ANZ Banking Group: Expected Significant Cost Pressure Ahead

Who is ANZ Group?

$ANZ Group Holdings Ltd (ANZ.AU)$ is a multinational bank and financial services company listed in Australia. As one of the four major banks in Australia, ANZ's main business is focused on Australia and New Zealand, while also having multiple branches in other regions of the world, providing comprehensive financial services including personal banking, commercial banking, institutional banking, and wealth management.

What is ANZ's main business?

ANZ's business is divided into four parts: Australian Commercial Banking, Australian Retail Banking, New Zealand Business and Institutional Banking.

ANZ's Commercial and Retail Banking business is dedicated to providing a range of financial services in Australia, including savings, transactions, loans, credit cards, insurance, and investment products. Commercial banking mainly targets small and medium-sized enterprises, while retail banking targets individuals and small micro-enterprises.

New Zealand Business refers to the comprehensive banking and financial services ANZ provides to individuals, businesses, and governments in New Zealand.

Institutional banking mainly provides services to large enterprises, government agencies, and financial institutions, including investment banking and financial market trading.

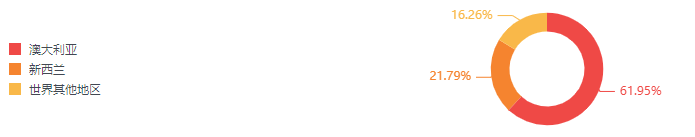

Regionally, ANZ's revenue mainly comes from Australia and New Zealand, which account for more than 80% of total revenue. The remaining 20% of revenue mainly comes from the Asian region, with branches in key markets such as China, Japan, and Singapore, mainly focusing on institutional banking business.

Highlights of the Latest Quarter

Since the beginning of 2024, ANZ's stock price has risen by 14.30%, outperforming Australia's largest bank, $CommBank (CBA.AU)$, with a relatively impressive performance. In addition to other stable and positive factors, in the recently released half-year financial report for the 24 fiscal year, ANZ showcased the following performance highlights to investors:

1. Stable increase in institutional banking business

As shown in the latest half-year financial report, compared to the same period last year, revenue from institutional banking business has steadily increased, with a growth rate of 34% in the first half of 2021.

It can be seen that the institutional banking business has performed particularly well in this half-year performance, which is the area where ANZ has done better than other banks, and also their advantage and differentiation. The revenue of this business increased by 34%, accounting for 43% of the total revenue. This growth rate is particularly outstanding in the increasingly fierce market competition. According to the board's statement, ANZ's institutional banking business growth is mainly due to the company's strategic deployment, which has enabled it to have more exposure than its peers in this field, helping it achieve higher revenue in the current fierce market competition. At the same time, the net interest income of institutional banking increased by 3% compared to the same period last year, achieving positive progress in managing loan and deposit portfolios in institutional business.

2. Rapid development of ANZ Plus

ANZ Plus is a key strategic project of ANZ, which is a comprehensive digital banking platform that provides customers with one-stop banking services. It aims to enhance customer experience and service efficiency through digital transformation, thereby enhancing the bank's competitiveness. In addition to basic banking services, the platform also provides customers with personalized financial advice and tools, helping customers make wiser financial decisions through digital transformation and artificial intelligence. It encourages customers to actively participate in managing their financial situation through the use of its financial health functions, and 47% of ANZ Plus customers are using one or more financial health functions on the platform.

Since its launch, ANZ Plus has attracted a large number of new customers, and currently has more than 650,000 customers, successfully encouraging them to use this new platform consistently. Managed deposits have significantly increased to AUD 13 billion, accounting for more than 8% of ANZ's retail banking deposits.

These two highlights are the main driving forces behind the ANZ stock price increase.

Shareholder Returns Increase, But ANZ Expects Significant Cost Pressure

In the first half of the 24 fiscal year, ANZ's total revenue was AUD 10.347 billion, a decrease of nearly 2% year-on-year, mainly due to the decrease in net interest income (NII). The high interest rates and consumers' more cautious mindset have led to interest expenses far exceeding income. At the same time, expenses increased by 4% year-on-year, which is related to ANZ's strategic deployment of digital transformation and business expansion. According to the company's report, the diluted earnings per share for the first half of the 2024 fiscal year were AUD 1.115, compared to AUD 1.13 for the same period last year. The total net profit was AUD 3.4 billion, a decrease of about 4% in mid-term profits.

As part of its capital management plan, the bank also plans to buy back up to AUD 2 billion of shares in the market. The mid-term dividend increased by 2% to AUD 0.83 per share, and the company's dividend yield is currently 6.02%. The company also stated that the preparatory work for the merger of Suncorp Bank into the ANZ Group is progressing smoothly and is expected to create long-term value for shareholders.

For the current ANZ, the biggest risk is the cost pressure that has exceeded expectations, that is, when the return on investment will come under the capital management level is similar to that of peers. As mentioned earlier, ANZ is constantly expanding and reforming, whether it is the development of digital platforms or the acquisition of Suncorp, all of which show its ambition. In the short term, ANZ may continue to face profit challenges, mainly from intensified competition in the housing loan sector and the sustained increase in wholesale financing and deposit costs, which may continue into the second half of the 2024 fiscal year. In addition, it is also necessary to pay attention to the fact that ANZ's credit loss provision is only AUD 70 million, lower than the industry average, which means its risk resistance ability is relatively low.

Currently, the company's TTM P/E ratio is 12.85x, which is at a relatively high level. In the short term, ANZ's continuous rise in stock price has been driven by its future strategic planning. However, in the medium and long term, sustainable core profit growth needs to be restored to maintain the current stock price.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment