Inflation Fell A Little, and Market Is Not Celebrating

Morning mooers! It's finally Friday, May 31, the market is open and mostly climbing. PCE index numbers showed a single 0.1% decline in core prices for April, to not much celebration.

My name is Kevin Travers, and here are stories herd on Wall Street Today:

$MongoDB (MDB.US)$ fell 24% after the firm's earnings failed to impress, the lowest declining stock on the Nasdaq 100.

$Dell Technologies (DELL.US)$ fell about 19% after its earnings also failed to impress, and investors watching its AI server sales were let down.

$Gap Inc (GPS.US)$ Shares climbed 20% after the firm posted earnings that showed a multi-quarter comeback, with sales growth aided by seccessful news styles and celebrity marketing campaigns.

$VF Corp (VFC.US)$ shares climbed 9% after the firm appointed Lululemon's former chief product officer Michelle 'Sun' Choe as global brand president of Vans.

$Super Micro Computer (SMCI.US)$ suddenly dropped 7% Friday while I wrote this newsletter.

In sectors, 'Software Infrastructure' was falling 1.2% following MongoDB down and $SentinelOne (S.US)$ -16%

U$Crude Oil Futures(JUL4) (CLmain.US)$ fell by 0.50%, with an OPEC meeting scheduled for next week. Gold fell 0.15%, while Silver prices traded flat. Bitcoin fell again, down 0.81%.

As a general recap, indexes were cautious and flatter Friday. Just after 10:30 AM EST, the $S&P 500 Index traded down 0.47%, the $Dow Jones Industrial Average climbed 0.09%, and the $Nasdaq Composite Index fell 1.04%.

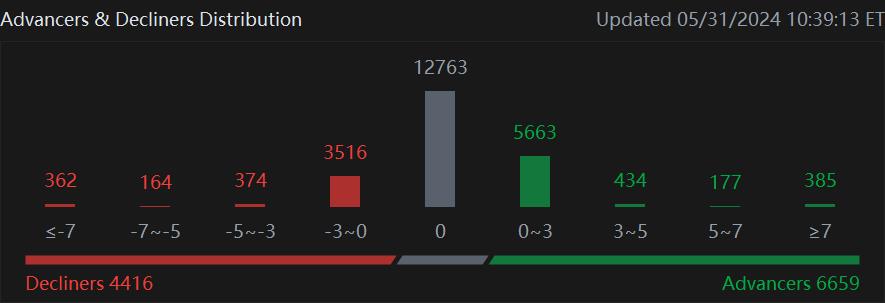

By direction, 6600 equities advanced while just 4400 fell.

In macro, the Personal Consumption Expenditure Index inflation gauge showed a slight month-to-month slowdown. Core prices climbed just 0.2% from March to April, from 0.3% expected, while year-over-year changes came in at expectations, maintaining last month's 2.7% regular and 2.8% core price growth.

Thursday, revised GDP numbers for Q1 showed the U.S. economy grew at a slower 1.3% annual pace in the first three months of the year, largely due to softer consumer spending. The numbers were revised down from a previous 1.6%. It was the smallest increase in twpo years, and one of the largest drivers of the economy, consumer spending, fell to 2% growth from a .5% figure last month.

Wednesday, the Fed Beige book summarized the economic activity across each Federal Reserve Region. INvestors still await the Personal Consumption Index inflation gauge on Friday. In market-related news, the SEC implemented a "T+1" settlement structure Tuesday, meaning stocks and equity trades will settle the day after they are made, after sitting at two days settlement since 2017, and three days before.

Last week the FOMC meeting minutes from the April 30-May 1 meeting showed that members felt uncertainty in the possibility that "high interest rates may have smaller effects than in the past." Some members said they would be willing to raise rates.

The $U.S. 2-Year Treasury Notes Yield (US2Y.BD)$ fell to 4.88, and the $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$4.49.

Mooers, what are you watching today? Comment below and I may feature your comment tomorrow!

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See thislinkfor more information.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Rockhoundj : Look at you city folk touching that grass.

. Happy Friday!

. Happy Friday!

Rockhoundj : Thanks for the recap.

Kevin Travers OP Rockhoundj : Thanks ranger rick, I actually have never been outside before

ShaoHu Tang : What is the reason for the sharp drop today, the NASDAQ 100 fell -1.2%?!?!

Rockhoundj Kevin Travers OP : My badge gives me such authority

Expendabiggles : 0.1% is laughable after the damage that 20% has caused. Damn the FED & congress to hell.

Drift along : Friday

Taco moo-ncher : Stop with this moomoo-original nonsense, tell me why this stock is moving. I don't care what people think about inflation rates.

Kevin Travers OP ShaoHu Tang : Well, the entire Mag Seven is down today, a lot of tech pulling back, the Nasdaq is very tech heavy

Tuffyturf : cool

View more comments...