Elias=JC family trading warfare iron law (it's never too much to emphasize repetition):

Win in bear markets; win in volatility; win in courage; win in wisdom; win in composure; win in learning; win in change; win in adaptation; win in mathematics; win in physics; win in models; win in functions; win in oscillations; win in quantification; win in frameworks; win in moderation; win in probability; win in technology; win in psychology; win in dexterity; win in flexibility; win in oscillations; win in long-term; win in investment; win in mentality; win in forgiveness.

Lose in closed-mindedness; lose in self; lose in rigidity; lose in self-abandonment; lose in self-deception; lose in chasing highs; lose in chasing strength; lose in overtrading; lose in stagnant growth; lose in one-sidedness; lose in gambling; lose in defense positions; lose in full positions; lose in financing; lose in liquidation; lose in perpetual motion; lose in gambling; lose in complaining; lose in excuses; lose in blaming; lose in wishful thinking; lose in plans; lose in predictions; lose in short term gains; lose in impatience; lose in greed; lose in mindset.

98% of people can never overcome the bias of preferring rising to falling and trying to predict the market. Without a certain proportion of reserve funds and a strong backup plan, 98% of people can only end up in failure. Trading is a way of making a living, not being a stock slave or engaging in battles of opinions (Elias=JC does not participate in opinion warfare, not interested). It's about winning through investment and trading.

Alarm bell rings: The first and last chapters of the Book of Wisdom both write 'There is no such thing as a free lunch in the world.' Don't expect to make money without hard work by just looking at others' post-market replay charts analysis. Here, at this moment, all JC's posts are personal expressions before, during and after the market, research and exploration, without emotional views, stock recommendations, or spiritual chicken soup, which cannot be used as the basis for trading. Therefore, the resulting gains and losses in trading can only be borne by oneself, regardless of profit or loss, all self-inflicted.

We were originally strangers, let alone in the financial realm. Even if you are capable, in this money-playing financial market, it's easy for others to see you as a swindler. Therefore, JC will never use research results as a means to give away money for free, because there's no need for it. Are there really any true friends in the financial market? Each person goes their own way, does their own thing, being firm without desires. JC won't depend on you, won't adhere to your ways, won't care about your opinion. Except for Jesus Christ (who is actually God, the Holy Trinity of the Father, the Son, and the Holy Spirit), JC fears no one.

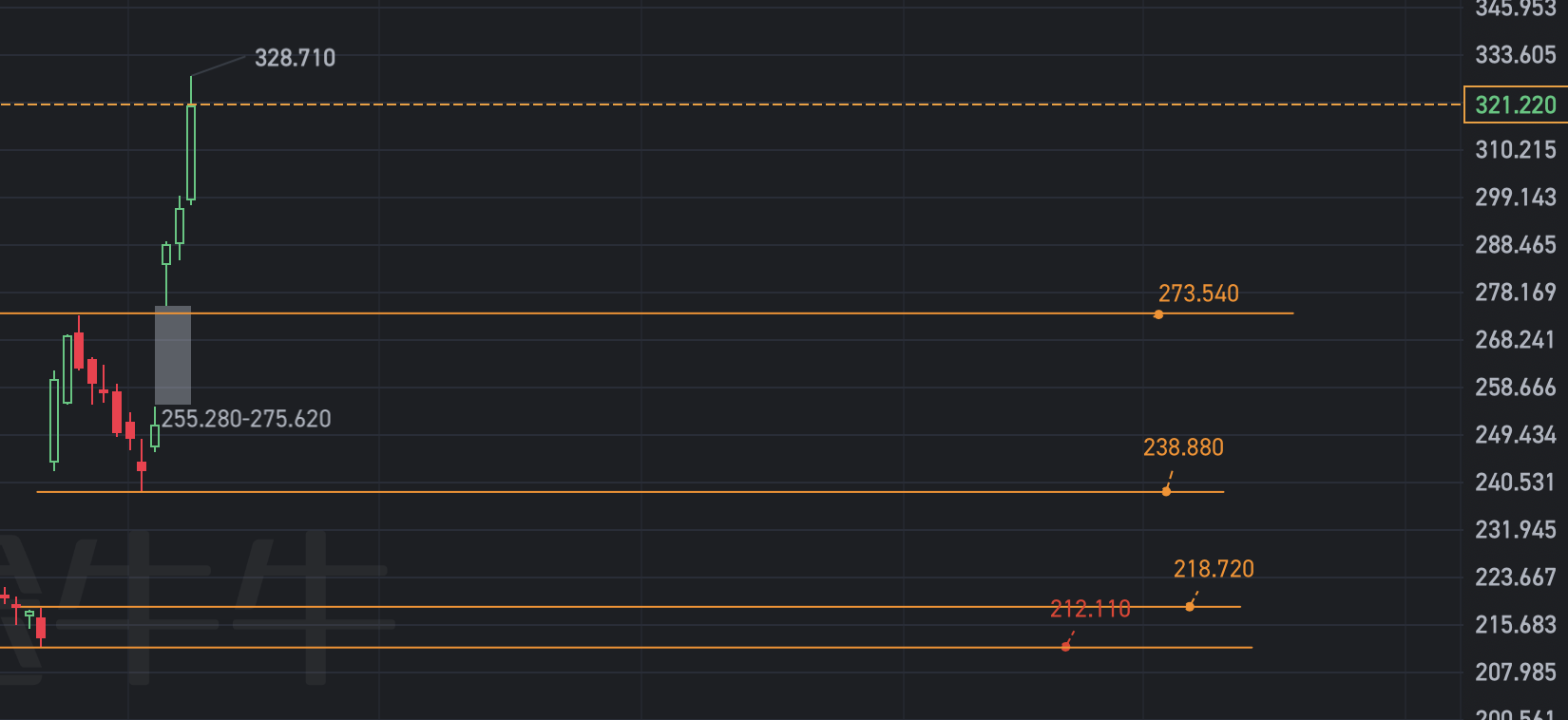

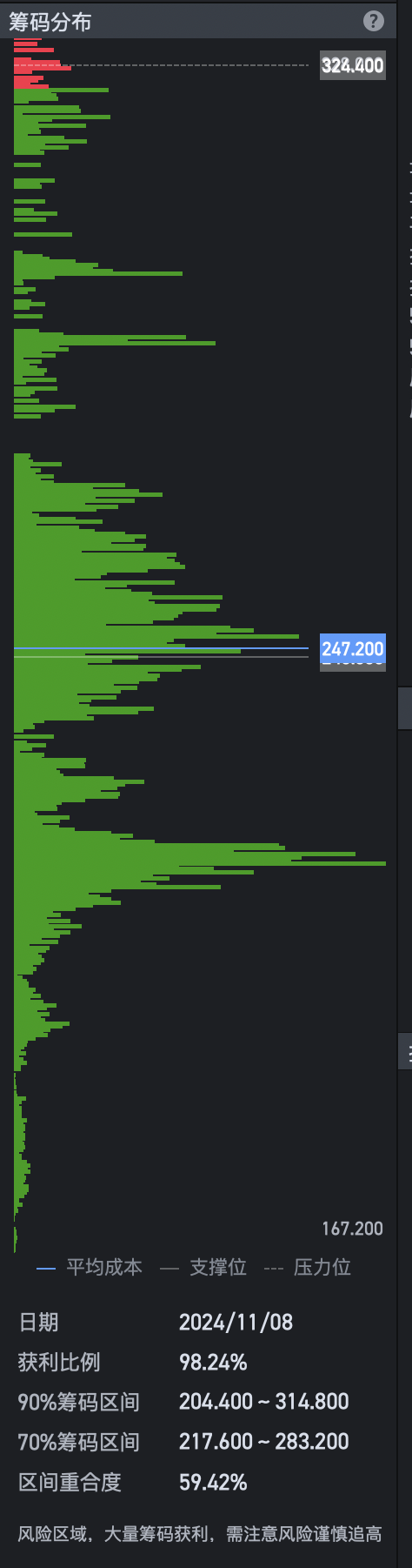

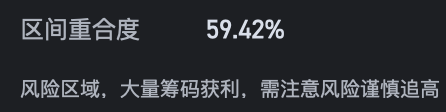

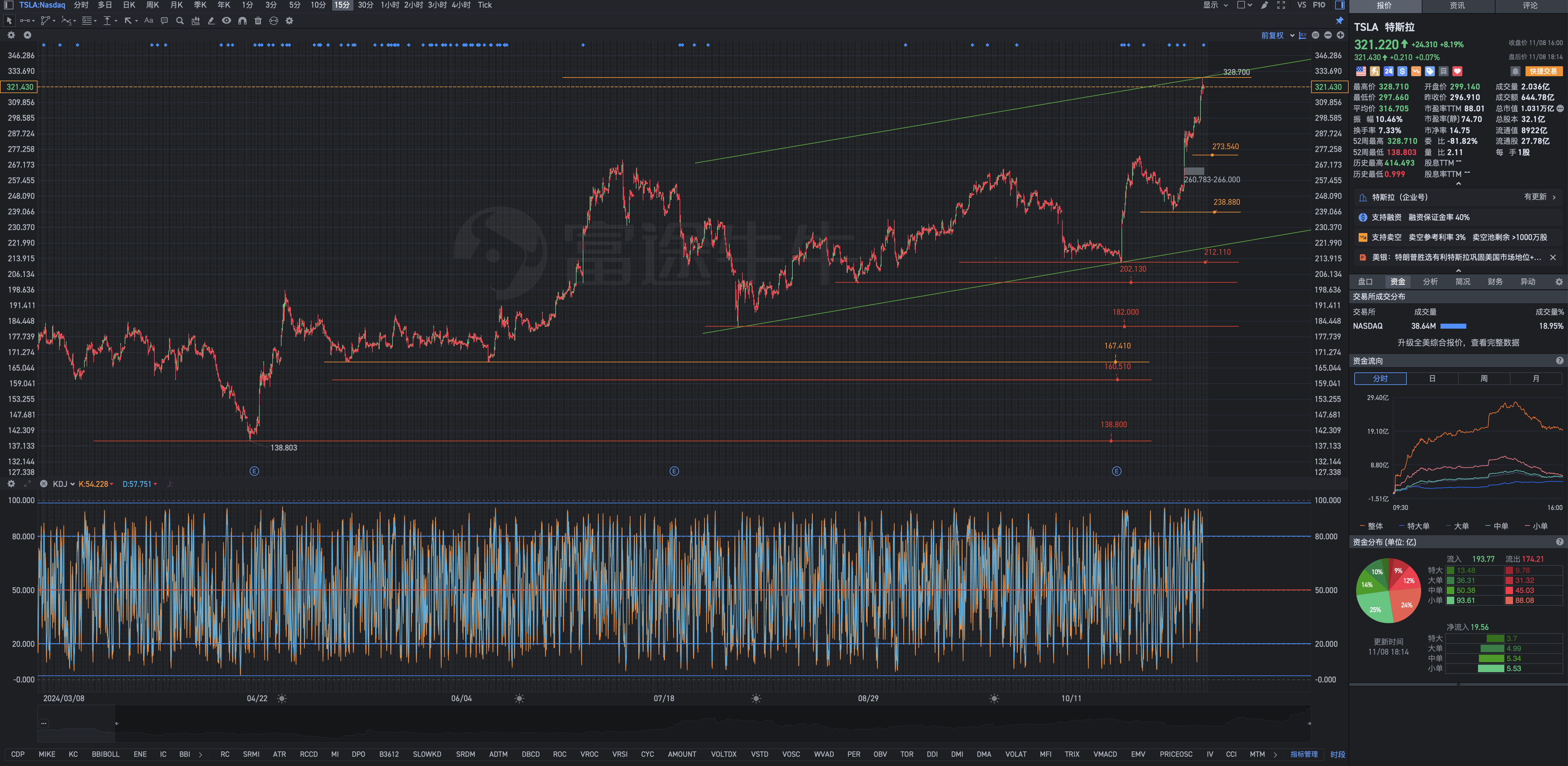

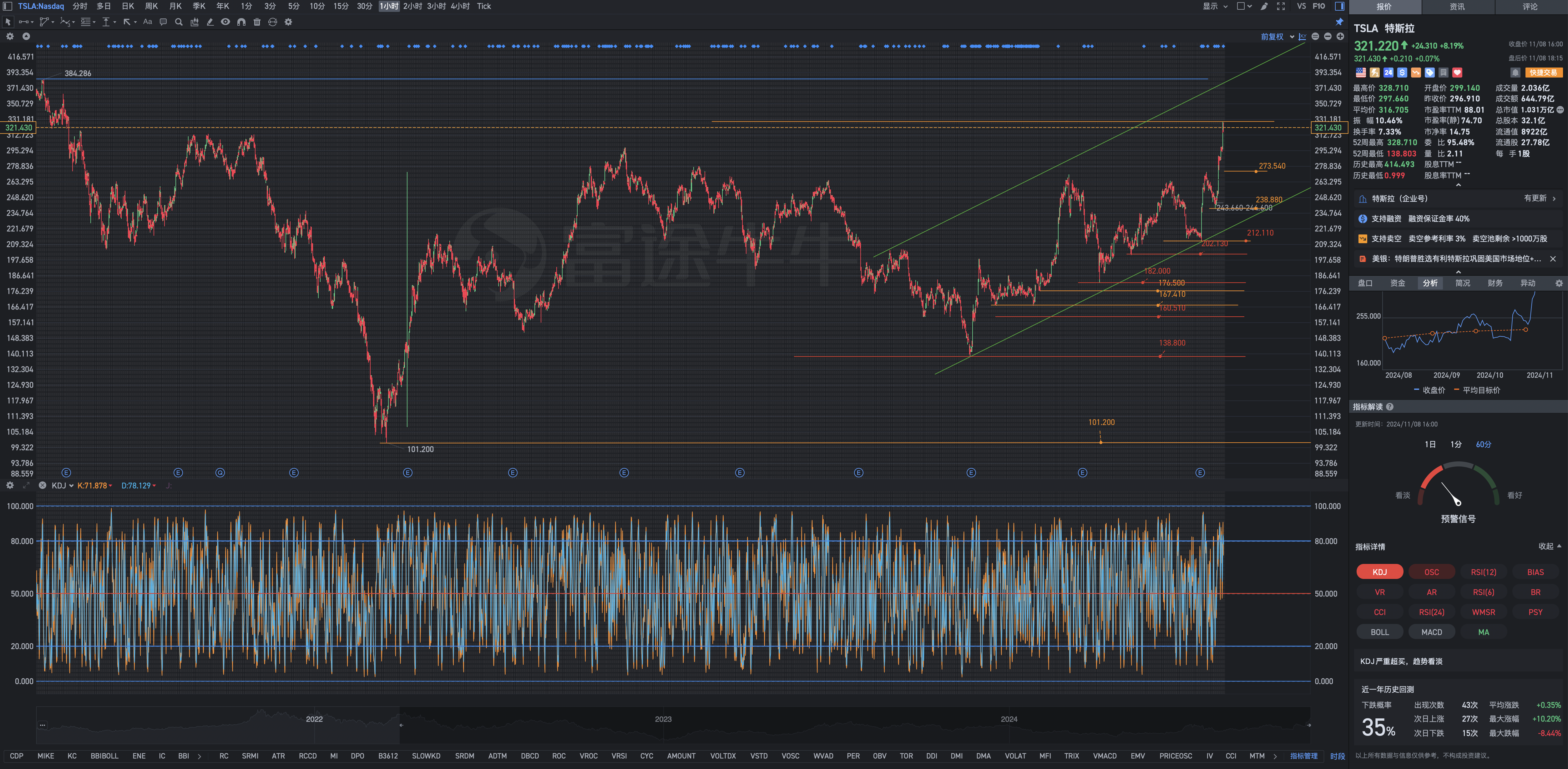

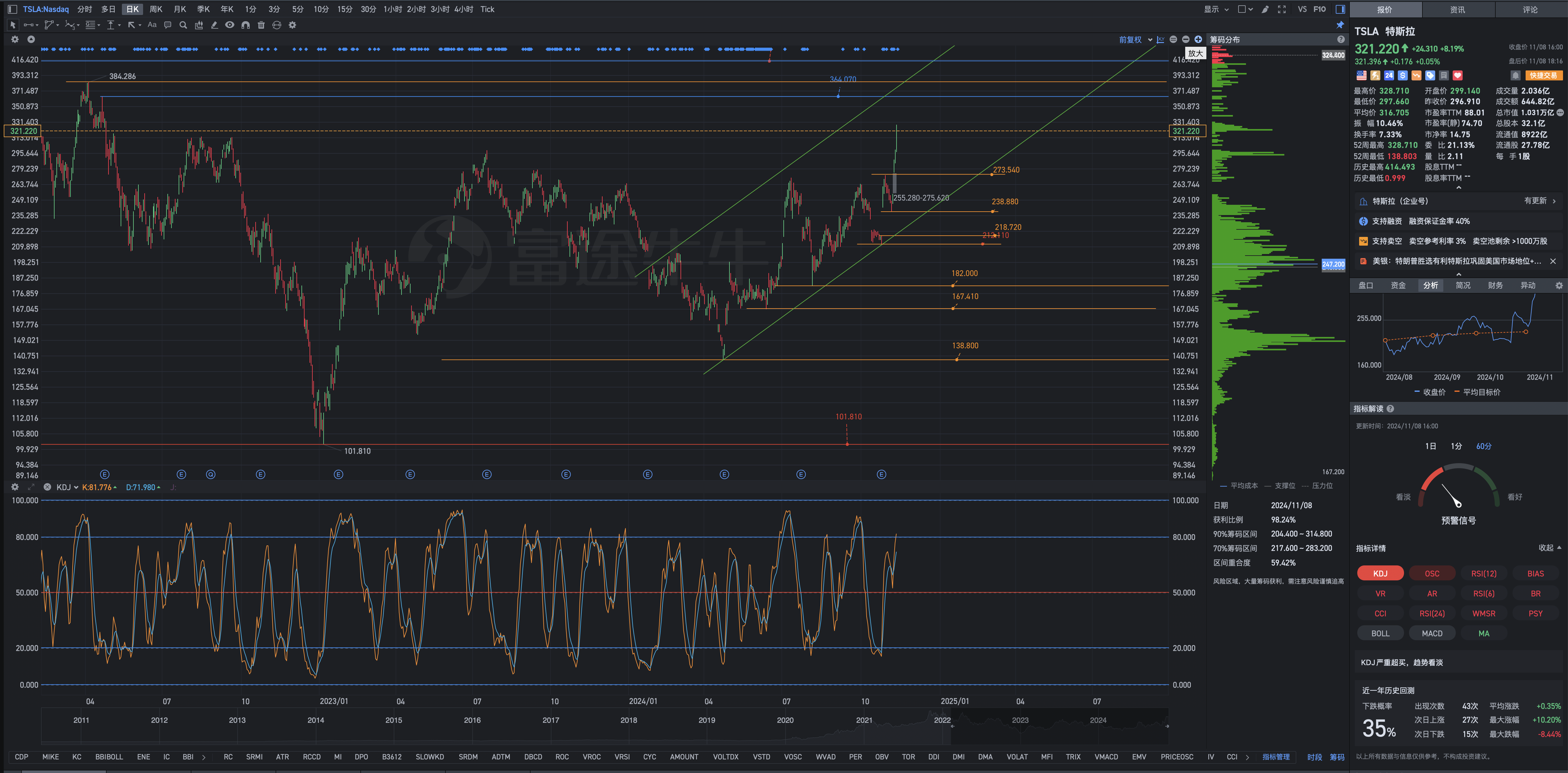

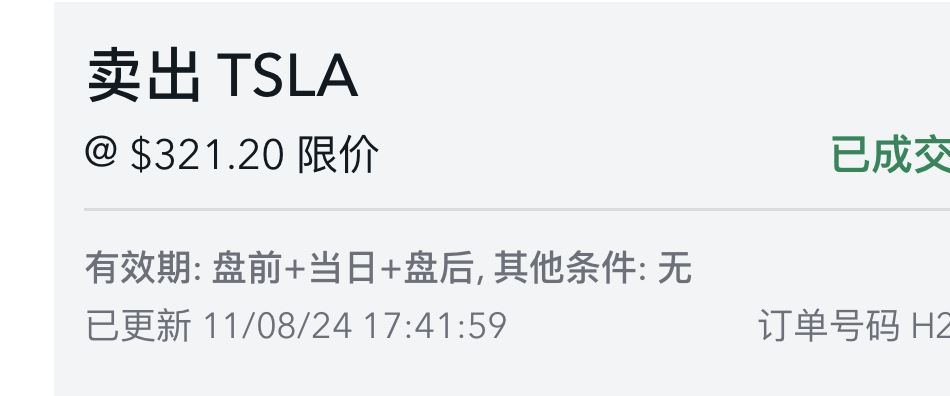

Disclaimer: There are many crazy people in the securities market, so it is better to clarify what needs to be clarified. This article is a personal trading diary, not an opinion or stock recommendation. This is the well-regulated US securities market, not the A-share securities market. The blogger has a long-term trading style. However, in special circumstances, such as when the market is particularly good and the profit chip ratio exceeds 80-90% for a long time, the blogger will choose to sell and close the position to realize the floating profit. When the market and individual stocks are not good, especially when it is extremely bad, such as when the profit chip ratio is less than 21-7%, JC will choose to build a scattered random variable position in a gradient and batch manner. Therefore, ordinary traders should not imitate this operation.

蛇蛇 : Well said, please post more in the future.