Can GE Aerospace (GE) Overcome Production Concerns For An Earnings Surprise?

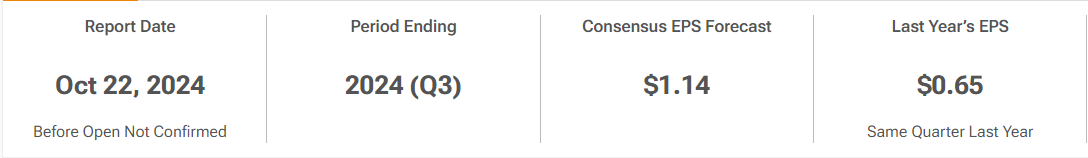

$GE Aerospace (GE.US)$ is scheduled to report its third-quarter earnings before the market open on Tuesday (22 Oct).

Strong performance for GE Aerospace stock is expected with potential breakout to a fresh multi-year high this week after its earnings.

GE is the largest player in aircraft propulsion and consistently delivers the highest margins, but there is also key questions for GE's third-quarter results will be around the production of LEAP (leading edge aviation propulsion) engines following a shortfall in deliveries to Airbus in Q2 and the impact of Boeing's (BA) labor strike.

Wall Street analysts are optimistic about the company’s performance, with consensus estimates predicting earnings of $1.14 per share on revenue of $9.05 billion.

This sharp decline in revenue is partly due to the company's spinoff of its energy segment, GE Vernova (GEV), earlier this year.

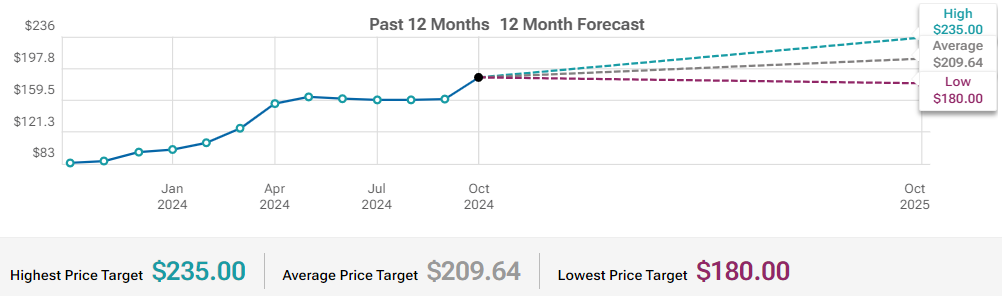

GE Aerospace (GE) Price Target Forecast

Based on 11 Wall Street analysts offering 12 month price targets for GE Aerospace in the last 3 months. The average price target is $209.64 with a high forecast of $235.00 and a low forecast of $180.00. The average price target represents a 8.84% change from the last price of $192.61.

If we looked at the price target optimism, this could be due to the expectations that GE Aerospace would benefit from the airlines spending, though concerns of shortfall in deliveries to Airbus remains.

GE Aerospace (GE) Post Earning Movement Options

The options market overestimated GE stocks earnings move 67% of the time in the last 12 quarters.

Market expect a sizable swing in GE stock after the print drops, according to the options market, with a possible implied move of 5.3% in either direction, versus an average of the actual earnings moves of 4.5% (in absolute terms).

If we looked at the implied volatility skew which shows the market's bias for pricing in volatility risk to the option premium of downside puts and upside calls.

The implied volatility for downside puts is increasing relative to upside calls, this suggests the market is pricing in a larger fear to a downside move.

The current skew indicator shows a bearish signal.

GE Aerospace (GE) Technical Analysis Using MACD and MTF

Technical indicator as of 21 October is showing an uptrend despite the options market giving a bearish signal.

If I were to think of GE as a potential stock to invest in, this might be a good time as we are seeing a potential MACD bullish crossover, and GE is trading above the short-term and long-term MA, and MTF is also giving a strong uptrend from multi timeframe.

This should give investors confidence for this stock as we are also seeing utilities sector performing in the past one weeks.

Summary

We might be seeing mixed signals from the technicals, but the expectations from market for a solid earnings might fueled investors sentiment.

So I am expecting to see some trading activities on GE, I will be watching the price action on GE on 21 Oct before deciding whether to take a position.

Appreciate if you could share your thoughts in the comment section whether you think GE could give an earnings surprises.

Disclaimer: The analysis and result presented does not recommend or suggest any investing in the said stock. This is purely for Analysis.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment