Do you smell the gun smoke?

It seems Tesla is destined to follow an unusual path — first using human weaknesses to artificially expand distortions, then overdo it, and then overdo it, asymmetrical cyclical fluctuations. The history of JPMorgan (JPMorgan) and Morgan Stanley (Daimon), led by James Dimon (James Dimon), once bearish and short selling on Tesla stocks has taught us a profound lesson. The market exploded in despair, rose in hesitation, and died in joy (it seems to be at this stage, the more it rises, the more exciting it is. (I was still alert at first; later, nothing seemed to happen, and then the world was filled with love and love). What you pay attention to is your destiny. Follow flies to find toilets, follow bees to find flowers, follow tens of millions to earn millions, and follow beggars to ask for food. Live fish go up against the current, and dead fish go with the flow.

To be in awe of technology is to acknowledge the value of technology and understand its limitations. You still have to rely on yourself to correctly and deeply interpret the function curves and function values of technical indicators. Those chasing high-ranking duvet covers are often heavy or even full.

Strategy:

1. Why arbitrage? There are already many positions; the only way to open positions is when there is a sharp decline or a deep decline (full attack and defense is inappropriate).

2. Divide the funds in two: trading funds and deposit funds. This is the key to victory.

3. Split the position in two: hold 40-60% for a long time, not tempted by floating profits brought about by short-term fluctuations in stock prices. Unwavering for a long time.

4.60-40% is used to change positions during short-term arbitrage trading. Move less, look more, and change positions when it is best for you.

5. In principle: no return, no purchase; small back small purchase; big back big purchase. Flexibility is the best ability. Where did it fall? Where did the decline stop and stabilize? Frankly speaking, I don't know, and I can't measure it. The overall feeling isn't necessarily a deep drop; I don't know. However, I can respond by acting on an opportunistic basis, dividing gradients into batches, discrete random variables, and position opening layouts. Those who are actually involved in mathematics, who think that a very shallow wave theory can accurately predict points are deceiving themselves.

Ultimately, all problems are a matter of time. Once conditions are met, Tesla's stock price will begin an epic rise. Once the rise resolves a thousand worries, large and small duvet covers will become proof, basis, and support for profit.

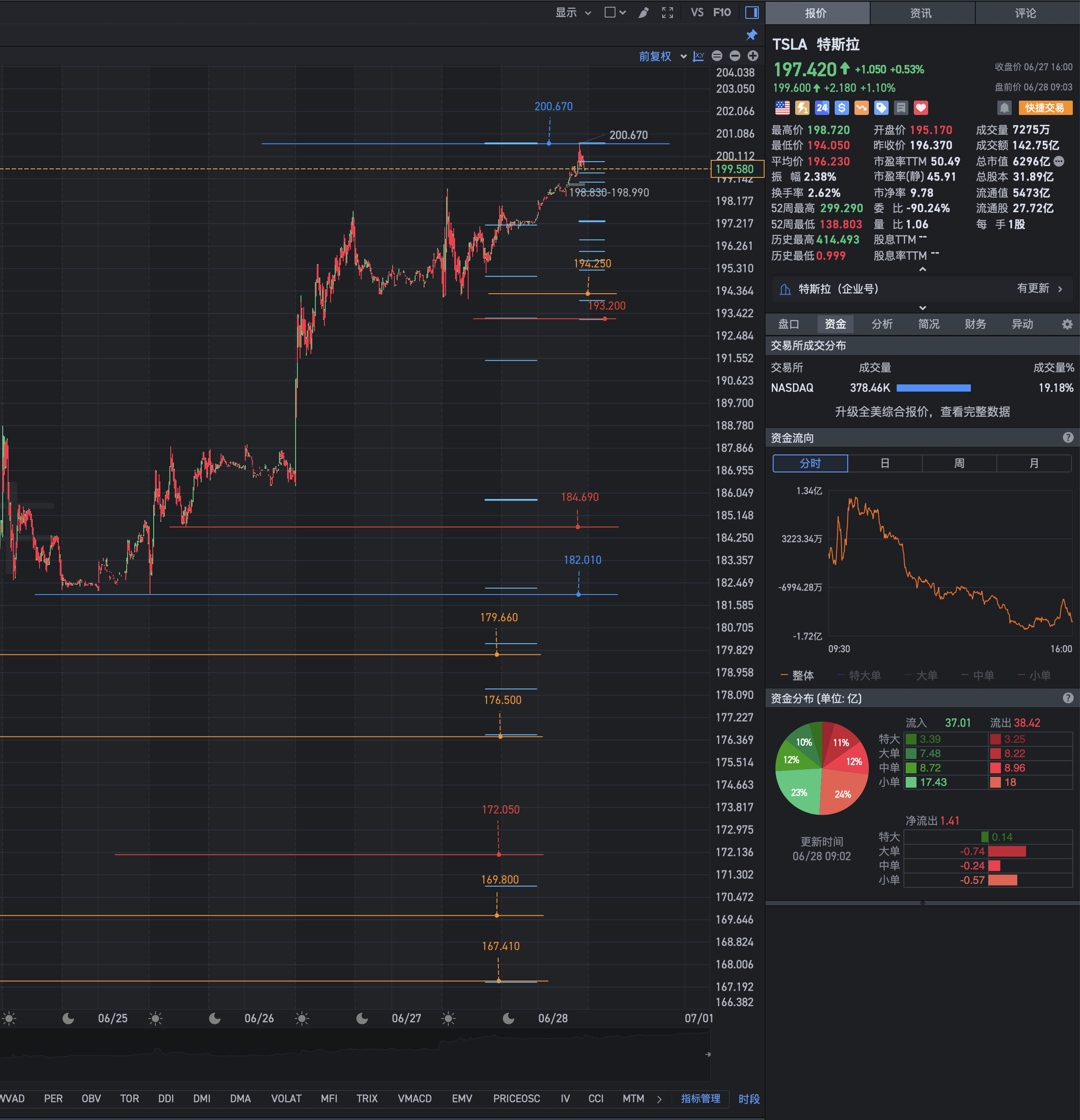

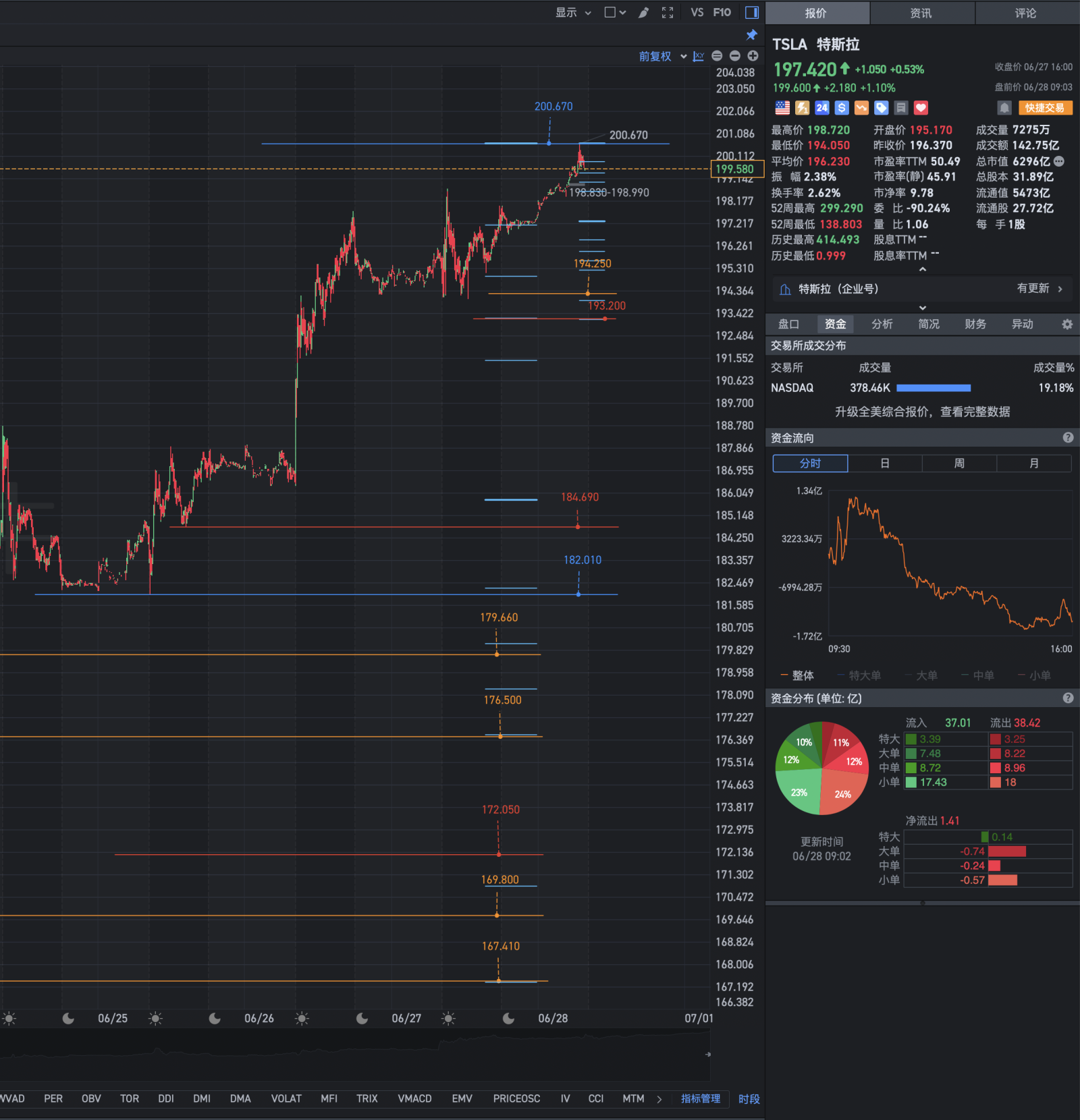

The general framework blueprint for Tesla's trend: Tesla's stock price first crossed the 182.800-187.420 region. The prudent side set up positions in this region. The so-called “not seeing rabbits” does not throw eagles. In the second step, Tesla's stock price crossed 187.420-191.300 and continued to rise. Step 3: Tesla's stock price rises👆It floated out of the strong resistance zone of 198.870-205.600, opening the prelude to Tesla's spectacular gains. The stock price effectively standing at 220.800 will start the main upward trend. Due to the vastness of these three regions, the rise in stock prices depends more on the gold pits made up of relatively low chips that appeared after the decline, so Tesla's strategic investors are willing to build up their overall positions. It is not until there is a major breakthrough in Tesla's fundamentals and signs of financial profit bookkeeping, that the situation of long-time stock price swings will evolve into a pattern of continuous rise.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Nightwolf-moon : It’s coming.