From ICU to KTV: The Wild Ride of Chinese Stocks and What’s Next

Back on August 29th, I wrote an article describing Chinese stocks as being in the ICU—barely holding on, with valuations at rock bottom and investor sentiment deeply pessimistic. At the time, the market felt lifeless, and no one seemed confident enough to jump in. The uncertainty was thick, and it felt like the Chinese market was on life support. If you missed that post, you can still find it in my profile to understand the context of what the market was like just a few weeks ago.

But fast forward to today, and what a difference a few weeks can make. The sentiment has shifted dramatically. What was once an ICU has now transformed into something more like a KTV—everyone is in a celebratory mood, and the market feels like a place of euphoria. People who would’ve never touched Chinese stocks are suddenly jumping in, from the seasoned hedge fund managers to everyday retail investors. This isn't just a rally; it’s a frenzy. The party is on, and everyone wants a piece of the action.

The catalyst for this dramatic shift? The Chinese government. It’s no secret that China has launched one of its most aggressive stimulus campaigns in years, and the effects have been nothing short of spectacular. The key drivers have been monetary easing and a massive influx of liquidity into the market, starting with an initial 500 billion yuan injection and with more rounds expected if needed. These funds are not just flowing into the stock market but are also aimed at stabilizing other critical sectors of the economy, like real estate.

This stimulus package includes targeted re-lending to support banks in providing loans to listed companies, measures to reduce reserve ratios, and broad encouragement for foreign investors to get back into Chinese stocks. The result? Even with the Chinese stock exchanges closed for the National Day holiday until October 8th, foreign capital is still flooding in via the Hong Kong Stock Exchange. Every day, massive amounts of money are pouring into Chinese and Hong Kong stocks, pushing valuations higher and higher. It's almost surreal—despite the Shanghai and Shenzhen exchanges being on a break, the stocks are still soaring through the roof.

And let’s not forget the context here: Chinese stocks have been in decline for the past four years, consistently disappointing investors. Yet, in just under a week, those four years of losses have been erased, with gains so dramatic they almost seem too good to be true. Every day, we’re seeing stocks hit their daily limit up, and when they do, investors simply move on to the next stock, eager to ride the wave.

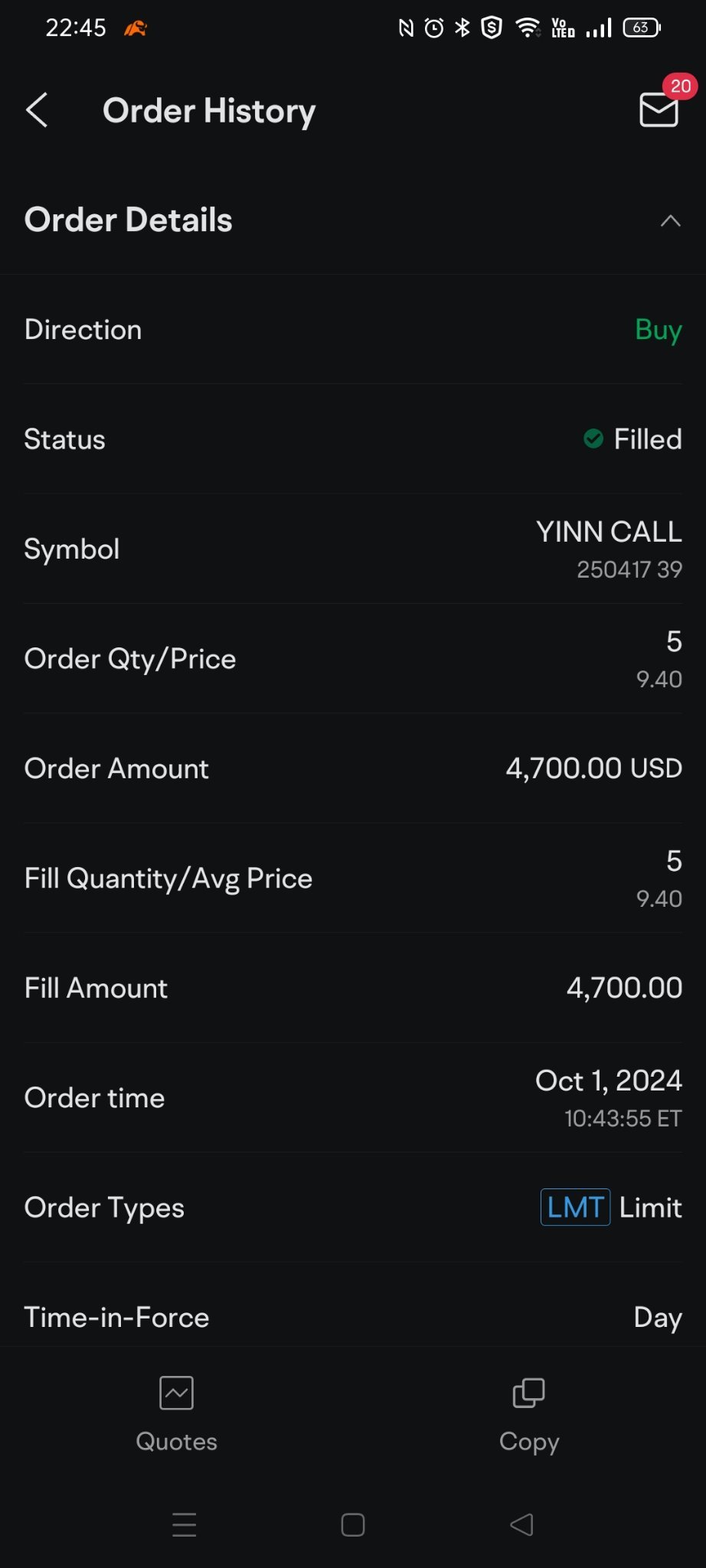

I took advantage of this shift by purchasing call options on the YINN ETF—a 3x leveraged ETF tracking the top Chinese companies. I bought 5 lots at $9.40 each, and within just one day, the price shot up to $17.04, delivering me a substantial gain overnight. It’s the kind of price action you’d expect in a bull market, and honestly, the kind of surge you rarely see unless you’re leveraging your position. In this case, it worked out perfectly.

But YINN wasn’t my first foray into Chinese stocks. I’ve been holding small positions in Miniso (MNSO) and Yum China (YUMC) for a while now. These are solid companies with strong fundamentals, but my positions were relatively small—just 100 shares of Miniso bought at a low price and YUMC, which has already gained 40%. While the growth has been impressive, the size of these positions meant the returns weren’t particularly life-changing. That’s why I decided to take a more aggressive stance with YINN. With a relatively small upfront cost, the upside potential is significant, especially in a market like this, where sentiment has flipped so dramatically.

Looking ahead, the key question is whether this momentum can sustain itself. My bet? I believe it can. The Chinese government is determined to keep this rally going, and they’ve only just started with their stimulus efforts. With more liquidity injections on the horizon, and as foreign investors continue to pour in through the Hong Kong exchange, I expect to see this rally stretch well into October and beyond. Once the Shanghai and Shenzhen exchanges reopen after the holiday, there’s likely to be another wave of investment as domestic investors jump back into the market.

That being said, there will inevitably be pullbacks—there always are in markets like these—but with the government effectively backstopping the market, I’m confident that any dips will be short-lived. We may even see the market transition from the first phase of this bull run into the second, as more retail investors pile in and institutions adjust their positions.

If you’re still on the fence about Chinese stocks, now might be the time to consider them. The risks are always there, but so are the opportunities. I’m keeping a close eye on my YINN options and will continue to update as the situation develops.

If you found this post helpful, make sure to give it a like, and don’t forget to follow my profile for more updates. Your support keeps me motivated to keep sharing my strategies and thoughts.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

股海踏浪 : Violating economic laws, artificially creating momentum, the frantic rush results in a mess. It is an inevitable trend to fall back.

△□X○ 股海踏浪 : Saving listed companies, saving state-owned enterprises, and saving local debts are duties and responsibilities of lbx pharmacy chain joint stock.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

74319973 股海踏浪 : It is normal for valuation to soar due to injecting liquidity directly now.

股海踏浪 △□X○ : What can save? Relying on empty talk and printing money is useless, what we should rely on is people's hearts, trust, and a fair and just economic environment.

△□X○ 股海踏浪 : Isn't it true that lbx pharmacy chain joint stock and savings are starting to give up interest on large deposits in exchange for silver to securities in the last two days before the holiday?![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

股海踏浪 △□X○ : This may be the final destination.

△□X○ 股海踏浪 : That's the purpose, this time entering the stock market.5000It was very obvious that the intention was to invest in real estate and expand lending to businesses, but since no one was borrowing, they had to come to the stock market to fish.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

股海踏浪 : Yes, this is on par with the USA stock market, where Americans deceive the world into buying a bunch of garbage stocks that lose money every year. The Chinese stock market deceives the retail investors into exchanging real gold and silver for a bunch of worthless non-dividend-paying Arabic numerals.

into buying a bunch of garbage stocks that lose money every year. The Chinese stock market deceives the retail investors into exchanging real gold and silver for a bunch of worthless non-dividend-paying Arabic numerals.

杜员外 : If you still don't understand political economics, the short positions won't be able to rise. Looking back on the past, right now is still at the level of the first step at the foothills, be sure not to get off the car.

溫馨提示 股海踏浪 : Who cares what they do with business we are small potatoes as soon as make money than run like a bitch lol

View more comments...