Follow the trend, anti-technology, anti-human operation

Stock god Warren Buffett's key to winning. Simply put, in addition to choosing the right target for the investment transaction, the other two points are that the stock price is low enough, the quantity is large enough, and the period of holding the shares is long enough (at least 1 year or more, ideally 3-5 years, depending on the actual situation).

As far as the natural texture and potential of a listed company is concerned, I can't find a better one than Tesla. Musk also has eight more tech-savvy companies that have yet to go public.

Patience is the only way to hear the voice of wealth. Because I believe, I can see. Many of Tesla's projects fall under the category of Artificial Intelligence, or even higher-level Quantum Science and Technology, and have a complete industrial chain layout, and Nvidia is an important core node of Artificial Intelligence. There is still a major difference between the two.

Nvidia is very good, seems to be perfect, congratulations. However, people have different ambitions, and I know what it means to continue to rise and fall sharply — rising is a process of risk accumulation; falling is a process of risk release. For strategic investors, the most important thing is to seize your own opportunities. Tesla is currently in the second phase of a new strategic investment. Not being excited about opportunities that don't belong to them, and not being upset about opportunities they can't seize, is a strength that strategic investors must have.

In principle, always maintain a peaceful mindset, rise or fall at will; up: bullish positions are welcomed; down: there is a battle sequence to protect the funds.

It's important to invest the right way, but it's even more important to look at how much you put in the right place. It is very foolish and harmful to try to fill up positions and even hastily use brokers' funds.

The world is difficult to predict, and the stock market is difficult to predict. Fortune Mountain has two devilish limitations: the principle of undetectability and the principle of spatial orientation disorder. If someone tells you that he/she is not bound by this restriction, and at the same time he/she doesn't have a background in theoretical physics or applied mathematics that is difficult for the vast majority of people to understand, then the likely incident is that they have encountered people and events that use you as a profit.

Market research is mainly aimed at seizing continuous opportunities and avoiding continuous risks. You are too late to grasp or avoid sudden and occasional rises or falls. This is not your fault. Keep calm in your mentality and don't give up on yourself.

Very few people can make big money in the stock market by predicting short-term stock price rises and falls. Otherwise, they are the richest people in the world. If not, it means they are happy or not worried. Even if they are lucky for a while, they will end up losing ground. The world's super-rich, who are worth 100 billion dollars, are still getting their hands on time.

You can choose not to do it, but you can't completely reverse the general direction. The main trend of the US stock index and the vast majority of US stocks, especially the seven major US technology growth stocks, from a long-term perspective, is upward. A period of sharp opposition between short-term trends, secondary trends, long-term trends, and main trends is an opportunity to open positions.

Don't be driven by a sense of urgency to make money, and don't force yourself to make frequent and hasty decisions.

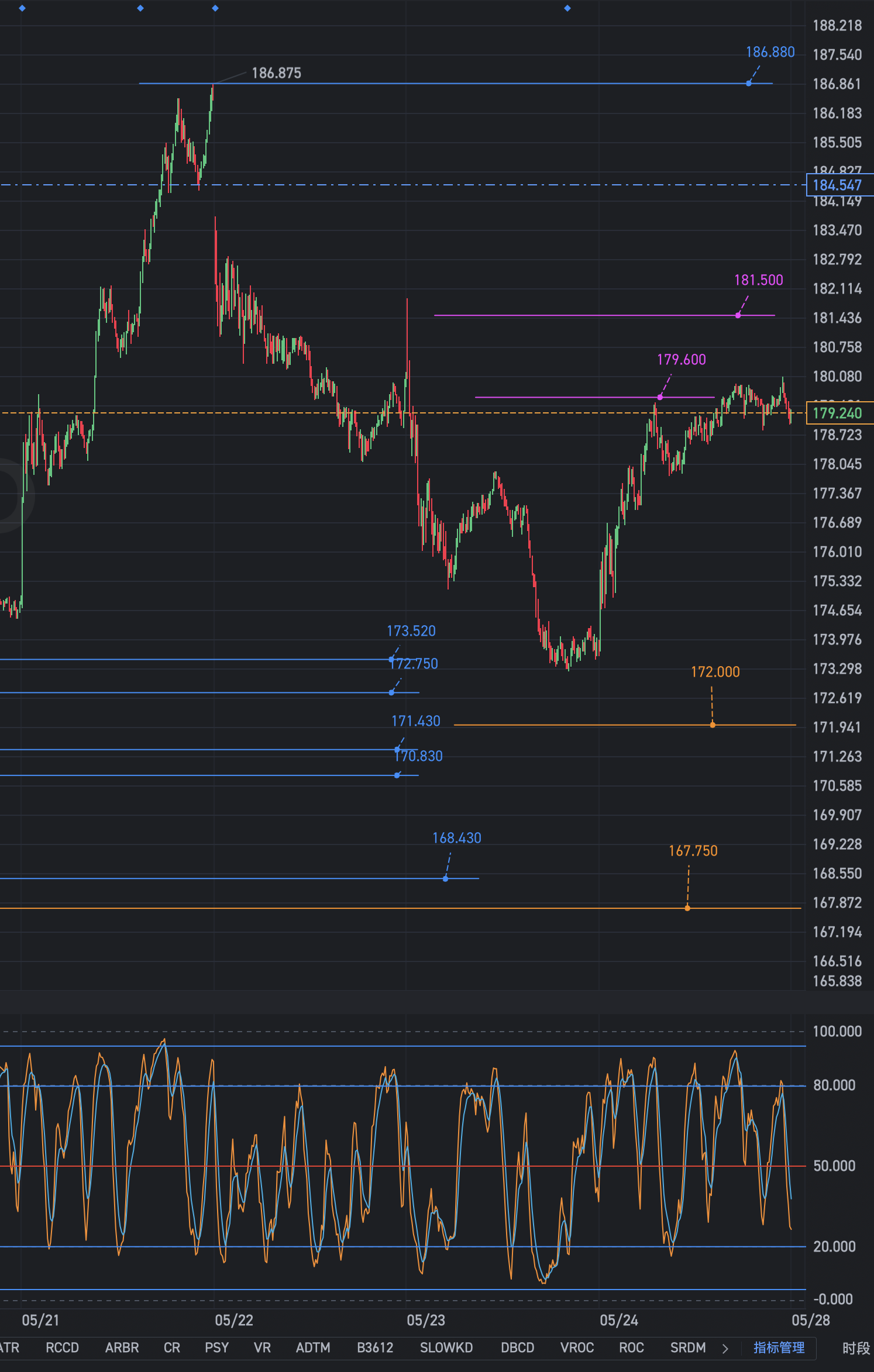

If Tesla's stock price falls further by an amount of 6.85-11.35, the technical side will definitely deteriorate again. It is said that the devil will not see the bottom: long stop-loss orders and bearish short sales are pouring out one after another. They claim to know the Elliott Wave Theory very well, and they assume that the stock price will return to 140. The ideal position opening layout conditions for strategic investors are in place.

How to deal with the plan that there are also mineral resources such as oil under the cellar:

Pre-set one in advance”Receive Funds” (Receiving funds),It is specially designed to deal with the possibility that Tesla's stock price enters the 160.510-138.800 region, and has enough courage to resolutely and resolutely step in, cut off the backbone of vicious bears in one fell swoop, and turn decay into magic. Regardless of whether the “incident under the cellar” occurs or not, withReceive FundsA plan is a must. This is the advantage of never being satisfied with warehouse operations; time and fate are in your own hands. All problems are ultimately a matter of time, especially the problem that Tesla's coat of multiple uncertainties slowly fades away and unleashes its huge potential.

The butt determines the head. Danny Moses, a well-known air god trader, is still not satisfied and has lost a lot of money by insisting on big bearish short sales. He believes Tesla's stock price will still fall sharply in the future. Although Tesla's stock price has fallen 32% so far this year, Moses continues to short Tesla. He believes everything in Tesla's core business is falling apart. Musk is trying to divert everyone's attention to robotic taxis, artificial intelligence, and autonomous driving in order to escape the plight of falling stock prices. Per Lekander, the up-and-coming hedge fund manager who sold Tesla on a bearish basis, simply thought Tesla might “go bankrupt” and that its stock could plummet to $14.

On the other hand, Laurence Douglas Fink (Laurence Douglas Fink, BlackRock, or BlackRock, or BlackRock, or BlackRock, or BlackRock, is the chairman and CEO. He and his seven partners founded BlackRock in 1988, and under his leadership, the company has developed into a global leader in investment and technology solutions, the Federal Reserve's go-to trader, and one of Wall Street's four magic pins): bullish on Tesla's late-stage trends; Ronald Stephen Baron (Ronald Stephen Baron is an American mutual fund manager and investor. He is the founder of investment management company Baron Capital. The New York-based company manages Baron Funds, which he founded himself, and manages around $45 billion in assets. (More personal assets than Laurence Douglas Fink, over 5 billion US dollars, Tesla's important strategic investor): The major root area of Tesla's historical stock price, 160.510-138.800, has already been determined.

On April 23, the New York market trading session closed, and Tesla announced financial results. The stock price plummeted to 138.800, but was instantly boosted by strong buying power by 13%. Since then, the stock price continued to rise over the next two trading days, reaching a high of 198.870.

The downside of the 160.510-138.800 region, which is the root of Tesla's history, has in fact been taken by Wall Street's three BlackRock (BlackRock, Blackstone, Tesla's third-largest shareholder), Vanguard (Pioneer Pioneer, Tesla's second-largest shareholder), State Street Global Advisors (State Street Global Investors, Tesla's fourth largest shareholder), and Ronald ARK Investment Management LLC (Ark Investment Management Co., Ltd., Ark Investment, Tesla's major shareholder and strategic investor), led by Stephen Baron (Ronald Stephen Barron) and Cathie Duddy Wood (Catherine Duddy Wood, Sister Mu) led by Baron Capital (Ronald Stephen Barron), cleverly and implicitly teamed up with Tesla's largest shareholder and CEO Blocked by Elon Musk and closed.

From the bottom of my heart, I would like to thank Laurence Douglas Fink (Lawrence Douglas Fink), CEO of BlackRock (BlackRock), and Ronald Stephen Baron (Ronald Stephen Baron), CEO of Baron Capital (Baron Capital)) for their pioneering and decisive “groundbreaking work.” This is a “groundbreaking ceremony” of great value. Of course, I would also like to thank ARK Investment Management LLC (Ark Investment Management Co., Ltd., Ark Investment), led by Cathie Duddy Wood (Kathleen Duddy Wood, Sister Mu), who still firmly believed in the conclusions of mathematical models and quantitative analysis during Tesla's most difficult times, and continued to invest irrevocably and persevere in Tesla, and finally succeeded.

If you have eyes, watch; if you have ears, listen.

The layout of opening positions in the 160.510-138.800 region without vision or courage was the final fate and end of the mediocre people.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment