Apple Options Market Heats Up as Soaring Stock Price Fuels Heavy Call Volume

$Apple (AAPL.US)$ shares climbed more than 6% Friday after the iPhone maker announced a record $110 billion share buyback, boosted its dividend and reported better-than-expected quarterly financial results Thursday night. That's also fueling the heaviest trading in options for the stock in at least two weeks.

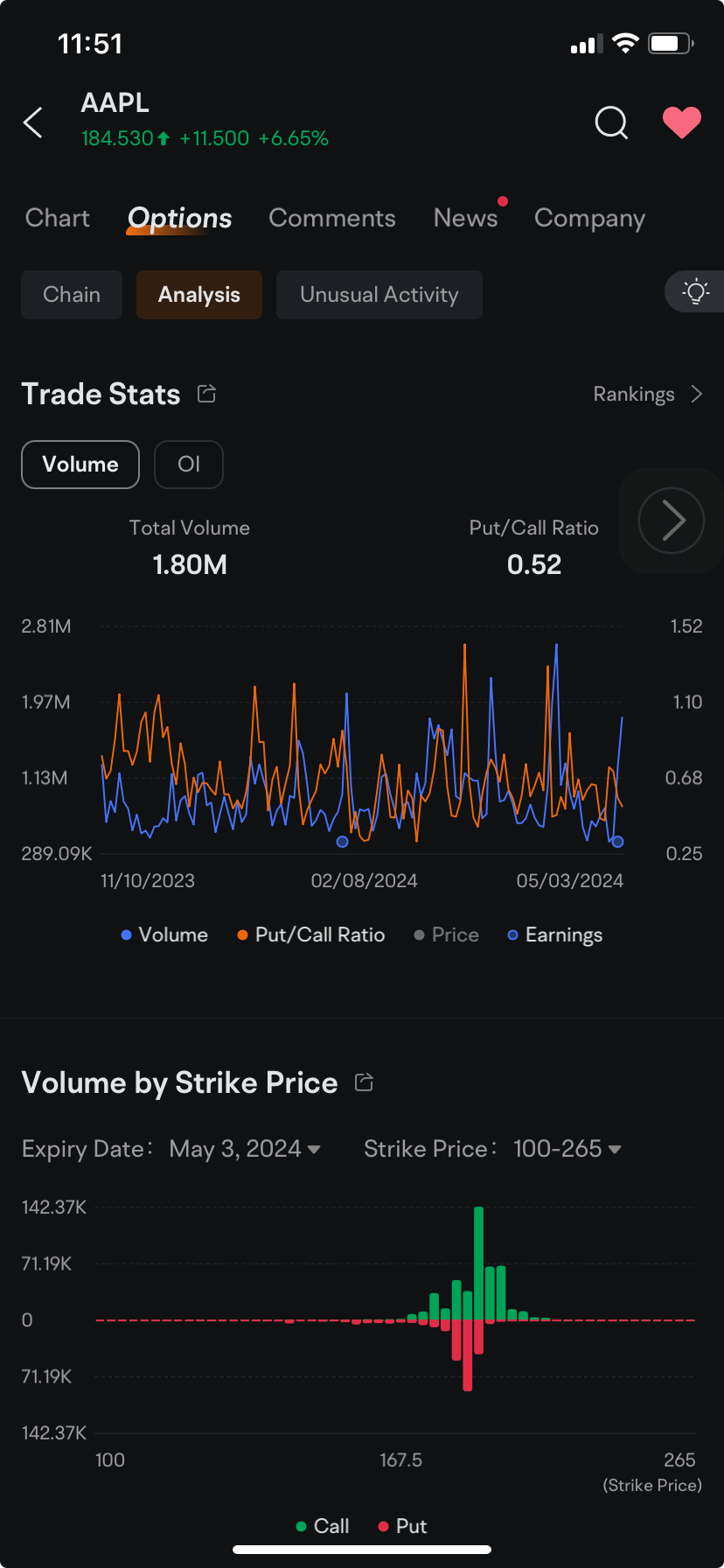

As of 11:50 a.m. in New York Friday, about 1.88 million options changed hands, more than double the 715,160 contracts for the full trading day on April 26, when the previous weekly options expired. The surge came a day after its earnings release which typically drives volatility and increased bets on the stock. That landed Apple in the top spot for the highest stock options volume, surpassing $Tesla (TSLA.US)$ and $NVIDIA (NVDA.US)$, which typically alternate in occupying that slot.

Shares soared after Apple announced the biggest share buyback in U.S. history as it reported revenue and earnings in its fiscal second quarter ended March 30 that topped analysts' estimates. The company also forecast sales growth in low-single digits in percentage terms for the current quarter that ends June 30.

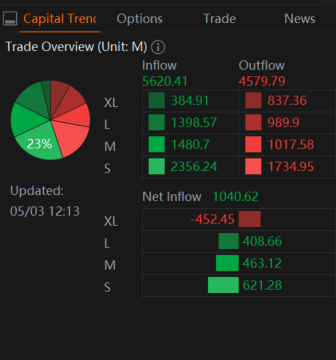

JPMorgan raised its price target on Apple to $225 from $210, Dow Jones reported. Apple attracted a net inflow of $1.04 billion, according to data compiled by moomoo as of 12:14 p.m. Friday in New York.

The highest volume is seen in options expiring at close today, with calls almost double puts. The most-active contract is the call option that gives the holder the right to buy Apple stock at $185 by the end of the trading day, with volume reaching more than 144,000. That may include investors who wrote call options and are now buying them back because they don't want their shares to be called away today.

Even deep-pocketed investors are also in on the action. Within seconds after the market opened, a block trade was posted for call options that give the holder the right to buy 175,000 Apple shares at $172.50 each by the end of the day. The buyer paid a $2.49 million premium for that specific trade.

At that exact time, another block trade for calls expiring today was posted, with the buyer paying a premium of $2.07 million for the option to buy 175,000 Apple shares at $175 each. It's possible that the trades were meant to close a position or buy back the calls sold at those strike prices, but the available data doesn't give that level of detail.

The biggest block trade posted before noon Friday was for a contract that doesn't expire until Dec. 19, 2025. That was for a call that gives the holder the right to buy Apple 150,000 shares at $170 each. The buyer paid a $5.6 million premium for those 1,500 calls covering 100 shares each.

In the case of put options, the heaviest volume is in the contract that give the holder the right to sell Apple shares at $182.50 each by the end of today, with 91,110 changing hands around noon. Holders are rushing to unload them before the value goes to zero. The price of those puts shrank 98.5% to 15 cents.

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

70183665 : Every time, this kind of prediction gave quite a few people a path to harvest

72734102 : Apple gave up on ev! Why they spent alot

72927947 72734102 : Yes

Svetlana Polishuk : yes