On Thursday, December 31st, Tesla's post-market review chart geometric analysis: buy the dip, don’t buy the rally, sell the rally, don’t sell the dip.

Tips for trading individual stocks:

1. Be well prepared, have a solid and comprehensive logic. Before you buy stocks, you should conduct sufficient analysis, such as whether the stock you choose fits the current trend, whether the trading volume is active, whether the candlestick pattern trend is good, what the breakout point is, what the profit model is, whether you are planning for medium to long-term or short-term, and roughly what your profit-taking and stop-loss methods are. All of these should be planned in advance. Do not hesitate to sell when it rises, or hesitate to cut losses when it falls.

2. Consider the background when buying and selling. The trend of individual stocks should consider the background, especially the trend of the large cap, the stock's style, and the technical indicator status of the large cap and individual stock. It is important to emphasize that individual stock styles can follow the large cap or not, and there are cases where the major trend does not follow the large cap but the minor trend does follow the large cap. These distinctions must be clear.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more 9

9 2

2

Bin Li4 : Brother, you posted a lot of pictures, what are you trying to express?

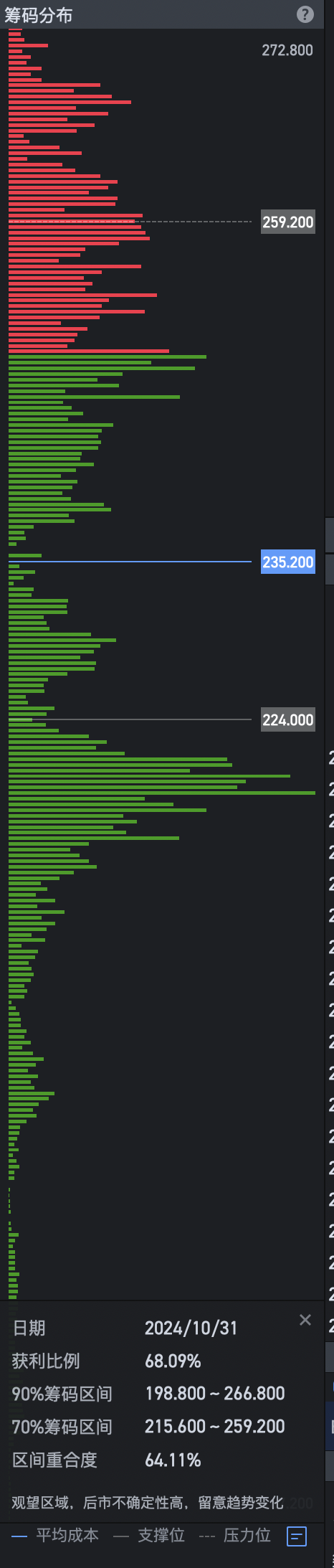

Elias Chen OP : Locking in Tesla as an investment symbol, 70% of the funds and 60% of the positions are used for medium to long-term global strategic investments, while 30% of the funds and 40% of the positions are used for short-term trend aerial combat - game-like investment trade in Tesla's eternal bull market.