Flowers once told me how I lived through Tesla's exuberant years, and I told myself that Tesla's sweet dream can only be achieved through long-term value investment and resolutely missed.

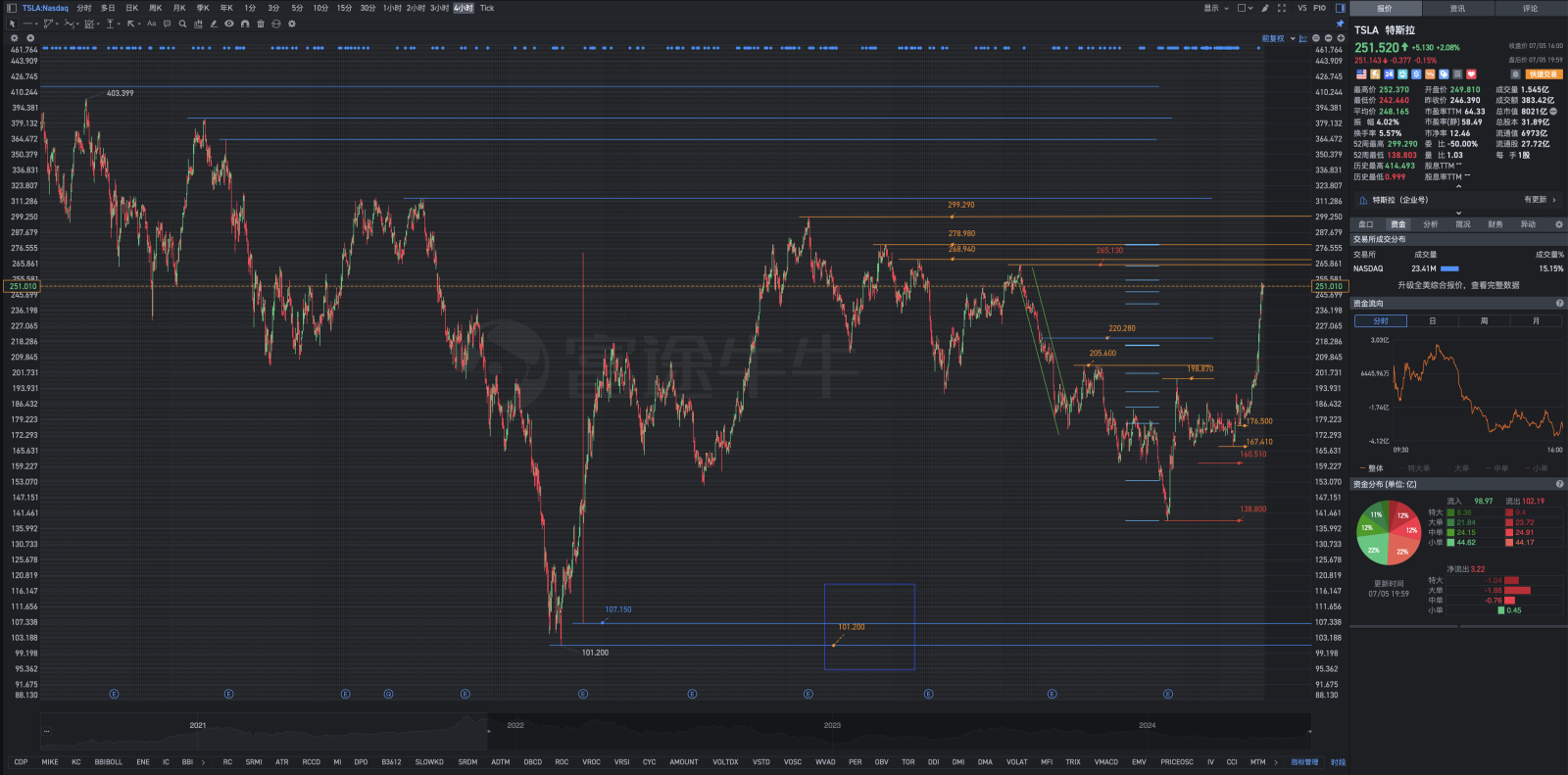

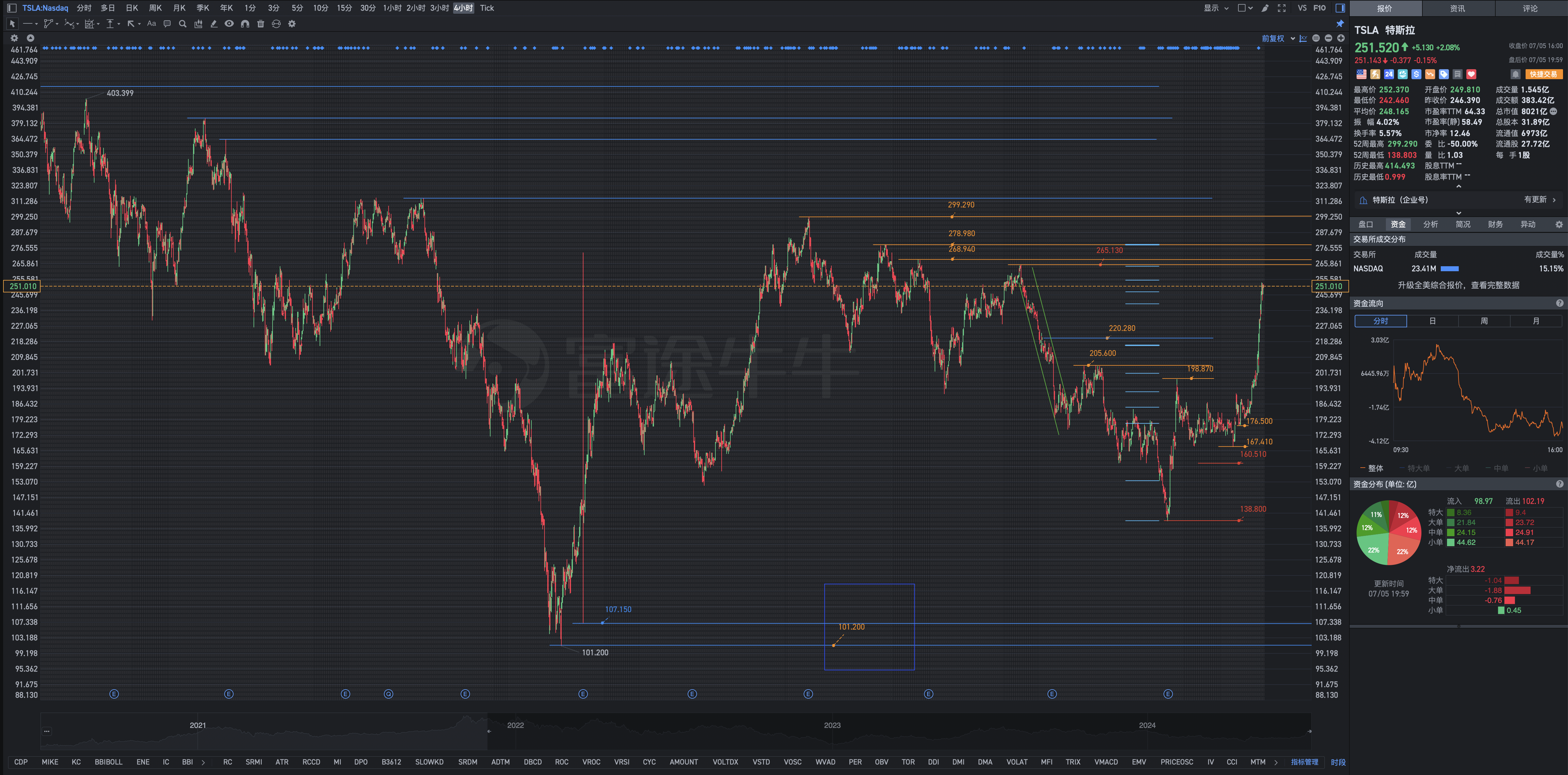

Keep in mind the following seemingly irregular sequence:101.810; 138.800; 167.410; 176.500; 202.000; 216.250; 230.500; 242.000,...

flowers💐Told me how you walked

The Earth knows every corner of your heart

No one will miss a sweet dream

Today's happy moment has finally arrived

Mizusenjo Mountain 10,000 Za We have walked

Every encounter and smiley face engraved on each other

On a sunny and happy day

We're holding hands, I want to talk too much

Starlight filled all my childhood

The wind and rain have traveled all over the corner of the world

The same feelings gave us the same desires

The same joy gave us the same song

Sunshine wants to penetrate all languages

Spring brings friendly stories to legends

The same feelings gave us the same desires

The same joy gave us the same song

********

Elon Musk warns:Once Tesla completely solves the problem of autonomous driving and mass produces Optimus Prime robots, anyone still holding a short position will be eliminated, even Bill Gates (Bill Gates).Are you confident? Have eyes to see; ears to listen.

No doubt about employing people, no doubt about it; if you don't invest in questionable stocks, don't doubt investing. Elon Musk is an angel sent by God, a gifted member of the American Academy of Engineering, an honors physics student, and an excellent software architect. He already said: Once Tesla completely solves the problem of autonomous driving and mass-produces Optimus Prime robots, anyone still holding a short position will be eliminated, even Bill Gates (Bill Gates). If you're only staring at his other negative things, or even thinking that Elon Musk isn't trustworthy and that you're better than him, then Elias=Jerome wants to ask you, why are you investing and trading Tesla? Why do we need to do more of this? Ultimately, the only thing that will enable you to make big money in the midst of large fluctuations is a firm belief, not the so-called short-term and short-term technical analysis ability. Elias=Jerome has opened positions in gradients and batches along the three important bottoms of 138.800, 160.510, and 167.410. After the layout was completed, the stock price fell again, and all of the bullish parts of the structure were covered, causing huge floating losses. Needless to say, Elias=Jerome also wavered and regretted not doing short-term arbitrage trades, even short-term arbitrage trades. Because all positions were bought when the stock price fell, the profit was somewhat variable at first.

Elias=Jerome makes investment transactions by establishing mathematical models and performing quantitative analysis at the function level. As far as short-term trends and short-term trends are concerned, the accuracy is still relatively high and satisfactory. In those years where the sky felt dark, they all survived with firm conviction.

Elias=Jerome's method of operating is to split the position in half, hold 60% of the position for a long time, and use 40% of the position for short-term trends, including game arbitrage for short-term trends. However, it is likely that short-term trends, including short-term trend arbitrage, will be completely abandoned in the future.

Anyone, including the eminent mathematician, investor, and philanthropist James Harris Simons, who defeated stock god Warren Edward Buffett and finance mogul George Soros for 27 consecutive years, believes that God allows the financial markets to set two limits on the wealth mountain: the “unfathomability principle” and the “spatial disorientation principle.” Humans can only get infinitely closer; they cannot reach it.

Historical financial data shows that short-term speculation will never make a lot of money (the world is under pressure from all kinds of environmental pressure, and it is easy to unwittingly fall into short-term or short-term speculative transactions), and only medium- to long-term investments that span time and years can achieve the grand blueprint vision. Being happy and tired of falling is a fatal injury for the vast majority of people.

If you don't use the Baum—Welch (Baum—Welch algorithm model) of the arbitrage platform Leonard Esau Baum (Leonard Esau Baum) Baum—Welch algorithm model) like Renaissance Technologies LLC (Renaissance Technologies LLC) after improving, extending, differentiating, and editing it into a large-scale high-speed computer program, you shouldn't rely too much on quantitative analysis using modeling functions, but rather use stock god Warren Edward Buffett's classic investment theory with Leonard Esau Baum (Leonard Esau Baum)'s Baum—Welch (Baum—Welch algorithm model) performs effective checks based on actual parameters, and then the two are cleverly integrated with each other, taking into account qualitative analysis and quantitative analysis, complement each other, complement each other. Having principles and being more flexible is king and trump card.

********

1. Significant changes in the values of investment transactions.

Significant progress has been made through a period of in-depth research and reflection, particularly in reunderstanding Tesla. This is based on re-understanding and rejustification of the derivation and conclusion of Tesla's profit prospects proposed by ARK Investment Management LLC (Ark Investment Management Co., Ltd.) led by Cathie Duddy Wood (Kathie Duddy Wood).

The same work also established mathematical models for the derivation and conclusion of Tesla's profit prospects proposed by Baron Capital Management (Baron Capital Management) of Baron Capital (Baron Capital Management) led by Ronald Stephen Baron (Ronald Stephen Baron), carried out quantitative analysis at the function level, and perfect solutions to related functional and non-functional issues.

Elias=Jerome is a student of theoretical physics and applied mathematics (an important tool for theoretical physics), and there are many things I don't know about. For example, write and structure the following arbitrage platform computer language programs. The project was so large and complex that Elias=Jerome decided to completely abandon it, but they have many applications of scientific tools and special uses that are worth learning from.

For example, the arbitrage platform Medallion Fund (Medallion Fund) of Renaissance Technologies LLC (Renaissance Technologies LLC) led by the late famous mathematician, investor, and philanthropist James Harris Simons (James Harris Simons) is based on improvements and extensions to Leonard Esau Baum (Leonard Esau Baum)'s Baum—Welch (Baum—Welch Algorithm Model) to explore its possible profits Relevance, and this improvement was made by algebraist James Burton Ax (James Burton Ax).

In mathematical logic, model theory is a discipline that studies the relationship between formal theory (a set of sentences expressing statements about mathematical structures in formal language) and its model (the structure in which theoretical statements are founded). Aspects of research include the number and size of theoretical models, the relationships between different models, and their interaction with formal language itself. In particular, model theorists also study the sets that can be defined in theoretical models and the relationships between these definable sets. As an independent discipline, model theory can be traced back to Alfred Tarski (Alfred Tarski, Polish-American logician and mathematician, a prolific writer known for his work on model theory, metamath, and algebraic logic; he also contributed to abstract algebra, topology, geometry, measurement theory, mathematical logic, set theory, and analytical philosophy.) He first used the term “model theory” in his publications in 1954, and since the 1970s, the stability theory of Saharon Shelah (Sahron Shera, Israeli mathematician, professor of mathematics at Hebrew University in Jerusalem and Rutgers University in New Jersey) has had a decisive influence on this subject.

The arbitrage platform Medallion Fund (Medallion Fund) of Renaissance Technologies LLC (Renaissance Technology Co., Ltd.) differentiates the research subjects of these models and algorithms, to paraphrase James's words: I am Mr. Model, and I don't want to do fundamental analysis. One of the advantages of the model is that it can reduce risk. Relying on personal judgment to select stocks, you may become rich overnight or lose well the next day. Our starting point is not a formula but market data; we don't think about how market prices should develop such preconceived notions.

James's investment strategy was later called the “gecko investment method.” The “gecko investment method” refers to making short-term directional predictions during investment and making profits by trading many varieties and making a large number of transactions in a short period of time. In James's words, “Deals need to lie motionless on a wall like a gecko, quickly eat mosquitoes as soon as they appear, then calm down and wait for the next opportunity.” He only looks for those tiny profitable moments that can be replicated, and never invests money with a bet that “the market will eventually return to normal.” Whether it was the Russian bond crisis in 1998 or the internet bubble at the beginning of this century, Renaissance Technology has stood firm through several financial crises, overshadowing the hypothesis of an effective market.

James's unique investment style includes: introducing a scientific spirit into the investment field; an investment team composed of scientists; and intensive application of data mining techniques. Specifically, it is a quantitative investment method using mathematics, statistics, and information technology to manage investment portfolios. Quantitative investment portfolio construction focuses on analyzing macroeconomic data, market behavior, corporate financial data, and transaction data, and processing data using data mining techniques, statistical techniques, calculation methods, etc. to obtain optimal investment portfolios and investment opportunities.

James cleverly applied mathematical theory to actual stock investment: designing quantitative investment management models for different markets; using computer computation as the lead to eliminating human interference; and conducting short-term transactions in various global markets. The greatest significance of this trading method is to minimize the influence of subjectivity on the transaction, and then use a series of mathematical model calculations to reduce systemic risk and find a “depression” of value.

The products James invests in must meet three requirements: the variety must be publicly traded, the liquidity must be high enough, and it must be suitable for trading using mathematical models. Well, to meet these three conditions, this trading type must have sufficient historical price, transaction volume, etc. data that can be analyzed to find the most suitable trading model to carry out quantitative investment.

What James has in common with other successful investors is that it uses systematic trading strategies to develop a trading system with positive expectations, and uses fund management technology to improve performance. Its investment uses advanced mathematical models to replace human subjective judgment, uses the system's powerful information processing capabilities to have greater investment stability, greatly reduces the impact of fluctuations in investor sentiment, and avoids making irrational investment decisions in situations where the market is extremely fanatical or pessimistic. Even today, this system is still of practical significance to investors. By creating models and analyzing data, discover combinations that are likely to help investors make money, and then use this as a basis to scientifically allocate various types of assets with different risks and different returns. This is also aimed at achieving long-term steady returns.

2. Elias=Jerome wants to use her strengths and strengths, combined with stock god Warren Edward Buffett's traditional and philosophical way of thinking to establish an investment and trading system that suits her.

Elias=Jerome is convinced that the US index is long and short, and I believe in the ability of the US index and US stocks to repair.

Elias=Jerome believes from the perspective of his theoretical physics specialty: Elon Musk is an angel sent by God, a genius academician of the American Academy of Engineering, an honors student in physics, and an outstanding expert engineer in the field of software architecture and programming.

Three 2022 Nobel Prize winners in physics, Alain Aspect (French physicist), John Francis Clauser (John Francis Clauser, American theoretical physicist and experimental physicist), and Anton Zeilinger (Anton Salinger, Austrian quantum physicist) have performed world-class professional assessments for Tesla and the projects behind it. Almost all of Elon Musk's industrial projects are inseparable and inseparable from Artificial Intelligence and Quantum Technology Revolution. Tesla, led by Elon Musk, is very forward-looking in the layout of the high-tech industry. Tesla's stock price will definitely expand its wings as time goes by.

Baron Capital (Baron Capital) of Baron Capital (Baron Capital) led by Ronald Stephen Baron (Ronald Stephen Baron): Tesla's stock price will reach $1,500 in 2030. (Although Ronald Baron was once famous, he was widely questioned by market participants when presenting his grand vision of Tesla.)

ARK Investment Management LLC (ARK Investment Management LLC) led by Cathie Duddy Wood (Kathryn Duddy Wood): By 2029, Tesla's valuation will exceed $8 trillion, and the stock price will reach $2,600. (She proposed her long-term goal for Tesla at a time when Tesla was under a sharp bearish short sale led by Xiaomo and Damo. The biggest drop in stock prices was over 60%, over a period of more than a year. There is a huge contrast between the two, and Cathie Wood is viewed as a counter indicator and joke by many sharp and mean people.)

Elias=Jerome carried out the most comprehensive, in-depth and accurate modeling and quantitative analysis of Tesla from the perspective of his own applied mathematics: Tesla's profit prospects are limitless. Currently, Tesla's market value is about 800 billion US dollars. If God favors, the market value will exceed 1000 billion US dollars during or by the end of the year 2024, and there is a high probability that the stock price will break through the historical peak of 414.49-500 after the split. In other words, Tesla still has an increase of at least 30%, and this is not the end , but rather a starting point or relay point.

3. Elias=Jerome decided not to carry out any short-term trend or short-term trend operation until Tesla's market capitalization is 800-1000 billion US dollars, and not to reduce its holdings. Taking advantage of the previous position reduction actions carried out in the 198.870-205.600 phase to redeem some of the winning results directly led to the sell-off results, and it was impossible to find any opportunities for low absorption in the traditional sense of the word. The more you are afraid to chase, the more the stock price rises, and there is no such thing as a chance to lose interest. Until Tesla's results are released, I'm afraid it will be difficult to have the right opportunity to increase positions.

4. Elias=Jerome's previous long positions were all arranged when the stock price fell, so the cost of holding the position was very low, even unbelievably low. So here's the question. How to hold onto these chips, which already have considerable floating profits, without all kinds of temptations, is a very real question. Anti-terrorism and anti-corruption issues exist all the time in financial markets.

On July 23, EST, Tesla announced financial results for the fourth quarter of 2024. After the earnings report is released, Tesla will hold a results conference at 17:30 on the 23rd. If there is a moderate or sharp drop in stock prices, positions will be increased and expanded again.

On August 8, EST, Tesla will release Robotaxi (driverless taxi) products.

*******

If someone bought shares in Berkshire Hathaway (Berkshire Hathaway) in 1965 and held them all the time, then they made an outstanding investment—and their stockbrokers would starve to death. Most pension funds probably didn't buy Berkshire shares in 1965 and have held them ever since. If they actually did that, they would have far fewer problems today. Berkshire's stock price at the time was $22. Today, its share price is close to $0.133 million.

Buffett said if I were on Wall Street, I probably wouldn't be as successful as I am now. On Wall Street, you'll be overstimulated. You hear a lot of news every day, which can turn your attention into a short-term one, and short-term attention isn't good for long-term gains. At Omaha, I just need to care about how much each company is really worth. I don't need to go to Washington to know how much the Washington Post is worth. I don't need to go to New York to understand the value of other companies. Everything is made simple. Assessing a company's value is a thoughtful process, and the more static the surrounding environment, the more helpful it is in this process. What is the deliberation process? It refers to clarifying your ability to evaluate the value of a company in certain business fields, and then, within your ability, find the company with the lowest current stock price relative to its value. I have no ability to evaluate the value of companies in many fields. For example, the genius academician Elon Musk manages Tesla. He is really outstanding and excellent, which simply dazzles me. But I also have my own areas of expertise. We can also receive emails and journals in Omaha, and receive all the information we need to help us make the right decisions. Unlike Wall Street, there are 50 random people on the street who will tell you that you should listen to this or that. I don't like excitement; what we need is information and facts, not stimulation.

Buffett and Wall Street hedge fund company Protégé Partners have a ten-year gamble to track whether S&P 500's exchange-traded funds (ETFs) actually perform better than the five specialized investment funds (FoF) selected by Protégé Partners. Buffett bet on this ETF to win, and Protégé Partners bet on FOF to win. After 10 years, FOF only outperformed the S&P 500 ETF in 1 year, and the rest of the 9 years were behind. So the result was that the old urchin Buffett won. This gamble is actually a comparison of the long-term benefits of passive funds and active funds. Passive funds can also be called index funds (index funds or ETF funds). This type of fund tracks a certain index, such as the Dow Jones Index, Toronto Exchange Index, S&P 500 Index, NASDAQ Index, etc. They buy all or part of the securities included in the index according to the criteria for the composition of a certain index. The purpose is to achieve the same level of return as the index and achieve simultaneous growth with the market. These funds can also be called “lazy people's funds”, because fund managers basically don't need to do a lot of selling and buying work, so the management fee (MER) is very low, usually 0.5% to 0.8%, and usually not more than 1%.

Active funds, on the other hand, allow fund managers to select stocks themselves. Usually, they sell and buy far more activities than passive funds, so the management fee is also high, usually more than 2%. So if both types of funds increase in value by 10%, then after deducting management fees, the return of passive funds will be at least 1% higher. What's more interesting is that I've read a statistic. More than 85% of active funds can't beat the growth of the trading index in the long run, so passive funds themselves have low management fees and high value-added, which is compared to most active funds.

Generally, fund managers are professionals and have a lot of knowledge and experience with stocks and investments, but why can't they beat the trading index?

This is where many active fund managers are very unconvinced, and it is also why Wall Street hedge fund companies want to gamble with Buffett. There are many reasons why active funds can't beat the trading index. For example, actively managed funds need to find someone to do research and analysis, and they need to trade stocks frequently. These are all costs, and they may also buy stocks that will lose money in the future. Also, there are funds that were originally well-made, which attracted many people to buy because they were famous. As a result, in order to convert large amounts of cash into stocks, fund managers had to change their strategies and buy uninteresting stocks, which dragged down performance, etc. Of course, not every trading index has a good long-term performance. For example, the Toronto Exchange Index, from a peak of 15,000 in 2008 to 15,600 now, has only grown 4% in 10 years, far behind ordinary active funds. In contrast, the S&P 500 and Dow Jones indices have both grown by about 100% in the past 10 years, so you should do your homework before choosing a “lazy person fund.”

Although fund managers and banks know that active funds usually don't outperform trading indices, they rarely actively introduce trading index funds to investing customers, even though they also sell such funds. Because banks want to charge more for fund management fees, the management fee for trading index funds is very low. When you go to the bank to talk to an investment advisor, if you are interested in trading index funds, you must take the initiative to buy financial products that actually meet your investment requirements.

How to beat Buffett for 27 consecutive years: Modelling human behavior

Probably no one in the investment community knows James Simmons. Originally a world-class mathematician, he founded the “Chan-Simmons Constant” with Professor Chen Shengshen. After that, because of his strong interest in the securities market, he founded Renaissance Technology Company.

James Simmons is no ordinary person. He created the most powerful money-making machine in financial history, making Renaissance technology companies have great influence in the fields of world politics, technology, education, and charity.

Since 1988, Renaissance Technology's flagship product, the Medallion Fund, has earned an annualized yield of 66%, and profits of more than 100 billion dollars in transactions. This record is second to none in the investment world.

According to estimates by the book's author Gregory Zuckman, Simmons personally has assets of about 23 billion dollars, and the rest of Renaissance Technology's employees are also billionaires. The average assets in the company's hedge fund are 50 million dollars, creating huge wealth that can only be owned in fairy tales.

1

Simmons spent 12 years searching for a successful investment model. In the early days, he also relied on nature and intuition to invest and trade, but he often failed. Afterwards, he worked with several top mathematicians and scientists to develop computer models to process massive amounts of market data and select the best trading opportunities from them.

Simmons believes this is a scientific and systematic approach that can be used to remove emotional elements from the transaction process. Simmons wants to use mathematics to conquer the market. If successful, he can not only earn huge wealth, but even influence the world beyond Wall Street. This is probably Simmons' real goal.

However, Simmons' idea of a deal was not well received. In that era, a group of excellent investors, such as George Soros, Peter Lynch, and Bill Gross, had already begun to emerge. Thanks to their intelligence, intuition, and traditional economic indicators and technical analysis, they have reaped huge benefits in international financial markets.

In contrast, Simmons doesn't know how to manage cash flow, evaluate new products, or predict interest rate trends. All he did was dig up massive amounts of price data. This trading method included elements such as data cleaning, signal mechanisms, and backtesting. Wall Street had no idea about it at the time, and didn't even have an appropriate name to summarize this method. However, Simmons has smelled the triumph of the computer trading system.

Simmons was born in 1938. When he was 3 years old, he was able to calculate twice and half a certain number, and he was also able to calculate square numbers of 2 to 32, and he didn't get bored at all. His mother taught him “You should do what you love, not what you feel you should do.” Simmons' favorite thing to do is think about math problems, and he often indulges in thinking about numbers, shapes, and slopes. He believes that powerful theorems and equations can help people discover truth and harmonize the different fields of algebra and geometry.

As a teenager, he loved to read. He often visited the local library and loaned 4 books a week, many of which were beyond his comprehension. However, what attracted him the most was math. In his sophomore year of high school, he was passionate about discussing all kinds of purely theoretical issues, such as the infinite ductility of a plane. Later, he was accepted to the Massachusetts Institute of Technology. After starting school, he simply skipped his freshman math class because he had already studied it in high school. He received his bachelor's degree in mathematics in 1958. After that, he studied for his doctorate degree and studied under Professor Chen Shengshen.

While studying for his graduate degree, Simmons developed a keen interest in financial investments. Indeed, he craves money, and he wants to be rich. However, he is most eager to use mathematical tools to discover and record those universal principles, laws, and truths. In 1964, he joined the US Defense Analysis Institute to work as a code-breaker. At the time, he created a partial differential equation. Differential equations describe derivatives or relative rates of mathematical variables that are widely used in the fields of physics, biology, finance, and sociology. This equation later became known as the “Simmons equation.”

The Defense Analysis Institute's working hours are very flexible, so Simmons is able to set aside time to focus on the stock market. At that time, he developed a new stock trading system and published a paper claiming that he could find a trading method to maintain an annualized yield of 50%.

Simmons is committed to finding macro variables that can predict the short-term behavior of the stock market. He doesn't focus on fundamental stock market data such as earnings, dividends, and company news like most investors. He divided the stock market into 8 states. Among them, a period of high volatility means that stocks fluctuate sharply, and a good period means that stocks maintain their upward trend. He used purely mathematical methods to identify the current state of the market and then used the model to buy stocks.

Arguably, Simmons was a pioneer in using mathematical models to study the stock market. Investing with mathematical models, involving factor investing, models based on unobservable states, and other forms of quantitative investment, is a harbinger of an “investment revolution,” which will sweep the entire investment world in a few decades.

2

Simmons did not show any talent when he first got involved in the investment field. He's just full of confidence because he has a unique insight and perspective on how the financial markets work. He's very used to looking for some kind of pattern in seemingly random data — looking for some simple and beautiful results underneath the surface of nature's chaos and disorganization. These laws and regulations that have been discovered form the laws of science.

Simmons recognises that markets aren't always understandable or operate in a rational way, so simply relying on traditional research and analytical perspectives isn't enough. However, no matter how chaotic the market may seem on the surface, the prices of financial assets seem to have some definite rules, much like potential rules hidden behind seemingly unregulated weather.

Simmons sees the financial market as an ordinary chaotic system, just like physicists mining massive amounts of data to establish scientific models to describe the theorems of the natural world. As a result, Simmons decided to establish a mathematical model to identify price laws in financial markets.

Soon, Simmons founded a company called “Monemetrics,” meaning “monetary econometrics,” which indicates that he uses mathematical methods to analyze financial data and make investment decisions.

He found a mathematician named Lennie Baum as a partner to explore his unproven investment strategies.

Baum and an informationist named Lloyd Welch founded the “Baum—Welch algorithm” to analyze the Markov model.

The Markov model is a collection of events. The probability of the next event can only be determined by the current state, not related to previous events.

This means that you can't predict future events with certainty, but you can make a better estimate of future events by observing the rules of the entire chain. Baseball is a typical Markov game. Assuming a batter has already hit 3 fast kicks and 2 good goals, then the previous order of these hits and the number of fouls during the period are irrelevant; as long as he hits another good ball by mistake, he's out.

The hidden Markov model means that the sequence of events itself is also unknown, controlled by hidden parameters and variables, and is a double random process. The events people observe are only the output results of the chain, and cannot be used as a basis for speculating on the direction of the chain. Financial market prices, voice recognition, and other complex processes can all be thought of as hidden Markov processes. As a result, Simmons began his financial investment career.

After that, several computer technology experts joined, and they developed a system that could cover all kinds of commodities, bonds, and foreign exchange transactions. This system mainly uses the principles of linear algebra to analyze large amounts of data and give investment suggestions. For example, the system will suddenly be strongly optimistic about the price of potatoes and allocate 2/3 of the cash to potato futures contracts.

As a result, Simmons gradually established a high-tech trading system driven by an algorithm, or a computer program executed step by step to replace human subjective judgment. He no longer wants to rely solely on rough models and complement his personal instincts to trade. His goal was to create a complex automated trading system driven entirely by pre-defined algorithms, a system that completely shielded from human intervention. In 1988, Simmons established the Medallion Fund.

Under Simmons, a large group of world-class mathematicians and computer scientists gathered. Among them, mathematician James Eckes is one of the founders of the “Ex-Coshen Theorem.” He also believes that financial markets are very similar to Markov's model: the next event depends only on the current state of affairs.

In the Markov model, it is impossible to accurately predict the next step, but if there is a reliable model, it is possible to predict trends for multiple steps in the future. The Markov model is used in a general sense for stochastic systems of equations. Stochastic systems of equations can be used to describe dynamic processes that evolve over time, and can also accommodate a high degree of uncertainty.

These mathematicians and computer scientists don't think that the market is really random, or completely unpredictable, as some scholars say. The market does have some randomness, as cloudy and uncertain as the weather, but they think they should be able to predict future price trends using some kind of probability distribution, just like any other random process.

Therefore, their goal is to develop mathematical models and use them as a framework to derive some practical conclusions and results. Of course, simple linear regression models are generally not effective in predicting complex and volatile financial market price movements, and these prices may be severely impacted by factors such as blizzards, panic markets, and geopolitics.

However, they are convinced that the computer itself will search for relationships between these data, find a similar trading environment in the past, and then observe price performance, so they can develop a complex but more accurate predictive model to identify hidden price trends. To put this method into practice, they needed a lot of data. They used computer models to make relatively reliable guesses to fill in the gaps. When they began testing this approach, their investment performance improved rapidly.

Exes's model mainly brings together two simple strategies. Sometimes, models use momentum trading strategies to follow price trends, then buy and sell a basket of commodities assuming the trend continues. Other times, the model uses a reversal strategy, believing that the current price trend will reverse. Thanks to a large amount of historical data, Excelsior has access to more price information than its competitors. Because price trends often repeat history, this data allows companies to more accurately assess the sustainability of trends.

In October 1987, the Dow Jones index fell 22.6% in one day. Since AEX bought Eurodollar futures ahead of time, it hedged losses when the stock market plummeted. However, the Exes model is not invincible. In 1989, Medallion lost 30% in just a few months.

3

When Erwin Bolekamp was in charge of the Grand Medal, he advocated more short-term deals. Many long-term positions held by Medallion only led to losses, while short-term trading was the biggest contributor to the fund's earnings. Medallion carefully examines historical price data to find price trends that may be repeated in the future. The implicit assumption is that investors' actions will be repeated over and over again. They are convinced that this approach works, provided it is implemented in a more scientific and complex form, and only applied to short-term transactions rather than long-term investments.

Burlecamp believes that if transactions are infrequent and the results of each transaction have a big impact on the company, then if there are a few more loss-making transactions, the company will collapse; however, if there are frequent transactions, then the results of a single transaction are not that important, which helps reduce the company's overall risk.

Short-term trading model

This practice is similar to a casino. There are many gambling games in the casino every day. As long as you make a profit on more than half of the games, the casino as a whole makes money. The same goes for medallions. As long as high-frequency transactions are guaranteed every day, most of them can be profitable, and Medallions can make a lot of money. With just a little advantage, high-frequency repetitive gaming will ensure that the law of large numbers is on their side. “If you trade enough, then it's enough to guarantee that 51% of it is profitable.”

Burlecamp created the theory that market traders buy and sell commodities and bonds to keep the market liquid. For example, they will clear their positions before the weekend to prevent bad news from the weekend leading to losses. Similarly, on-market brokers on commodity exchanges reduce positions before economic data is released to prevent lower than expected data from causing position losses.

Compared to competitors, Medallion actually has a huge advantage: they have more accurate pricing information. Over the years, they have collected high-frequency intraday price information for various futures, and the vast majority of investors ignored this kind of granular information. The computer with one million instructions per second in the Medallion Office allows the team to quickly mine all pricing information and generate thousands of significant observations to reveal price patterns that have not been detected before.

Medallion's operation was very effective, with a yield of 55.9% in 1990. Simmons was convinced the company was on the right track. He believes that historical price rules can be used as a basis for developing computer models to identify market trends overlooked by investors, so that people can see the future from the past.

Over the centuries, speculators have exhausted all methods to find price patterns, but all have largely failed miserably. Richard Dennis has successfully developed a trading system that can pre-set algorithms to remove emotional and irrational factors from his trading operations. He had great success, but lost a lot in the 1987 stock disaster and had to end his trading career.

Simmons agreed with Burlecamp that technical indicators are more suitable for short-term trading than long-term trading. He hopes to escape the fiasco experienced by technical analysts through rigorous testing and more complex models based on statistical analysis.

Renaissance Tech continues to apply mathematical techniques to improve models. Mathematician Henry Lauffer discovered in revising the model that Medallion funds should only use a single trading model, rather than using multiple different models in various markets and market conditions like other quantitative trading companies. This discovery later proved to be invaluable.

Medallion Fund

As a result, medallion transactions began to become frequent. It started trading 5 times a day, then rose to 16. They will choose the period of the day with the highest trading volume to place orders to reduce the impact cost. Renaissance Technology's factor development follows 3 steps:

find unusual laws in the price series;

Ensure that the entire pattern is continuous and non-random;

See if you can find a reasonable explanation.

Co-CEO Peter Brown and computer scientist Robert Mercer have designed a system to build an ideal investment portfolio, make optimal decisions, and generate maximum returns, taking into account transaction costs, various leverage, risk parameters, and various other restrictions and requirements. The beauty of this approach is that by combining all trading signals and portfolio requirements into a single model, it is easy to test and add new signals to instantly know whether a new investment strategy is profitable.

Furthermore, the system is self-adaptable, that is, it can learn and adjust independently. If the model's recommended trades are not executed, for whatever reason, it will self-correct, self-search for buy or sell instructions, and drive the portfolio back on track.

Simmons gradually realized in practice that the losers were not individual investors who bought and held for a long time, nor were the financial management departments of multinational companies that adjusted foreign exchange positions according to the company's needs, but rather people who often predicted the rise and fall of the market and placed frequent bets, regardless of its size. People like this “are a good harvest target,” Simmons said. Essentially, Simmons used the negligence and mistakes of other speculators to make money.

Simmons actually doesn't know another thing. While he and his team were working on models, behavioral finance also came out of nowhere. Amos Tewoski and Daniel Kahneman studied people's decision-making process and proved that most people tend to make irrational decisions. Typical psychological biases that have been identified include loss aversion, anchoring prejudice, and endowment effects. Faced with intense pressure, market participants usually panic and then make biased decisions. Therefore, it is no coincidence that Medallion funds find that most of their profits are often realized under extreme circumstances in financial markets. The Medallion Fund's profit phenomenon continued for decades.

However, models aren't one-size-fits-all either. During the 1987 stock market crash, all leading quantitative companies faced more and more problems. Morgan Stanley lost 0.6 billion dollars, and the Medallion Fund lost more than 1 billion dollars in a week, with a loss rate as high as 20%. Simmons created a computerized automated trading system with the intention of eliminating human emotional factors. However, when Medallion lost a huge amount of money, he actually interfered with the trading system and reduced his position. Brian Keating said, “Scientists are people, and they're not lacking in humanity at all. When data and desire collide, the latter often wins out.” This sentence fits just right here.

Overall, Simmons and his team didn't have a statistical model based on behavioral finance because they couldn't design an algorithm that could avoid or take advantage of investors' psychological biases. However, they also realized that it was psychological bias and overreaction that contributed to their profits, and that their system seemed particularly good at exploiting common mistakes made by other traders. Therefore, they are actually modelling human behavior to confirm the theory of behavioral finance.

At the same time, George Soros's theory of reflexivity is also a model of human behavior. Humans are highly predictable in their high-pressure behavior, and they instinctively show panic. The premise of Renaissance Tech's modeling is that humans will constantly repeat past behavior, and they have learned very well to use this.

Video playback link🔗: - YouTube

Video playback link🔗: - YouTube

Video playback link🔗: - YouTube

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment