Canadian Rate Cut Winners: Shopify,E-commerce Powerhouse Set to Thrive with Canadian Rate Cut

Stay Connected.Stay Informed. Follow me on MooMoo!![]()

![]()

![]()

In the previous Canadian Rate Cut Winners series, we introduced the Bank of Nova Scotia (BNS), which has a very attractive dividend rate in Canada. In this article, we will introduce another company that benefits from the interest rate cut measures - Shopify Inc. (SHOP). If you are interested, let's take a look together!

Who is Shopify?

$Shopify Inc (SHOP.CA)$ is a Canadian multinational e-commerce company, founded in 2006 and headquartered in Ottawa, Ontario. Shopify provides a comprehensive e-commerce platform for merchants around the world, supporting them in establishing, operating, and growing their online businesses. It is committed to reducing the barriers to entrepreneurship through technological innovation, helping merchants to achieve profitability globally.

I. Introduction to Main Business

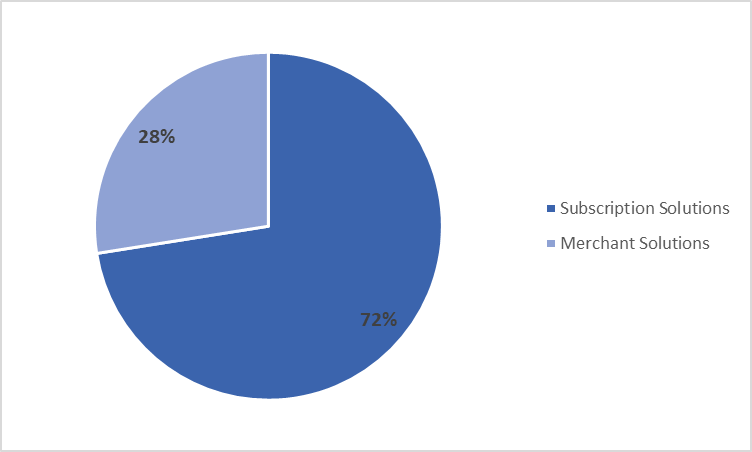

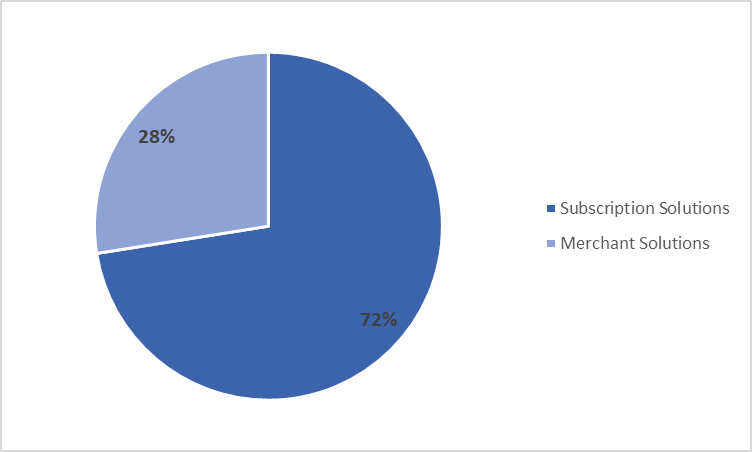

All of Shopify's revenue comes from a single e-commerce division, which can be divided into two main types:

(1)Subscription Solutions: Provides Software as a Service (SaaS) subscription services for merchants, including website building, inventory management, order processing, and other basic e-commerce functions. Merchants can choose different subscription plans and pay periodic subscription fees to use the Shopify platform.

(2)Merchant Solutions: Offers value-added services, such as payment processing (Shopify Payments), logistics services, financing solutions (Shopify Capital), and customized services for large enterprises through Shopify Plus.

Chart: Main Business Composition

II. Company Highlights

1.Steady Market Share Ranking First Globally, Clear Competitive Landscape

Shopify holds an important position in the global e-commerce service market and is currently the largest e-commerce service platform (SaaS) globally. As of the end of May 2024, Shopify's market share in the global e-commerce market reached 26.2%, firmly sitting on the throne of the industry's first place.

Thanks to the company's leading market share across the industry, Shopify has carried out e-commerce business in multiple markets globally. With the recovery of consumers' willingness to shop online after the pandemic, Shopify's performance also has room for growth. As of the first quarter of 2024, the company's total revenue reached 2.5 billion Canadian dollars, a 23% increase year-on-year, showing the company's good business development status.

2.Strong Performance, GMV Growth Rate Exceeds 20%

In the first quarter of 2024, Shopify's GMV was 82.075 billion Canadian dollars, a year-on-year increase of 22.44%. The adjusted net profit for the first quarter was more than 20 times that of the same period last year, reaching 345 million Canadian dollars. The rapid rise in performance is due to a significant 23% increase in Shopify's e-commerce revenue, and thanks to reduced R&D investment, Shopify's operating expense ratio also decreased from 50% in the same period last year to 41% in this quarter, further driving the company's net profit increase.

3.Increasing Usage Rate of Shopify Pay, B2B Brings Huge Business Opportunities

Shopify continues to improve the user experience of its existing services (such as Shopify Pay), enhancing user experience and increasing conversion rates. At the same time, in Forrester's 2024 B2B Commerce Platform Wave assessment, Shopify was listed as a leader, further proving that the company's B2B products contain significant business opportunities.

At the latest performance meeting, the company's senior management stated: Thanks to the simplification of Shopify Pay operations, the usage of Shopify Pay in the first quarter of 2024 increased by 56% year-on-year, processing a GMV of 14 billion US dollars, accounting for 39% of the company's total payment volume; in addition, in the B2B area, Shopify has also made significant progress, with the first quarter B2B GMV growing by more than 130% year-on-year, nearly doubling compared to the same period in 2023.

III. Future Outlook

1.Interest Rate Cuts May Promote Transaction Volume Increase, Raising Company Valuation Premium

On June 5, the Bank of Canada announced that the Canadian interest rate would be reduced from 5% to 4.75%. For Shopify, this interest rate cut policy will reduce the operating costs of merchants on the platform, promote commercial activities of online merchants, drive an increase in transaction volume on the Shopify platform, and Shopify can also obtain more commissions from these increased transactions.

In addition, after the Bank of Canada lowers the interest rate, major banks will also reduce deposit interest rates in the next few quarters, which will stimulate consumers to reduce their savings willingness and engage in more consumption behavior. This is also beneficial to the performance growth of Shopify's e-commerce.

In addition to the benefits to the company's e-commerce transactions, interest rate cuts are also expected to reduce the company's weighted average cost of capital (WACC) and interest expenses. The former is beneficial to the assessment of the company's net present value, and the latter is beneficial to increasing the company's cash flow, both of which help to enhance the valuation of Shopify.

2.Technological Innovation Drives Market Share Growth

At the latest investor relations meeting, Shopify said that it will invest more in AI and machine learning in the future, allowing the company to more accurately target consumer marketing advertisements and further improve the platform's turnover and user experience.

With the enhancement of product competitiveness and the implementation of AI precise push strategies, Shopify is expected to maintain rapid growth in performance in the next few quarters, thereby continuing to increase its share in the global e-commerce market.

3.Future Performance Growth Rate is Worth Looking Forward to

So far in 2024, Shopify's stock price has fallen by 18%. Analysts pointed out that the reason for such a large decline in the company's stock price recently is that Shopify's performance growth rate in the first quarter did not meet market expectations. Although the company's performance growth rate is still above 20% this quarter, Wall Street's expectation for its performance growth rate was as high as 30%, so the gap between expectations and reality after the performance release led to poor performance of the company's stock price recently.

It is worth noting that from May 28 to June 10, Shopify experienced a continuous stock price increase, with a total increase of nearly 11%, and the stock price rebounded. It is recommended that everyone pay attention to Shopify's performance changes, as long as the performance continues to grow stably, it is expected that against the backdrop of interest rate cuts, the valuation is likely to increase.

Thanks to the company's AI layout and multiple favorable factors such as interest rate cuts, we expect that the company's performance will continue to grow rapidly in the next few quarters. Considering that Shopify's current stock price may be in a low price range, therefore, in the long run, buying the company's stock at a lower price is likely to yield good returns.

Conclusion

As a leader in the field of e-commerce services, Shopify, with its strong market position, continuous technological innovation, and successful expansion into international markets, has shown outstanding business strength and growth potential. The company's current valuation is 11 times PE, lower than the historical 14xPE, and the future growth potential is worth looking forward to.

At the same time, against the backdrop of the interest rate cut by the Bank of Canada, the company's performance and valuation can also benefit. If Shopify can determine a real dividend plan for shareholders in the future, its development prospects will be even more worth looking forward to by investors.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment