Delta Air Lines Kicks Off Earnings Season: Can Airline Stock Rally Persist?

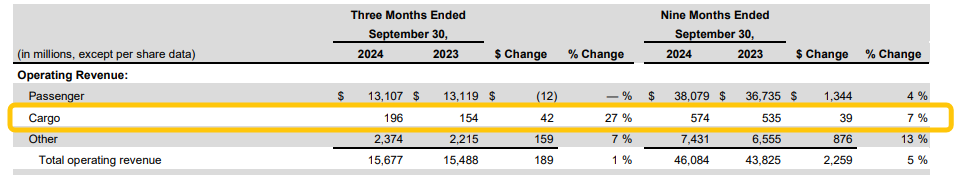

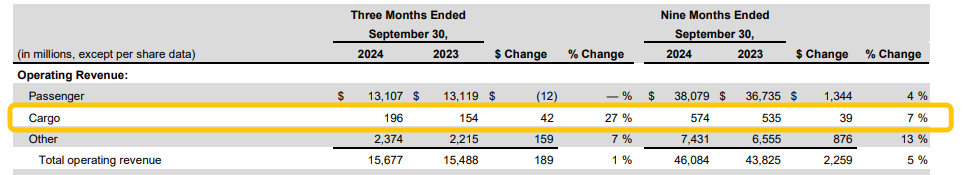

Delta Air Lines reported third-quarter earnings that missed expectations slightly, with non-GAAP operating revenue at $14.6 billion, just below the $14.65 billion forecast. Non-GAAP earnings per share came in at $1.50, compared to the anticipated $1.52.

In July, a technical issue with CrowdStrike grounded approximately 7,000 flights, leading to direct and indirect revenue losses of about $500 million and reducing EPS by 45 cents.

Following the earnings report, Delta's shares fell 1.06% on Thursday. Year-to-date, the stock has gained 26.4%, outperforming the $S&P 500 Index (.SPX.US)$ 's 21.2% increase.

Air Travel Demand Maintains Recovery Momentum

$Delta Air Lines (DAL.US)$ reported sequential unit revenue growth across all regions in the third quarter, indicating strong travel demand. The airline sees "a better balance between demand and supply as industry expansion moderated," according to Delta's President Glen Hauenstein.

The freight market also showed resilience, posting a 27% year-on-year increase and achieving double-digit growth across all international regions.

Premium Products grew 4% year-on-year, while Main Cabin declined 5%. "Consumers are continuing to prioritize premium experiences, and our core customer base is in a healthy financial position with travel remaining a top spend category," Delta CEO Ed Bastian noted during the earnings call.

The business travel market is on an upward trajectory, with managed corporate travel sales up 7 percentage points. Technology, media, and banking sectors posted double-digit growth. A survey revealed that 85% of companies plan to boost business travel spending by 2025.

The company projects fourth-quarter revenue to grow 2% to 4% year-on-year, driven by a 3% to 4% increase in capacity. It anticipates an operating margin of 11% to 13% and earnings per share between $1.60 and $1.85.

Delta Air Lines signaled that the fourth quarter might be its most profitable ever, propelled by robust holiday travel bookings and enhanced pricing power.

Yet, a dip in consumer travel spending is expected around the U.S. elections in November, which could shave a percentage point off unit revenue. "Historically, domestic travel demand softens in the weeks surrounding the election," said Hauenstein during a call.

Morgan Stanley analyst Ravi Shanker remarked that management’s confidence in holiday and early 2025 bookings “is a reassuring sign that demand remains strong.”

Will the Airline Sector's Surge Sustain?

Delta is a leading player in the aviation sector, accounting for about 50% of the industry's total profits. Its early earnings release is often seen as an indicator for the sector.

Next week, $United Airlines (UAL.US)$ will report earnings on Tuesday, with $American Airlines (AAL.US)$ and $Alaska Air (ALK.US)$ following on Thursday. $Southwest Airlines (LUV.US)$, $JetBlue Airways (JBLU.US)$, and $SkyWest (SKYW.US)$ will report at the end of the month.

Earlier this summer, airline capacity exceeded demand by 3-4%, leading to a significant drop in ticket prices, compounded by network disruptions.

However, since July, a sharp decline in jet fuel prices has improved the profitability outlook for airlines. Data shows that in North America, the average price of aviation fuel fell nearly 25% year-on-year for the week ending October 4.

$Airlines (LIST2090.US)$ has risen 29.7% since early August, surpassing the S&P 500's 12.9% gain.

After experiencing competitive pricing due to excess seat supply over the summer, U.S. airlines have adjusted capacity.

"Domestic supply growth continues to rationalize. Across much of the industry, there has been an accelerated pace of change and we are encouraged by the actions the industry is taking to improve profitability and returns," Bastian said during the earnings call.

Bank of America analysts observed that annual U.S. seat growth has slowed from 5.5% in July to 1.5% in October and November.

Source: SeekingAlpha, Investing, Reuters, Bloomberg

by moomoo News Olivia

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Alen Kok : Oh.

Laine Ford : no comment to share

Alen Kok : o

jiajiajin : It is still advisable to continue holding stocks and wait for the Christmas holiday.

RVLTN : So the reality is different than the spin and it’s simply disrespectful for Delta to say its core customers have the means to pay.

Delta is gouging imo and they are trying to gouge a little extra because they are the better carrier.

Being the better carrier was a given for the last decade but ironically, their service has gone downhill fast the past 6 or so months.

So they jacked up rates and see first class and your jaw will drop, but they jacked up all classes.

People are hurting, many hurting bad, and Delta has degraded its service, increased what it charges for it, and then have the nerve to use the gains for a record profit.

I’m disgusted by them after so many years of a clear advantage by flying with them but that’s gone and they’re going to squeeze those that are loyal until every nickel is gone.

joemamaa : wow