Complex things, composite functions, divide and conquer; piecewise functions, segmented investment trading, precisely strike each and every one, choices made orderly by me.

Technical exits and puts do not necessarily mean short selling, nor do they change the bullish view on Tesla's primary trend and long-term trend.

Currently, Tesla's stock price is in a high probability event's main consolidation zone and extreme value area in the short term.

The abnormal variation and frequency modulation of Tesla's short squeeze to maintain overbought conditions are the main reasons for eliminating the put short sell group - a rapid surge of long-range shock suspension.

Not adding unnecessary embellishments or engaging in sycophantic behaviors, but focusing on doing more meaningful acts of timely assistance like sending charcoal in snowy weather:

In the darkest and most hopeless times, still holding firm beliefs, dealing with it calmly with a happy and open mindset: buying low and selling high, with a planned and step-by-step approach, in batches and increments, using discrete random variables, and laying out positions. Most people in this world, who are focused on immediate gains and losses, cannot achieve this level of detachment and attitude towards money and wealth.

The time required to complete one full vibration cycle (lower rail - middle rail - upper rail > upper rail - middle rail - lower rail; trough - mid wave - peak > peak - mid wave - trough) is called a full cycle.

The moon waxes and wanes; people experience joys and sorrows, separations and reunions; cycles include full cycles, half cycles, and intermittent cycles.

Not delighting in external things, not grieving for oneself. When the enemy comes, the general will block; when the water comes, the earth will cover. When the enemy arrives, the general will meet it, following nature's course.

The Rothschild Family has a family motto and saying: The reason why the Rothschild Family has been able to survive in its current form is because they get off the train early at crucial moments.

Renowned American mathematician, investor, and philanthropist James Harris Simons has a famous quote on Wall Street: Why don't you run away when you smell of gunpowder?

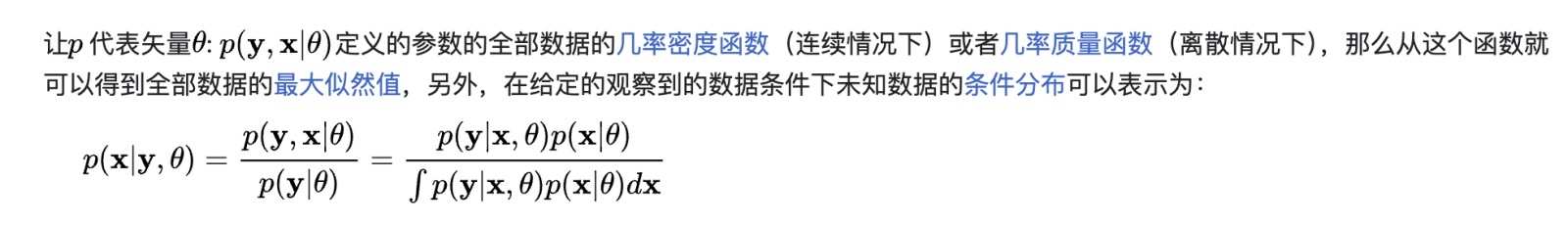

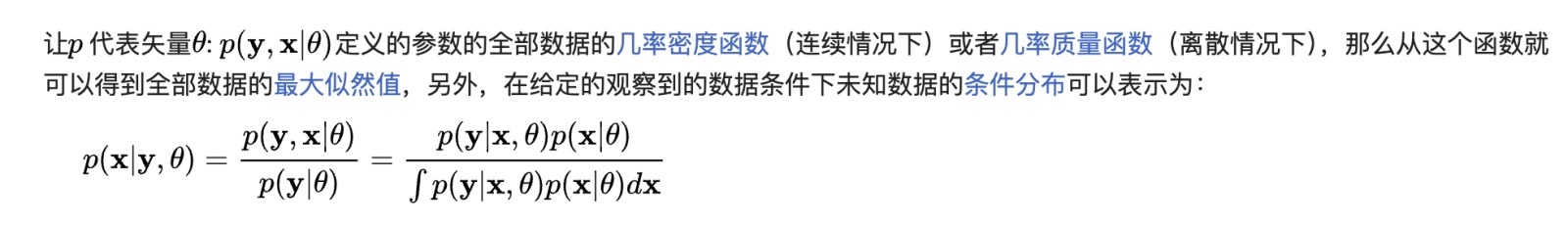

When using the Baum-Welch algorithm model and Hidden Markov model, as well as the profit chip proportion function curve trajectory equation, a critical point is to identify the main settlement area of high-probability events, and then deploy the main capital firepower in that area; the non-main settlement areas of high-probability events can be ignored to a certain extent, thereby greatly improving the effectiveness and efficiency of capital firepower usage.

This is also the main reason why James Harris Simons, a world-class great mathematician, investor with a net worth exceeding $24 billion, philanthropist, led the establishment of Renaissance Technologies LLC in 1988, which created the most profitable investment portfolio for the company, the 'Medallion Fund', dominating Wall Street in the financial market, strategically outperforming, and consistently surpassing the stock god Warren Edward Buffett and the financial giant George Soros.

Renaissance Technologies LLC has an average annual fund return rate of over 70%. The quantitative model of the Medallion Fund is based on the improvement and extension of the Baum-Welch algorithm model by Leonard Baum, exploring the relevance of possible profits, a modification completed by the algebraist James Coase. Simons and Coase established a fund based on this, naming it 'Medallion' to commemorate their past mathematical honors.

This is also the main reason why James Harris Simons, a world-class great mathematician, investor with a net worth exceeding $24 billion, philanthropist, led the establishment of Renaissance Technologies LLC in 1988, which created the most profitable investment portfolio for the company, the 'Medallion Fund', dominating Wall Street in the financial market, strategically outperforming, and consistently surpassing the stock god Warren Edward Buffett and the financial giant George Soros.

Renaissance Technologies LLC has an average annual fund return rate of over 70%. The quantitative model of the Medallion Fund is based on the improvement and extension of the Baum-Welch algorithm model by Leonard Baum, exploring the relevance of possible profits, a modification completed by the algebraist James Coase. Simons and Coase established a fund based on this, naming it 'Medallion' to commemorate their past mathematical honors.

Following the trend, against technology, counter human nature. Combining individual stock characteristics, flexibly using the establishment models in Applied Mathematics, function-level quantitative analysis, along with setting and adjusting parameters, as well as handling non-functional problems flexibly and ingeniously, are all key to victory.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment