In June, no institutions reduced their positions and holdings; they only increased their holdings. This explains the problem very much.

James Dimon (James Dimon), representing the famous and powerful JP Morgan (Daimon) and Morgan Stanley (Daimon), have announced that they have abandoned their previous disagreement with Elon Musk and Tesla, which means shedding light on the world (sadly, many people don't know James Dimon, who knows, let alone think about the meaning of Xiaoma and Dama's behavior, and keep his mouth shut every day. Xiaomo Damo is far more kind than Goldman Sachs and Citadel Fortress. At least they have their own opinions. (Goldman Sachs is famous for its cunning and the ferocity of the fortress.) :

1. Xiaomo and Daimo have the power to use market forces and Wall Street's three major guiding principles, namely The Vanguard Group (Pioneer Group), BlackRock Inc (BlackRock Group), and State Street Global Advisors (State Street Global Advisors) to fight back the court, and can make snipers feel uncomfortable. You can't see the biggest drop in Tesla's stock price of more than 60%. This also shows that Tesla is in a period of transformation to AI, and the stock price is at a historic low level in the new strategic investment period. There are no eternal friends, only eternal interests.

2. For the common good, Xiaoma and Damo have abandoned their previous differences and entered into a strategic alliance with Tesla, led by Elon Musk, to advance hand in hand. Because people with similar personalities, interests, and circumstances love, sympathize, and support each other — they feel sorry for each other. Both Xiaoma and Damo have finished drawing out all of Tesla's empty positions and have begun to turn around brilliantly to support Tesla and Elon Musk. After all, Elon is an amazing person, and Tesla is, after all, a publicly traded company with endless prospects. It is time to put an end to all speculative bearish and short selling Tesla; otherwise, you are solely responsible for the serious consequences. Out of nowhere, should mediocre people still be bearish and short sell Tesla?

The so-called technical analysis, which relies on so-called software that can detect major capital movements, assumes various possibilities, and the final conclusion is marked with a question mark, so that self-justifiable results can be achieved.

The apparently smooth, unmistakable analytical operation plan actually doesn't live up to its name, indicating that these people actually don't have an accurate spectrum at all.

In the midst of large fluctuations, the only thing that can win big is firm belief and medium- to long-term strategic investment, rather than game-based so-called speculation. No doubt about employing people, no doubt about it; if you don't invest in questionable stocks, don't doubt investing.

As far as Tesla's vote on Elon Musk's salary is concerned, there is no suspense. There is only one outcome: Elon Musk's salary has been approved again. After a short squat, the stock price is about $6.85 to $11.35. The stock price will rise in three stages and steps. Tesla's stock price first crossed the 182.800-187.420 region. The prudent side set up positions in this region; the so-called “don't see rabbits” and don't throw hawks. In the second step, Tesla's stock price crossed 187.420-191.300 and continued to rise. Step 3: Tesla's stock price rises👆It floated out of the strong resistance zone of 198.870-205.600, opening the prelude to Tesla's spectacular gains. The stock price effectively standing at 220.800 will start the main upward trend.

Stop randomly chasing the best Nvidia. If you like Nvidia, you also need to take a break and fall when it falls. Especially when the profit chip ratio falls below 21%, then open a position layout, and rest and wait and see if it doesn't fall. I'm afraid Nvidia will actually fall, especially if it continues to plummet. You are bearish and afraid to buy, or even go short.

Tesla has a latecomer advantage over Nvidia; latecomers take the lead. This is a historical law:

Often in the early stages of a new technology, hardware providers are the biggest beneficiaries. Early-stage hardware vendors Intel Intel and Cisco's profits, for example, were later beaten by software providers Microsoft and Oracle Oracle running on these hardware. Today's Nvidia Nvidia is currently the biggest beneficiary of the AI industry, but then its profits will definitely be beaten by Tesla, a software provider that runs on this hardware. Artificial intelligence is ultimately reflected in software, and intelligence is generated as a result of brain operation. Therefore, Tesla will definitely have better prospects than Nvidia in the future. What's more, Nvidia is currently at an all-time high in stock prices, while Tesla is at an all-time low in stock prices. Nvidia is an important core node for AI. Tesla is a complete industrial chain, and many of the projects behind Tesla even fall within the category of The Quantum Technology Revolution, which is more advanced in the next 20-50 years. Elon Musk himself is a genius academician of the American Academy of Engineering, a scientist in the field of physics, and an application software architecture engineer. He is extremely hands-on, and has a sharp and unique vision. On the other hand, we can't see this; they only see people's complicated relationships with the opposite sex, smoke special substances, and then put a stereotypical label on people, saying that they only draw big cakes and defraud people of money by bragging about big bullies. Does Elon Musk need to defraud his money? He has 9 companies, and currently only Tesla is listed. This is the least technologically advanced company among them. He could go public with those companies, and none of the top ten super-rich people in the world would necessarily surpass Elon Musk in terms of value. How can Elon Musk be blamed for losing money in the US stock market by themselves? Most of Wall Street's short-term runners are poor institutions and individuals. Running in the short term requires deep application of mathematics, keen observation, and an innate sense of drive. Most people don't have this kind of background, and there is a high probability that they will lose money if they work hard. The most important thing is that life expectancy is relatively reduced and short life; that is really hard work; it's not sustainable at all.

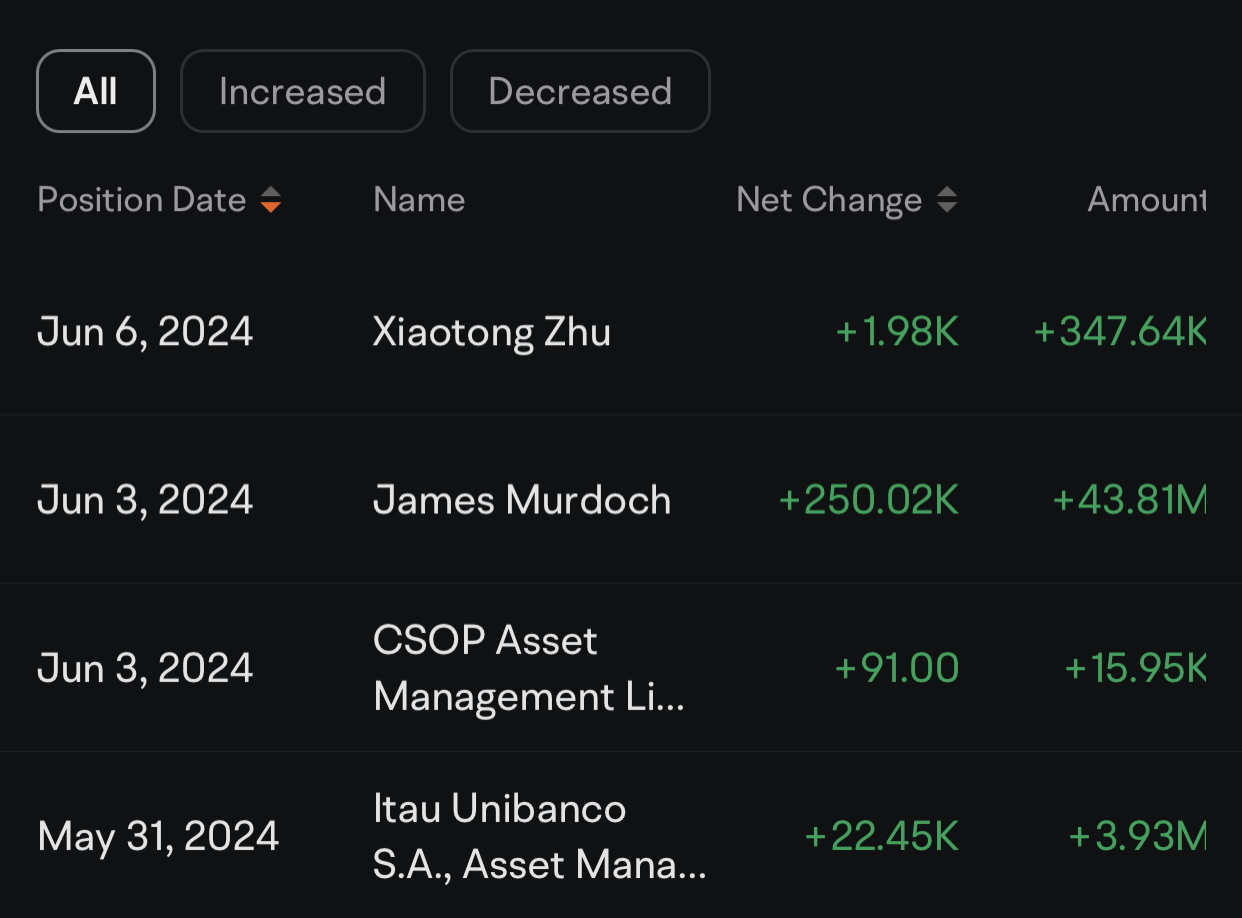

Question: All the institutions consider their holding in Tesla, but Tesla's share price announced in June. So who are lying now? Or instead Musk selling Tesla in June? (All institutions increased their Tesla holdings, but Tesla shares fell in June. So who's lying now? (Or did Musk sell Tesla in June?)

Reply: Seemingly, being happy to rise and being tired of falling is deeply ingrained. You just want to find and eliminate the downside factors. First, falling stock prices are not a bad thing, or even a good thing (falling is a risk release process, and it can also reduce the cost of opening a position). First and foremost is a universal truth. Changes in the positions of various financial institutions announced by the SEC, or the fact that these financial institutions have not reduced their holdings, only increased their holdings, does not mean that the stock price will not fall. There are also many investment traders who are not regulated by the SEC and do not require a declaration. Because their individual numbers are too small. Many traders who have already entered the market saw Tesla's stock price sell off without rising, which caused the stock price to fall. As far as Musk is concerned, at this point, he wouldn't sell stocks at all. If you want to learn, don't understand anything and don't be confused. I've said it many times: the short term grows; it goes down first, then goes up. The amount of room for the share price to fall is about 6.85 to 11.35, and the point is about 171.430 to 167.500.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

FF-Rise : Did it pass or fall first and then rise? I disagree

JC1616 : All the institutions increased their holding in Tesla, but Tesla’s share price dropped in June. So who are lying now? Or instead Musk selling Tesla in June?

Elias ChenOP JC1616: It seems that the love of rising and the dislike of falling are deeply rooted. You just want to find and eliminate the factors that cause the stock to fall. First of all, a fall in stock prices is not a bad thing, it is even a good thing (falling is a process of risk release and can also reduce the cost of building a position). It is a universal truth that it goes down first and then up. The changes in the holdings of various financial institutions announced by the SEC, or the fact that these financial institutions have not reduced their holdings but only increased their holdings, does not mean that the stock price will not fall. There are also many investment traders who are not regulated by the SEC and do not need to report. Because their individual number is too small. Many traders who have entered the market sold Tesla shares when they saw that the stock price did not rise, which led to the stock price falling. As for Musk, at this point, he would not sell his stocks at all. You must learn, don’t be confused without knowing anything. I have said many times: short short and long long, go down first and then go up, the downward space of the stock price is about 6.85–11.35, and the point is about 171.430–167.500.

105250542 : Good point