Broadcom's Earnings Review: Bullish Turnaround or Temporary Peak?

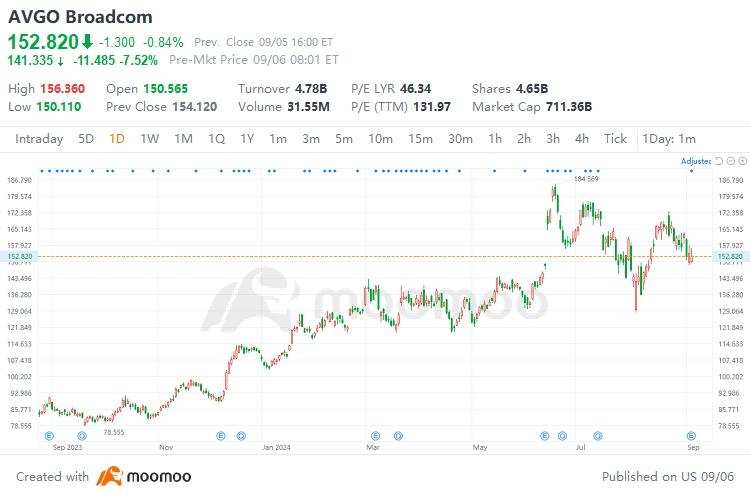

Leading global chip design company Broadcom released its financial performance for the third quarter of fiscal year 24, with overall strong performance. Revenue increased by 47% year-on-year to $13.072 billion, and non-GAAP diluted EPS increased by 18% year-on-year to $1.24, exceeding market expectations. However, after the company's performance announcement, the after-hours stock price dropped more than 8%, mainly due to the unexpected slowdown in semiconductor solutions revenue growth for the quarter, falling below expectations. Additionally, the company's guidance for the fourth quarter also fell short of expectations, causing market concerns.

So, was Broadcom wronged by the market? The semiconductor industry has recently performed poorly, are we nearing a peak in the cycle? Next, we will start our analysis from Broadcom's financial report, unveiling the fog and providing investment advice for investors.

I. Where is Broadcom's future growth point?

Broadcom's revenue mainly comes from two main segments: semiconductor solutions and infrastructure software business. The semiconductor solutions revenue accounts for a large proportion, exceeding 50%, while the infrastructure software business has rapidly expanded in scale since the acquisition of VMware.

Source: Company Announcement

This quarter, the company's revenue grew by 47%, mainly driven by a 200% growth in the infrastructure software business, benefiting from the acquisition of VMware. The impact of the acquisition is expected to continue into the next quarter, returning to normal growth levels afterward. However, this quarter, the semiconductor solutions revenue growth slowed to 5%, mainly due to weak growth in non-AI businesses, with broadband revenue declining by 49%, non-AI network revenue declining by 41%, offsetting the strong performance in the AI field. The lower-than-expected performance guidance was also affected by the drag from non-AI businesses.

Looking ahead, Broadcom's performance growth driver remains the growth in demand for AI chips.

Broadcom's custom AI chips and network chips are essential components for data center providers to build AI systems, making Broadcom undoubtedly one of the core targets benefiting from the surge in AI demand. This quarter, the company once again raised its sales expectations in the AI field, expecting AI component and custom chip sales for fiscal year 24 to reach $12 billion, an increase of 9.1%. This is the second time the company has raised expectations, showing continued optimism for AI demand.

The company's management disclosed that over the next 3-5 years, the potential market for the company's annualAIbusiness is expected to reach $30 billion to $50 billion, based on the $12 billion revenue for fiscal year 24, there is still a doubling growth space in the future, effectively driving the company's performance.

II. The lackluster post-earnings stock performance in the semiconductor industry, what is the market worried about?

Although the overall performance exceeded expectations, Broadcom's stock price dropped more than 8% after the financial report was released. Similarly, we found that the post-earnings stock performance of most semiconductor companies this financial reporting season is not optimistic. Specifically:

(1) Nvidia released a strong second-quarter report, with revenue and net profit significantly exceeding market expectations, but the stock price fell nearly 7% in after-hours trading that day, closing down 6.38% the next day.

(2) TSMC released a strong second-quarter report, both performance and guidance were very optimistic, but the post-earnings stock price fell by 1.38%.

(3) ASML reported a strong second quarter exceeding market expectations, but the third-quarter revenue guidance fell short of expectations, causing the post-earnings stock price to drop by 12.74%.

(4) AMD's second-quarter performance growth was strong, with third-quarter guidance meeting expectations, but the post-earnings stock price gain narrowed to 4.36%, and the stock price fell by 8.26% the next day.In addition, we can also observe that the Philadelphia Semiconductor Index has fallen nearly 20% from its peak in July.

So, why are semiconductor companies experiencing lackluster stock performance even when their performance is outstanding? The reasons are as follows:

(1) High market expectations.After significant gains in the previous period, driven by the AI wave, the market continues to raise performance expectations for semiconductor companies, especially for future growth expectations. Once the performance guidance of semiconductor companies fails to meet the highest expectations and cannot digest high valuations, the company's stock price will experience a significant pullback.

(2) The poorAIinvestment returns or downstream demand impact.The current surge in the semiconductor market is mainly driven by the rise of the AI wave, and the performance growth of semiconductor companies comes from the increasing demand for AI chips from downstream customers. However, the investment returns of major customers in AI by semiconductor companies are not optimistic, as seen in the second-quarter reports of major technology internet companies; the substantial AI capital expenditures have not brought corresponding returns but have instead lowered profit margins. Therefore, in this context, if downstream customers cannot continue to increase capital expenditures, semiconductor companies will face the issue of declining order growth and slowing performance growth.

(3) The inevitable slowing of performance growth due to a high base.Semiconductors belong to a cyclical industry, with 2023 and 2024 being explosive high-growth periods for the industry. After 2025, with the continuous increase in chip supply and the cooling of industry demand, combined with the issue of a high base, the revenue growth rate of the semiconductor industry is inevitably slowing down.

Therefore, we can conclude that the semiconductor industry is approaching the top of the industry cycle, and with the slowing down of company performance growth after 2025, the pricing of companies needs to return to a reasonable level.

III. How to deploy trading strategies in the current market environment?

In the current market environment, it is crucial to focus on the performance growth prospects of semiconductor companies.

1.Trading strategy for Broadcom

Looking at Broadcom, it is expected that AI customized chips will become the driver of the company's performance growth, with double-digit EPS growth expected for fiscal years 24 and 25. In terms of shareholder returns, the company's dividend yield (TTM) is approximately 1.33%, and no stock buyback plan has been announced, making shareholder returns less attractive. The current market value of the company is $711.359 billion, with a PE ratio (TTM) of 131.97. Calculated based on profit expectations for fiscal years 24 and 25, the forward PE ratios are 32x and 25x respectively, indicating a relatively reasonable valuation with limited upside potential for stock prices.

It is recommended that investors holding the underlying stock can use a covered call investment strategy by selling high-priced call options; for investors who do not already hold the stock, it may be advisable to wait for further price corrections before considering entry points.

2.Trading strategy for the semiconductor industry

Currently, the semiconductor industry's prosperity is at its peak, with high industry valuations. It is advisable to closely monitor changes in the macroeconomic environment in the United States and advancements in AI technology. US macroeconomic data fluctuates frequently, with the latest manufacturing data showing less optimistic results, and the upcoming release of non-farm payroll data tonight is expected to have a significant impact on the market.

It is anticipated that there will be significant volatility in the short term in the semiconductor industry, with the risk of a pullback. The leveraged ETF SOXS is currently known for shorting semiconductors, but holding leveraged ETFs for an extended period is not recommended due to high costs. Trend trading can be considered for short-term profits, with selling once gains are achieved.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

LittleSoldier : How funny, I bet the shorts are crying in their boots over that! Will see how the day progresses after jobs posting

are crying in their boots over that! Will see how the day progresses after jobs posting

Noah Johnson OP LittleSoldier :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)