Buffett's secret to surviving Coca-Cola's 10-year bear market

This article re-examines Buffett's investment from the perspective of dividends, which will be very enlightening for us to understand the value of continued dividends.

In this year's shareholder letter, Buffett used the cases of Coca-Cola and American Express to describe his "secret weapon" in investment: justice + time, that is, long-term sustainable justice.

In the eyes of value investors, companies with low valuations, good cash flow, and strong dividend capabilities, especially those that can create sustained and stable dividends, are good targets for crossing bulls and bears.

Because there are actually two sources of stock income, one is the income from rising stock prices, and the other is the income from corporate cash dividends. A formula is expressed as stock income = stock price increase or decrease + dividend income.In the mature U.S. capital market, dividends (dividends) are an indicator that investors value very much, and corporate dividends have long become a practice for rewarding investors.

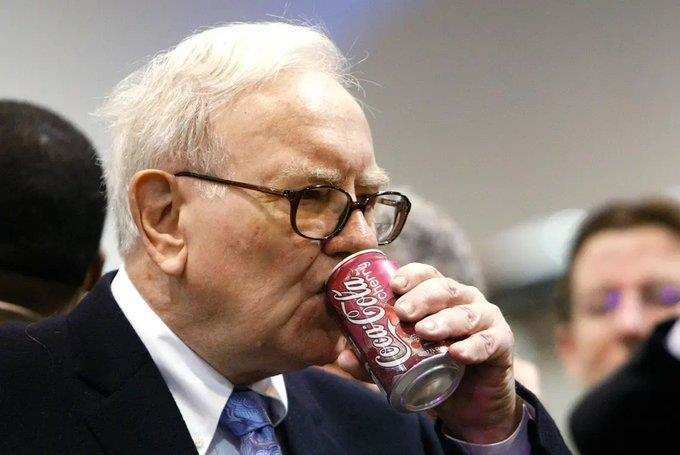

Revisiting the case of Coca-Cola from the perspective of dividends

Buffett disclosed that he completed a seven-year purchase plan for Coca-Cola in 1994. He currently holds a total of 400 million shares at a total cost of US$1.3 billion. In 1994, he received a dividend of 75 million yuan. By 2022, the dividend has grown to US$704 million.

There are two information points here that are easily misunderstood if simply followed literally. I have seen many media reports with incorrect translations.

In the shareholder letter, Buffett mentioned that Berkshire bought a total of 400 million shares of Coca-Cola. In fact, these 400 million shares were not the number that Buffett originally bought, but the number that he currently owns after multiple stock splits.I specifically checked the information for verification.

In 2022, Coca-Cola will pay dividends a total of 4 times (many companies in the U.S. stock market pay dividends once a quarter), with a total dividend of US$1.76 per share. The current total share capital of Coca-Cola is 4.327 billion, which means that the total dividend cost is 1.76*43.27= Around US$7.616 billion. Berkshire holds 400 million shares and will receive 4*1.76=$704 million in 2022.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

RDK79 :