Check Out How Warren Buffett's Portfolio Changed in Berkshire's Latest 13F

The Q3 13F filings, released yesterday, reveal the latest positions of prominent investors and major hedge funds. These filings, required by the SEC for entities managing over $100 million, detail quarterly share and ETF transactions.

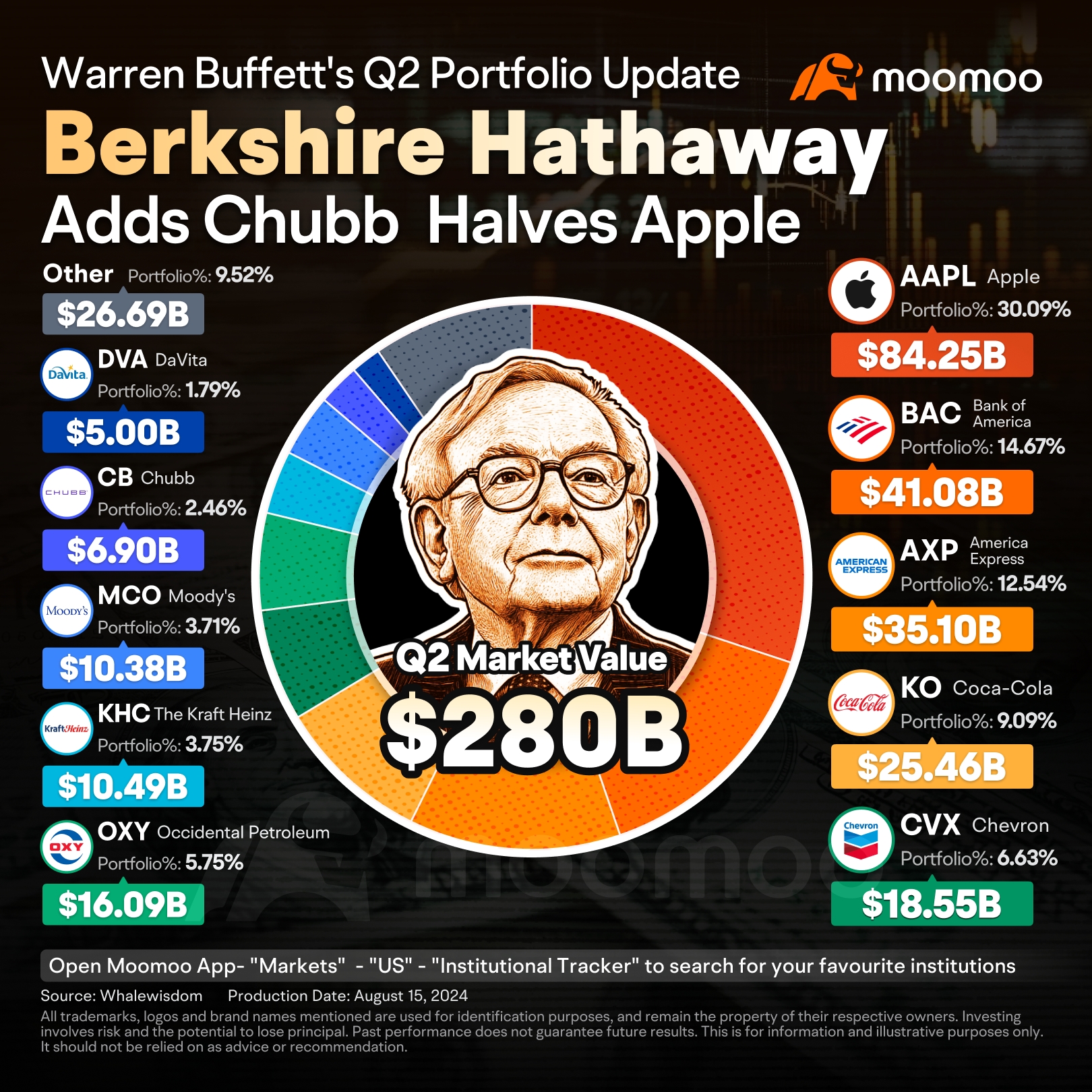

Warren Buffett's $Berkshire Hathaway-A (BRK.A.US)$/ $Berkshire Hathaway-B (BRK.B.US)$ added new positions in $Ulta Beauty (ULTA.US)$ and $Heico (HEI.US)$ in Q2, according to the filing. Despite cutting its $Apple (AAPL.US)$ stake by half, Apple remains Berkshire's top holding, comprising nearly a third of the portfolio.

Buffett also reduced positions in $Chevron (CVX.US)$, $Floor & Decor (FND.US)$, and $T-Mobile US (TMUS.US)$, while exiting $Paramount Global-B (PARA.US)$ and $Snowflake (SNOW.US)$. Additions were made to $Occidental Petroleum (OXY.US)$ and $Chubb Ltd (CB.US)$.

It's important to note that 13F filings provide a snapshot of the portfolio at the quarter's end and do not include subsequent transactions, such as the $Bank of America (BAC.US)$ shares sold in July. They also do not detail gains or losses from sales.

Here's Berkshire's Portfolio as of June 30:

Berkshire Hathaway acquired about 690,000 Ulta Beauty shares worth approximately $266 million as of June 30, causing Ulta's stock to soar 14% in extended trading on Wednesday. Buffett also bought around a million Heico Corp. shares, with Heico's stock rising nearly 4% after hours.

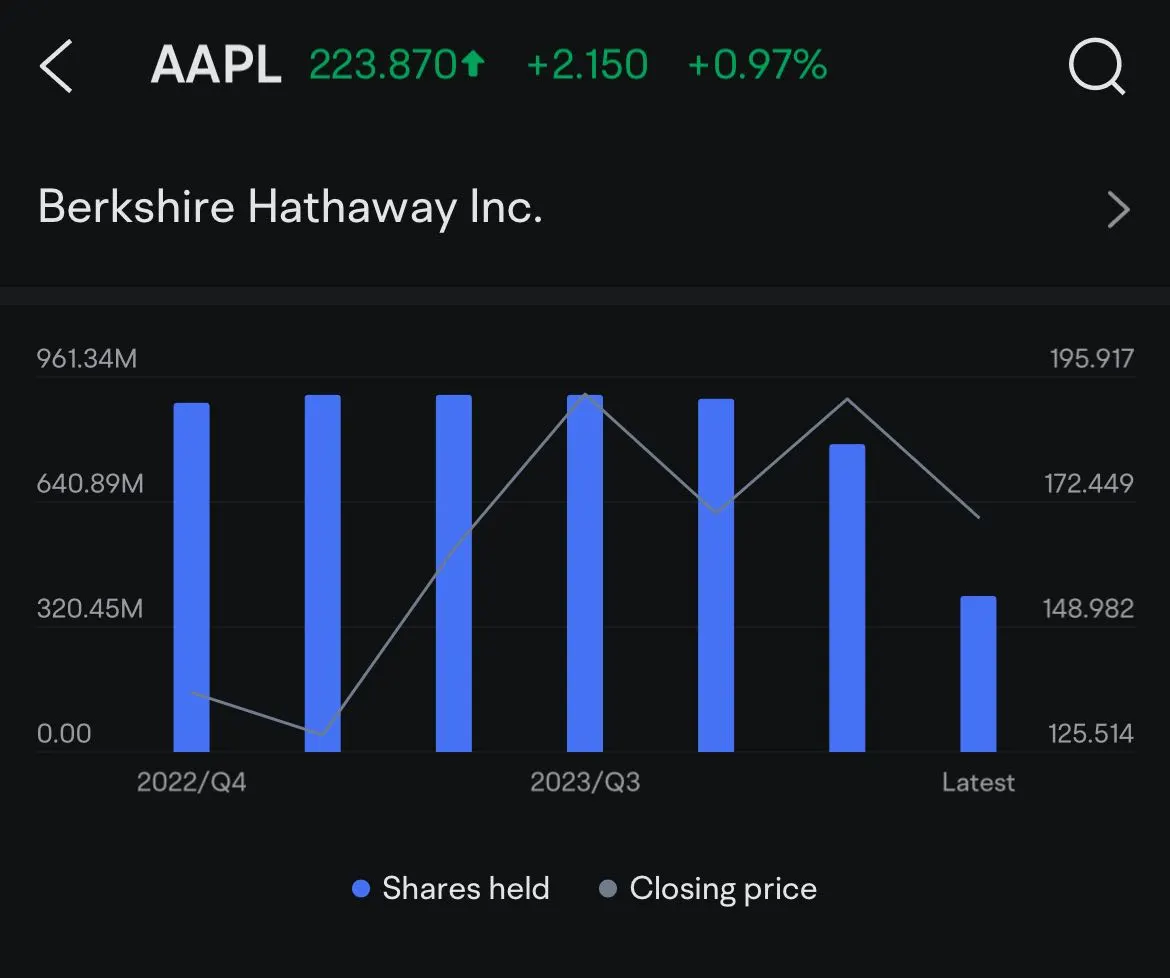

The filing shows Berkshire's exit from Paramount Global, a loss-making investment Buffett had acknowledged at the May shareholder meeting, and the complete sale of its 6.1 million-share stake in Snowflake, previously valued at about $989 million at Q1's end. Berkshire halved its Apple stake to 400,000 shares valued at $84.2 billion by Q2's end and sold nearly 4.3 million Chevron shares, though Chevron's portfolio weight increased to 6.6%. Other notable sales included 2.6 million Capital One shares, 800,000 Floor & Decor shares, and 570,000 T-Mobile shares. As a result of all the selling, Berkshire's already massive cash pile has ballooned to the record level of $277 billion.

Buffett also added 7.2 million Occidental Petroleum shares, bringing the total to roughly 255 million shares valued at nearly $16 billion (5.7% of the portfolio), and over 1.1 million Chubb Limited shares, increasing the count to 27 million.

Source: Investing.com, YahooFinance, Investopedia, Bloomberg, Whalewisdom

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

73842510 : Everyone wants to know what "the oracle of omaha" is investing. Although it was the last quarter information, people still will "copy" his trades. Consequently, his position will grow even further. Interesting, isn't it?

Laine Ford : future money stock make that money