Meta Bearish Signal? The Company's Struggle Against TikTok's Rising Influence

In Q3 2023, $Meta Platforms (META.US)$ reported a total revenue of $34.1 billion, with a staggering $33.6 billion derived from advertising, constituting 98.5% of the total earnings. This substantial income is primarily generated through Meta's key social platforms, Instagram and Facebook.

According to a report by Statutebrew, Meta's suite of social platforms commands the lion's share of the global social media user base.

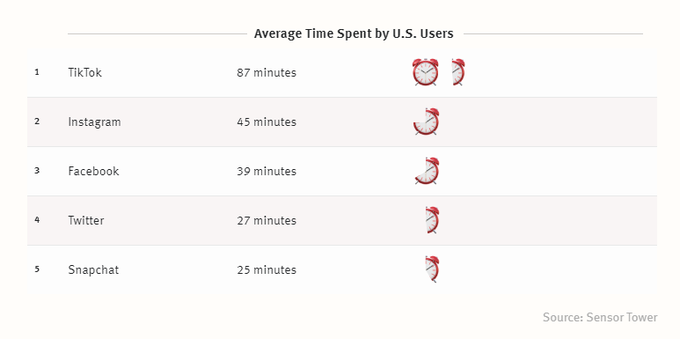

TikTok Tops U.S. Daily Screen Time Over Facebook and Instagram Combined

Despite having the largest user base, advertising revenue correlates more closely with user engagement duration. Data from Sensor Tower indicates that, on average, users in the U.S. spend 87 minutes per day on TikTok, which surpasses the combined daily usage of Facebook and Instagram at 39 and 45 minutes, respectively.

Meta's products have captured 19.5% of the U.S. online advertising market share, yet account for only 7.6% of user engagement duration, a twitter user says (@foxshuo) . This discrepancy is one of the reasons some investment banks maintain a long-term bearish stance on Meta.

What Other Challenges Does Meta Face?

● Meta Lags Behind TikTok in User Spending Power

According to Statista data as of August 2023, most Instagram users in the U.S. within the 25 to 54 age range, representing 57.5% of the platform's user base. This demographic is recognized for its considerable purchasing power and receptivity to advertising.

Facebook users aged 25-54 make up55.9% of Facebook's users.

However, TikTok's user base has a larger share of the 20-49 age range with high purchasing power, at 59.8%, which exceeds the spending potential of Meta's users.

The percentage of U.S.-based TikTok users by age

Source: App Ape

● TikTok's Rising Ad Market Share Threatens Meta's Dominance

Per Statista, TikTok's U.S. digital ad market share tripled from 1% in 2021 to 3.1% in 2023, driven by growth in active users, viral content, and engagement with Gen Z and Millennials. Statista forecasts that TikTok will capture 3.5% of U.S. digital ad spend by 2024. This increase in digital advertising share is likely to compress Meta's market share.

TikTok share of digital ad spend in the U.S. 2021-2024

● Impact of Economic Uncertainty on Meta's Ad Revenue

Although many economists believe that the U.S. economy may be poised for a soft landing, inflation has not yet achieved the 2% target, leaving the economic landscape with considerable uncertainty. In the event of an economic contraction, the resultant contraction in user spending capacity could substantially curtail Meta's advertising income. Bloomberg data shows that from Q2 2023, while ad prices rose, Meta's ad impressions significantly fell, with a continued drop expected in the next quarters. However, should the macroeconomic environment tighten, average price per ad is likely to face downward pressure as well.

Source: Bloomberg

● Meta's Countermove: Reels Excel in Video View Metrics Over TikTok

Instagram Reels, a feature for sharing longer video content than Stories, is Instagram's counterpart to TikTok's short video functionality. Research by Emplifi indicates that longer Reels, specifically those exceeding 90 seconds, garner a median view count twice as high as that of TikTok videos.

Moreover, Insider Intelligence reveals that 97.6% marketers plan to use Instagram, leveraging its array of content options like videos and images, and its creative tools. While TikTok stands as a contender with its Reels feature, Instagram overall remains the preferred choice for marketers. This data suggests that the network effects of social applications are significantly stronger than those of TikTok.

Source: Statista, Yahoo Finance, WSJ, Statutebrew, Sensor Tower, Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment