DBS – strong earnings, outlook and capital management

-Over the past week, DBS surged as much as 9.2% post its earnings result to a record high of $42.75 yesterday

-Apart from its better than expected earnings announced on 7 November, the share price surge is driven by a surprise $3 billion share buyback programDBS shares are now the second best performing index constituent on the Straits Times Index with a 39.2% year-to-date gain, compared to the benchmark index’s 14.8% year to date increase

- Investors keen to hear Macquarie Research’s (MQ) view on DBS shares may wish to read more below.

-Apart from its better than expected earnings announced on 7 November, the share price surge is driven by a surprise $3 billion share buyback programDBS shares are now the second best performing index constituent on the Straits Times Index with a 39.2% year-to-date gain, compared to the benchmark index’s 14.8% year to date increase

- Investors keen to hear Macquarie Research’s (MQ) view on DBS shares may wish to read more below.

Note: Macquarie Research is independent from the Warrants business, what the Macquarie Warrants desks quote from Macquarie Research may not reflect the complete analysis of Macquarie Research on the relevant company over time.

Key points

– DBS' wealth franchise continues to perform. MQ thinks the prospect of higher for longer rates and a stronger USD support the shares

– The S$3b announced buyback provides downside support. Doing more than S$3b could risk pushing Temasek beyond a 30% holding, however

– MQ upgrades their earnings per share by 3% for FY2025 on higher wealth fees, partially offset by higher costs. MQ’s new price target is 11% higher at S$45.50

Strong earnings and outlook. Wealth fees and trading drove the 3Q24 earnings beat. 3Q24 wealth management income rose 55%, helped by a confluence of inflows (steady S$6b per quarter), more investments/total assets under management and the Citi Taiwan acquisition.

Even excluding Citi Taiwan, wealth was up 46% year on year, DBS said. Management highlighted there remains upside to investment income/total wealth assets under management (56%) with the private banking segment able to operating at around 70%, and 120 recently added RMs yet to fully ramp up their individual revenue contributions (which can scale 5-6x over 3 years).

Buyback more of a floor in MQ’s view, higher dividends still key. MQ’s calculations is that DBS' S$3b buyback would drive 2.6% earnings per share accretion if fully implemented now at the current share price. In practice, the buyback is likely to be deployed opportunistically around any market volatility. The key remains lifting payouts over time close to 70% (MQ’s FY2026 estimate is 68%).

Trump 2.0 presents risks and opportunities. Though uncertainty on policy impacting trade and potentially China growth, a higher USD and the potential for a higher terminal US Fed rate are positives for DBS. Singapore is geopolitically neutral, and as a hub in the region could benefit if intra Asian trade flows and FDI accelerates.

Earnings changes: MQ is raising earnings per share by 3% each for FY2024 and 2025 reflecting higher fee income, partially offset by slightly higher operating expenses in FY2025.

Valuation: MQ is rolling forward their price target to end-FY2025, slightly increase long-term growth (3.0% vs 2.5% prior) and fully weight their excess capital now that Basel IV fully loaded is known (2% CET1). MQ’s price target on DBS is 11% higher at S$45.50.

Catalysts: The final '24 dividend increase from S$0.54/sh to S$0.60/sh (1Q25) should affirm the capital management outlook; potential upward revisions on USD, Fed rates and refinements to guidance in this scenario.

Investment thesis and recommendation

DBS is the most profitable and, MQ believes, the highest quality Singapore bank. DBS' wealth franchise continues to outperform market expectations. Near term, USD strength and fewer US Fed cuts are positives. DBS is in the top 5% in our quant model.

MQ has an Outperform rating on DBS shares and a 12-month price target of $45.50 based on a Price-to-Book stock methodology.

-------------------------------------------------------------------------------------------------------------------

– Investors keen to trade the short-term moves in DBS shares may wish to consider using Macquarie’s DBS warrants which will move more than DBS shares whilst costing a fraction of its share price.

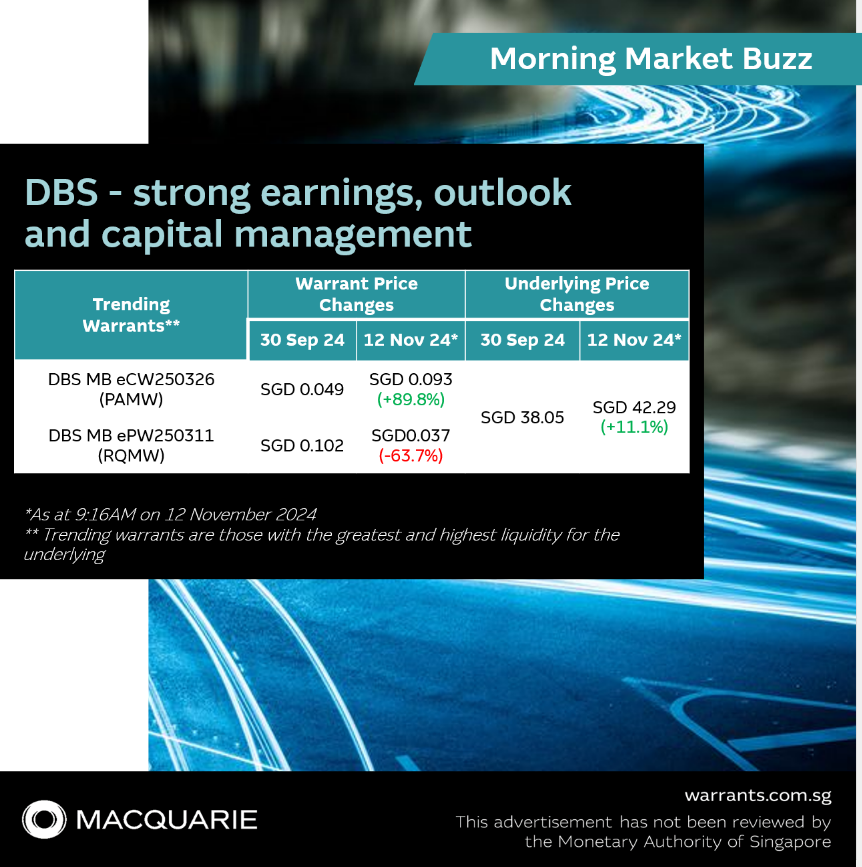

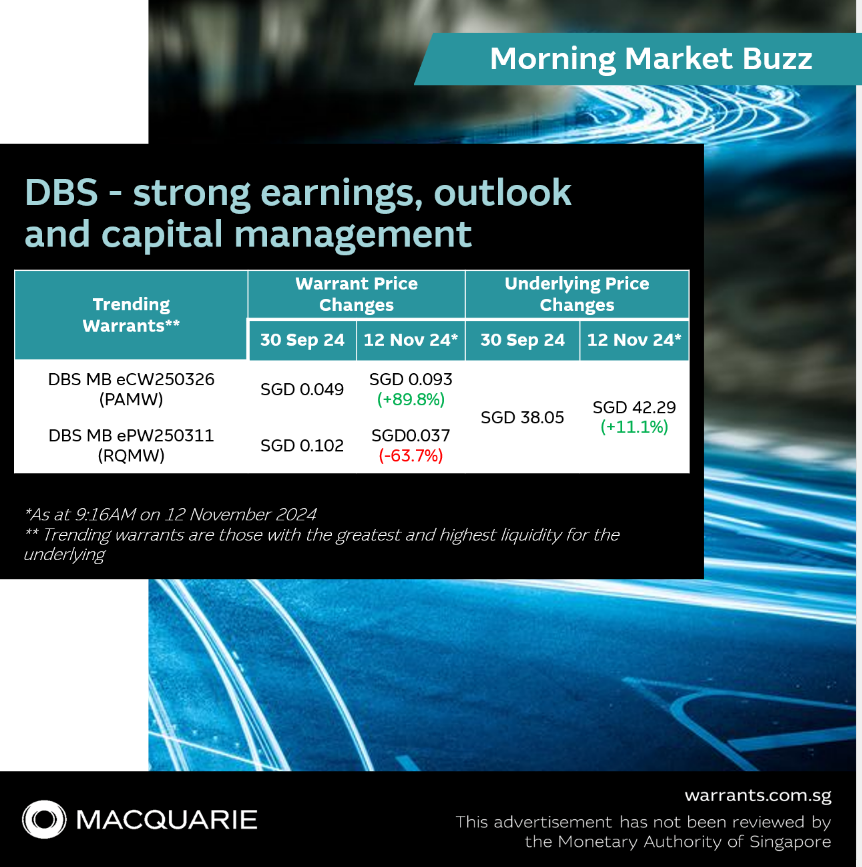

– As an example, Macquarie’s trending DBS call warrant $DBS MB eCW250326 (PAMW.SG)$ (https://warrants.com.sg/tools/warrantterms/PAMW) is up 91.8% to SGD 0.094 with DBS shares rising 11.2% quarter-to-date while trending DBS put warrant $DBS MB ePW250311 (RQMW.SG)$ (https://warrants.com.sg/tools/warrantterms/RQMW) is down 63.7% to SGD 0.037 over the same period

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment