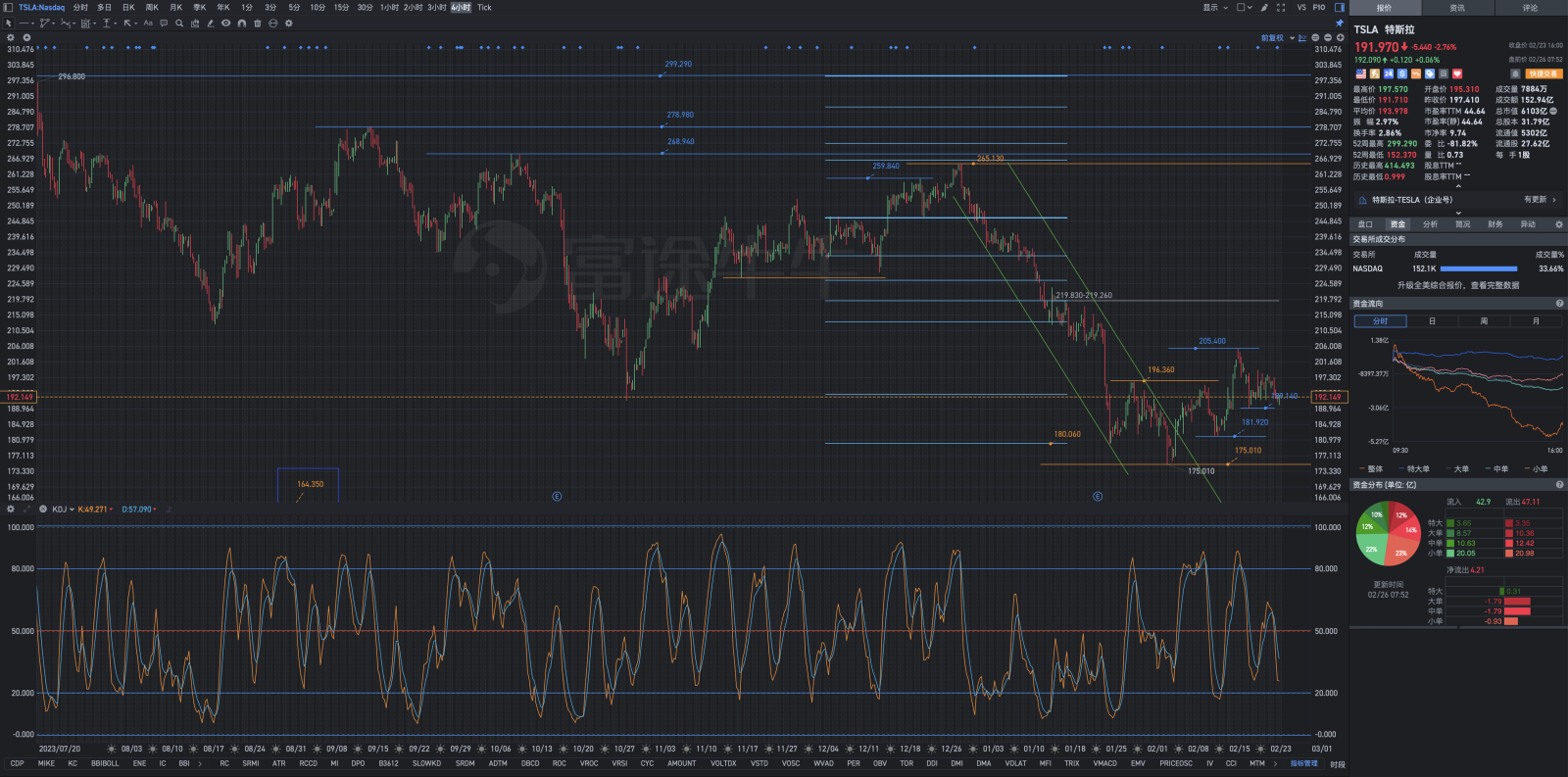

[Core Tips🔔: Going with the trend (main trend up, secondary trend down, intense confrontation), against technology (traditional technical analysis appears bearish, Renaissance Technology known for precise trading is increasing its shareholding. Wall Street's two big shots BlackRock and Vanguard are also increasing their shareholding.), against human nature (the market is generally focused on disappointing Tesla financial reports, praising Nvidia, beating down on Tesla, pulling the wall down collectively, breaking drums and beating thousands of people. Following the trend, each holding their ground, scheming and plotting. Cautious and hesitant, swirling beehives, standing not knowing how many millions have fallen. The long bridge lies on the waves, who knows what dragon? Recurring empty paths, no rainbow without clearing up? High and low in confusion, not knowing east from west. The singing platform warmly resonates, the spring light is melting. The dance hall's sleeves cold, the wind and rain bleak. In a single day, between two forces, yet the atmosphere is in discord. People have short-sighted views, greedy for immediate gains. ]

104546310 emi : $Tesla (TSLA.US)$