Alex Wong Cian Yih

liked

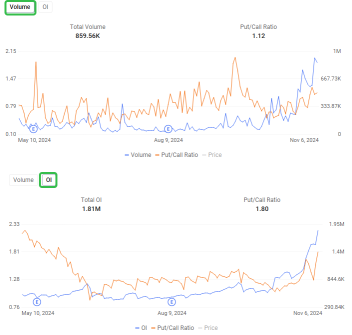

After Trump won the presidential election yesterday, the market value of Trump Media & Technology Group, the owner of Trump's social media company Truth Social, initially soared. However, by the close of trading yesterday, the stock price had given up most of its early gains, ending up 5.9%. In pre-market trading on Thursday, DJT fell more than 13%.

After the election ended, DJT saw a standard IV crush

For several months, Trump Media has been repre...

After the election ended, DJT saw a standard IV crush

For several months, Trump Media has been repre...

+3

58

18

Since I first shared my thoughts on Seatrium in August, the stock has experienced a fair share of volatility, reaching SGD 2.1 before settling around SGD 1.9. To some, this fluctuation might reinforce their doubts about Seatrium as a potential investment. I’ve noticed certain skeptics labeling it a “meme stock” or even dismissing it as a “pump-and-dump” play, as though its recovery story is no more than a speculative fad. However, my persp...

36

Alex Wong Cian Yih

commented on

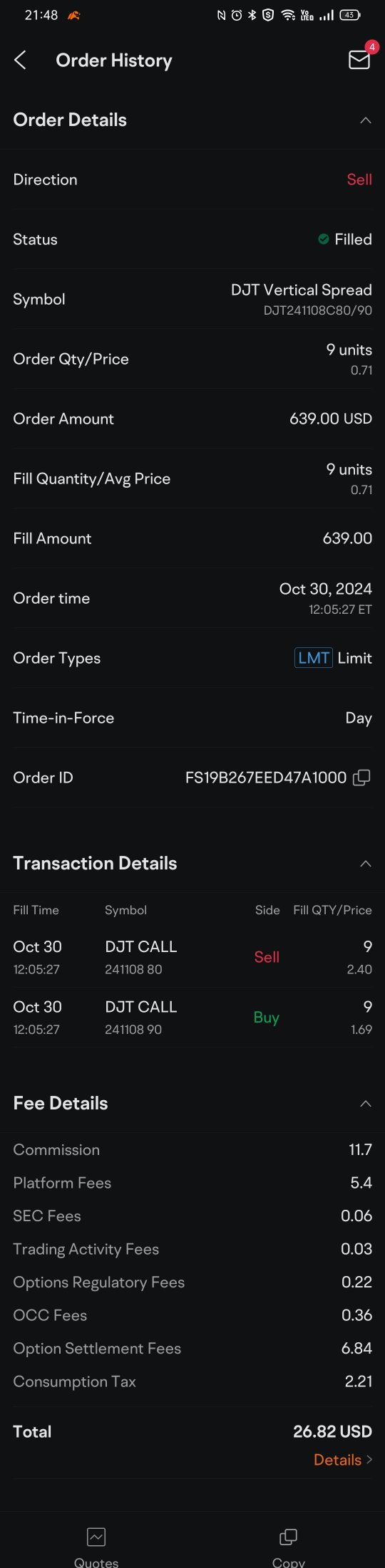

On October 30, I executed a DJT vertical spread with a strike range of $80 to $90, set to expire on November 8. This trade was carefully timed, leveraging both high implied volatility (IV) and the benefits of time decay, while based on an objective analysis of the company’s fundamentals and market sentiment.

The Trade Setup

I sold 9 units of DJT call spreads, securing a total premium of $639. After accounting for p...

The Trade Setup

I sold 9 units of DJT call spreads, securing a total premium of $639. After accounting for p...

26

3

October has been a rollercoaster, particularly for those of us who had high hopes for Chinese markets. Early in the month, I took a significant position on YINN, buying $60 call options with the expectation of an upward trend in Chinese stocks. Unfortunately, the market had other plans. A severe downturn in Chinese equities led to a substantial loss on October 8, reminding me of the inherent risks tied to such speculative play...

+2

14

3

Today, Pfizer released its Q3 2024 earnings, delivering results that, in my view, strongly exceeded market expectations. Many analysts and investment banks had set target prices and earnings estimates that Pfizer managed to surpass by a significant margin. With revenue coming in at $17.7 billion (up 31% year-over-year) and adjusted EPS of $1.06 (43% growth), the company has undeniably beaten Wall Street fo...

14

After holding onto Pfizer stock for a considerable time, I recently doubled down, purchasing an additional 200 shares at $28.85 per share. This decision was not made lightly, as my confidence in Pfizer’s growth potential and its Q3 earnings expectations is stronger than ever. In fact, I believe that the upcoming earnings announcement could be a turning point, one that propels the stock price upward and finally validates its underlying value.

...

...

loading...

29

In my recent journey through the Chinese stock market, I've experienced both the exhilarating highs of initial gains and the sobering lows of unexpected losses. Initially optimistic due to government policies and interventions, I invested heavily in Chinese equities, confident in a bullish outlook. However, as the market surged and then sharply retreated, many investors, including myself, found ourselves facing significant losses. I ended up los...

28

1

The recent decline in the U.S. bond market, especially the TLT ETF, has sparked considerable attention. This isn't just about rising yields or falling prices—it's about understanding the broader economic forces at play and recognizing opportunities amidst uncertainty.

The Bigger Picture: Manipulated Data or Economic Strength?

September’s economic data showed robust growth, with the CPI rising 2.4% year-over-year and core CPI at 3.3%. These figures, a...

The Bigger Picture: Manipulated Data or Economic Strength?

September’s economic data showed robust growth, with the CPI rising 2.4% year-over-year and core CPI at 3.3%. These figures, a...

16

1

Alex Wong Cian Yih

commented on

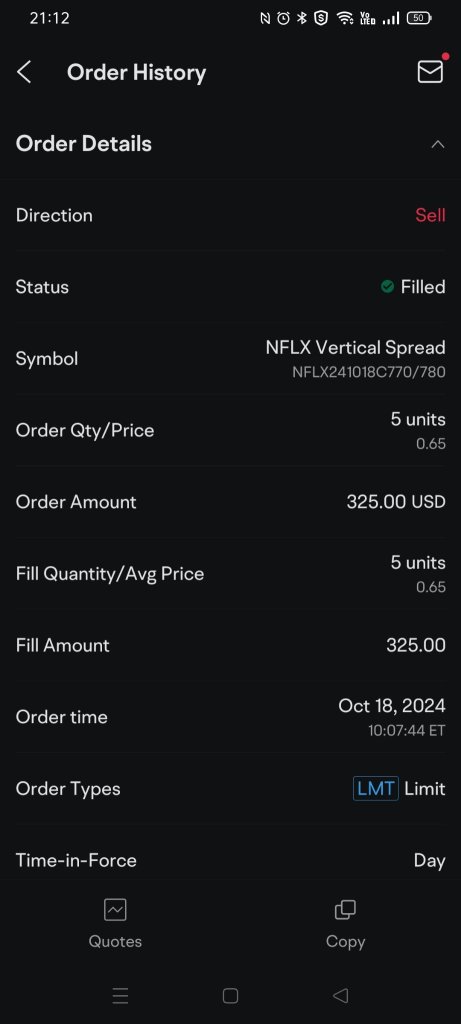

Today is a monthly options expiration day, and with Netflix up over 10%, be cautious. We've seen strong market movements, but keep in mind that later in the day, there could be what traders call a 'double whammy' where both bulls and bears get caught. If the stock rises quickly but experiences profit-taking or sudden selling pressure near the close, those who don't lock in their profits may see gains vanish. Stay alert, as th...

3

Today’s rally in the Hong Kong and A-shares markets caught many by surprise, with both indices rebounding sharply after days of losses. Since October 8th and 9th, the markets had been on a downward trend, with slight recoveries overshadowed by further drops. It wasn’t until today, October 18th, that we saw a significant bounce back, leaving many wondering whether this marks the start of something bigger.

---

A Reflec...

---

A Reflec...

7

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)