Asian indices drop alongside US indices as Fed's forward guidance turns hawkish

– Asian indices such as the HSI futures (-1.2% to 19,650) and Nikkei225 (-1.1%% to 38,735) are trading in the red as of 925AM this morning, led by the overnight 2% drop in US indices.

– The moves come after the Fed lowered rates overnight by 25 basis points to 4.25 to 4.5% as expected, but issued quarterly forecasts showing several officials expect fewer rate cuts in 2025 than previously estimated.

– Fifteen of 19 officials now see a higher risk inflation will exceed their expectations rather than undershoot them, a massive shift from the three who felt the same back in September. And 14 officials said they see higher uncertainty around their inflation forecast.

– The dot plot was adjusted in a hawkish direction; now projecting 50 bps of cuts in 2025 (down from 100 bps in September). The long-run dot edged higher to 3.0%, its fourth consecutive quarterly rise. Notably, 6 (prev. 4) of 19 participants believe this is 3.5% or higher

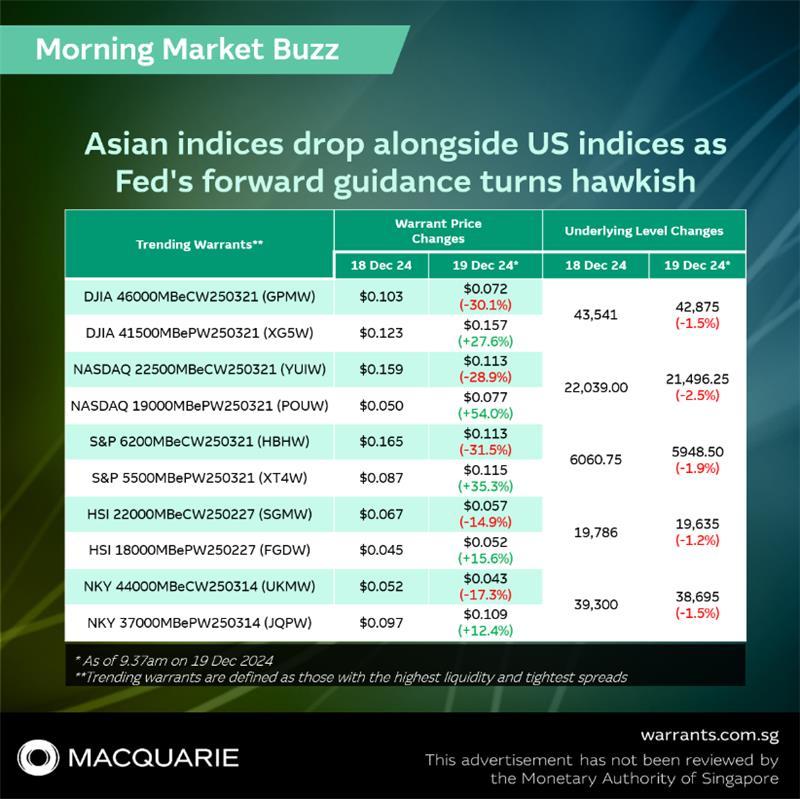

– Following the drop in key Asian and US indices, put warrants tracking the indices rose between 12% to 54% as of 935AM this morning

– Today's Bank of Japan's rate decision is the next event risk for traders, with any surprise in the policy outcome likely to whip up more volatility in global markets. (Bloomberg)

– Investors wanting to hedge against further short-term pullbacks in the indices may wish to consider our index put warrants, while those who see a rebound from here can consider our call warrants. Both will move in greater magnitudes than the underlying futures indices they track while requiring a low capital outlay, as evidenced by this morning's magnified moves in the call and put warrants.

The codes for the trending index warrants mentioned above are as follows:

Dow call $DJIA 46000MBeCW250321 (GPMW.SG)$

Dow put $DJIA 41500MBePW250321 (XG5W.SG)$

Nasdaq call $NASDAQ 22500MBeCW250321 (YUIW.SG)$

Nasdaq put $NASDAQ 19000MBePW250321 (POUW.SG)$

S&P500 call $S&P 6200MBeCW250321 (HBHW.SG)$

S&P500 put $S&P 5500MBePW250321 (XT4W.SG)$

HSI call $HSI 22000MBeCW250227 (SGMW.SG)$

HSI put $HSI 18000MBePW250227 (FGDW.SG)$

Nikkei225 call $NKY 44000MBeCW250314 (UKMW.SG)$

Nikkei225 put $NKY 37000MBePW250314 (JQPW.SG)$

Dow call $DJIA 46000MBeCW250321 (GPMW.SG)$

Dow put $DJIA 41500MBePW250321 (XG5W.SG)$

Nasdaq call $NASDAQ 22500MBeCW250321 (YUIW.SG)$

Nasdaq put $NASDAQ 19000MBePW250321 (POUW.SG)$

S&P500 call $S&P 6200MBeCW250321 (HBHW.SG)$

S&P500 put $S&P 5500MBePW250321 (XT4W.SG)$

HSI call $HSI 22000MBeCW250227 (SGMW.SG)$

HSI put $HSI 18000MBePW250227 (FGDW.SG)$

Nikkei225 call $NKY 44000MBeCW250314 (UKMW.SG)$

Nikkei225 put $NKY 37000MBePW250314 (JQPW.SG)$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment