Google: Reasons For Bulls and Bears

Bull reason 1: Massive buybacks & Costs optimization

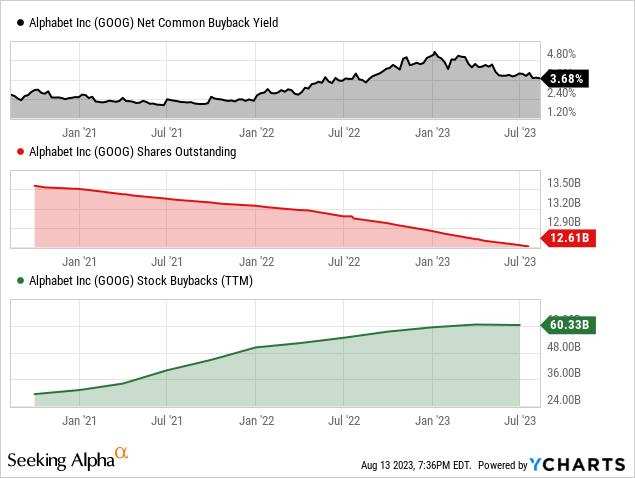

Alphabet is one of the top 5 largest companies in terms of buyback volume in the US market. The stock repurchases totaled $29.5 billion since the start of the year at the end of Q2.

IN THE MEANTIME,During a conference call, top management basically said that cost structure optimization is not a quick process, and therefore the main effect will be noticeable only in 2024.

Shareholders would benefit directly from cost optimization as it will allow the company to increase its massive buyback program (the current one is $70 billion in repurchases).

Bull reason 2: dominance in the search engine market

Despite AI-related fears that Google might lose its dominance in the search engine market and, therefore, in the digital advertising market, the empire hasn't been challenged (yet). Google.com still stands at an unbeatable 91.5% market share. Thanks to the economies of scale, as well as an efficient ecosystem of services, Alphabet maintains a leading position in the digital advertising market. Ad revenues from Google Search, YouTube, and Network account for 87% of the total Services segment.

Bull reason 3: YouTube strength

Shorts currently have 50 billion views per day, up from 30 billion a year ago and 7.5 billion two years ago. The company is already testing monetization in YouTube Shorts. In terms of subscription services, YouTube Music and YouTube Premium now have over 80 million paid subscribers.

According to Nielsen, YouTube leads all streaming services in the US in terms of TV watch time.

And, most importantly, it's way more popular than competitors among teens with 19% of all US teens constantly on the platform.

Bull reason 4: Cloud profitability

Google Cloud platform revenue grew by 28% YoY in Q2, as in Q1, and reached a record $8 billion.

Moreover, the cloud segment is finally on its way to operating profitability as the operating margin reached 4.85% in Q2.

There is a chance that Google Cloud could reach 30% in operating margin by 2027 given that AWS and Microsoft Intelligent Cloud have 35.3% and 42.7% respectively, while also benefiting from a low base effect.

Bear reason 1:

The potential impacts of a recession could be massive for Google. The digital advertising market is as cyclical as it has ever been. Advertising currently accounts for 78% of total revenue.

In 2023, the overall marketing budgets, according to Gartner, have decreased slightly but this did not affect digital advertising. In fact, 53% increased their investment in social advertising, 51% are spending more on digital video advertising and 40% expect search channel budgets to grow (vs 26% decreasing investment in search advertising).

Thus, digital advertising expenses are still yet to be cut, even if the economy could be under pressure.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment