Here's Why Tesla's Stock Is Struggling Despite a Revenue Beat

Tesla unveiled a mixed bag of second-quarter results post-market on Tuesday, with revenue marginally surpassing expectations while earnings marginally fell short. The electric vehicle (EV) titan also signaled a more tempered growth trajectory for 2024 and reaffirmed its commitment to launching a more affordable EV by the first half of 2025.

Earnings Highlights

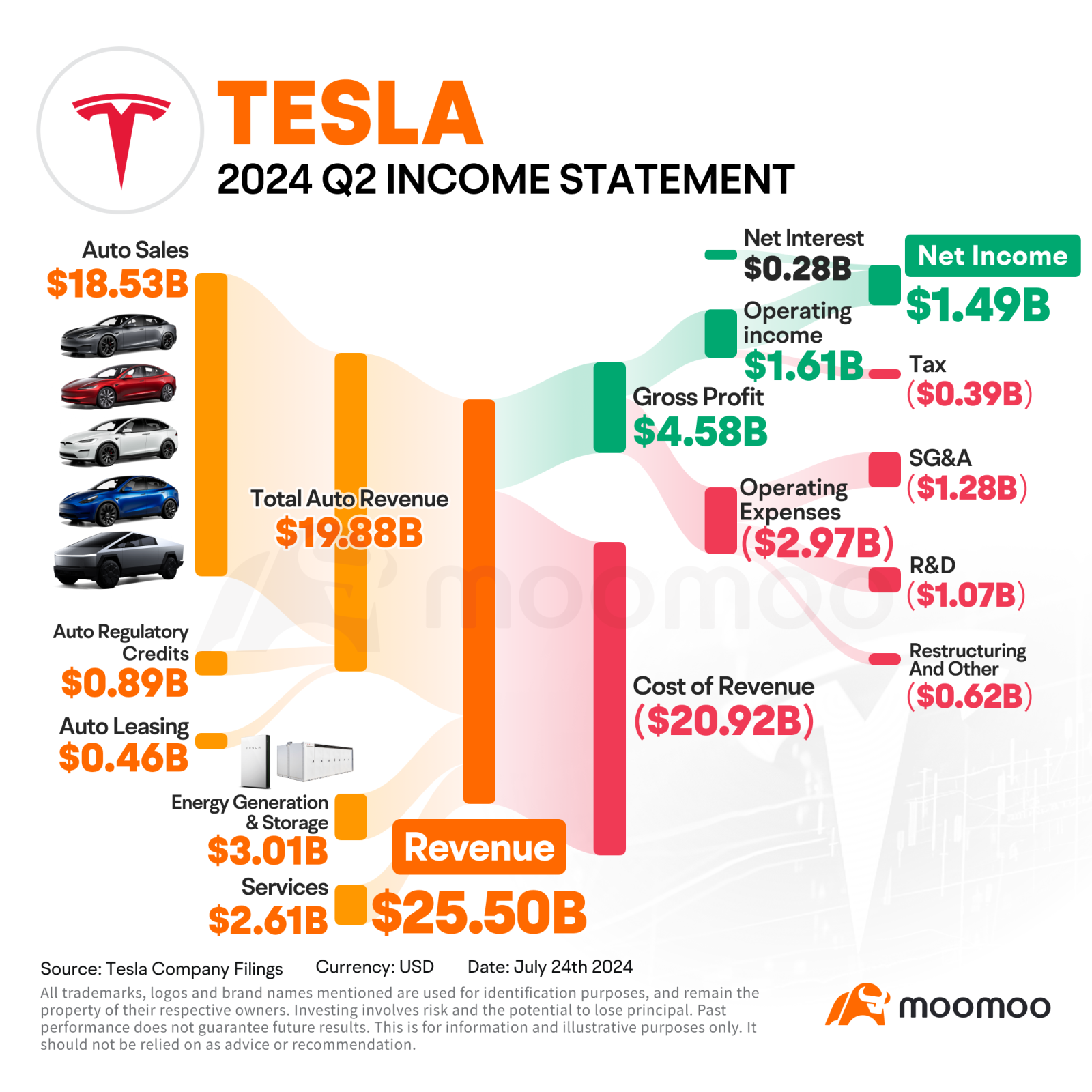

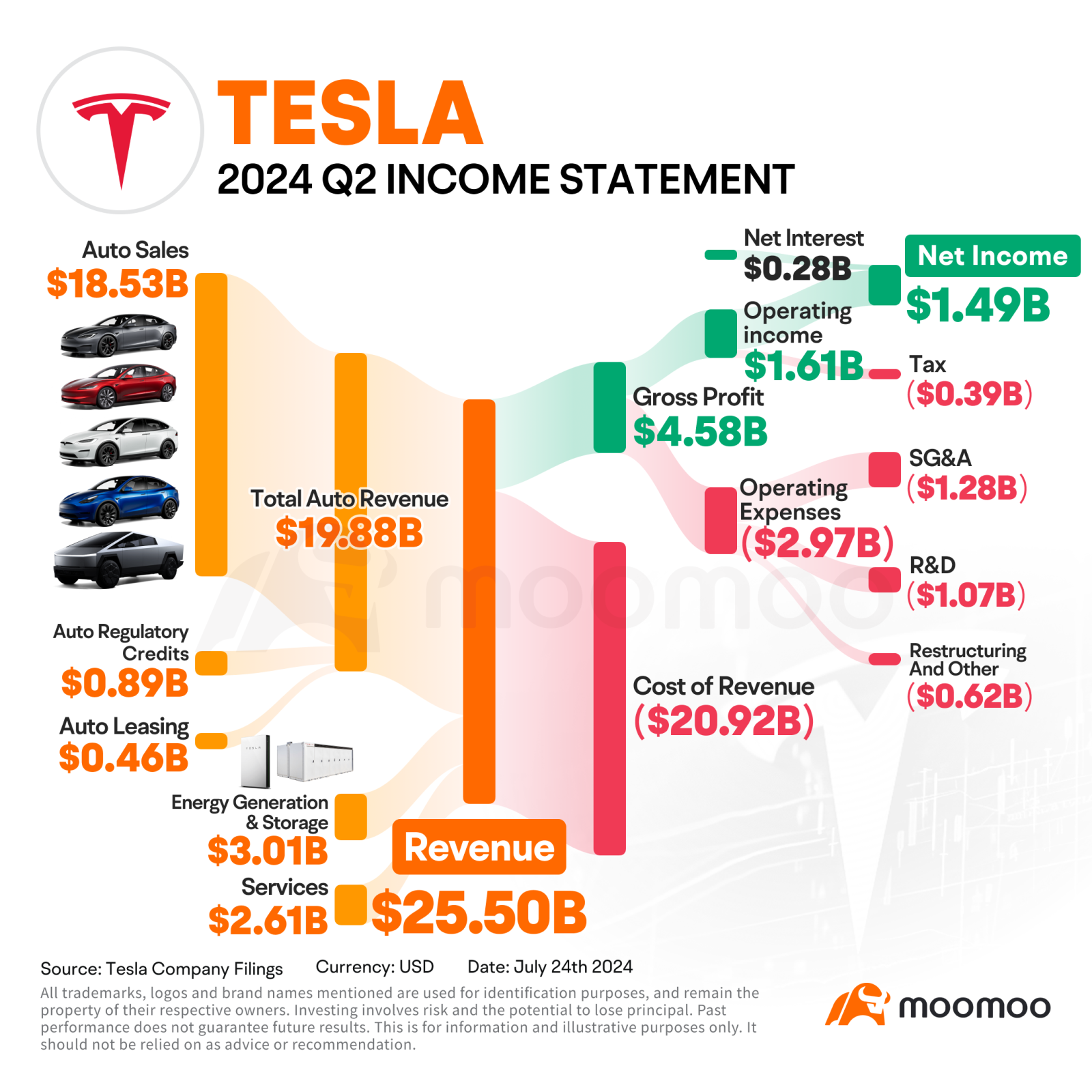

$Tesla (TSLA.US)$ reported Q2 revenue of $25.5 billion, slightly above the $24.63 billion forecasted by Bloomberg consensus and an uptick from the $24.93 billion posted a year ago. However, adjusted earnings per share (EPS) came in at $0.52, missing expectations of $0.60 while marking a 43% down year-over-year. The company's net income stood at $1.49 billion.

Breaking down the earnings by segment reveals key insights. The automotive business generated $19.9 billion in revenue, slightly exceeding market expectations. A significant driver of this was the record $890 million in regulatory credit revenue, more than double the $442 million in the previous quarter. However, revenue from vehicle sales was $18.5 billion, falling short of the $18.7 billion market expectation.

In the energy sector, Tesla achieved $3 billion in revenue, a 100% year-over-year increase, contributing significantly to the company's overall revenue beat. Energy storage installations surged to 9.4 GWh, more than doubling from 4 GWh in the prior quarter, with a gross margin of 25%.

Despite these gains, Tesla's automotive gross margin, excluding regulatory credits, dropped to 14.6%, well below market expectations of 16.2%, and down 1.7 percentage points from the previous quarter. This decline reflects the costs associated with aggressive pricing strategies, such as offering interest rate subsidies to boost sales in June and counteract a sales slump in April and May.

Overall, the automotive gross margin, bolstered by the doubling of regulatory credit revenue, stood at 18%, roughly flat compared to the previous quarter.

Causes Behind the Results

Several factors contributed to Tesla's mixed performance. Increased operational costs, particularly those associated with AI projects, a drop in EV deliveries, and a decline in the average selling price (ASP) of its vehicles were primary factors. The company also incurred expenses related to restructuring efforts.

Tesla's aggressive pricing strategies to boost affordability amid rising competition led to reduced margins. The company offered zero-interest loans in markets like China and Germany and low-interest loans in the U.S. to spur sales, which pressured its bottom line.

Tesla's Future: A Glimpse Ahead

Tesla's outlook remains largely forward-looking despite current challenges. The company reaffirmed plans to begin production of a more affordable EV by the first half of 2025. This new model aims to leverage aspects of both the next-generation and current platforms and will be manufacturable on existing production lines.

CEO Elon Musk remains bullish on Tesla's future in AI and autonomous driving. The company is set to unveil its robotaxi on October 10, a two-month delay from the original plan. Musk emphasized that Tesla’s value lies predominantly in its autonomy capabilities, promising significant advancements in self-driving technologies.

These plans rely heavily on Tesla's AI infrastructure and "Dojo" supercomputer. Musk declared his intention to "double down on Dojo" to remain competitive with $NVIDIA (NVDA.US)$, the industry leader in GPU sales. For Tesla to succeed in the robotaxi market and take on well-established competitors like $Alphabet-C (GOOG.US)$'s Waymo, this action is essential.

He also said Tesla was likely to win regulatory approval for its "supervised" Full Self-Driving software, which requires driver attention, in China and Europe by the end of this year.

The company is also accelerating its energy business, which is expected to outpace the automotive segment in revenue growth this year. Tesla's investments in AI infrastructure and the development of humanoid robots, such as Optimus, signal a diversification strategy that could redefine its market positioning.

Musk highlighted that the Optimus project would commence small-scale production in 2025, initially for internal use, with broader production slated for 2026 and beyond.

Dan Coatsworth, investment analyst at AJ Bell, said Tesla has now missed earnings targets for four quarters in a row. "There is a lot of talk about robotaxis, humanoid robots and autonomous driving, which provides an exciting narrative for investors but doesn't get over the fact that these are tomorrow's potential riches, not today's."

Company Valuation

Morgan Stanley analysts recently set a price target of $310 for Tesla, based on a comprehensive evaluation of various business components. The breakdown includes $56 per share for the core auto business, assuming 5.7 million units sold by 2030 with a 9.0% weighted average cost of capital (WACC) and a 13x exit EBITDA multiple.

Tesla Mobility is valued at $61 per share, based on discounted cash flow (DCF) projections of approximately 158,000 cars operating at $1.8 per mile by 2030. The valuation also includes $40 per share for Tesla as a third-party supplier, $50 for its energy business, $5 for insurance, and $97 for network services, which assume 15 million monthly active users generating an average revenue per user (ARPU) of $180 by 2030, discounted by 50%.

However, the trajectory is not without risks. Competition from domestic automakers and Chinese EV manufacturers, execution challenges in ramping up multiple factories, and the revenue outlook of Dojo-enabled service opportunities pose significant threats.

Musk remains confident, advising shareholders to focus on Tesla’s long-term potential rather than short-term fluctuations.

"I've said this before in these calls — the value of Tesla overwhelmingly is autonomy," Musk said. "These other things are an annoyance relative to autonomy. So I recommend anyone who doesn't believe that Tesla will solve vehicle autonomy should not hold Tesla stock."

Source: Bloomberg, Tesla Company Filings, CNBC

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

rezki_kwn2 : its going down...time to leave...

102514703 : Don't talk nonsense, it has never exceeded expectations, don't speak as if it could exceed expectations.

151369719 : EPS keep falling after so many years in production. Cars can't compete with Chinese EVs. Sales prices keep falling, thus net earnings and EPS declining. Self driving cars and robots are the same hype. Baidu had it running for 5 years and still losing money and pouring good money in the drain. Went to China to learn how to lose money? Not going to perform where the Chinese can do cheaper. Even batteries are the same. This stock will soon fall to $50 and less in a few years.

You can only give good money to them to play. Like the space ships that go up in smoke.

NSIKAN DICKSON : Join the discussion here in our new post to learn more about moomoo

steady Pom pipi : Musk should provide more details and evidence to prove the viability of robotic taxis, humanoid robots, and autonomous driving. If he did, the stock price wouldn't have plummeted like today.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

SPACELIGHT rezki_kwn2 : Bye.

Laine Ford : just come on line no comment l am ready now no comment to day

Shootingstar : He is targetted like how trump was. Now is not the right time to showcase new innovations or strategies.

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)