Key Takeaways

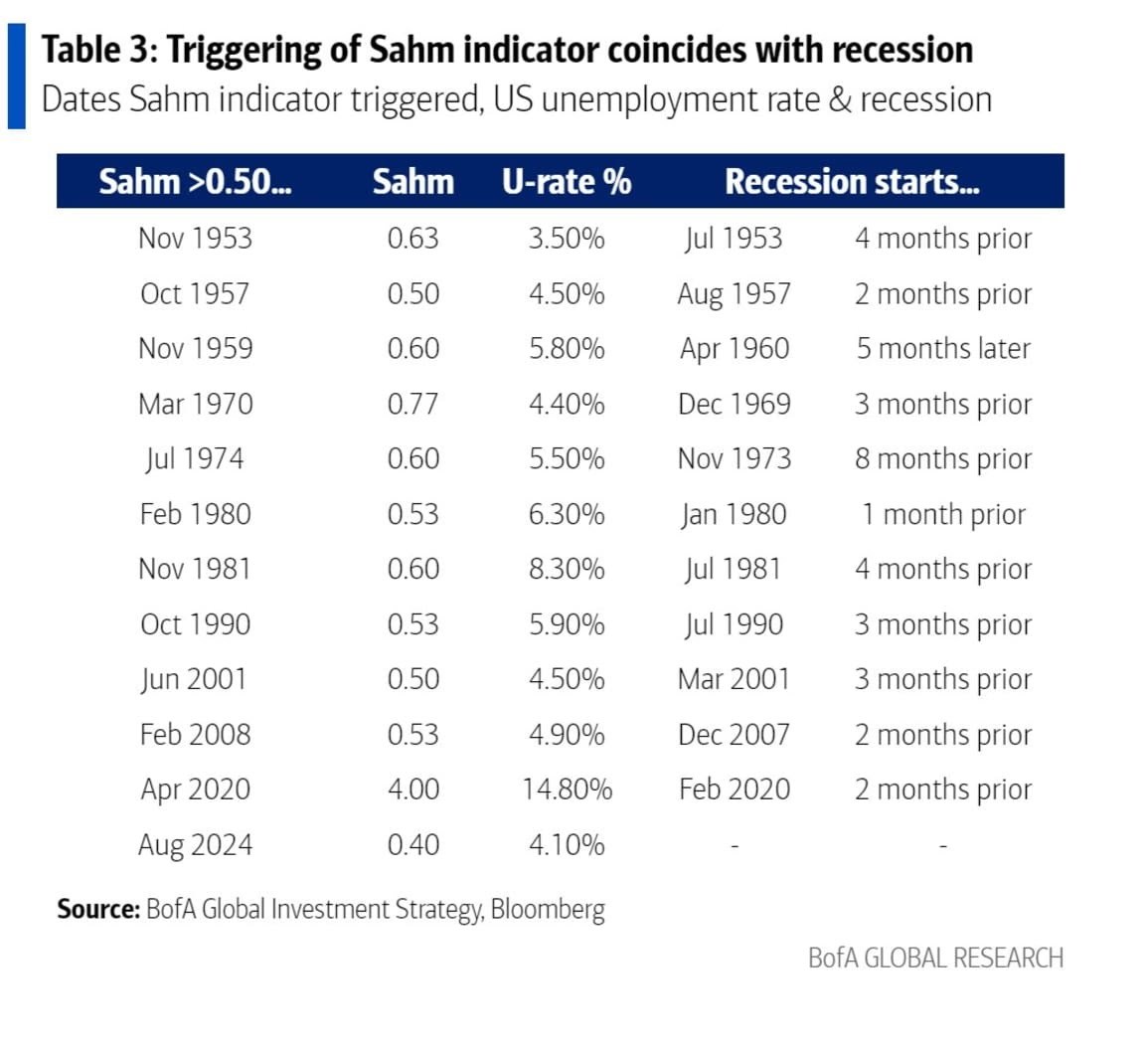

1. Immediate Implications: Historical data suggests that when the Sahm Rule exceeds 0.5%, the economy is already in a recession. This means that the current reading of 0.53% as of July 2024 indicates that the U.S. economy is already in a recession, not just likely to enter one.

2. Current Situation: Given the historical patterns, it is highly probable that the U.S. economy has been in recession for one to two months already.

Federal Reserve's Position

The Federal Reserve, in its July 31, 2024, meeting, indicated that it might lower interest rates by 0.25% in September. However, given the current economic conditions and the Sahm Rule's indication, the probability of a 0.5% rate cut has increased significantly. This suggests a more aggressive approach to counter the rapidly deteriorating economic outlook, with expected sharp rises in unemployment rates in the coming months.

Given the lag in response, with the Sahm Rule already indicating a recession and the Fed's potential action only set for September, it may be challenging to achieve a soft landing. Ideally, the Fed should have started cutting rates by 0.25% as early as June to mitigate the downturn effectively. However, it seems this window of opportunity has passed, and we must prepare for the consequences.

Conclusion

I apologize for any confusion caused by my previous post. The updated analysis suggests that the U.S. economy is not only likely to enter a recession but is already in one. It is crucial to stay informed, be cautious with your investments, and prepare for the potential downturn.

If you find my insights and analysis helpful, please follow me for future updates. Your support is appreciated, and I aim to keep you informed with the latest and most accurate economic insights.

Ultratech : stop. please let's not do this.. just the day beforehand they were saying the us economy skipped any sort of recession.

let's not do this.. just the day beforehand they were saying the us economy skipped any sort of recession.

Alex Wong Cian Yih OP Ultratech : Hey Ultratechman,

Thanks for your comment. Here’s my perspective:

Despite the skepticism from Claudia Sahm and Jerome Powell, the Sahm Rule has a nearly perfect track record in predicting recessions. Historically, when the Sahm Rule exceeds 0.5%, the economy is either already in a recession or enters one very soon. This consistency makes it a reliable indicator, and I choose to trust it based on its past performance.

During the COVID-19 recession, officials were reluctant to acknowledge the downturn, labeling it as a "technical recession." Later, data and charts categorized it as a genuine recession. This shows that politicians often play with terminology to avoid admitting to a recession, especially around critical times like elections.

Given the upcoming U.S. elections in November 2024, it’s plausible that officials might delay acknowledging a recession to avoid political fallout. Current economic data suggests we might already be in a recession, despite official statements to the contrary.

I believe in the Sahm Rule's data over public statements due to its historical reliability. Time will tell if this analysis is correct, but for now, I trust the indicator.

Thanks for the discussion!

Best,

Alex

Ultratech : I already figured they wouldn't cut them before election cuz things could get out of control but September is close enough. People are going to want to sell then switch positions and next day market goes the other direction forcing them to cut and follow new trend. this is how people lose money dumping their shares. up and down but then after it's all over the general direction will always be up. it could be a simple thing such as apple is too high bringing spy down everyone starts crying blood. plus I believe while market is in a correction fear driven bs gets pumped down our throats then next thing you know everything rallies again anyway where you were better off just holding original positions.

Alex Wong Cian Yih OP Ultratech : Hi Ultratechman,

Thanks for sharing your thoughts. I just wanted to give a friendly reminder to be cautious about being overly optimistic right now.

Recently, we've seen significant market volatility. On August 2, 2024, the Dow Jones dropped by 1,000 points, and Japan's Nikkei Index plummeted by 2,000 points, signaling a collective global market downturn. The triggers included disappointing ISM manufacturing PMI, poor U.S. job data, and an unexpected rise in the unemployment rate to 4.3%.

Although the Federal Reserve hinted at a possible rate cut in September, this was initially seen as a positive signal by Wall Street. However, the sudden market crash shortly after suggests underlying issues. Historically, when the Sahm Rule exceeds 0.5%, as it did recently (now at 0.53%), it has consistently indicated a recession, regardless of official statements.

Moreover, notable investors like Warren Buffett have significantly reduced their positions in major stocks like Apple and Bank of America, signaling potential concerns about the market's direction. This aligns with historical patterns where market crashes often follow periods of excessive optimism and denial of underlying economic issues.

Given these indicators and the upcoming U.S. elections, it’s plausible that official narratives might downplay the severity of the situation. Therefore, I believe it’s prudent to stay cautious and prepared for potential downturns.

Best,

Alex

Ultratech : he sold apple cuz he wanted to. it was high. Apple sucks anyway.. I know about the potential of a bearish September market idk why you're telling me this

Shootingstar : Even if there is a recession or stock market crash apart from this outdated sahm rule hasn't the stock market exceeded aths each time?