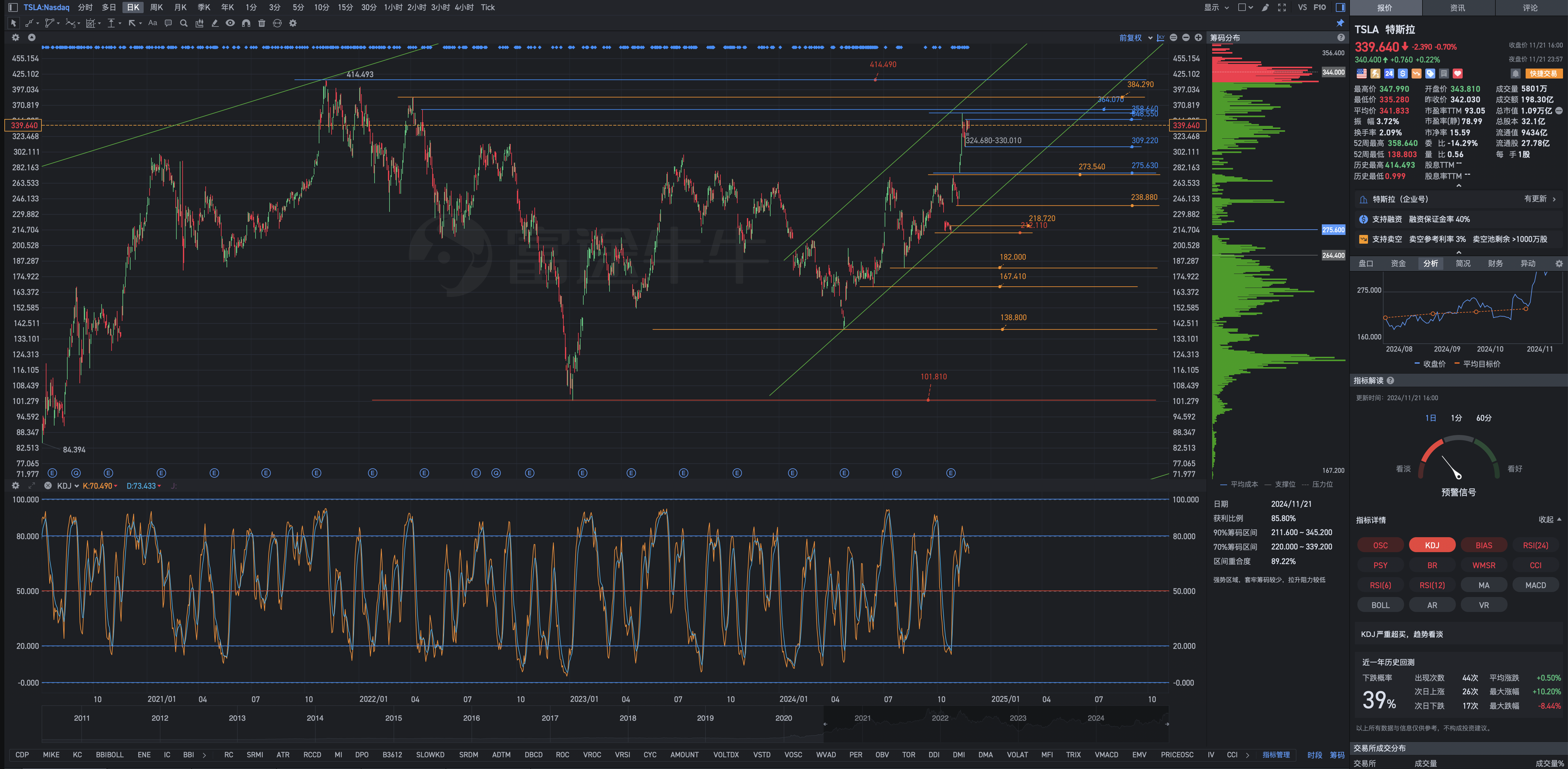

Core Tips🔔Principles of increasing shareholding and expanding stocks: transitioning from electric auto manufacturers to Artificial Intelligence deep development application companies.Artificial Intelligence deep development application company+Energy storage company+Self-driving cars FSD + RoboTaxis (robot taxis) software company+Optimus (Optimus Prime) humanoid robot companyThis is where Elon Musk leads Tesla's determination to change the world, as well as the belief that the world will be changed by multiple factors. You have the right to continue to believe that Elon Musk is making empty promises in order to raise money. However, once Tesla perfects the self-driving cars FSD+RoboTaxis (Robot Taxis) software, it will mark the soaring start of Tesla's stock price. When you cannot coexist with uncertainty, deny, and refuse to accept nascent developments that are still in a vague stage, you also lose the future. Investors can handle their investment trades according to their own circumstances. Just like Vanguard manages individual retirement accounts (IRAs) and 401(k) fund accounts, handle your stock account investments well. Eventually, the consequences of liking to buy high and hating to sell low, as well as chasing highs and strengths, will show. A slightly over 60% long position in stocks rising should not cause anxiety. Going all-out is a completely different matter, and very unwise. A person without long-term planning and who does not prioritize the mental health of investment trading will not go far, even if Tesla has the potential to break through the 271,000–299,290–314,800 range, or even higher ranges like 414,490–515,000; you will not be able to hold onto the gains in hand.