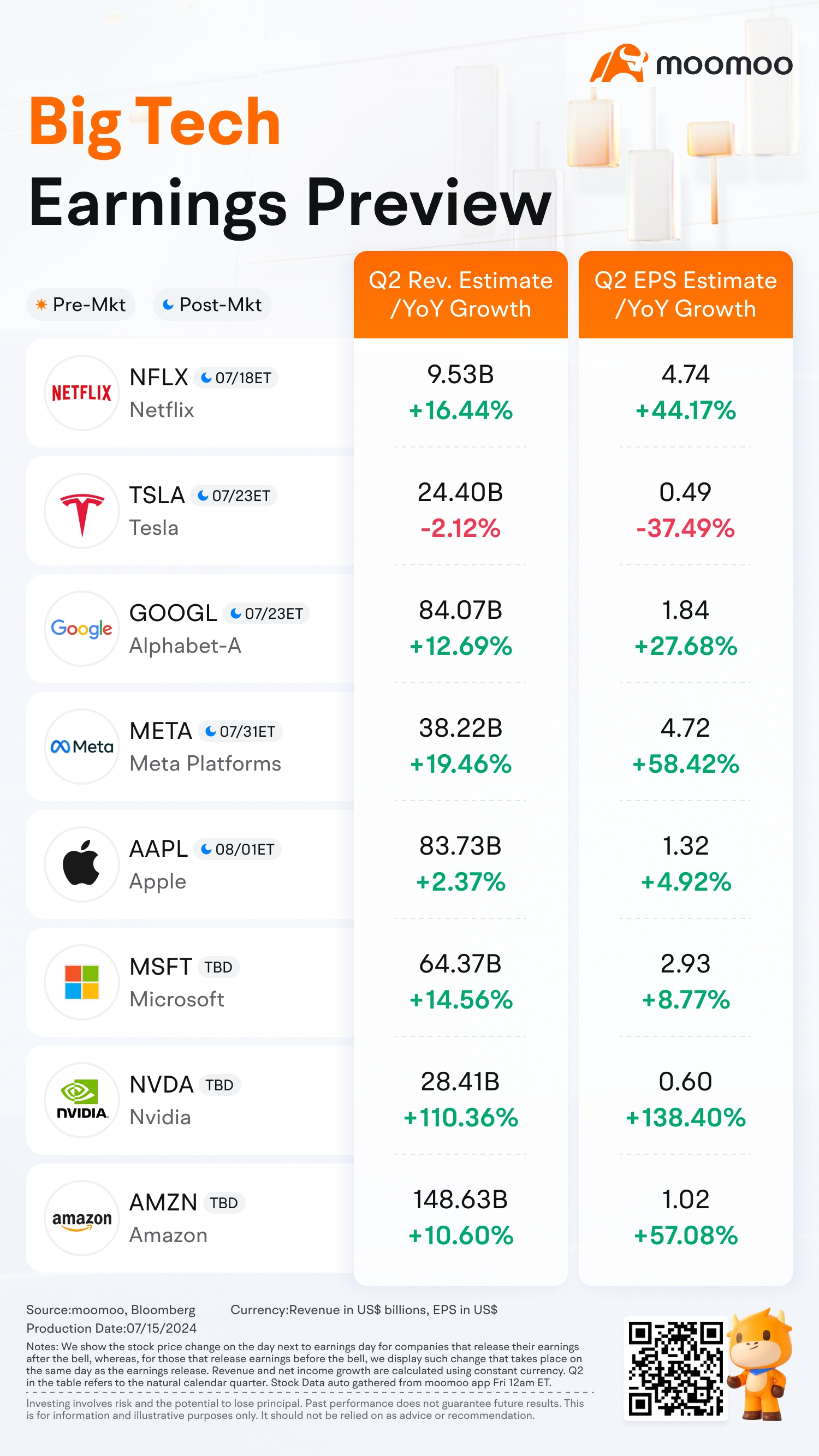

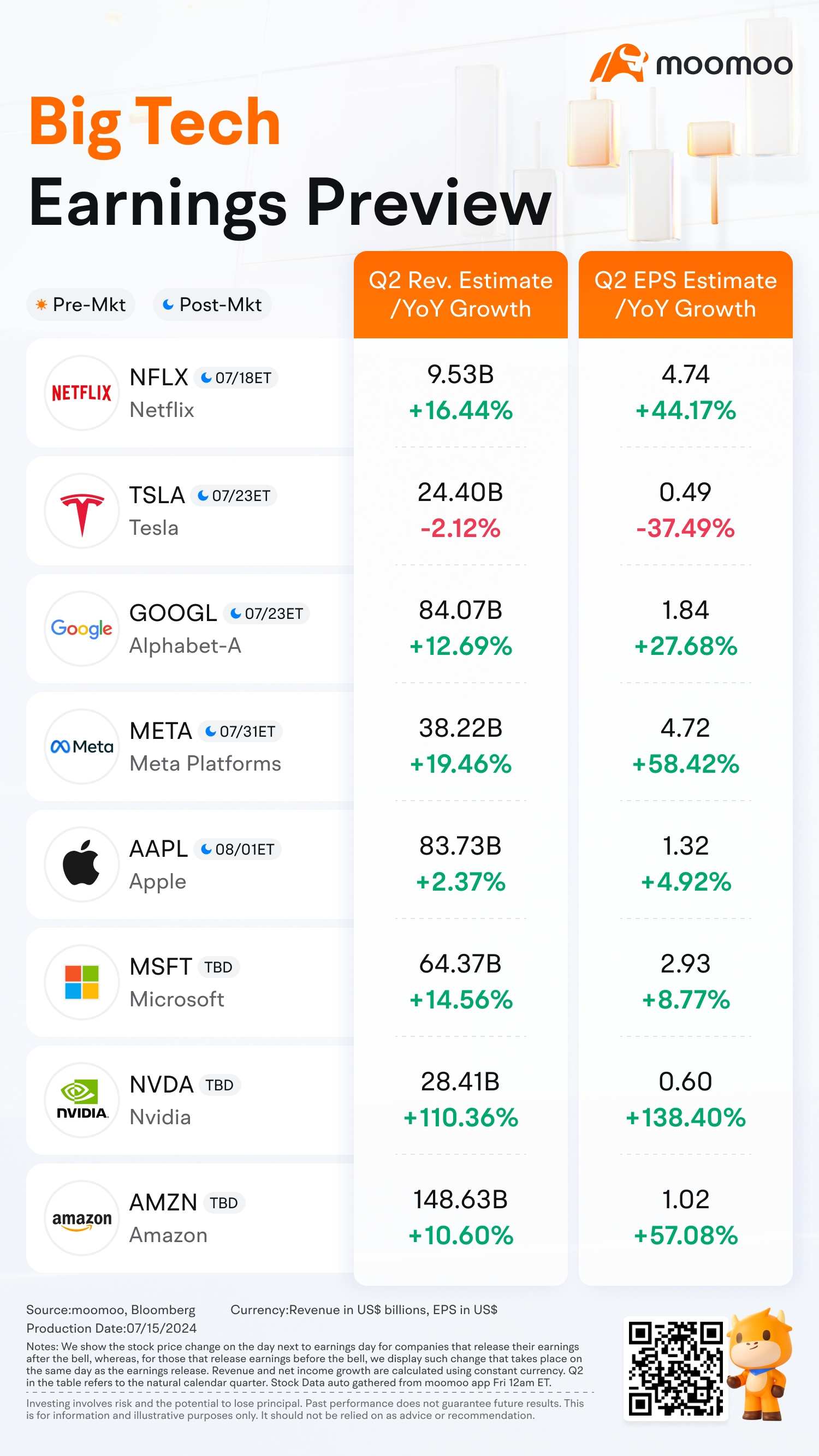

In One Chart | Big Tech Earnings Preview: Can Giants Sustain the Second-Half Rally?

Big tech earnings season is in full swing. Over the next few weeks and months, some of the largest tech stocks on the Nasdaq exchange, including 'Magnificent Seven' like $NVIDIA(NVDA.US$, $Apple(AAPL.US$, $Microsoft(MSFT.US$, $Alphabet-A(GOOGL.US$, $Meta Platforms(META.US$, $Tesla(TSLA.US$ and $Amazon(AMZN.US$, will be releasing their earnings reports.

Check Out Key Expectations of Big Techs' Upcoming Earnings:

According to the latest institutional forecasts compiled by the London Stock Exchange Group (LSEG), the $S&P 500 Index(.SPX.US$ components are expected to see revenue growth of 4.1% and net profit growth of 10.1% in the second quarter, marking the fifth consecutive quarter of positive growth. Information Technology remains a key driver, anticipated to contribute one-third of the total profit growth. FactSet data suggests that the S&P 500's earnings are projected to increase nearly 9% year-on-year in Q2, potentially marking the largest quarterly gain since early 2022. This sets a high bar for U.S. companies, particularly the tech giants, which need to deliver robust profit growth to meet Wall Street's optimistic expectations and pave the way for further market highs. The "Magnificent 7" tech giants are expected to show strong earnings growth of 29.9% this year, slowing to 17.8% by 2025. In contrast, the rest of the S&P 500 is expected to see growth of 6.4% this year, doubling to 13.3% by 2025. Despite high valuations, the sector's fundamentals remain strong, and some, like Jason Alonzo of Harbor Capital Advisors, believe that the current enthusiasm around AI is not yet excessive.

Wall Street's heavy tilt towards the tech sector, fueled by AI, has raised the stakes. Valuations are high, and earnings growth is expected to slow, adding uncertainty for investors. Lisa Shalett, CIO at Morgan Stanley's wealth management unit, warns of "stretched momentum, weak breadth, and complacency" in the market. The S&P 500 has risen 17% this year, with two-thirds of that gain coming from just six companies: Nvidia, Microsoft, Alphabet, Amazon, Meta, and Apple. Nvidia alone accounts for nearly 30% of this year's advance. Matt Stucky of Northwestern Mutual notes that many investors favor megacaps for their high-quality characteristics amid economic uncertainty. However, he cautions that these stocks have become more expensive, and the market is highly momentum-focused. If AI excitement wanes, the market could become vulnerable.

Citi strategist Scott Chronert notes that the market may need even higher growth forecasts to sustain its recent uptrend. The strong stock performance of U.S. tech giants this year has raised Wall Street's expectations, making their upcoming earnings reports a critical focal point.

Source: Bloomberg, Seeking Alpha, Nerdwallet

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

103492747 : GOOD EVENING

1000proof : Great information to read up on today. Thanks

Paul bin Anthony : very helpful thanks

WWWSSS :