How to Decode Keppel(BN4.SG)Q1 Earnings?

$Keppel (BN4.SG)$ reported its Q1 FY24 earnings on August 1st, highlighting sustained growth in its core businesses.

Overall, this financial report reflects Keppel's focus on a light asset, capital-efficient growth strategy. In the first quarter of 2024, Keppel's recurring income increased by 51% year-on-year, with contributions from both asset management and operating income on the rise.

The company's overall revenue for the first quarter was SGD 1.5 billion, up 5% year-on-year, driven by increased revenues from infrastructure and connectivity, which offset the decline in the real estate sector.

Keppel suffered a 92% year-on-year drop in its net profit in 1Q 2024, falling to SGD 304 million. Excluding legacy O&M assets, net profit from continuing operations would be 7% higher YoY.

So, where has Keppel's light asset strategy taken it, what are the highlights of its performance growth, and what is the investment value? The following analysis will cover the company's business model and shareholder returns.

Overall, this financial report reflects Keppel's focus on a light asset, capital-efficient growth strategy. In the first quarter of 2024, Keppel's recurring income increased by 51% year-on-year, with contributions from both asset management and operating income on the rise.

The company's overall revenue for the first quarter was SGD 1.5 billion, up 5% year-on-year, driven by increased revenues from infrastructure and connectivity, which offset the decline in the real estate sector.

Keppel suffered a 92% year-on-year drop in its net profit in 1Q 2024, falling to SGD 304 million. Excluding legacy O&M assets, net profit from continuing operations would be 7% higher YoY.

So, where has Keppel's light asset strategy taken it, what are the highlights of its performance growth, and what is the investment value? The following analysis will cover the company's business model and shareholder returns.

1. Diversified Business Model, Steady Increase in Recurring Income

Keppel's business model is diversified, covering everything from asset management to operational services, project development, and construction. Recurring income includesAssetManagementIncomeand Operating Income, while other income encompassesValuation Items and Development/EPC.

In FY 2023, 88% of the net profit from continuing operations came from recurring income, up from 60% in FY 2022. Recurring income grew by 54% year-on-year, from USD 503 million to USD 773 million.

1.1 Breakdown of Recurring and Other Income:

Asset Management Income:

Management Fees: Keppel earns fixed management fees by managing listed real estate and infrastructure trusts, as well as private funds, typically based on a percentage of the assets under management or fund size.

Performance Fees: When a fund or investment meets certain performance benchmarks or targets, Keppel earns performance fees, often linked to excess returns.

Transaction Fees: Keppel may earn transaction fees for facilitating asset sales or other transactions, serving as compensation for the cost and efforts involved.

The primary indicators for Asset Management Income are Funds Under Management (FUM) and asset management capabilities.

Operating Income:

Sale of Gas, Electricity, Utilities: Keppel generates revenue by selling energy and providing utility services.

Leasing Income: Revenue from leasing properties or assets owned by Keppel.

Operations & Maintenance: Providing facility operation and maintenance services to ensure normal functioning and upkeep.

Facility Management: Offering professional property management services, including security, cleaning, and maintenance.

Telecommunication Services: Providing telecom infrastructure and services, such as data centers and network services.

1.2 How Did the Company Perform This Quarter? What Lies Ahead?

Significant Growth in Asset Management

In the first quarter of 2024, Keppel Ltd. achieved significant growth in its fund management and investment platforms. The company earned SGD 88 million in asset management fees, a 52% increase year-on-year, demonstrating strong growth in asset management. Additionally, Keppel raised approximately SGD 436 million in equity year-to-date and completed transactions worth about SGD 1.1 billion through a series of acquisitions and divestitures, further solidifying its market position and providing a strong financial foundation for future expansion.

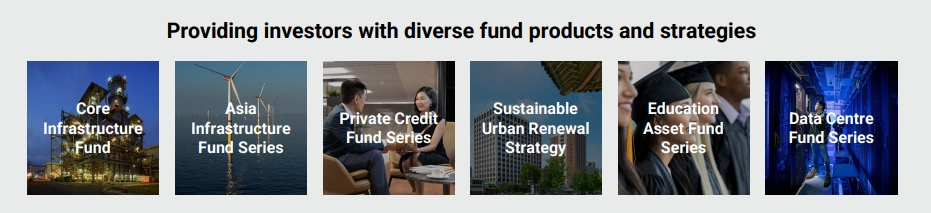

Looking ahead, the company plans to launch funds focused on Asian digital infrastructure, educational assets, and private credit solutions, promoting business diversification and organic growth. Keppel currently has 19 active private funds.

FUM Update: Keppel is working towards completing this acquisition by the end of April 2024, which would see the Company’s FUM grow to about SGD 79 billion, or close to 80% of its interim FUM target of SGD 100 billion by 2026.

Overall, Keppel shows positive momentum and strong market positioning in asset management income. With new fund launches and strategic acquisitions, the company is poised to further enhance its asset management income and market competitiveness.

Future Outlook:

With inflation easing and interest rates stabilizing, market liquidity is expected to improve in the second half of 2024, creating new opportunities for fundraising and transactions. Limited partners (LPs) will likely invest in sectors supported by resilient macro trends such as energy transition, climate action, and digitalization. Infrastructure, as a rapidly growing asset class, will benefit from the global demand for clean energy and digital connectivity, requiring substantial capital to support sustainable development.

As market conditions improve, Keppel will leverage its expertise and operational capabilities to advance over USD 14 billion worth of transactions, mainly in infrastructure and connectivity, offering attractive fund products to LPs.

Steady Performance Across Three Major Business Segments

Keppel has made notable advancements in the infrastructure sector. The Keppel Sakra Cogen Plant (600 MW) is now 51% complete and is expected to become Singapore's first hydrogen-ready, high-efficiency power plant by 2026. Additionally, the capacity charge agreement and operations & maintenance services agreement for the Keppel Merlimau Cogen Plant (1,300 MW) have been extended for another 10 years, which will help Keppel maintain its crucial position in Singapore's power market. By the end of March 2024, approximately 60% of Keppel’s contracted generation capacity will be secured under long-term agreements of over three years, ensuring stable cash flow.

In the real estate sector, Keppel, through its asset-light business model, manages a portfolio of nine projects valued at SGD 7.9 billion. This reflects the company’s active and successful efforts in asset monetization.

In the connectivity sector, the full leasing of Keppel DC Singapore 8 and the service readiness of its Shanghai data center illustrate Keppel's strong market performance and growth potential in data center projects. M1’s enterprise business revenue grew by 17% year-on-year, accounting for 41% of M1’s total revenue in Q1 2024, up from 36% in the same period in 2023, showcasing steady growth in enterprise business.

Future Outlook:

Given Keppel's continued investments in infrastructure and connectivity, along with its asset-light strategy in real estate, the company is expected to continue its growth trajectory in the coming years. Notably, with the increasing global demand for sustainable energy and digital infrastructure, Keppel's long-term decarbonization and sustainability solution contracts grew by 12% to SGD 4.8 billion, which will provide a stable revenue stream for the company.

The expansion of the data center market and the trend of digital transformation suggest that Keppel’s business in this sector will continue to grow. The strong performance of Keppel DC Fund II lays a positive foundation for raising the third fund.

2.Executing an Asset-Light Strategy: Unlocking Capital through Asset Monetization

By the end of 2023, the total assets on the balance sheet stood at USD 26.8 billion, down approximately 17% from USD 32.3 billion at the end of 2021. During the same period, funds under management (FUM) grew by more than 30% from USD 42 billion to approximately USD 55 billion.

As an asset-light company, Keppel will rely less on its balance sheet to drive future growth. With the aim to scale up and achieve FUM targets of USD 100 billion by 2026 and USD 200 billion by 2030, investments will primarily be made through its private funds and listed real estate and infrastructure trusts.

As an asset-light company, Keppel will rely less on its balance sheet to drive future growth. With the aim to scale up and achieve FUM targets of USD 100 billion by 2026 and USD 200 billion by 2030, investments will primarily be made through its private funds and listed real estate and infrastructure trusts.

3.Delivering Shareholder Returns

Over the past few years, Keppel has consistently paid out 50-60% of its annual net profit as cash dividends. Additionally, in 2023, there were in-kind distributions of shares in Sembcorp Marine and units in Keppel REIT. With asset reduction and continued growth in funds under management, the strategy of increasing recurring income and driving asset monetization will collectively release more capital.

This is expected to provide sufficient funds for investments, debt repayment, and shareholder returns.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

101576178 : Can it get stronger?