Gain Exposure In ProShares Bitcoin Strategy ETF (BITO) For Bitcoin Rally In 2024

$ProShares Bitcoin ETF (BITO.US)$ which tracks the price of futures tied to the Bitcoin has made the news recently after Cathie Wood's ARK Invest bought 4.3 million shares.

We have seen Bitcoin staging a rebound in the last 2 months after a brutal 2022, I am looking more towards why Ark decide to sell $Grayscale Bitcoin Trust (GBTC.US)$ and buy into BITO.

Cathie Wood told Bloomberg TV in an interview that ARKW sold its Grayscale holdings "out of an abundance of caution," as they are not sure if the conversion would be approved in early January. "It's just a moment of uncertainty between now and January 8th to 10th,"

Wood said bitcoin's rally this year and the reduction of the gap between GBTC's price with its net asset value meant "double good news" for ARK. GBTC's discount to its net asset value, or the price of its bitcoin holdings, narrowed to around 6.9% on Wednesday from over 40% in June.

If I were to look at how Ark is thinking, there might be a chance that approval for the Bitcoin ETF which is scheduled to expire in January,might not take place for all. So in order to keep ourselves invested in Bitcoin, I would think BITO is a better chance now.

In this article, I will be sharing how BITO performance have been like, and whether is it a good time to buy into this ETF?

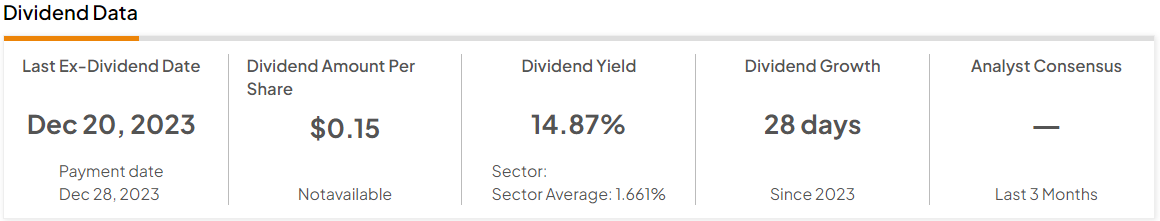

ProShares Bitcoin Strategy ETF (BITO) Dividends Yield

Other than expense ratio, one thing investor look at is the dividend yield. No doubt that the expense ratio for BITO is on the high side at 0.95. But this could be compensate by the more than 14% dividend yield as of 20 Dec Ex-dividend date.

ProShares Bitcoin Strategy ETF (BITO) Annual Return 2022 and 2023

As we can see than BITO return in 2023 have been pretty impressive and more than 100%, and if we look at the correlation with S&P 500, it is at 0.23.

Something you might need to be aware of is the volatility is 50.7% as compared to 13.8% for S&P 500.

ProShares Bitcoin Strategy ETF (BITO) Return vs S&P 500

As we have seen that BITO volatility is higher than S&P 500 but if we were to look at the past 1 year return, we can see that it has performed well better than S&P 500.

But it has fallen -50% since its IPO in 2021, so this would mean BITO price is undervalued based on lower than IPO price.

ProShares Bitcoin Strategy ETF (BITO) Hedge Fund

We can see that hedge fund have been increasing their holding for BITO, prior to Ark purchase of 4.3 million shares.

This would mean sentiment from institutional investors are positive.

ProShares Bitcoin Strategy ETF (BITO) Holdings

As we can see from BITO holdings, quite a significant of it is in US Treasury bills other than cash, this would mean if treasury yield go higher, BITO most likely would benefit as well.

U.S. Treasury yields were higher on Thursday as investors weighed the path ahead for the economy and financial markets as the new year nears. The yield on the 10-year Treasury added more than 5 basis points to 3.844%. The 2-year Treasury yield rose more than 3 basis points to 4.275%.

ProShares Bitcoin Strategy ETF (BITO) Investors Sentiment and Holdings

Investors sentiment for BITO have been very positive and it is in the Bought region, which I believe we could see more buying as investors start to plan for next year asset allocation.

We could see that investors with portfolio holding BITO have increased by more than 8% over last 30 days. And 1.9% over the last 7 days

Is it A Good Time To Buy Now?

Currently, BITO is trading above the 50-day MA period, and if we were to look for an entry price. I would think we can wait for a short pull back.

The price I would enter would be when BITO trade around the 50-day period at around $18.50 to $19.50 region.

Summary

Based on what I have gathered I feel that it is a good time to monitor and start planning to enter BITO, so that we could have a much safer exposure to Bitcoin, this ETF does have a pretty high correlation to Bitcoin prices move, so it is important that we monitor the Bitcoin price movement closely.

Though GBTC has a correlation of 1.0, but there is caution that SEC might reject GBTC's conversion into a bitcoin ETF.

I will be monitoring as the current price is not a good entry price for me.

Appreciate if you could share your thoughts in the comment section whether you think BITO would be a good ETF for us to prepare for a Bitcoin rally after its halving events and also to safeguard against any uncertainty from pending other Bitcoin ETFs approval.

Disclaimer: The analysis and result presented does not recommend or suggest any investing in the said stock. This is purely for Analysis.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Talented Mr Ripley : the stampede will come. buy buy buy