Investment Opportunities in Aluminum Stocks? Goldman Sachs Predicts Higher Aluminum Prices Due to a Larger Deficit

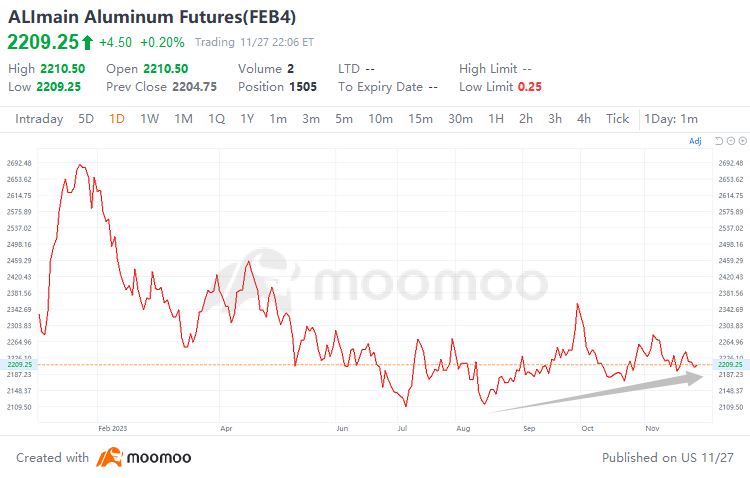

$Aluminum Futures(FEB5) (ALImain.US)$ prices have shown a tentative upward trend since mid-August. Towards the end of the year, concerns about possible aluminum supply shortages in the coming year, coupled with the expectation that the Fed's aggressive rate hikes are coming to an end, have once again bolstered aluminum prices. According to Goldman Sachs analysts, aluminum prices could increase to $2,600 a ton in 12 months as the deficit widens.

1. Aluminum Supply in Major Producing Country is Currently Tight

As the world's largest producer and consumer of aluminum, China's primary aluminum production constitute around 58.36% of the worldwide total in 2022, while its primary aluminum consumption accounts for approximately 58.67% of the global total. Consequently, any fluctuations in supply and demand from China are critical in determining the trajectory of aluminum prices.

On the supply side, China has been transitioning from coal-fired to hydroelectric aluminum production in recent years due to environmental protection needs. Currently, major hydroelectric aluminum production areas such as Yunnan are gradually entering the winter dry season and facing power shortages and production restrictions. This situation has resulted in an estimated annualized production capacity reduction of approximately 1.15 million tons, which will further intensify supply contraction in the short term. In the long term, China's annual production cap of 45 million tons of electrolytic aluminum is likely to provide ongoing support for aluminum prices. Moreover, the heightened uncertainty of geopolitical conflicts has led to disturbances on the aluminum supply side.

While the recovery of demand for aluminum still requires additional confirmation, China is increasing its policy support for the real estate industry. In the medium to long term, as housing construction reaches a stable level, the traditional demand for aluminum in building applications is anticipated to stabilize as well. Additionally, the long-term growth of new energy vehicles and photovoltaics is expected to further stimulate the demand for aluminum.

According to the latest data, China's aluminum imports rose for the fifth consecutive month in October, reaching 351,065 metric tons. This marks a 5.8% increase from the previous month and a significant surge of 78.7% compared to the same period last year. The rise in imports is attributed to an anticipation of reduced supply in the domestic market.

2. End of Federal Reserve's Aggressive Interest Rate Hike Cycle Weakens Suppression on Commodity Prices

The market is currently anticipating that the Federal Reserve's current interest rate hike cycle has ended and will shift towards a loose monetary policy in the first half of next year. This shift, coupled with the recent decline in the value of the $USD (USDindex.FX)$, has provided support for the rebound in commodity prices, including aluminum.

Goldman Sachs expressed bullish sentiment towards commodities in a note dated mid-November, expecting higher spot commodity prices due to an improving cyclical backdrop, significant carry returns from structural tailwinds, and hedging value against negative supply shocks. The bank further predicted a 20.9% increase in the S&P GSCI Commodity Index over the next 12 months. Specifically, they expect a sharp tightening of aluminum stocks into the mid-decade period, which will drive up prices starting from the second half of 2024.

Goldman Sachs' analyst Nicholas Snowdon further stated this week, “the impact of China's supply bind, where a combination of hitting the capacity cap and Yunnan winter cuts means that onshore primary production will likely only grow 2% next year.” The bank predicts a global shortage of 1.23 million tons of primary metals in 2024, which is nearly double the deficit in the current year. As a result, they expect prices to increase to $2,600 per ton within the next 12 months.

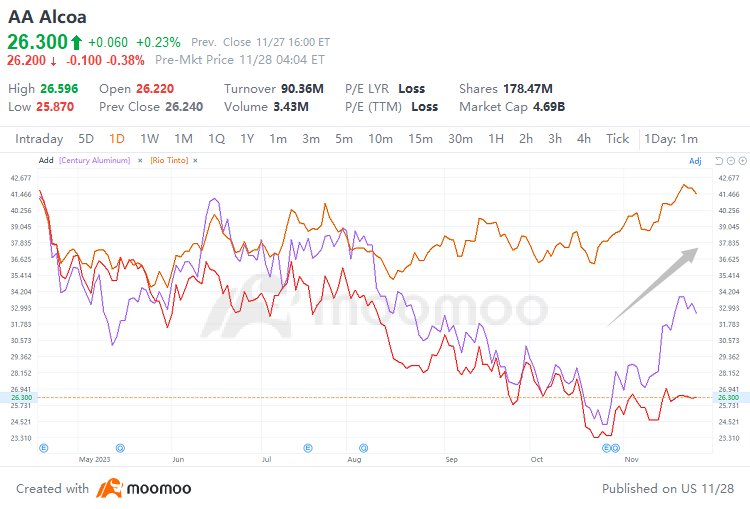

Since November, the $Aluminum (LIST2211.US)$ has seen a 6.00% rebound overall, with major companies experiencing varying degrees of growth.

As of the close on November 27th, $Century Aluminum (CENX.US)$ spiked significantly by 17.55%, outpacing the $S&P 500 Index (.SPX.US)$'s performance over the same period of 8.50%. Additionally, $Rio Tinto (RIO.US)$ climbed 7.29% this month, and $Alcoa (AA.US)$ gained 2.57%, seeming to demonstrate signs of recovery.

Source: Bloomberg, Reuters, moomoo

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

nyseoption : Aluminum these nuts

美股洛杉矶小虾 : Thanks for sharing