Freedom > stuff

Freedom and ownership of our own time is the real flex 💪🏽

Not houses 🏡 cars 🚘 jewelry and vacations

Wealth is who you are not what you have…

Wealth has to be an inward realization before it becomes an outward manifestation.

#CoachDonnie

Wealth has to be an inward realization before it becomes an outward manifestation.

#CoachDonnie

Work for a cause, not for applause. Live your life to express, not to impress, don’t strive to make your presence noticed, just make your absence felt.

Let’s all

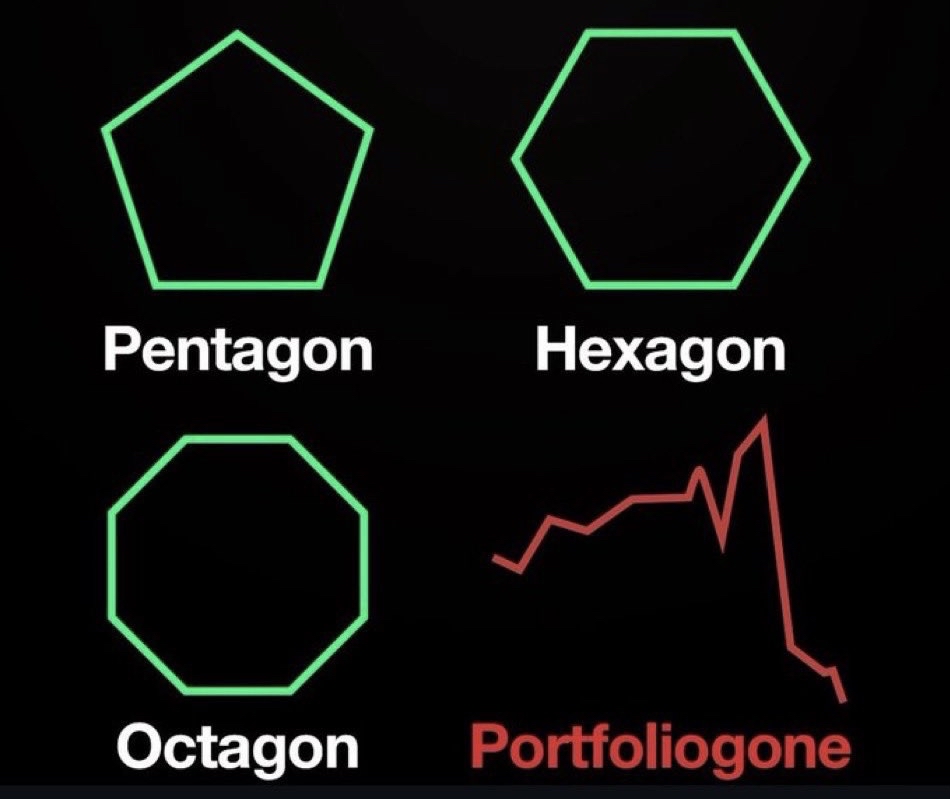

Stop 🛑 focusing on a quick buck. Hold, and go long.

Collect Assets at a Discount. DCA either way. Be patient.

We Build Wealth.

The compound annual growth rate (CAGR) is the mean annual growth rate of an investment over a period longer than one year.

It's one of the most accurate ways to calculate and determine returns for individual assets, investment portfolios, and anything that can rise or fall in value over time.

= 10 to 100% CAGR or more for All of Our Assets:

Ex:

What does 10% CAGR mean?

CAGR tells you the average rate at which an investment has grown over a specified period.

10% CAGR means the 10% interest you earn every year is first added to your principal investment. And then, on the total amount, you again get 10% return.

Traditional Investing

Buy & Hold

Big Boy Blue Chip

Long Term

Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.

- Warren Buffett, Billionaire

• Look into Capital Gains Taxes, long term vs short term wherever you’re located

When you sell for a profit there are often larger gains taxes which is good to be aware of so you’re not shocked

#CoachDonnie

* For ANY and all aforementioned/heretofore Stocks, ETFs, side hustles or other Assets/asset classes discussed here

Remember the following:

🚨 DISCLAIMER 🚨

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

I Share Because I Care. The aforementioned is for Informational Educational & Entertainment purposes ONLY, this is NOT investment advice.

You have to do what’s best for you and yours at the end of the day. There’s NO guarantees in Investing nor Asset Accumulation.

Reach out to your Financial Advisor, CPA and or CFP.

I am not a Financial Advisor, CFP nor CPA.

Stop 🛑 focusing on a quick buck. Hold, and go long.

Collect Assets at a Discount. DCA either way. Be patient.

We Build Wealth.

The compound annual growth rate (CAGR) is the mean annual growth rate of an investment over a period longer than one year.

It's one of the most accurate ways to calculate and determine returns for individual assets, investment portfolios, and anything that can rise or fall in value over time.

= 10 to 100% CAGR or more for All of Our Assets:

Ex:

What does 10% CAGR mean?

CAGR tells you the average rate at which an investment has grown over a specified period.

10% CAGR means the 10% interest you earn every year is first added to your principal investment. And then, on the total amount, you again get 10% return.

Traditional Investing

Buy & Hold

Big Boy Blue Chip

Long Term

Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.

- Warren Buffett, Billionaire

• Look into Capital Gains Taxes, long term vs short term wherever you’re located

When you sell for a profit there are often larger gains taxes which is good to be aware of so you’re not shocked

#CoachDonnie

* For ANY and all aforementioned/heretofore Stocks, ETFs, side hustles or other Assets/asset classes discussed here

Remember the following:

🚨 DISCLAIMER 🚨

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

I Share Because I Care. The aforementioned is for Informational Educational & Entertainment purposes ONLY, this is NOT investment advice.

You have to do what’s best for you and yours at the end of the day. There’s NO guarantees in Investing nor Asset Accumulation.

Reach out to your Financial Advisor, CPA and or CFP.

I am not a Financial Advisor, CFP nor CPA.

Some ‘do’s’ and ‘don’t’s’:

Do:

- Read, study, listen and learn daily. Information is power, use it to advantage.

- Ask questions! It’s silly to be shy, there are eight billion of us, and we are ALL learning.

- Buy ETFs at least 80% of your portfolio (like SPLG FTEC FHLC FSKAX VOO VGT). You don’t have to be the expert with ETFs.

- Build a base in shares through DCA or an allotment strategy using income (perhaps to weight more on equities that are down in a given moment). DCA is recommended.

- Whether growth or value, invest in that which has promise of greater comparative returns. Growth is recommended unless you’re at retirement enjoyment protection phase.

- Know yourself. Focus on strengths and mitigate weakness, be who you are.

Don’t:

- Buy individual stocks only, especially if you don’t know what you’re doing. Hedge your bet with ETFs, Real Estate when the Cash on Cash return makes sense, Gold and Silver, Businesses, other assets.

- Overleverage, Overbuy, Overtrade. Only make a move based strong conviction.

- Forget that there is always an opportunity.

- Blindly follow others. Getting ideas is great, be sure to conduct your own due diligence as well.

- Be afraid to ‘lose’ sometimes. That is part of this exercise; accept that and move on.

- Overleverage. Stay within a safe zone and build over time.

Happy investing 🌞

Do:

- Read, study, listen and learn daily. Information is power, use it to advantage.

- Ask questions! It’s silly to be shy, there are eight billion of us, and we are ALL learning.

- Buy ETFs at least 80% of your portfolio (like SPLG FTEC FHLC FSKAX VOO VGT). You don’t have to be the expert with ETFs.

- Build a base in shares through DCA or an allotment strategy using income (perhaps to weight more on equities that are down in a given moment). DCA is recommended.

- Whether growth or value, invest in that which has promise of greater comparative returns. Growth is recommended unless you’re at retirement enjoyment protection phase.

- Know yourself. Focus on strengths and mitigate weakness, be who you are.

Don’t:

- Buy individual stocks only, especially if you don’t know what you’re doing. Hedge your bet with ETFs, Real Estate when the Cash on Cash return makes sense, Gold and Silver, Businesses, other assets.

- Overleverage, Overbuy, Overtrade. Only make a move based strong conviction.

- Forget that there is always an opportunity.

- Blindly follow others. Getting ideas is great, be sure to conduct your own due diligence as well.

- Be afraid to ‘lose’ sometimes. That is part of this exercise; accept that and move on.

- Overleverage. Stay within a safe zone and build over time.

Happy investing 🌞

Patience Discipline Consistency

When we understand the cycles ☝🏽 we can enjoy the journey more

We can buy the dips and unplug (or do nothing) when there’s downtrends, dark pool market manipulations, sell offs etc

We can also enjoy the upswings without getting caught up in FOMO and succumbing to the pressure of buying stuff at All Time Highs

Gotta enjoy yourself otherwise the market is more stressful than a job 🤣

Mindset produces Assets:

Enjoy the journey smile 😃 laugh 😂 this is as much about us Becoming Better as it is about Asset Accumulation.

#CoachDonnie

When we understand the cycles ☝🏽 we can enjoy the journey more

We can buy the dips and unplug (or do nothing) when there’s downtrends, dark pool market manipulations, sell offs etc

We can also enjoy the upswings without getting caught up in FOMO and succumbing to the pressure of buying stuff at All Time Highs

Gotta enjoy yourself otherwise the market is more stressful than a job 🤣

Mindset produces Assets:

Enjoy the journey smile 😃 laugh 😂 this is as much about us Becoming Better as it is about Asset Accumulation.

#CoachDonnie

We are Investors, not speculators. We are optimistic not pessimistic.

Many ain’t gone wanna hear this oh well 🤷🏽♂️

Facts > Feelings Truth > Traditions

Once you have certain FORMULAS (understand how each Asset benefits you & how much they appreciate per year, etc), thought processes and understanding

You can make money off Assets whenever you want instead of guessing, chasing money & panic selling like many people do when they start investing.

There’s Investors, Traders, & Speculators

The 1st one has always earned the most (based on historical data),

the second one has earned the second highest…

speculators are often emotional and have lost the most and continue to because their strategy is emotions vibes logic etc instead of practical wisdom and principles.

Speculators freak out when there’s fear in the market and or in their portfolio, they freak out when there’s fluctuations and or corrections, they also freak out when there’s FOMO (fear of missing out).

This mentality ☝🏾 makes it easy to be misled and “lose your shirt” because they sell when it’s time to buy and vice versa.

That’s why it’s Great to have the Farmer Mentality (Patience Prayer 🙏🏽 Persistence Perspective Prosperity) instead of the “Lottery Mentality”.

Diversifying your portfolio, learning more about the financial market, choosing to be informed not inundated, learning how the news and historical data play a role in how money moves up and down, only putting in what you can afford to lose (while expecting to win), controlling your emotions, abundance mindset, positive expectancy, choosing Faith > fear, anticipation of gain > fleeing from pain. These things are very helpful tools.

Decide which type of Investor you’re going to be and you’ll have a better idea of which ones you’ll invest in. All have their + & their - but it’s definitely better to GIVE AND INVEST than to spend and try to save” whatever’s left over while making everyone else wealthy.

P.S.

Investors (Farmer Mentality) Change More Lives, Have More Fun and Make More Money 💰

Have a Blessed Faith Family Financial Freedom Friday

And a Wealthy Weekend.

#CoachDonnie

Many ain’t gone wanna hear this oh well 🤷🏽♂️

Facts > Feelings Truth > Traditions

Once you have certain FORMULAS (understand how each Asset benefits you & how much they appreciate per year, etc), thought processes and understanding

You can make money off Assets whenever you want instead of guessing, chasing money & panic selling like many people do when they start investing.

There’s Investors, Traders, & Speculators

The 1st one has always earned the most (based on historical data),

the second one has earned the second highest…

speculators are often emotional and have lost the most and continue to because their strategy is emotions vibes logic etc instead of practical wisdom and principles.

Speculators freak out when there’s fear in the market and or in their portfolio, they freak out when there’s fluctuations and or corrections, they also freak out when there’s FOMO (fear of missing out).

This mentality ☝🏾 makes it easy to be misled and “lose your shirt” because they sell when it’s time to buy and vice versa.

That’s why it’s Great to have the Farmer Mentality (Patience Prayer 🙏🏽 Persistence Perspective Prosperity) instead of the “Lottery Mentality”.

Diversifying your portfolio, learning more about the financial market, choosing to be informed not inundated, learning how the news and historical data play a role in how money moves up and down, only putting in what you can afford to lose (while expecting to win), controlling your emotions, abundance mindset, positive expectancy, choosing Faith > fear, anticipation of gain > fleeing from pain. These things are very helpful tools.

Decide which type of Investor you’re going to be and you’ll have a better idea of which ones you’ll invest in. All have their + & their - but it’s definitely better to GIVE AND INVEST than to spend and try to save” whatever’s left over while making everyone else wealthy.

P.S.

Investors (Farmer Mentality) Change More Lives, Have More Fun and Make More Money 💰

Have a Blessed Faith Family Financial Freedom Friday

And a Wealthy Weekend.

#CoachDonnie

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Coach Donnie OP : 1-3 Trillion dollar valuations and market cap

NVDA

MSFT

AAPL

AMZN

GOOGL

META

TSLA is the only one under a Trillion temporarily

Coach Donnie OP : Some ‘do’s’ and ‘don’t’s’:

Do:

- Read, study, listen and learn daily. Information is power, use it to advantage.

- Ask questions! It’s silly to be shy, there are eight billion of us, and we are ALL learning.

- Buy ETFs at least 80% of your portfolio (like SPLG FTEC FHLC FSKAX VOO VGT). You don’t have to be the expert with ETFs.

- Build a base in shares through DCA or an allotment strategy using income (perhaps to weight more on equities that are down in a given moment). DCA is recommended.

- Whether growth or value, invest in that which has promise of greater comparative returns. Growth is recommended unless you’re at retirement enjoyment protection phase.

- Know yourself. Focus on strengths and mitigate weakness, be who you are.

Don’t:

- Buy individual stocks only, especially if you don’t know what you’re doing. Hedge your bet with ETFs, Real Estate when the Cash on Cash return makes sense, Gold and Silver, Businesses, other assets.

- Overleverage, Overbuy, Overtrade. Only make a move based strong conviction.

- Forget that there is always an opportunity.

- Blindly follow others. Getting ideas is great, be sure to conduct your own due diligence as well.

- Be afraid to ‘lose’ sometimes. That is part of this exercise; accept that and move on.

- Overleverage. Stay within a safe zone and build over time.

Happy investing

#CoachDonnie

Coach Donnie OP : Work for a cause, not for applause. Live your life to express, not to impress, don’t strive to make your presence noticed, just make your absence felt.

Coach Donnie OP : Patience Discipline Consistency

we can enjoy the journey more

we can enjoy the journey more

laugh

laugh  this is as much about us Becoming Better as it is about Asset Accumulation.

this is as much about us Becoming Better as it is about Asset Accumulation.

When we understand the cycles

We can buy the dips and unplug (or do nothing) when there’s downtrends, dark pool market manipulations, sell offs etc

We can also enjoy the upswings without getting caught up in FOMO and succumbing to the pressure of buying stuff at All Time Highs

Gotta enjoy yourself otherwise the market is more stressful than a job

Mindset produces Assets:

Enjoy the journey smile

#CoachDonnie

Coach Donnie OP : Let’s all

focusing on a quick buck. Hold, and go long.

focusing on a quick buck. Hold, and go long.

DISCLAIMER

DISCLAIMER

Stop

Collect Assets at a Discount. DCA either way. Be patient.

We Build Wealth.

The compound annual growth rate (CAGR) is the mean annual growth rate of an investment over a period longer than one year.

It's one of the most accurate ways to calculate and determine returns for individual assets, investment portfolios, and anything that can rise or fall in value over time.

= 10 to 100% CAGR or more for All of Our Assets:

Ex:

What does 10% CAGR mean?

CAGR tells you the average rate at which an investment has grown over a specified period.

10% CAGR means the 10% interest you earn every year is first added to your principal investment. And then, on the total amount, you again get 10% return.

Traditional Investing

Buy & Hold

Big Boy Blue Chip

Long Term

Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.

- Warren Buffett, Billionaire

• Look into Capital Gains Taxes, long term vs short term wherever you’re located

When you sell for a profit there are often larger gains taxes which is good to be aware of so you’re not shocked

#CoachDonnie

* For ANY and all aforementioned/heretofore Stocks, ETFs, side hustles or other Assets/asset classes discussed here

Remember the following:

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

I Share Because I Care. The aforementioned is for Informational Educational & Entertainment purposes ONLY, this is NOT investment advice.

You have to do what’s best for you and yours at the end of the day. There’s NO guarantees in Investing nor Asset Accumulation.

Reach out to your Financial Advisor, CPA and or CFP.

I am not a Financial Advisor, CFP nor CPA.

Coach Donnie OP : Wealth is who you are not what you have…

Wealth has to be an inward realization before it becomes an outward manifestation.

#CoachDonnie