Brace for More Bankruptcies: Zombie Firms are Surging Amid Rising Borrowing Costs and Recession Risks

$WeWork (WE.US)$ plans to file for bankruptcy as early as next week as it struggles with a massive debt pile and significant losses, reported by the Wall Street Journal on Tuesday.

From a $47 billion private market valuation to a $9 billion IPO via a SPAC in 2021, and now trading at $1.22 a share, marking a 99% drop from its IPO price.

Bankruptcies are surging

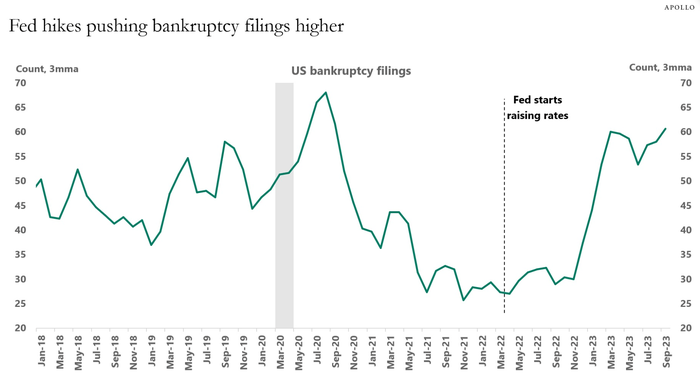

The number of bankruptcy filings in the U.S. has sharply risen this year and may outpace 2020, with 516 firms filing for bankruptcy from January through September 2023.

More and more companies are going bankrupt because of Fed hikes," said Apollo chief economist Torsten Sløk.

The Fed has raised rates 11 times since March 2022 in an effort to bring inflation down to the central bank's 2% target.

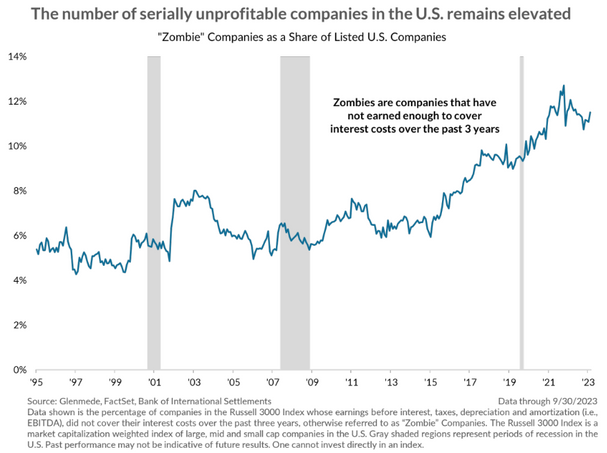

Brace for more zombie companies

About 11.5% of the Russell 3000 index was pegged as zombie companies that have consistently earned less than they owe in interest costs, according to Glenmede.

The combination of rising borrowing costs and heightened recession risks could begin to tip zombie companies into bankruptcy," a team led by Jason Pride, chief of investment strategy and research at Glenmede, wrote in a Tuesday client note.

The chart suggests an elevated risk of public U.S. companies could make a potentially ugly situation for investors even worse. Unlike bonds, stocks are often at risk of losing their entire value if a company files for bankruptcy. High-debt load smaller and weaker companies are more vulnerable during recessions since funding from Wall Street can dry up.

While the percentage of Russell 3000 index zombies is high, the group accounts for only 2.2% of the stock market's total value, mainly because many of these firms are small-cap companies.

Source: MarketWatch, CNBC, Markets Insider

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Shootingstar : Confirm more unemployment will rise and fed will be happy to provide them with payouts as well

71370083 : more phantom market fugazi pump gotcha

Apmj : It's going just as planned. Fed V. Small biz... First, they force us to close up shop , get our workers accustomed and comfortable depending on them for free money and free food, print and print and print more dollars then they bankrupt small us, one after another. Until we're begging for their help.