JPM 24Q2 Preview: Investment banking drove revenue and profit growth, while net interest income and trading fees were pressured

Introduction

According to Bloomberg consensus expectations, JPM net interest income is expected to decline in the second quarter, but the decline in net interest income will be made up by the increase in other business income, asset size is expected to be relatively good, is expected in the second quarter:

Revenue of $46 billion, up 8.65% year-over-year and up 8.27% sequentially;

Net profit was $14.889 billion, up 2.88% year-on-year and 10.95% quarter-on-quarter;

Diluted adjusted earnings per share were $4.99, up 2.84% year-over-year and down 3.02% sequentially.

Overall, JPM's revenue and profit improved from last year and last quarter, while its earnings per share declined from last quarter. The following is a detailed analysis of each element.

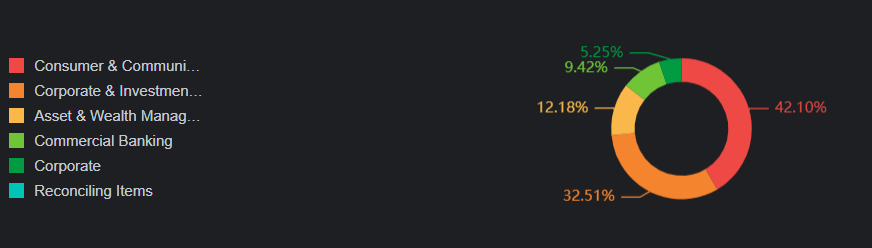

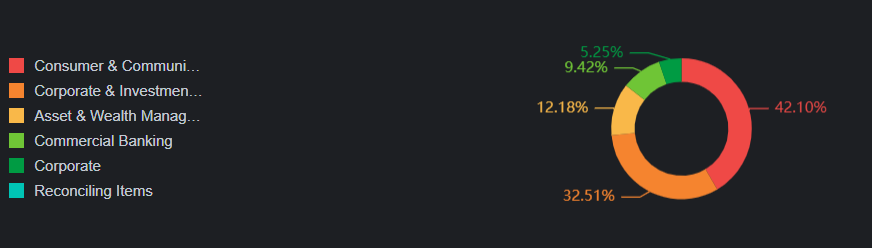

As the largest financial services institution in the United States, JPM is mainly engaged in banking and other financial services, and its main business consists of four parts: Consumer and Community Banking, Corporate and Investment Banking, Asset and Wealth Management, and Commercial Banking.

Net interest income is expected to be slightly lower sequentially

Among them, net interest income (NII) is expected to be approximately $22.77 billion, up 4.55% year-on-year and down 1.35% sequentially; Non-interest income is expected to be approximately $22,891 million, an increase of 17.23% year-over-year and 21.42% sequentially. As a result, net interest income declined while other business income increased. That is, the decline in net interest income will be offset by an increase in other business income.

In general, a bank's net interest income is the income it earns on its interest-earning assets (such as loans, bonds, and other investments) minus the interest expense it pays on interest liabilities (such as customer deposits and borrowings). It is a key measure of the profitability of a bank's core lending and borrowing activities, and one of its main sources of revenue.

JPM's interest income comes mainly from its deposits, loans and money markets operations in its personal and community banking and commercial banking businesses. According to the forecast, its total interest income was $47.244 billion, up 13.45% year-on-year, while total interest expense was $24.299 billion, up 22.32% year-on-year. Interest expense grew faster than interest income.

This segment of the business is primarily influenced by factors such as the macroeconomic environment such as consumer confidence and monetary policy such as interest rate adjustments. On the macro side, while a rebound in the US economy in the second quarter could lead to higher lending growth and higher reinvestment rates, this benefit is likely to be offset by higher deposit flows and portfolio shifts, as well as higher funding costs.

The economic recovery led to a recovery in investment banking, and seasonal factors affected transaction fee income

In terms of non-interest income, JPM's revenue mainly comes from investment banking fees, principal transaction income, loan deposit fees, asset management and securities income, credit card income, and mortgage banking business, among which principal transaction income and asset management-related fee income account for a large proportion.

According to the forecast, transaction fee revenue declined 0.63% year over year due to seasonal factors; The gradual recovery of the US economy led to the enthusiasm of US new shares, which is expected to drive its investment banking business to achieve 20.96% year-on-year growth to $1.883 billion. The rest of the fee income achieved high single - or 10-digit year-over-year growth. Among them, mortgage banking benefited from an increase in seasonal lending, which grew 10.89% year on year.

Notably, JPM will have an $8 billion accounting gain from its share exchange with credit card giant Visa (V), which split its stock structure into three classes and authorized a stock exchange offer in January. In May, Visa accepted an exchange that allowed jpmorgan to swap 37.2 million of its Visa B-1 common shares for Visa B-2 and C common shares, resulting in a gain of about $8 billion for the bank. J.p. Morgan donated about $1 billion worth of tradable Class C common stock to the J.P. Morgan Foundation as a noncompensation expense.) This will also be factored into pre-tax earnings growth in the second quarter.

Overall, Wall Street expects JPM's total revenue to continue to grow.

Investment drives up costs at a slower rate than revenue

According to Bloomberg data forecast, JPM 2024 second quarter of the total non-interest expenses of about 22.933 billion US dollars, an increase of 12.41%. Among them, human salaries and technical equipment-related expenditures increased the most. The former is driven by business growth, while the latter is driven by increased spending on technology and professional services. Overall, JPM's fees are expected to rise this quarter due to the annualized FRC and remaining inflationary pressures, as well as an increase in related technical and professional services.

Despite the increase in expenses, but its growth rate is still less than the growth of revenue, JPM forecast net profit for the quarter of $14.889 billion, up 2.88% year-on-year, an increase of 10.95% quarter-on-quarter.

Stable shareholder returns and favorable share exchange may drive buyback programs

In terms of shareholder returns, JPM increased its quarterly common stock dividend to $1.25 per share for the third quarter of 2024, an 8.7% increase from the current dividend of $1.15 per share. At the same time, the Company has approved a new $30 billion common stock repurchase program, which will be effective July 1, 2024.

On March 19, 2023, JPM announced that it would increase its quarterly dividend by $0.1 (9.5%) to $1.15. At the same time, its $30 billion buyback program announced in 2022 had $16.9 billion remaining as of the first quarter. According to the company, it is expected to increase the amount of repurchases relative to the repurchase rate of $2 billion per quarter. And thanks to the $5.3 billion gain from the share exchange with Visa, the market expects it to drive the buyback program again in the second and third quarters. Its total payment ratio reached 47.24% in the quarter, up 26.3 percentage points from a year earlier, according to Bloomberg forecasts.

According to the forecast, JPM's non-performing assets ratio will rise slightly to 0.58% in the second quarter of 24, and loan loss reserves will increase quarter-on-quarter. On the credit card front, JPM released credit card data for April and May. JPM's NPL ratio rose 6 basis points to 1.75% in May after falling 2 basis points in April, and its total default ratio rose 1 basis point (up 2 basis points in April) to 0.82%. In May, the early delinquency rate decreased 1 basis point to 0.41%(+1 basis point in April), while the late delinquency rate increased 2 basis points to 0.41%(+1 basis point in April). JPM is expected to increase its loan loss provisions by $220m in the second quarter after releasing $72m in the first quarter.

Since its last quarterly earnings report (April 12), JPM's shares have risen about 13.5%, ahead of the S&P 500's 8.66% gain, to $207.45 at the 7.11 close. Although the long-term interest rate reduction trend and short-term high financing costs lead to poor net interest expectations of large banks such as JPM, the market is expected to have good non-interest income, and the cost growth is less than the revenue growth rate, and the shareholder return is stable, so Wall Street is optimistic about its earnings forecast.

And while the market is betting on a higher chance of a rate cut this year, that is likely to reduce JPM's net interest income. Investors are advised to pay attention to changes in JPM's business guidance for fiscal year net interest income expectations after the earnings report and pay attention to the gap between its expected changes and market forecasts for interest rate cuts.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment