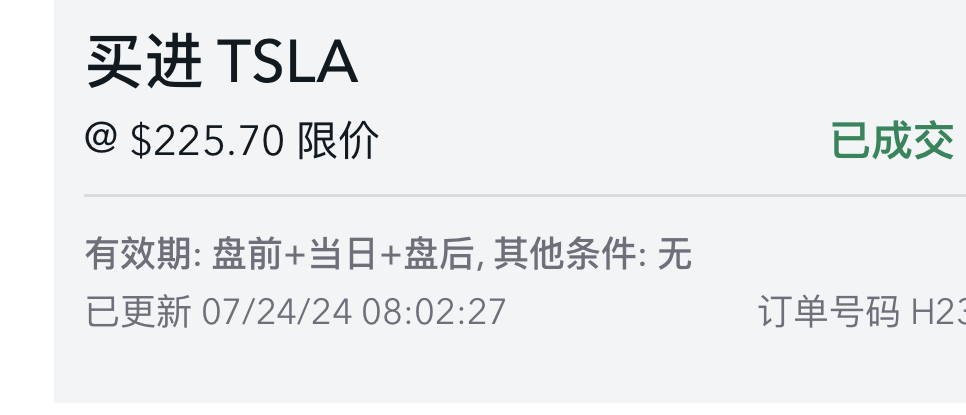

Analysis of the Tesla pre-market review chart on Wednesday, July 24: sharp and mean, falling into a rock and hitting $14

Control emotions; control risk. The stock price after falling is the stock price that has released risk.

Beliefs are exclusive (hers). People who have faith have simple opinions and are firm in their will. They are consistent from lifestyle habits to living in the world, and they are not confused when faced with choices. Knowledge is not strength; faith is strength.

In the upward trend, there is a sure-fire trick called “actively buying a suit”. What holds you back is not a shackle, but a gold necklace... Actively buying a package is not about buying higher, but rather adjusting the end, maybe at the end, and suck lower in batches. (Active bid buying is also the highest level of investment transactions.) The biggest risk for investment traders is ignorance, and the biggest risk is ignorance of ignorance.

The deep-seated reason most investors fail.

First, there is no investment belief. There is a lack of a foundation for observing and understanding the market, and a source of internal strength for integrating knowledge and action.

Second, man's limited rationality. I inadvertently think of myself as an omniscient and omnipotent being, and use finite to pursue infinity and perfection. Investing is an art of regret. We must acknowledge the flaws in the system, the imperfection of results, and the uncertain and serendipitous nature of the fate of investment.

Third, financial markets are naturally infused with pragmatic ideological tendencies. Most participants had no faith. If they didn't believe it, they only saw that the spirit wasn't working; they believed everything, and they didn't believe anything. The pragmatic approach does not start from the principles and system of the transaction, but rather measures everything based on the benefits and results of the transaction.

On positions

1. If there is a trick to success, it is to understand his (her) person's position and be able to balance their own and his/her positions at the same time.

2. Different positions and different opinions. Do you need to be clear about what you want, or what others want?

3. Only weak people are limited by positions. Pragmatism is superior to virtual, and objectivity is superior to authority.

4. A kind, scientific, and rational understanding cannot have positions. Alas, how can pedantic people understand this? They just know: bullish or bearish? Go long or short? Where can the increase go? Where can a drop go? There are no functions at all: independent variables, dependent variables, domain, range, range, open range, closed interval, half-open and half-closed interval, extreme value, maximum value, monotonicity, monotonic interval, single value correspondence, multi-value correspondence, etc.

On stand:

1. If there is a secret to success, it is to be aware of his (her) person's position and to be able to take into account both his (her) person's position at the same time.

2. Different positions and different views, do you have to be clear about what you want, or what others want?

3. Only the weak will be restricted by the position, the pragmatism is higher than the virtual, and the objective is higher than the authority.

4. Kindness, science, and rational cognition cannot have a stand. Alas, how can pedantic people understand this? They Just Know: Bullish or Bearish? Long or short? Where can it go up? Where can it fall? No function at all: independent variable, dependent variable, domain of definition, range, interval, open interval, closed interval, half-open half-closed interval, extreme value, maximum value, monotonicity, monotonic interval, single-value interval, multi-value interval, etc. Wait.

Stocks with falling stock prices have the greatest potential; falling stock prices are the greatest benefit. This experience has been proven many times by the market, and it is worth remembering and must know the superior tactic of action. If this experience is combined with betting stocks or institutional stock holdings, it must not be easily let go.

Remember the following seemingly irregular series: 101.810; 138.800; 167.410; 176.500; 202.000; 216.250; 230.500; 242.000,...

Never underestimate Tesla's own ability to repair itself. 136.800-160.510 have all come this way, do we still need to be afraid now?

When Tesla's stock price plummeted, gold fell from the sky, stunned you, and bold people took it away.

Elias=Jerome is a long-term value investor, not just a game-driven speculative random trader (speculators should leave the market after the stock price falls below the 231.520 platform, or even take advantage of the rebound to sell short and open positions). They think it's more of an opportunity. The worse the technical graphics, the better. This is completely different from the speculative trading mentality.

Looking at the long-term plan, there may be a better chance tomorrow. Now it has dropped to $17. The stock price is already very attractive, and it continues to hit new lows. Currently, the lowest price is 226.700. The 231.520 platform has already been broken, and the technical starting point for this round of gains can be thought to have started at 202.000. If you count from the high of 271.000 in this round to 225.010, it has already dropped $48.990.

Elias=Jerome, the JC family's iron law of trade warfare (cannot be overemphasized):

Winning in the falling market; winning in amplitude; winning in boldness; winning in wisdom; winning in open-mindedness; winning in learning; winning in change; winning in adapting; winning in mathematics; winning in physics; winning in models; winning in function; winning in vibration; winning in quantification; winning in framework; winning in moderation; winning in probability; winning in technology; winning in psychology; winning in dexterity; winning in the long term; winning in oscillation; winning in the long term; winning in investing: winning in mentality; winning in tolerance for error.

Losing to oneself; losing to oneself; losing in solidification; losing in abandonment; losing in self-reliance; losing in pursuit of strength; losing in rushing; losing in stagnation; losing unilaterally; losing in gambling; losing in protecting positions; losing in full position; losing in financing; losing in reversal; losing in Yongdong; losing in gambling; losing in complaining; losing on excuses; losing in scolding; losing in dreaming; losing in planning; losing in prediction; losing in the short term; losing in a hurry; losing in a hurry; losing in a hurry; losing in a hurry; losing in a hurry; losing in a hurry Greed; losing mentality.

98% of people will never be happy to rise, lose, or anticipate, and there are no plans of any kind with a certain percentage of treasury fund battle sequences as strong backing, so 98% can only end up in failure. Doing investment transactions is about making a living, not being a shareholder, not a battle of opinions (JC doesn't participate in opinion fights; he has no interest.) Instead, invest in a deal to win.

Alarm bells are ringing: The first and last chapters of the Book of Wisdom both read “There is no empty lunch in the world.” Don't expect to read other people's post-market review chart analysis; you can make money without effort on your own. Here, at this moment, all of JC's posts are private pre- and post-market personal statements, research and exploration. There is no passionate struggle of opinions, stock recommendations, and even less spiritual soup. They cannot be used as a basis for trading. The resulting trading profits and losses can only be borne by oneself. Regardless of profit or loss, all blame is taken by oneself.

We have never known each other in the first place. What's more, even if you have any financial skills, it's easy to be treated as a scammer in this financial market where you play with money. Therefore, JC will not use research results as a vehicle for free money delivery at all, because there is no need for this. What are the so-called true friends in the financial markets? There is a long road ahead. Everyone walks their own way, and if they don't want to, then it's just that. If JC doesn't eat your meal, if you don't eat that kind of thing, you don't need to look at your face. Except for Jesus Christ (who is actually God, Father, Son, and Holy Spirit in one.) No one is afraid of JC.

Disclaimer: There are a lot of neuroses in the securities market, so it's better to be clear about what needs to be clarified. This article is a personal trading log, not an opinion or individual stock recommendation. This is a well-structured US securities market, not an A-share securities market. Bloggers are a long-term operating style. However, in special circumstances, such as large markets, are particularly good. When the profit chip ratio exceeds 80-90% for a long period of time, bloggers will choose to sell and close positions to redeem part of the floating profit. Large markets and individual stocks are bad, especially weak to extremely bad. For example, when the profit chip ratio is less than 21-7%, JC will choose a planned and step-by-step layout, divided into gradients, batches, and discrete random variables, so ordinary traders cannot imitate this operation.

Winning in the falling market; winning in amplitude; winning in boldness; winning in wisdom; winning in open-mindedness; winning in learning; winning in change; winning in adapting; winning in mathematics; winning in physics; winning in models; winning in function; winning in vibration; winning in quantification; winning in framework; winning in moderation; winning in probability; winning in technology; winning in psychology; winning in dexterity; winning in the long term; winning in oscillation; winning in the long term; winning in investing: winning in mentality; winning in tolerance for error.

Losing to oneself; losing to oneself; losing in solidification; losing in abandonment; losing in self-reliance; losing in pursuit of strength; losing in rushing; losing in stagnation; losing unilaterally; losing in gambling; losing in protecting positions; losing in full position; losing in financing; losing in reversal; losing in Yongdong; losing in gambling; losing in complaining; losing on excuses; losing in scolding; losing in dreaming; losing in planning; losing in prediction; losing in the short term; losing in a hurry; losing in a hurry; losing in a hurry; losing in a hurry; losing in a hurry; losing in a hurry Greed; losing mentality.

98% of people will never be happy to rise, lose, or anticipate, and there are no plans of any kind with a certain percentage of treasury fund battle sequences as strong backing, so 98% can only end up in failure. Doing investment transactions is about making a living, not being a shareholder, not a battle of opinions (JC doesn't participate in opinion fights; he has no interest.) Instead, invest in a deal to win.

Alarm bells are ringing: The first and last chapters of the Book of Wisdom both read “There is no empty lunch in the world.” Don't expect to read other people's post-market review chart analysis; you can make money without effort on your own. Here, at this moment, all of JC's posts are private pre- and post-market personal statements, research and exploration. There is no passionate struggle of opinions, stock recommendations, and even less spiritual soup. They cannot be used as a basis for trading. The resulting trading profits and losses can only be borne by oneself. Regardless of profit or loss, all blame is taken by oneself.

We have never known each other in the first place. What's more, even if you have any financial skills, it's easy to be treated as a scammer in this financial market where you play with money. Therefore, JC will not use research results as a vehicle for free money delivery at all, because there is no need for this. What are the so-called true friends in the financial markets? There is a long road ahead. Everyone walks their own way, and if they don't want to, then it's just that. If JC doesn't eat your meal, if you don't eat that kind of thing, you don't need to look at your face. Except for Jesus Christ (who is actually God, Father, Son, and Holy Spirit in one.) No one is afraid of JC.

Disclaimer: There are a lot of neuroses in the securities market, so it's better to be clear about what needs to be clarified. This article is a personal trading log, not an opinion or individual stock recommendation. This is a well-structured US securities market, not an A-share securities market. Bloggers are a long-term operating style. However, in special circumstances, such as large markets, are particularly good. When the profit chip ratio exceeds 80-90% for a long period of time, bloggers will choose to sell and close positions to redeem part of the floating profit. Large markets and individual stocks are bad, especially weak to extremely bad. For example, when the profit chip ratio is less than 21-7%, JC will choose a planned and step-by-step layout, divided into gradients, batches, and discrete random variables, so ordinary traders cannot imitate this operation.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment