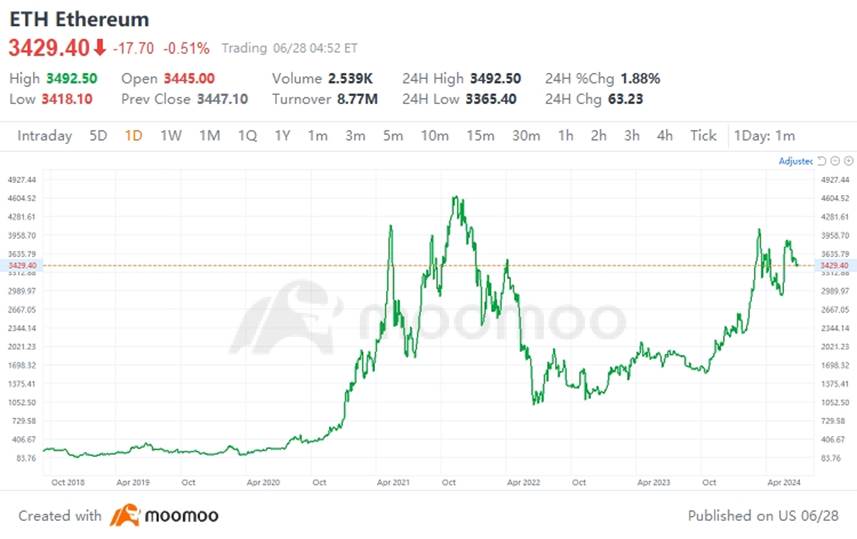

Cryptocurrency Tracking: Can the Issuance of ETFs Propel Ethereum To New Heights?

A Reuters report on Wednesday suggested that industry insiders believe the SEC might greenlight spot ETH ETFs by July 4. This development comes as discussions between asset managers and regulators are reportedly in their final phases. The anticipated approval date of July 4 corroborates previous conjectures by Bloomberg analyst Eric Balchunas, who had forecasted the launch of ETH ETFs to occur around July 2.

During a Bloomberg event on Tuesday, SEC Chair Gary Gensler remarked that the process of introducing spot Ethereum ETFs is progressing "smoothly." He emphasized that the launch of these products hinges on the asset managers' ability to provide comprehensive disclosures in their registration statements.

■ Exchange Ethereum supply may further decline

The research institute Glassnode's analytics reveal that the quantity of Ethereum held on exchanges is decreasing, even as the cryptocurrency's value climbs.

The report indicates a hesitancy among Ethereum's long-term holders to cash in on their investments just yet. These holders are possibly waiting for even greater price surges and a fresh record high before they start to take profits, particularly with the potential introduction of spot ETH ETFs looming.

Additionally, the allure of rising returns from ETH staking and the use of restaking protocols might be contributing to this trend of diminishing exchange reserves. Glassnode's figures also highlight a consistent rise in the amount of staked Ethereum, suggesting that a significant portion of Ethereum moving off exchanges is likely being channeled into staking mechanisms.

■ How much money will flow into the Ether Spot ETF?

Matt Hougan, the Chief Information Officer of Bitwise, stated that a US spot Ethereum ETF could attract $15 billion in net inflows by the end of 2025. Matt Hougan compared the relative market capitalization of Ethereum to Bitcoin. He expects investors to allocate according to the market capitalization of Bitcoin and Ethereum spot ETFs ($1.2 trillion and $405 billion, respectively). This allocation would provide about 75% weight to the Bitcoin spot ETF and about 25% to the Ethereum spot ETF.

Bloomberg analyst Eric Balchunas believes that after accounting for hedging trades and spot rotations, the actual net inflow for the spot Bitcoin ETF since its approval in January is $5 billion. Ethereum's flow could be 10% of Bitcoin's, which means that the real net inflow for a spot Ethereum ETF could be $500 million within the first six months after approval, with an optimistic estimate of around $1.5 billion.

Eric Balchunas emphasized that for ETFs targeting traditional institutions such as pension funds, endowments, and sovereign wealth funds, Ethereum is not popular. This is because Ethereum's institutional market holdings are smaller than Bitcoin's, but before the launch of the ETF, Ethereum had already risen fourfold from its low point, while Bitcoin had only risen 2.75 times, reflecting limited upside potential for Ethereum's price. Additionally, Ethereum has also underperformed from a quantitative data perspective.

■ What is the future price trend of Ethereum? Market opinions vary.

Brokerage and financial services firm StoneX predicts that Ethereum will rise by 40% within two months after the listing of a spot Ethereum ETF. Over a broader time frame, StoneX's model forecasts that the price of Ethereum will range between $2,142 and $12,621 over the next two years. The firm mentioned that its most conservative forecast is based on the assumption that there may not be tangible growth in gaming and real-world assets (RWA)—which many believe will promote the total value locked (TVL).

Galaxy Research analyst Charles Yu has observed that inflows into Ethereum ETFs could have a more pronounced impact on ETH's price compared to Bitcoin due to the considerable portion of Ethereum's total supply tied up in staking, bridges, and smart contracts, in addition to the smaller quantity of ETH stored on centralized exchanges.

Additionally, Yu points out that the Ethereum market may feel the pressure from capital exiting the Grayscale Ethereum Trust (ETHE), potentially dampening the positive effects of ETF inflows. He predicts these outflows could amount to around 319,000 ETH per month, equivalent to $1.1 billion. However, given that a lower proportion of Ether is contained within these trusts, Yu suggests that any negative impact on ETH's price caused by the conversion of ETHE to an ETF would likely be less significant when compared to the influence of the Grayscale Bitcoin Trust (GBTC) conversion on Bitcoin's price.

Source: FXStreet, CoinDesk

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

103942672 : eth 2 be the moon soon. Good news