Can the Wealth Creation Myths of Novo Nordisk & Eli Lilly Continue After Outperforming Analyst Target Prices?

Thanks to the significant increase in attention to weight loss drugs, $Novo-Nordisk A/S (NVO.US)$ and $Eli Lilly and Co (LLY.US)$ have enjoyed an upward march in their share prices this year, constantly setting new highs. As of current, $Eli Lilly and Co (LLY.US)$ and $Novo-Nordisk A/S (NVO.US)$ have seen respective YTD increases of 64.10% and 45.94%, with $Novo-Nordisk A/S (NVO.US)$ even surpassing LVMH in market capitalization in early September to become Europe's most valuable company .

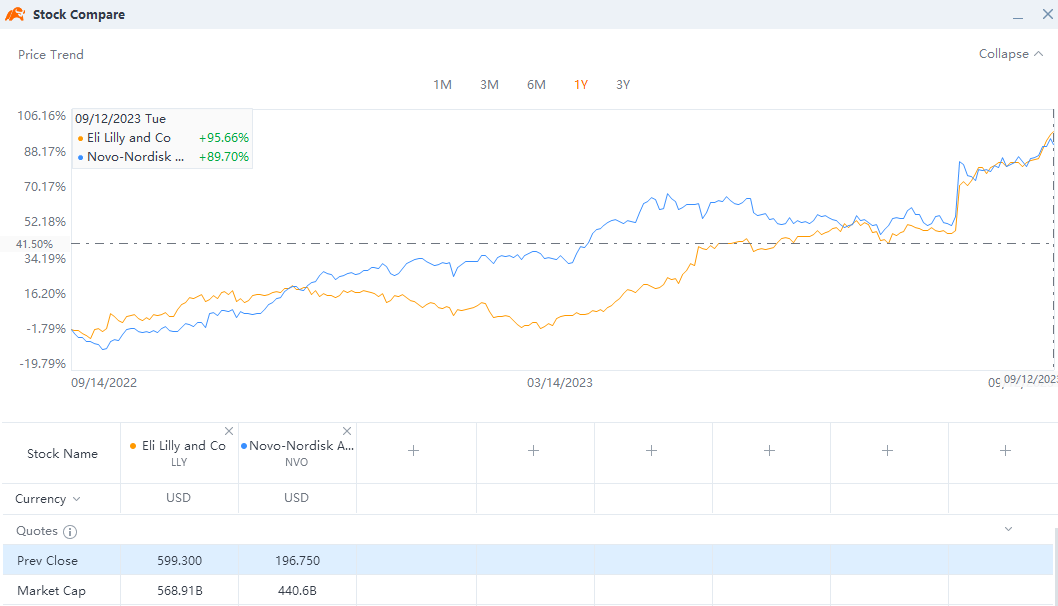

Driven by the approval and application of GLP-1 drugs such as Wegovy and Mounjaro in the field of weight loss, $Eli Lilly and Co (LLY.US)$ and $Novo-Nordisk A/S (NVO.US)$ shares have surged this year, even surpassing analysts' consensus expectations. As of the September 12th close, LLY's current price reached $599.30 and NVO's current price was $196.75, both hitting new highs while outperforming Bloomberg analysts' consensus target prices by 6.25% and 0.38%, respectively.

After receiving numerous positive weight loss trial results and FDA approval, Novo Nordisk's new drug Wegovy has garnered a significant following, including billionaire Elon Musk. Social media's rapid spread has further fueled the hype surrounding the weight loss drug industry and driven up demand for the drugs. According to J.P. Morgan's data, the drugs have attracted more attention in 2023.

Putting aside short-term hype, analysts believe that weight loss drugs have a solid fundamental basis. Considering the wide market demand, related pharmaceutical companies such as Novo Nordisk and Eli Lilly have far-reaching treatment effects and investment potential. Positive progress in the relevant drug trials, as well as news of their approval and market launches around the world, will serve as catalysts for short-term stock price increases.

J.P. Morgan's Olivia Schwern:“We believe Semaglutide is merely an opening chapter in new drug development; We expect to see powerful fundamental drivers propel value creation in the obesity drug market. The combination of commercial research innovation, faster drug reviews, and sustained market growth will continue to drive investment opportunities in the months and years ahead.”

“Social media activity documenting transformative weight loss, together with the establishment of affordable insurance coverage more quickly than anticipated, has helped drive demand for obesity medicines beyond our expectations,” said Mark Purcell, European Biopharmaceuticals analyst at Morgan Stanley.

J.P. Morgan has recently revised its estimates for weight loss drugs, forecasting that GLP-1 agonists will generate well over $100 billion in annual sales by 2030.

Furthermore, in terms of the market landscape, JP Morgan believes that LLY/Novo will continue to divide the market, which is different from its previous notion in July that "the weight loss drug market is unlikely to turn into a complete winner-takes-all competition".

JP Morgan specifically favors $Eli Lilly and Co (LLY.US)$ as its top pick in the sector, with significant potential upside to Street estimates for Mounjaro and LLY's portfolio of incretin drugs expected over time. Additionally, it have a positive outlook for the stock leading up to several key catalysts in 2023 and early 2024, including capacity expansion and obesity approval for Mounjaro/tirzepatide, comprehensive health outcomes data, and complete FDA approval of donanemab.

Source: J.P. Morgan, Morgan Stanley

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

SpyderCall : LLY is one of the best stocks for a long-term portfolio, in my opinion. It fits all of my criteria for a long-term investment.

Silverbat SpyderCall : NVO seems bette

SpyderCall Silverbat : I like NVO also. It is a solid company for sure. I'm just more familiar with LLY.

Silverbat SpyderCall : Thanks for your fine work on LLY, and will follow you