Fed's Usage Of 'Bank Term Funding Program' (BTFP) Spiked Again. What Does It Mean?

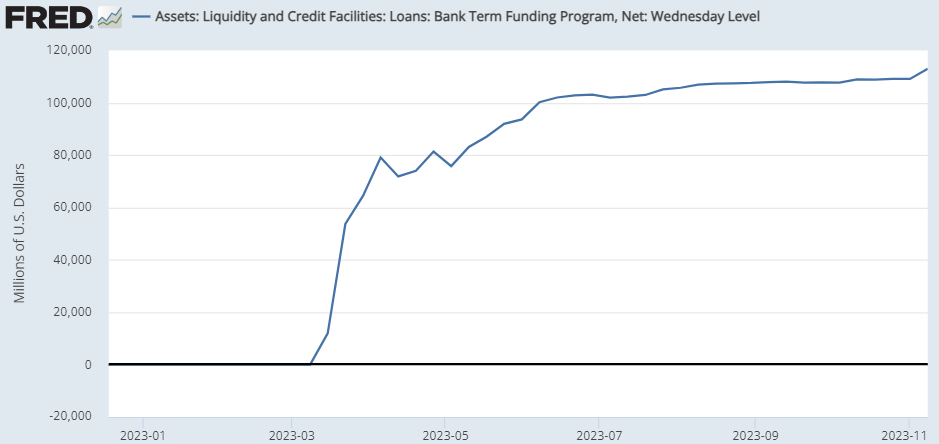

As of the week of November 8, 2023, the usage of the Fed's Bank Term Funding Program (BTFP) tool surged by US$3.865 billion, the largest increase since June 2023. The accumulated size of BTFP was US$112.935 billion, reaching a record high.

■ The surge in BTFP may be related to FHLBs' new regulation

Bloomberg reported recently that the Federal Housing Finance Agency will try to push Federal Home Loan Banks (FHLBs) back to their roots in housing finance, and away from serving as lenders of last resort to troubled banks.

On November 7, 2023, the Federal Housing Finance Agency, which oversees FHLBs, released the report "System at 100: Focusing on the Future", discussing that it will no longer act as a lender of last resort for financial companies in turmoil. The report plans to increase federal regulation and seek to push banks to seek help from the Federal Reserve's discount window during times of extreme stress.

The FHLBs were set up in the Great Depression to boost mortgage lending, but have since morphed into a backstop for banks and credit unions and became lenders-of-second-to-last-resort to the US banking industry. At the same time, their importance in housing finance has declined as nonbank mortgage firms grew to dominate home lending.

While FHLB loans helped many members weather market stress, four banks declared bankruptcy after borrowing from the FHLB.

■ Regional banks may become more vulnerable

The restrictions imposed by the FHLB program and the increased use of BTFP indicate that the vulnerability of regional banks may increase.

On the one hand, if banks have to turn elsewhere for funding, such as the commercial paper market, this could push up borrowing rates for institutions. On the other hand, losing some of the low-cost financing could result in lower bank liquidity coverage ratios. In response, financial institutions may opt to increase their reserve holdings to address any shortfalls in funding. Consequently, there might be an uptick in the minimum reserve threshold within the banking system.

As a result, the S&P Regional Bank Index fell 2.1 percentage points the next day after the FHLB report was released.

On November 6, the New York Fed updated its Banking System Vulnerability report, using four analytical models aimed at capturing different aspects of vulnerability of the banking system, with data through the second quarter of 2023.

The index indicates that although vulnerabilities have retraced some of the spike seen in 2023, they remain elevated compared to the low levels of the past ten years.

The report noted that the banks' suffered losses in their securities portfolio might, in turn, induce funding dry-ups and substantially weaken effective capital levels.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102905741 : Everything starts with 1 dollar.. Never add or take away even 1 cent

102905741 : Strange but true

Steve Bombardier : j$Volatus Aerospace Inc (FLT.CA)$ 100000000