Broadcom: Focus on AI product revenue

Introduction

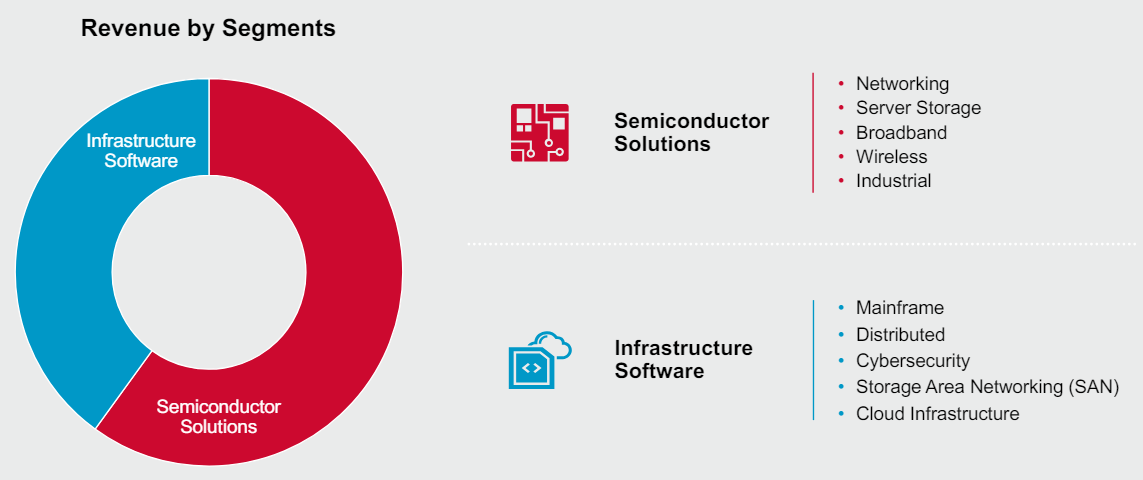

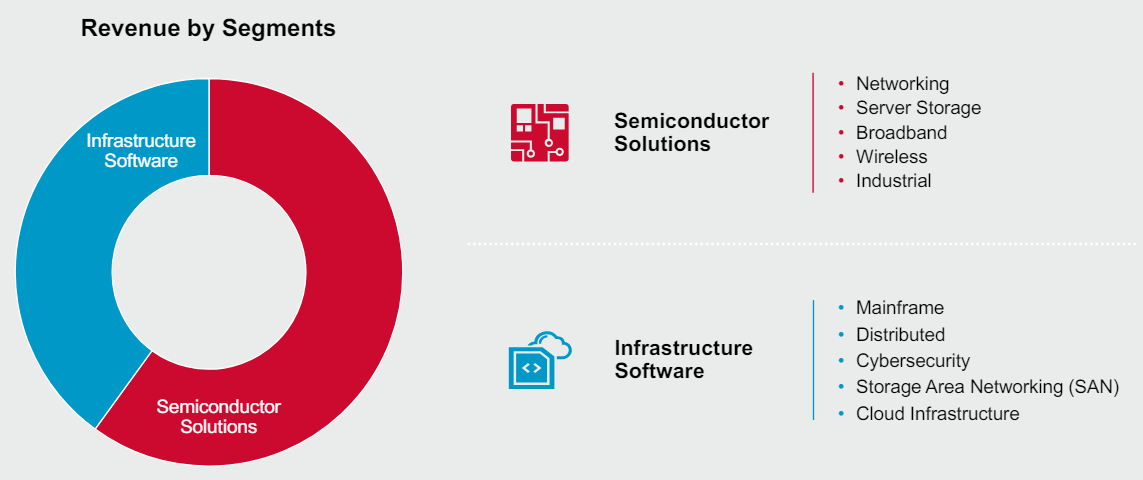

$Broadcom(AVGO.US$ is a global technology company that designs, develops, and provides semiconductor and infrastructure software solutions. The company's latest financial report shows a detailed breakdown of its business, with five subcategories each for semiconductors and infrastructure software, providing hardware and software-related products and services to enterprises worldwide. Currently, the company has a market capitalization of nearly $700 billion and serves top companies such as Google and Apple, making it a leader in the industry.

On June 12th, after-market close, this technology giant will release its Q2 2024 financial report and hold a press conference. The market has generally given optimistic expectations for Broadcom's latest quarterly performance. According to Bloomberg data, Wall Street analysts expect the company to achieve:

Total revenue of $12.057 billion for Q2 2024, a YoY increase of 38.07% and a QoQ increase of 0.8%;

Adjusted EPS of $10.80, a YoY increase of 4.67% and a QoQ decrease of 1.7%.

This article will provide a forward-looking analysis of Broadcom's upcoming financial report by synthesizing predictions and ratings from multiple institutions.

Sub-business revenue

With support from Google META, Broadcom's custom DPU business is expected to continue its rapid growth. All investors focus on whether AI revenue will exceed expectations.

Broadcom's semiconductor business includes five parts: Networking, Server Storage, Broadband, Wireless, and Industrial. Among them, Networking accounts for the highest proportion and generates around half of the total revenue of the semiconductor business. Broadcom's Networking business mainly involves router chips, data processing chips, fiber channels, Ethernet network interface cards, and other aspects, which are crucial for building and maintaining high-speed and efficient data transmission infrastructure.

According to Broadcom's Q1 2024 financial report, its semiconductor business revenue increased by 4% YoY, with Networking revenue increasing by 46% YoY, mainly driven by the growth of custom Data Processing Unit (DPU) chips. DPUs are specialized integrated circuits (ASICs) designed for specific data processing tasks or a group of specific applications and are currently widely used in the field of AI.

According to Bloomberg data before the financial report release, analysts unanimously predict that Broadcom's Q2 semiconductor revenue will be around $7.119 billion, a YoY increase of 4.57%. Similar to the previous quarter, their optimism about the semiconductor business still mainly comes from custom DPUs, with an expected YoY increase of nearly 40%. In the market's view, customized chips will become a continuous driving force for Broadcom's semiconductor business under the rapid development of AI technology:

In the financial report, Broadcom will classify AI ASICs and AI-focused network solutions together as AI accelerators. In the field of AI chips, Broadcom began deep cooperation with Google in 2013 and jointly designed all TPUs that have been publicly released, establishing its position as the second-largest AI chip supplier in the industry after NVIDIA. Recently, analysts at JPMorgan stated in a report that Broadcom has obtained the design contract for Google's next-generation AI chip TPU v7, stating, "This marks Broadcom's contribution to Google's seven-generation series of AI processors." This long-term cooperative relationship enables Broadcom to significantly benefit from Google's continued investment in AI technology. Meanwhile, it is reported that Broadcom has also partnered with META, and analysts predict that "Meta and Broadcom have jointly designed Meta's first and second-generation AI training processors." They expect that Broadcom will accelerate the production of Meta's third-generation AI chip (MTIA 3) in the second half of 2024 and 2025. Currently, Broadcom ranks first in the world in the market share of customized chips, followed by Marvell. With the deepening cooperation with multiple technology companies and the continuous updates and iterations of products, Broadcom's leading position in the industry is continuously consolidating.

Overall, Broadcom's AI-related revenue reached approximately $2.3 billion in Q1 2024, accounting for 31% of the total semiconductor revenue. Analysts predict that Broadcom's AI revenue will reach $11-12 billion this year and exceed $14-15 billion in 2025.

Expansion of Infrastructure software business - Will VMware pose a threat?

Broadcom's infrastructure software business mainly focuses on providing software and related services to enterprise-level customers, including data center and cloud infrastructure, network security services, data storage management, and automation management software. In recent years, this business has benefited from factors such as the digital transformation wave in the market and the continuous popularization of cloud computing, with revenue remaining slightly on the rise.

Last year, after completing the acquisition of VMware, a company providing cloud computing and virtualization software and services, for $61 billion, Broadcom's infrastructure software business revenue significantly increased. In Q1 2024, this company brought $2.1 billion in revenue to Broadcom, accounting for nearly 50% of infrastructure software revenue. For Q2, the market expects the company's revenue to increase slightly to $2.9 billion, a 38.5% increase from the previous quarter.

In fact, initially, due to Broadcom's significant adjustment of changing the software from a lifetime buyout system to a subscription system and uniformly raising prices, the market was generally worried that this would cause the original customers to switch to other options. However, according to the latest survey data, this prediction may have been exaggerated, and more customers are choosing to continue holding the company's products and waiting for better options to emerge.

Therefore, the market estimates that VMware's Q2 revenue will continue to grow, and the future direction of this subsidiary still needs to be continuously monitored.

Profitability and Dividend Payment Analysis

According to the guidance given at the last shareholder meeting, Broadcom expects to achieve significant profit growth between 2023 and 2026, with a compound annual growth rate of +20.7%/+15.7%. Broadcom's gross profit margin has always remained stable at around 75%, meaning that changes in costs are relatively small. However, due to the merger with VMware and the increasing investment in research and development, Broadcom's expenses have increased significantly since Q1 2024, reaching $2.183 billion, a YoY increase of 90% and a QoQ increase of 88%. Bloomberg predicts that expenses will continue to slightly increase to $2.3 billion in Q2 2024.

However, due to the significant increase in revenue, Broadcom's net profit is expected to be $5.297 billion, a YoY increase of 18%, still within the company's guidance range, but the profit margin has slightly decreased YoY.

In addition, Broadcom's generous annual dividend of up to $21 per share cannot be ignored. As a company that values shareholder returns, Broadcom's dividend has increased steadily for nine years and follows a quarterly dividend payment schedule. Currently, the dividend payment is $5.25 per share per quarter, with a historical payout completion rate of 100%, maintaining a stable and attractive dividend payment schedule.

In Q1 2024, Broadcom's adjusted free cash flow was very abundant, reaching $4.693 billion. For Q2, Bloomberg unanimously predicts that under excellent performance, the company's free cash flow will reach $5.48 billion, which provides abundant cash flow for shareholder returns and provides reinvestment capital for long-term investors.

Conclusion

Since the beginning of the year, the company's stock price has risen by 29.6%, and in the past 12 months, it has risen by 82%, significantly outperforming the US stock market. According to the company's profit guidance, Broadcom's future P/E ratios for the next three years will be 28.87x/23.62x/20.84x, which is reasonable compared to the industry's current average of 27.21x. As shown in the chart below, compared with its peers NVIDIA and AMD, Broadcom's valuation is relatively lower. Compared to AMD, Broadcom appears to be more attractive as a highly profitable and rapidly growing company.

Therefore, considering the market situation and currently known information, numerous Wall Street analysts are optimistic about Broadcom's performance in Q2 and expect to hear more positive news at the post-earnings conference. It is expected that once the company formally announces updates on its AI-related business, it will have a significant boost on the stock price.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

102188459 : Tq

Carter West OP 102188459 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)