As Trump Threatens 25% Tariff, What's the BOC Rate-Cut Path?

Just as Canada's federal government announced over $6 billion worth of stimulus measures that could spur consumer spending from mid-December through the first part of 2025, US President-Elect Donald Trump shocked with an announcement of a new plan to impose 25% tariffs on all goods and services from Canada from Day 1.

Such a plan, if enacted, would no doubt dampen Canada's economic outlook while putting upward pressure on inflation, at least initially, through a weaker Loonie translating into higher prices of imported goods.

How is the Bank of Canada reacting?

Traditionally, the central bank doesn't factor in policy decisions into its forecasts until the specifics are known.

In his first public speech as deputy governor, Rhys Mendes signaled this time was no different.

While acknowledging the importance of the US-Canada bilateral relationships for the Great White North's economy, we're still "a ways away from Inauguration day," he said during a question-and-answer session at the Greater Charlottetown Area Chamber of Commerce session, referring to January 20, when the new US President takes his function.

Rhys said the BoC will incorporate the Trump Administration's policies in its outlook once specifics are known.

Besides, media reports indicated that Prime Minister Justin Trudeau and Donald Trump had a "constructive" discussion following Trump's announcement, suggesting the threat could be a repeat tactic used by the president-elect to negotiate with Canada and Mexico as he had done prior to renegotiating the Canada-US-Mexico trade agreement during his first term.

Economists Warn 25% TariffsCould Trigger Canadian Recession

In other words, for now, the central bank still expects the slowdown in population growth and a pickup in GDP per capita to translate into a GDP growth of 2% next year. Inflation, currently at 2%, is expected to remain near the middle of the 1%-3% operational range.

Economists warned that if Trump imposes a 25% tariff on Canadian products, Canada's economy could fall into recession.

In early October, the Canadian Chamber of Commerce released a report highlighting that a 10% tariff on Canadian products would cost the Canadian economy between 0.9% and 1% of GDP. It would also result in a loss of $1,100 in real annual income for both Canadians and Americans.

Expect rate cuts to continue

Because Rhys confirmed the outlook even after Trump's announcement and the planned stimulus package consisting of lifting the Goods and Services Tax (GST) on targeted items and sending $4.7 billion worth of $250 checks, he also stuck to the monetary policy stance announced in October.

That stance was laid out in his remarks, that were prepared before Trump's announcement: "If the economy evolves broadly in line with our forecast, then it’s reasonable to expect further cuts to our policy rate."

He added that since that October decision, the inflation rate coming in at 2% is actually in line with the central bank's expectations.

He also said that the central bank expects "inflation will once again fade into the background as it settles back at 2%." This signals a focus on supporting growth.

But remember that the BOC worried in October that a 50bp rate cut could send the message the Canadian economy is in trouble. It might thus stick to 25bp this time around, especially with inflation back at 2% and a stimulus on its way in the short term.

Keep an eye on Canada's GDP and employment data

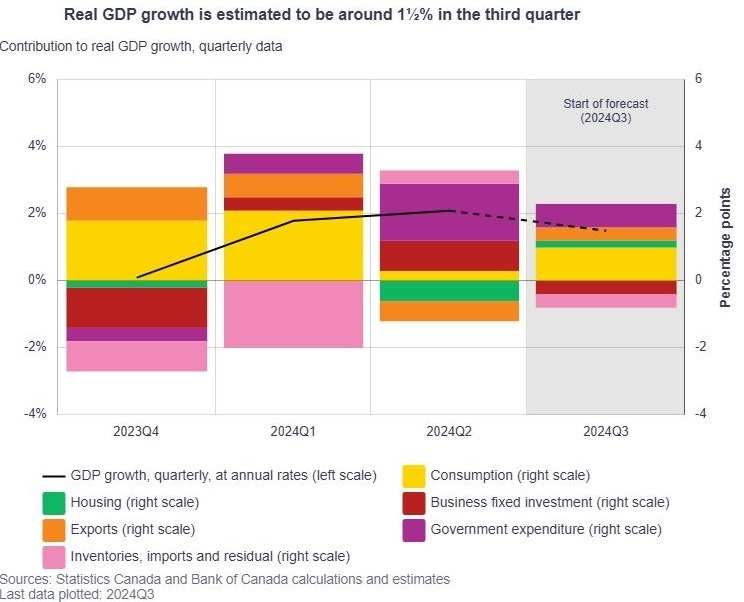

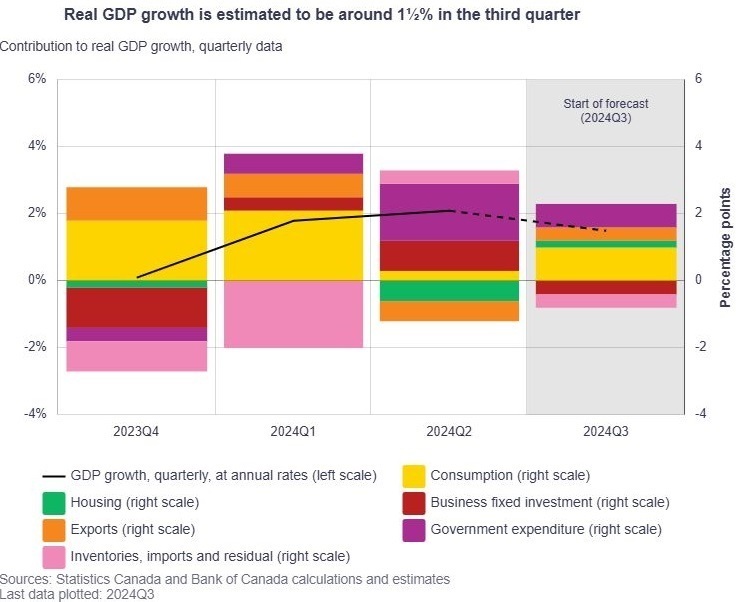

It is no wonder Rhys said the BoC will closely watch the GDP and employment data due before the Dec. 11 policy decision the last of this year, as it continues make decisions one meeting at a time.

The third quarter GDP report is due Dec. 3 and the employment report Dec. 6.

Such a plan, if enacted, would no doubt dampen Canada's economic outlook while putting upward pressure on inflation, at least initially, through a weaker Loonie translating into higher prices of imported goods.

How is the Bank of Canada reacting?

Traditionally, the central bank doesn't factor in policy decisions into its forecasts until the specifics are known.

In his first public speech as deputy governor, Rhys Mendes signaled this time was no different.

While acknowledging the importance of the US-Canada bilateral relationships for the Great White North's economy, we're still "a ways away from Inauguration day," he said during a question-and-answer session at the Greater Charlottetown Area Chamber of Commerce session, referring to January 20, when the new US President takes his function.

Rhys said the BoC will incorporate the Trump Administration's policies in its outlook once specifics are known.

Besides, media reports indicated that Prime Minister Justin Trudeau and Donald Trump had a "constructive" discussion following Trump's announcement, suggesting the threat could be a repeat tactic used by the president-elect to negotiate with Canada and Mexico as he had done prior to renegotiating the Canada-US-Mexico trade agreement during his first term.

Economists Warn 25% TariffsCould Trigger Canadian Recession

In other words, for now, the central bank still expects the slowdown in population growth and a pickup in GDP per capita to translate into a GDP growth of 2% next year. Inflation, currently at 2%, is expected to remain near the middle of the 1%-3% operational range.

Economists warned that if Trump imposes a 25% tariff on Canadian products, Canada's economy could fall into recession.

In early October, the Canadian Chamber of Commerce released a report highlighting that a 10% tariff on Canadian products would cost the Canadian economy between 0.9% and 1% of GDP. It would also result in a loss of $1,100 in real annual income for both Canadians and Americans.

Expect rate cuts to continue

Because Rhys confirmed the outlook even after Trump's announcement and the planned stimulus package consisting of lifting the Goods and Services Tax (GST) on targeted items and sending $4.7 billion worth of $250 checks, he also stuck to the monetary policy stance announced in October.

That stance was laid out in his remarks, that were prepared before Trump's announcement: "If the economy evolves broadly in line with our forecast, then it’s reasonable to expect further cuts to our policy rate."

He added that since that October decision, the inflation rate coming in at 2% is actually in line with the central bank's expectations.

He also said that the central bank expects "inflation will once again fade into the background as it settles back at 2%." This signals a focus on supporting growth.

But remember that the BOC worried in October that a 50bp rate cut could send the message the Canadian economy is in trouble. It might thus stick to 25bp this time around, especially with inflation back at 2% and a stimulus on its way in the short term.

Keep an eye on Canada's GDP and employment data

It is no wonder Rhys said the BoC will closely watch the GDP and employment data due before the Dec. 11 policy decision the last of this year, as it continues make decisions one meeting at a time.

The third quarter GDP report is due Dec. 3 and the employment report Dec. 6.

Source: Bank of Canada

What does it mean for investment opportunities?

With the stimulus package likely on its way, Canadian retailers would no doubt benefit, while also continuing to increase shareholder returns.

Loblaw, Empire Co, Metro, and Dollarama have payout ratios of 26.73%, 25.0%, 31.81%, and 7.96%, respectively. Their trailing twelve-months (TTM) dividend yields are 1.08%, 1.81%, 1.46%, and 0.22%, respectively.

The rise in Canadian wages has also been supporting consumer spending growth.

According to Statistics Canada, wages in Canada increased by 4.6% in August of 2024 compared to the same month in 2023. Additionally, the savings rate among Canadian residents has been on the rise since the second quarter of 2022. The Household Saving Rate in Canada increased to 6.9% in the second quarter of 2024, up from 6.7% in the previous quarter. As Canada’s wage growth outpaces inflation, consumers' real disposable income is set to increase, which will further boost consumption.

Stay up to date with the latest news fromMoomoo News Canada.

#ratecuts #tariffs #canada

What does it mean for investment opportunities?

With the stimulus package likely on its way, Canadian retailers would no doubt benefit, while also continuing to increase shareholder returns.

Loblaw, Empire Co, Metro, and Dollarama have payout ratios of 26.73%, 25.0%, 31.81%, and 7.96%, respectively. Their trailing twelve-months (TTM) dividend yields are 1.08%, 1.81%, 1.46%, and 0.22%, respectively.

The rise in Canadian wages has also been supporting consumer spending growth.

According to Statistics Canada, wages in Canada increased by 4.6% in August of 2024 compared to the same month in 2023. Additionally, the savings rate among Canadian residents has been on the rise since the second quarter of 2022. The Household Saving Rate in Canada increased to 6.9% in the second quarter of 2024, up from 6.7% in the previous quarter. As Canada’s wage growth outpaces inflation, consumers' real disposable income is set to increase, which will further boost consumption.

Stay up to date with the latest news fromMoomoo News Canada.

#ratecuts #tariffs #canada

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment