Lam Research (LRCX) Surprise Earnings Might Give A Good Potential Buy At Current Price

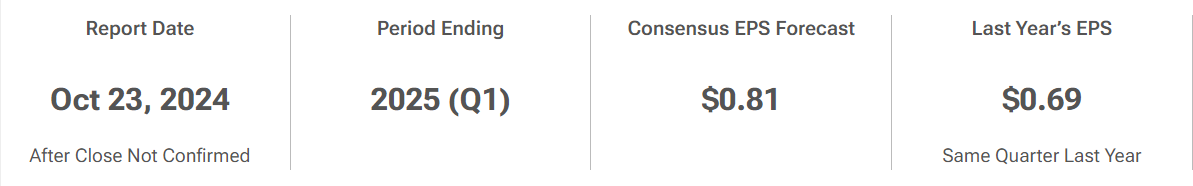

$Lam Research (LRCX.US)$ is scheduled to announce Q1 earnings results on 23 Oct 2024 (Wednesday) after market close.

Marker is expecting the consensus EPS Estimate to come in at $0.81 (-88.2% Y/Y) and the consensus Revenue Estimate is $4.06B (+16.7% Y/Y).

I would be more concerned about Lam Research’s PE ratio performance versus its stock price performance since its stock split in May and also the repurchase.

Will Lam Research Be Another ASML In The Making?

Lam Research designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the production of integrated circuits. In its annual filing, the company identified Micron, Samsung, SK Hynix, and Taiwan Semiconductor Manufacturing as its primary customers, highlighting its strong ties within the semiconductor industry.

According to McKinsey & Company, global investments in semiconductor fabrication facilities are projected to reach around $1 trillion by 2030. Additionally, much of this investment is focused on Asia and the United States.

During the Lam Research August earnings conference call, CEO Timothy Archer discussed the potential growth driven by artificial intelligence applications. As the use of AI expands, particularly with inferencing at the edge, there is an expected rise in demand for low-power DRAM and NAND storage in enterprise PCs and smartphones. This trend aligns with the company's capabilities, suggesting that investments in AI-enabled edge devices will significantly benefit the company.

Lam Research has an ROCE of 30%. In absolute terms that's a great return and it's even better than the Semiconductor industry average of 9.0%.

But can this translate into a better stock price returns for the investors?

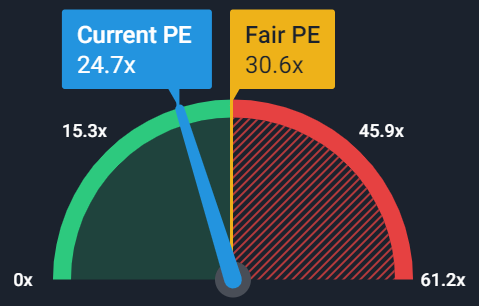

Lam Research (LRCX) Price to Earnings Ratio vs Fair Ratio

What is LRCX's PE Ratio compared to its Fair PE Ratio? This is the expected PE Ratio taking into account the company's forecast earnings growth, profit margins and other risk factors.

When we compared Price-To-Earnings vs Fair Ratio, Lam Research is good value based on its Price-To-Earnings Ratio (24.7x) compared to the estimated Fair Price-To-Earnings Ratio (30.6x).

This should garner more investors sentiment and into buying of this stock.

Lam Research (LRCX) Price Target Forecast

The market analyst have forecast Lam Research target price to be more than 20% higher than the current share price and analysts are within a statistically confident range of agreement.

While analysts are confident about the target price for Lam Research, from the recent performance since mid-October, we are seeing LRCX trending on the downside.

Partly it could be due to the ASML effect, but we have also seen semiconductor sectors in recovery mode, and some of the names have helped to move the market to stability yesterday (22 Oct), so we need to be cautious when trading this stock as there is a possibility it could produce the same impact as ASML.

Technical Analysis - MACD and Multi-time frame

In May, Lam Research announced a 10-for-1 stock split alongside a $10 billion share buyback program that adds to existing repurchase authorizations. It allows for repurchases in both public and private markets, including the use of derivative contracts and structured agreements, with no fixed termination date, although it may be suspended or discontinued at any time.

If we looked at how LRCX is trading from September, it is trading below the short-term and long-term MA, while some of the semiconductor names are recovering from the decline caused by ASML.

MACD has also given a bearish MACD crossover recently, and this might signal that investors are not confident that we could see an earning surprise from Lam Research, I would monitor the price action for Lam Research as the MTF is showing a downtrend.

This might be cautious as the earnings release could also impact the other semiconductor stocks.

Summary

While LRCX PE ratio and the analyst expectations looked positive, we might have the possibility that LRCX might lose out on the chips demand in Asia, as we know that $NVIDIA (NVDA.US)$ $Taiwan Semiconductor (TSM.US)$ are stronger in the Asia region.

I will be monitoring the price action to check out investors sentiment on how they would be buying and at what price. But there might be an opportunities to buy at low price if there is signal that Lam Research earnings could provide a surprise.

Appreciate if you could share your thoughts in the comment section whether you think Lam Research could provide an earning surprise and give us an opportunity to buy at current price?

Disclaimer: The analysis and result presented does not recommend or suggest any investing in the said stock. This is purely for Analysis.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment