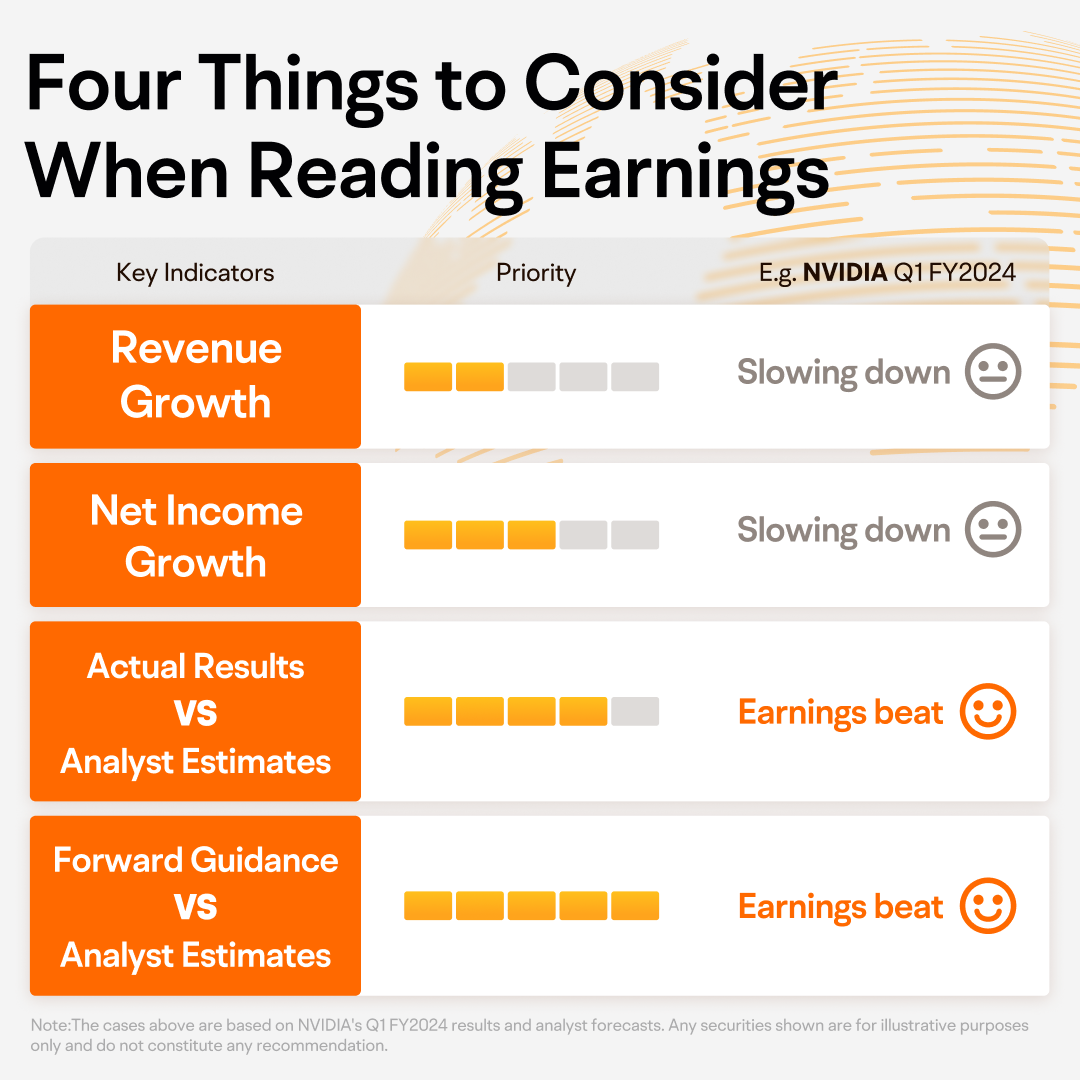

Earnings Basket: Four Things to Consider When Reading Earnings

When a company released its financial report, how do we determine if it's good or bad? There are many indicators to consider, but we can simplify and focus on the following 4 key points.

1、Revenue growth

The absolute value of the revenue growth rate may be a reliable indicator to help determine a company's growth momentum. The higher the growth rate compared to its peers in the industry, the more significant the company's growth potential.

2、Net income growth

The absolute value of the net income growth rate is another key variable to consider when evaluating a company's growth.

Moreover, it's important to compare the net income growth to that of revenue. If the net income growth rate exceeds the revenue growth rate, it suggests that the company is becoming increasingly profitable - a positive sign for investors.

3、Actual results VS analyst estimates

Analysts often make consensus estimates (average of all estimates) for big companies' revenue, net income, or earnings per share (EPS) ahead of their earnings releases.

If these key financial indicators exceed the consensus estimate, it might trigger a short-term increase in the stock price as investors react to the positive news. Conversely, if the actual numbers fall short of the estimate, it might weigh negatively on the stock price.

4、Forward guidance VS analyst estimates

Some companies may choose to release earnings guidance for the upcoming fiscal quarter following earnings reports. If the earnings guidance exceeds analyst estimates, the stock price might go up in the short term. Conversely, if the guidance falls short of expectations, it can cause the stock price to decrease.

When it comes to short-term stock prices, it's important to recognize that future expectations often hold more weight than current performance.

Of the four indicators mentioned - earnings guidance, comparison of analysts estimates to actual results, revenue growth, and net income growth rates - earnings guidance is considered particularly important because it guides future expectations. Meanwhile, the comparison between analysts estimates and actual results helps validate those expectations.

On the other hand, revenue growth and net income growth rates are actual performance figures, which may have already been priced into the stock price.

If you find this helpful, please like and follow Moomoo Learn for more useful content!

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

easygoing Dove_4830 : 0176958151@26501330205091010@Moomoo MY @Moomoo Lily @iamiam @HowTC_Invest @Alvinnnnnnn89 @Analysts Notebook

JsHappy0605 : Thank you for providing this investment knowledge in Chinese.

Moomoo Learn OP JsHappy0605 : Thank you for your support, I hope it helps you

AliceSam : Thanks for sharing, very useful

lightfoot : If sales are falling off, inventories are rising or stagnant = Gross Profit declines and EP will drop maybe go negative. Check orders as well.

Google Cloud : $HOWMET AEROSPACE INC $3.75 PREFERRED STOCK (HWM.PR.US)$

Google Cloud : $CSOP SEA TECH ETF S$ (SQQ.SG)$

Google Cloud : $LGI-OSPL SLC ETF S$ (ESG.SG)$

cpeoplesjr : Keep learning. Be consistent.