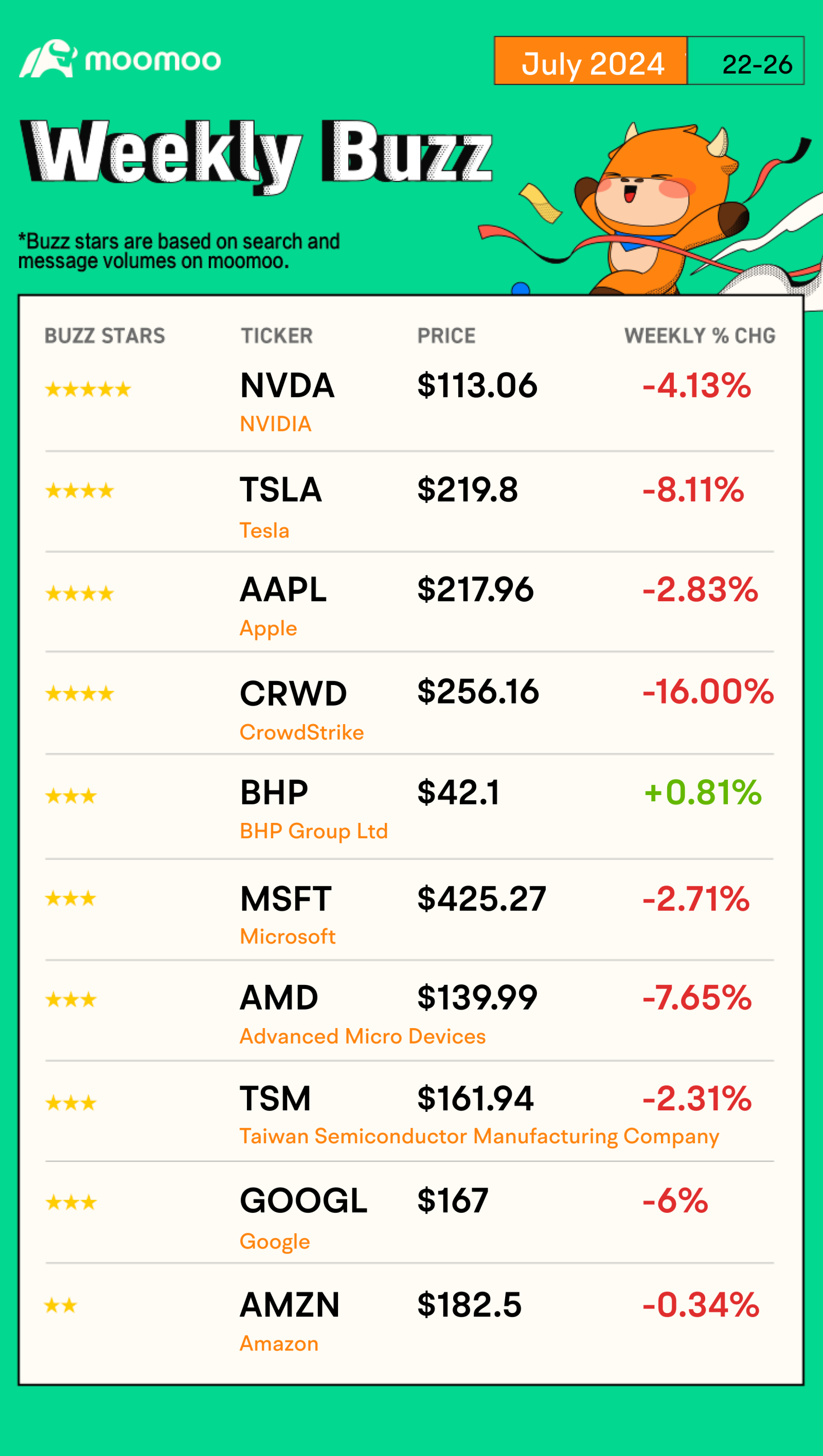

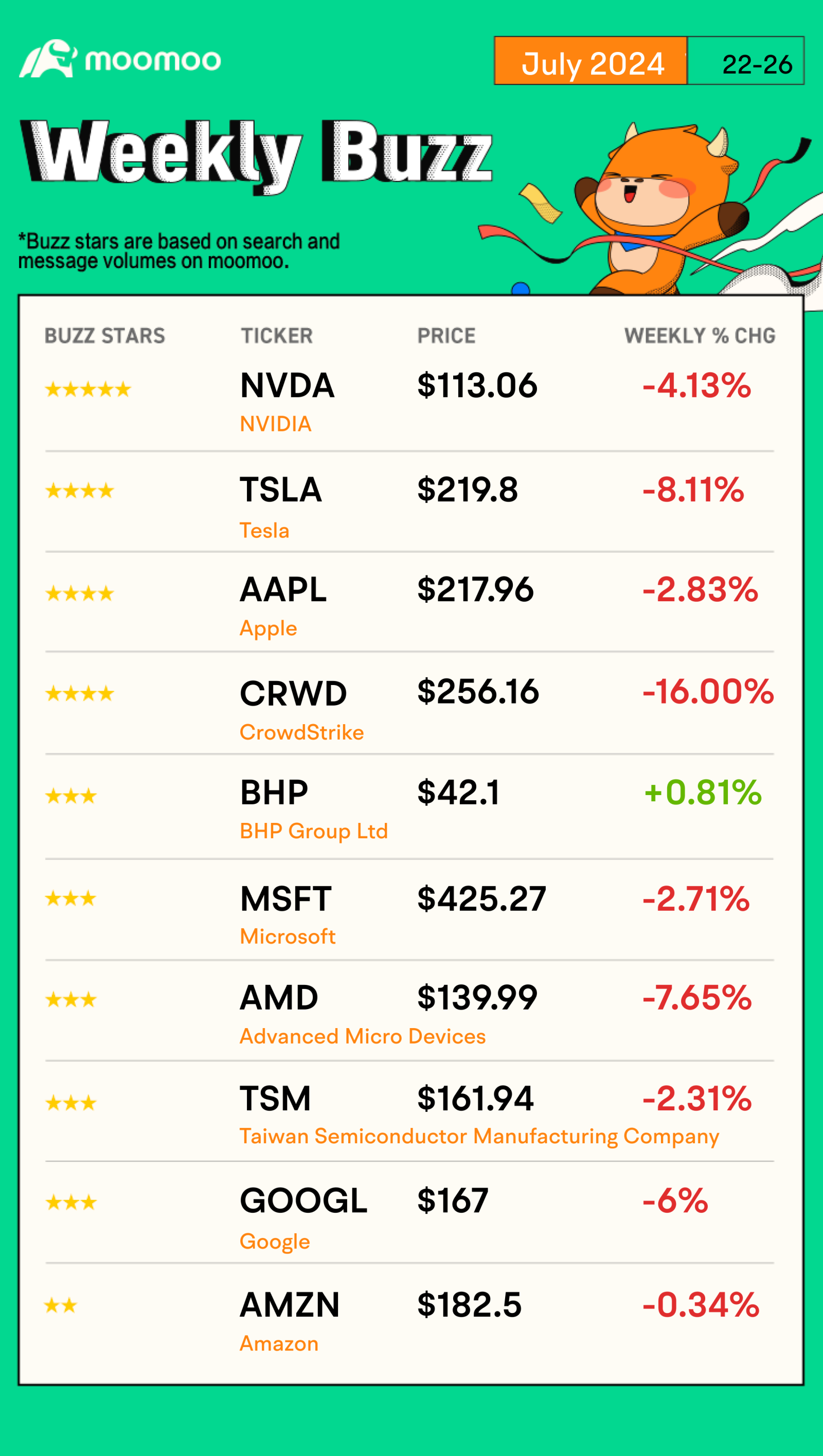

Aussie Weekly Buzz | Recap for the bleeding US market

Hello mooers!!!

Welcome back to Aussie Weekly Buzz, where we review the news, performance, and community sentiment of the top ten buzzing stocks on moomoo based on search and message volumes! Comment below to answer the Weekly Topic question for a chance to win an award!

Let's dive into the buzzing stocks last week!

1. NVDA Buzzing Stars ⭐⭐⭐⭐⭐

$NVDA.US$ shares dropped by 4.13% last week. Nvidia is reportedly designing a new variant of its most powerful GPU specifically for the Chinese market, with shipments expected to begin in the second quarter of 2025. This move comes despite concerns over restrictions from the U.S. and allies on selling advanced processors to China, which have negatively impacted Nvidia's stock. The strategy indicates Nvidia's continued commitment to China, a major market for its products, and could generate significant short-term revenue.

- Mooers Insights:

@ISTJ: Stop worrying about him (Jensen) selling again. Coz there are still around 2.6M shares his broker will continue selling according the filed plan.

@RetireInStyle: $NVDA.US$ will be 110-130 range till the next financial report.... think back 400-500 for 3 mths before it comes to now.... accumulate and hold is the key for Nvidia. R u confidence? I am.... :)

@Michael Fong: Looking at volume of shorts it looks like too many people are shorting Nvidia no wonder the pull of gravity is so strong just like Tesla but unlike Apple stock which has been spared.

2. TSLA Buzzing Stars ⭐⭐⭐⭐

$TSLA.US$ shares slid by 8.11% last week. Tesla reported Q2 revenue of $25.5 billion, slightly above the $24.63 billion forecasted by Bloomberg consensus and an uptick from the $24.93 billion posted a year ago. However, adjusted earnings per share (EPS) came in at $0.52, missing expectations of $0.60 while marking a 43% down year-over-year. The company's net income stood at $1.49 billion.

- Mooers Insights:

@NourTrades: TSLA currently has a double top at the 226 level. This also has a $20 gap that I am keeping a close eye on. It is FOMC week so you need be careful as far as sizing goes.

@ZnWC: Some commented that Tesla's share price fell was also due to the SpaceX incident. If this was so, the stock should rebound when the stock market opens tomorrow...... Read more>>

3. AAPL Buzzing Stars ⭐⭐⭐⭐

Apple shares declined by 2.83% last week. Apple is going to release its Q3 earnings on August 1, after the market closes. Wall Street expects EPS of $1.34 on revenue of $84.3 billion. iPhone revenue is still the bellwether for the Apple business, making up the majority of total revenue. Gross margins will also be under the spotlight amid a steady upward trajectory over the past few years, lifted as the firm has bought more of its supply chain in-house and grown its IT services businesses. AI developments will also be closely watched, with any updates on Apple's new generative AI software, Apple Intelligence, also closely watched. Apple intelligence is expected to drive a device upgrade cycle that could boost iPhone and iPad sales.

- Mooers Insights:

@kkwong13: Apple has massive potential with Apple Intelligence feature, they will be a lot of Apple loyal fans going to rush buying iPhone16, iMac & iPad, I watch + others service revenue + higher ASP price with AI features. With raising ASP price of 8% to 15% across all iPhone16, iMac, iPad products, that will easily improve it's revenue & earning, highly potential to hit $300 by year

4. CRWD Buzzing Stars ⭐⭐⭐⭐

Shares of cybersecurity company $CRWD.US$ dropped by 16% last week, after a recent technology outage caused by a security update led to global disruptions, affecting 8.5 million Windows devices. The incident, which resulted in system crashes and impacted critical infrastructure like hospitals, banks, and airports, has led to significant investor uncertainty. Several Wall Street analysts have downgraded the stock; for instance, Guggenheim's John DiFucci and a BTIG analyst both moved their ratings from Buy to Neutral, citing potential resistance to new deals and more negative feedback than expected. The market remains unsure about the long-term impact, suggesting that CrowdStrike faces a significant challenge in regaining trust and stabilizing its business.

- Mooers Insights:

@MACKGforEver: The outage was enormous in scale and harmed customers' physical machines; The even bigger issue is that this debacle happened because Crowdstrike didn't have any testing or release plans in place...... Read more>>

@Singh Rahul: My main question is when is a good time to start building a small position? What are some red and yellow flags to look out for?...... Read more>>

5. BHP Buzzing Stars ⭐⭐⭐

$BHP.US$ shares dropped by 0.49% and $BHP.AU$ rose 0.81% last week. Earlier, BHP has reported a milestone in its iron ore production, achieving a record output for the fiscal year 2024, while also experiencing a significant increase in copper production. The company attributes these successes to strategic expansions and acquisitions, particularly in Australia, despite facing operational challenges due to adverse weather conditions. By the way, BHP will release its financial results for the second half of FY24 before the market open on August 27.

- Mooers Insights:

@EvanderAU: It might not be so bad for the two major Aussie iron ore producers, though, suggest UBS. BHP’s dividend is likely to be lower than it was in 2023, but it’s still going to pay out a whopping US$3.5 billion in dividends – and that's just for the current June half. Rio’s payout is likely to add around US$3.1 billion to shareholders’ coffers.

@OB1KENOB: Miners are so undervalued it’s unbelievable. I’m not changing my stance. Don’t let the whale investors steal your shares.

6. MSFT Buzzing Stars ⭐⭐⭐

Microsoft shares dropped by 2.71% last week. Microsoft is set to report fiscal Q4 earnings after the close on July 30. Expectations are EPS of $2.93 on revenue of $64.38 billion. This marks a 9.3% and 14.6% increase, respectively, compared to last year's period. Beyond the headline figures, investors will be watching for sustained growth in Microsoft's cloud platform Azure, which has been fueling sales and earnings growth in previous quarters. Cloud revenue is expected to reach $37.2 billion. Furthermore, investors will also be watching closely commentary on AI as the firm has established itself as an early leader in the sector.

- Mooers Insights:

@Talented Mr Ripley: What a mess that will unfold over the next 12 months to add to the markets pullback. prepare for the worse, Hope for the best.

@whqqq: Although Microsoft stock has been a great buy historically, I'm avoiding it now due to one huge red flag.

7. AMD Buzzing Stars ⭐⭐⭐

$AMD.US$ shares dropped by 7.65% last week. On last Wednesday, an AMD executive announced the company's new Ryzen 9000 series desktop processors will be pushed out by one or two weeks in early August as initial shipments "did not meet" its quality expectations. Additionally, AMD is scheduled to release earnings after the market closes on July 30, and its artificial-intelligence story "will still probably be all that matters to investors" , according to Bernstein analyst Stacy Rasgon.

- Mooers Insights:

@Naiyin: If you see most of the analyst rate it as $200. It just keep dropping like crazy before earring? There has to be a reason, but why I don't see any news about it? Any fundamental problem here that makes this stock YTD because negative?

8. TSM Buzzing Stars ⭐⭐⭐

$TSM.US$ shares dropped by 2.31% last week. Earlier, TSMC released its Q2 earnings, with revenue reaching NT$247.8 billion, exceeding expectations and achieving the fastest growth since 2022. The company also raised its full-year revenue growth forecast, as demand for its advanced chips continued to surge amid enthusiasm over artificial intelligence.

- Mooers Insights:

@StellaGoh: The recent downturn in its stock price presents an attractive opportunity for savvy investors looking to capitalize on $Taiwan Semiconductor(TSM.US)$'s long-term growth prospects. Read more>>

9. GOOGL Buzzing Stars ⭐⭐⭐

$GOOG.US$ shares dropped by 5.97% and $GOOGL.US$ shares dropped by 6% last week. Alphabet reported earnings of $1.89 per share on $84.74 billion in revenue, exceeding consensus estimates of $1.84 per share on $84.19 billion in revenue. However, revenue from its YouTube advertising segment fell short of forecasts. The tech giant also announced a cash dividend of 20 cents a share that will be paid on Sept. 16 to shareholders of record as of Sept. 9.

- Mooers Insights:

@Scoreville: It's not just Google, its a red day for most. Can’t enjoy the up days unless you have down days to come up from. While going long, (Investing) lately ive been just zooming out to avoid the short term noise, (daily or weekly charts). short term charts are emotional rollercoasters, and no need of them if you dont day or swing trade.

@Opydac: I think the company has a lot of leverages to improve its net profit margin: Cloud growth, AI and operational efficiency. A calm long term investor would wait for the end of this consolidation phase to reinforce its position

10. AMZN Buzzing Stars ⭐⭐

$AMZN.US$ shares declined by 0.34% last week. Amazon is scheduled to release earnings after the market closes on August 1. Wall Street expects EPS of $1.01 and revenue of $148.54 billion, while Amazon guides for 144.00 billion to $149.00 billion. EBIT is expected to increase 17% in Q2 and 10% in Q3, boosted by improved profitability in North America and accelerated growth of Amazon Web Services. E-commerce and advertising had a strong showing in Q1, which investors will be keen to see continue this quarter.

- Mooers Insights:

@Mr Long Term: The firm anticipates that the company's Amazon Web Services (AWS) and North American e-commerce segments will help power strong, second-quarter performance. Morgan Stanley's analysts are looking for AWS to grow at least 18% as an indicator of its positioning in the generative artificial intelligence (AI) space.

@10baggerbamm: The way that I would buy Amazon is $AMZU.US$. it's a 2X leverage ETF I think Amazon common will put $10 on this week to the upside so on a percentage basis you're going to get double that move on the leveraged ETF.. you're not getting double the dollar move but you're getting double the percent move.

Congrats to the following mooers whose comments were selected as the top comments last week! ![]()

The selected TOP comments to win the reward for Aussie Weekly Buzz: Incidents of Tech and Candidate last week:

Comment below and share your ideas! We will select up to 15 TOP COMMENTs for a reward next week. Winners will get 200 POINTs next Monday, with which you can exchange gifts at Reward Club.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

steady Pom pipi : AAPL=TSLA2.0![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Will “Apple Smart” arrive late? Will allegedly miss the debut of iOS 18 and miss the first iPhone 16

Will “Apple Smart” arrive late? Will allegedly miss the debut of iOS 18 and miss the first iPhone 16

$AAPL.US$

It's over, it makes me feel and$TSLA.US$ The same.

Apple Intelligence's main AI features may be postponed until October, and iOS 18.0 and 18.1 beta versions will be launched at the same time.

mr_cashcow : Thanks again for the reward points!![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Diversified product ecosystem: iPhone, Mac, iPad, Apple Watch, and AirPods drive revenue and profitability

Diversified product ecosystem: iPhone, Mac, iPad, Apple Watch, and AirPods drive revenue and profitability

Multiple services segment growth: Apple Music, Apple TV+, Apple Arcade, and Apple Care contribute significantly to revenue, so many awesome apple TV shows that locks in subscriptions

Multiple services segment growth: Apple Music, Apple TV+, Apple Arcade, and Apple Care contribute significantly to revenue, so many awesome apple TV shows that locks in subscriptions

Innovation and R&D: AI & foldable phone, recently announced super slim iPhone model alongside their super slim ipad

Innovation and R&D: AI & foldable phone, recently announced super slim iPhone model alongside their super slim ipad

Exceedingly strong brand loyalty: Customer retention and loyalty drive repeat business

Exceedingly strong brand loyalty: Customer retention and loyalty drive repeat business

Global expansion: Despite slow down of sales in China, they have cut price in India to boost sale

Global expansion: Despite slow down of sales in China, they have cut price in India to boost sale

Efficient supply chain management that boost profit margins

Efficient supply chain management that boost profit margins

I am definitely keeping my eyes on $AAPL.US$ they recently slash their iPhone prices in India and although there is a slight delay in their AI service launch I still think it will be able to perform well with the price going up after earnings is released due to the following:

Yi Long Ma : I'm thinking that the price will go up after earnings. Although it might not be too much.

Analysts expect revenue and earnings to grow from the year-ago period.

The iPhone maker could also provide updates related to artificial intelligence.

Although worries surrounding slowing sales in China have weighed on Apple's stock, but analysts predict the third quarter could be the end of the decline, ahead of recovery. Also, they slashed price in India

protraderx : Jensen is selling from his right hand but buying back (re-accumulate at cheaper price) through a third party on the left hand - who knows. Not the first time after insiders sold, stock goes even higher and even goes parabolic again

ZnWC : My bet is Apple share price may fall after earnings.

Here is my analysis:

Positive

1) Expected to report revenue of $84.39 billion, +3.1% YoY

2) Net income is projected to be $20.64 billion, or $1.34 per share, an increase YoY

3) Apple is expected to launch an AI-supercharged iPhone 16 in September after recently unveiling iOS 18 with Apple Intelligence and an AI partnership with OpenAI.

6) Wedbush analyst said Apple could be on track to reach a $4 trillion market capitalization with a new iPhone upgrade cycle in the near future.

Negative

7) Analysts project Apple will report -2.6% decline in Q3 sales in China according to consensus estimates

8) Fed may delay rate cut to a later date beyond September as the inflation becomes sticky and employment data remains strong triggered weaker demand in tech products

9) Rotation of funds to small caps has not bottomed yet and mega stocks like Apple stock continue to be bearish.

102362254 : I believe Apple has a good chance of rising after its earnings release. Historically, strong earnings reports coupled with positive market sentiment have often led to upward movement in Apple's stock. Apple's solid fundamentals and track record of success point towards a positive trend. Their ongoing innovation and successful products and services segments all add to a positive outlook.

Dadacai : I think it will go up in the short term since Apple will probably do share buyback. iPhone 16 is also going to be the first phone to support AI features so sales forecast is strong.

DouGiee : keeping my eyes on meta heh

puddy1 : I am bullish of AAPL and I think the price will go up after earnings release. even thought there may be delay in launch of AI features, these may have already been priced in already. Given that revenue is expected to increase, I think the price will go up, unless there’s any unexpected negative news.

JulW21 : There are a few factors which will affect Apple share price such as earnings performance vs expectations, product sales performance, macro economic factors, market sentiments, news and etc. My prediction for Apple after earnings release is that there will be price volatility. However, over the long run Apple stock should be bullish.

SneakyBear : I believe Apple's ($AAPL.US$) price will likely go up after its earnings release. Apple has consistently shown strong performance, driven by robust sales of its flagship products like the iPhone, Mac, and iPad. Additionally, the company's growing services segment, including the App Store, Apple Music, and iCloud, continues to provide a steady revenue stream. With the anticipated release of new products and ongoing innovations in technology, Apple is well-positioned to exceed market expectations. Moreover, Apple's strong brand loyalty and expanding ecosystem of devices and services are significant factors that can drive its stock price higher post-earnings. Looking forward to them releasing the new iOS with AI!

Hase Investment King : My guess is that $AAPL.US$ going to be either maintain or drop slightly lower.

$AAPL.US$ earnings prospects for 2024 are mixed with some positive and challenging aspects. Analysts expect Apple's earnings to grow modestly, with predictions of a 12.14% increase in earnings per share, reaching about $7.39 per share by the end of the year.

However, the company has faced headwinds, particularly with declining iPhone sales in China, which saw a 24% drop in the first six weeks of 2024 due to competition from local brands like Huawei. This has raised concerns about Apple's market share in its largest market outside the US.

Despite these challenges, there are several catalysts that could boost Apple's performance in the latter half of 2024. The upcoming iPhone 16 launch, new product announcements, and potential developments in generative AI and AR technologies (like the Vision Pro headset) are expected to drive growth. But AI and AR may seem delayed.

Additionally, Apple's services segment, which includes iCloud, AppleCare, and the App Store, continues to show robust growth, contributing significantly to its revenue.

Overall, while Apple's current revenue and earnings show some year-over-year declines, the company's strong ecosystem, innovative product pipeline, and growth in services are likely to sustain its long-term prospects.

AnnYeo God of Money : I believe $AAPL.US$ sales will be pushed up by the recent reduced iPhone prices in India, a move linked to the government's decision to cut import tariffs on smartphones from 20% to 15%. The price cuts affect several models, including the iPhone 13, 14, and 15, with reductions ranging from ₹300 to ₹6,000, depending on the model. The iPhone 15 Pro, for example, has seen its price drop by about ₹5,100, now retailing at ₹1,29,800.

These reductions aim to make iPhones more competitive in the Indian market, where they are traditionally priced higher than in the U.S., often about 1.5 times more expensive.

Will AU : Based on the research and analysis from multiple sources, I believe that the price of Apple's stock (AAPL) is likely to increase following its upcoming earnings release.

Here are the key factors supporting this prediction:

1. Analyst Optimism and Upward Revisions: Several prominent analysts have raised their price targets for Apple. TD Cowen increased its target to $250, and Raymond James also raised its target to $250. This indicates strong confidence in Apple's financial performance and future growth prospects.

2. Strong Earnings and Revenue Growth Projections: Analysts forecast continued growth in Apple's earnings and revenue. For example, the average earnings per share (EPS) forecast for 2024 is $6.72, with an expected increase to $7.39 in 2025. Similarly, revenue is projected to grow from $394.26 billion in 2024 to $419.96 billion in 2025.

3. Positive Market Sentiment and Product Launches: The market sentiment around Apple's upcoming product launches, particularly the iPhone 16, is highly positive. Analysts expect the new product to drive significant growth, contributing to what they describe as the next AI supercycle.

4. Consensus Rating: The majority of analysts maintain a "Buy" rating for Apple's stock, with an average 12-month price target around $235.41, suggesting a potential upside from its current price.

Taking these factors into account, it is reasonable to expect that Apple's stock price will likely rise after the earnings release, reflecting the strong optimism and positive outlook from the analyst community.

The above comment are not advise for any particular trading decisions. Kindly make your own research.