Buy when it falls, don't buy when it rises. Sell when it rises, don't sell when it falls.

Try not to open fire until the stock price has not entered the anti-air firepower ambush circle. If you really can't hold on, you can use funds to scout for profits, but never use all your strength too early, empty the nest and attack.

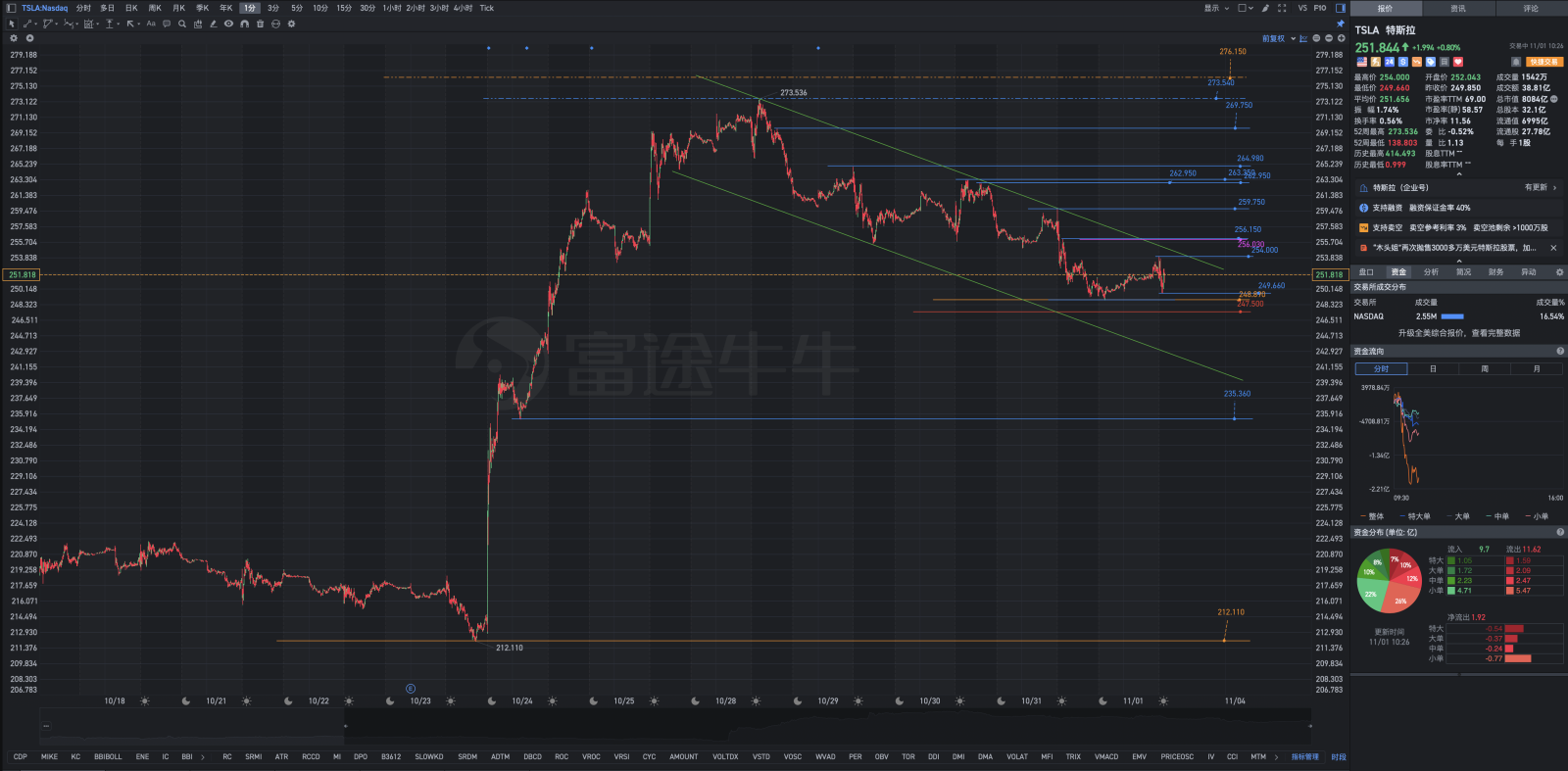

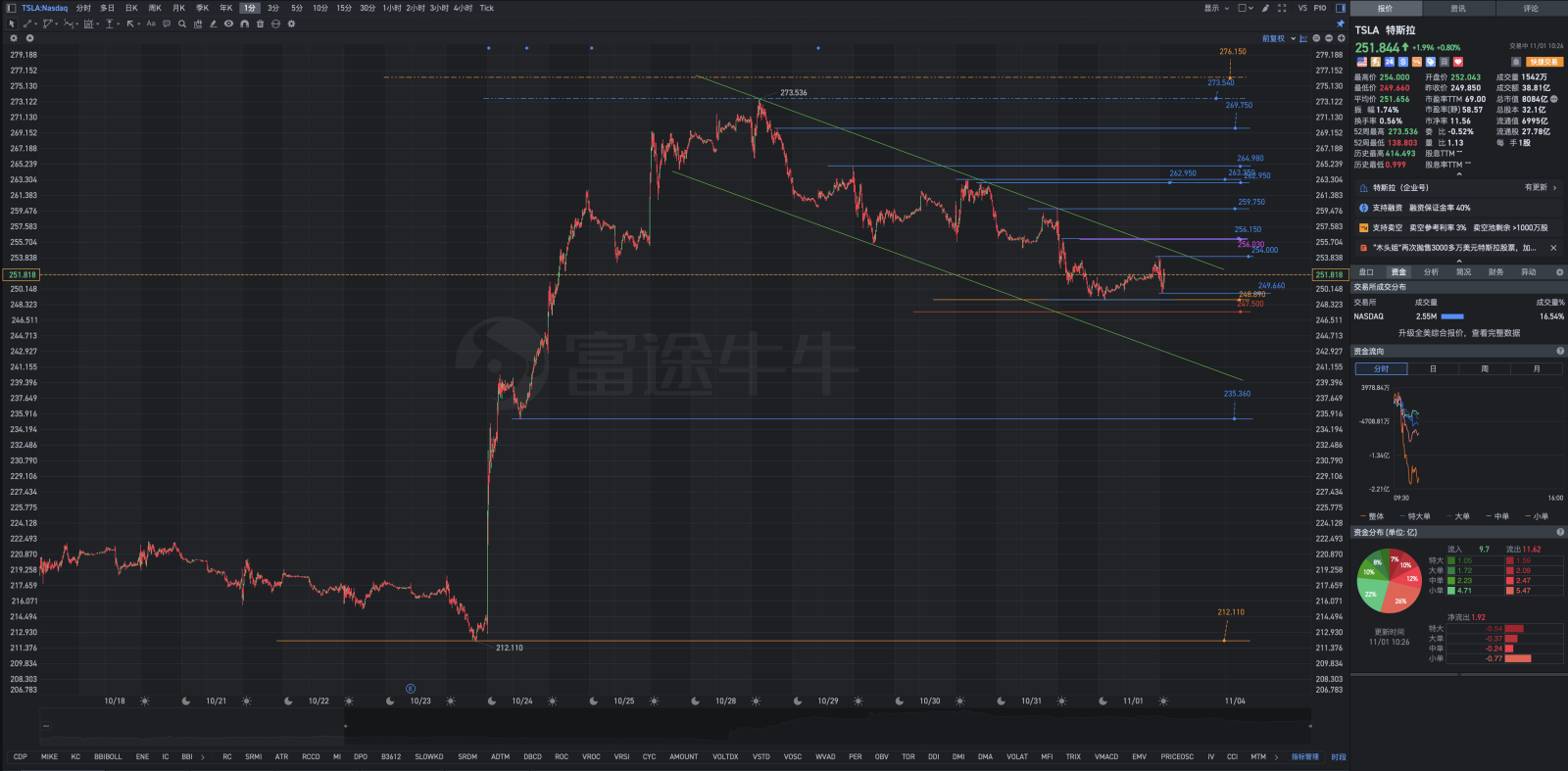

The stock price enters the range of 247.500–235.360, initiating the battle sequence of the fund to protect the warehouse;

The stock price has entered the 235.360-212.110 range, triggering a deep dive to buy fund battle sequence.

1. Taking all aspects into account, Tesla's future is still very promising, worth locking in as a medium to long-term strategic investment trade symbol.

2. Since you have chosen Tesla, it means confirming and locking in Tesla's primary trend and the long-term upward trend forever. Trust the stock you invest in, and do not invest in stocks you doubt.

3.70% of the funds and 60% of the positions are used for medium to long-term global strategy investments, while 30% of the funds and 40% of the positions are used for short-term trend trading, which is characterized by game-like speculative trading.

All uptrends are born from downtrends. When can we recognize the weaknesses of human nature - greed and fear, break free from their control - liking rises and fearing falls, and pursuing the unsustainable long and short double repairs, both long and short wins (which also counts as a kind of greed). Face the downtrend of secondary trends and short-term trends with a happy and open mindset. By avoiding the top and middle of the downtrend through various technical means, experiences, and insights from external sources, our chances of success are greatly increased in the final stage of the downtrend (which is not necessarily the end, this is an unpredictable occurrence).

The macro world is something we cannot choose and must accept, such as Tesla's fundamentals and the legendary figure of Tesla, Elon Musk; however, the micro world is vast and full of potential.

The latest uptrend started from 212.110 and peaked at 276.500. The profit chip ratio is 80.12%, the range overlap is 64.91%. The daily chart shows three black crows, and the KD curve exhibits a parabolic phenomenon in some areas, indicating that chasing higher prices or strength is not advisable. Additionally, despite several days of price decline, the stock price has not dropped below 247.500, indicating it remains strong. Do not hold unrealistic fantasies about stock price declines.

7. Establish a hedge fund and a deep buy fund specifically designed to deal with the decline in Tesla's stock price. Never operate at full position, there must be multiple levels of countermeasures, flexible position technology.

When downtrends occur, there should be a planned and systematic approach, with a phased and batched strategy, using discrete random variables, and establishing position layouts.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Longlin Liu : May I ask teacher, can I add positions for tesla?

Elias Chen OP : I'm sorry, I'm not a teacher, in the financial market, there are no teachers. My strategy for adding positions is: when the stock price enters247.500–235.360range, start the portfolio protection fund battle sequence;

Stock price enters235.360–212.110Region, initiate the strategy of buying deep dips in the fund battle sequence. I already have a position, so there is no problem of missing out. Rise: have long positions; Fall: have protective funds and funds for buying deeply on dips.