Article on BOJ's interest rate hike retreat speculation and CPI, as well as some strong stock price indices.

Major news and market conditions today

Yesterday.

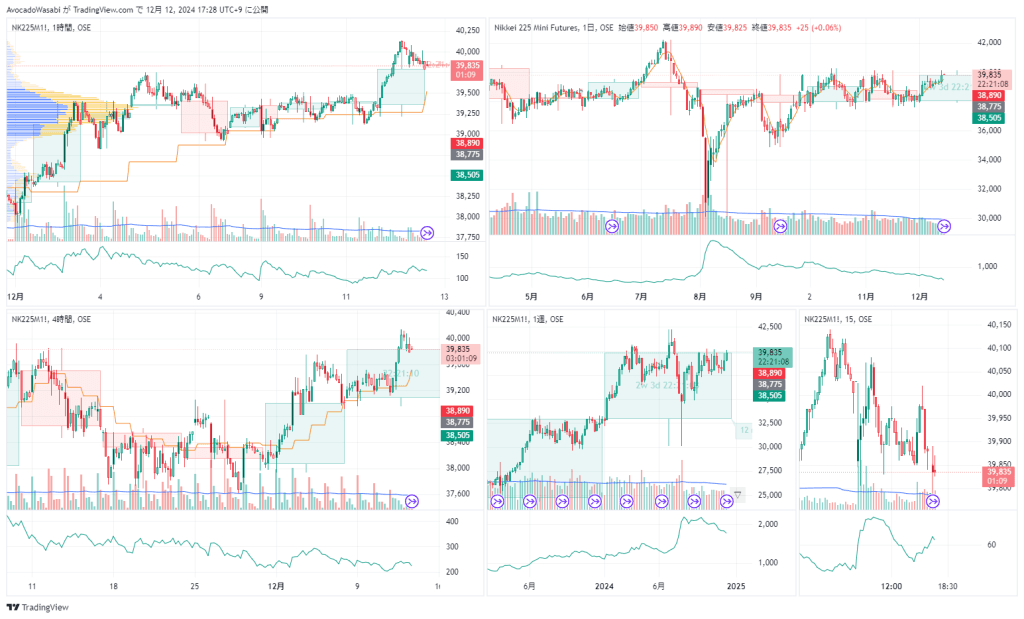

・In the night session, the Nikkei Average Futures touched 40,000 yen

・NASDAQ Composite Index has exceeded the 20,000-point mark for the first time

・The USD/JPY surged due to an article speculating the Bank of Japan's interest rate hike postponement

Subsequently, the CPI temporarily reversed its value slightly without any surprises.

Subsequently, the CPI temporarily reversed its value slightly without any surprises.

Today

There are no particularly notable price movements or individual stock news.

Market reaction

Source of information

The Bank of Japan is not in a hurry to raise interest rates, and even if it is postponed this month, the risk of accelerating prices is small - Bloomberg

https://www.bloomberg.co.jp/news/articles/2024-12-11/SO24P9T0AFB400

https://www.bloomberg.co.jp/news/articles/2024-12-11/SO24P9T0AFB400

Source: Trading Economics

Time: 10:30 PM Country: US Indicator: Core Inflation Rate Month-on-Month November

Result: 0.3% Previous: 0.3% Consensus: 0.3%

Time: 10:30 PM Country: US Indicator: Core Inflation Rate Month-on-Month November

Result: 0.3% Previous: 0.3% Consensus: 0.3%

Time: 10:30 PM Country: US Indicator: Core Inflation Rate Year-on-Year November

Result: 3.3% Previous: 3.3% Consensus: 3.3%

Result: 3.3% Previous: 3.3% Consensus: 3.3%

Time: 10:30 PM Country: US Indicator: Inflation Rate Month-on-Month November

Result: 0.3% Previous: 0.2% Consensus: 0.3%

Result: 0.3% Previous: 0.2% Consensus: 0.3%

Time: 10:30 PM Country: US Indicator Name: Inflation Rate Year-on-Year November

Result: 2.7% Previous: 2.6% Consensus: 2.7%

Result: 2.7% Previous: 2.6% Consensus: 2.7%

Future Market Outlook

Stocks have been bullish.

However, Dow continues to decline, and the bullish sentiment feels more like it's in the middle.

However, Dow continues to decline, and the bullish sentiment feels more like it's in the middle.

The Nikkei average is also known as Major SQ week this week,

Such price movements can be considered within a reasonable range.

Such price movements can be considered within a reasonable range.

Next week, there will be an announcement of the central bank's policy interest rate.

It seems that speculation and cautious observation will continue for a while.

It seems that speculation and cautious observation will continue for a while.

Avo's investment and trading strategy

The Nikkei Average is not necessarily the starting point for a bullish market trend here,

We are observing the situation in response to the rise in the index.

(I have physical stocks)

We are observing the situation in response to the rise in the index.

(I have physical stocks)

We are paying attention to whether there will be movements in the currency due to the central bank event.

I am watching closely.

I am watching closely.

*There are cases where assets and stocks that are investment candidates are mentioned.

There is no mention of trading timing or risk management.

Please consider it as a reference information only.

The final decision is your responsibility, thank you.

There is no mention of trading timing or risk management.

Please consider it as a reference information only.

The final decision is your responsibility, thank you.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment