The desire to cut short profits is overtaken by desire and obsession.

Alcohol, don't drink, don't get drunk. People, never get tired, never sleep. My heart is unbroken and unbroken. Love, if you don't learn it, you won't. Life is a grand encounter. If you understand it, please cherish it! The Bible is also a complete path to life's practice. It tells us that it is necessary to live a sea of love and hate, to fight through the world, to cut short interests, to overcome desire and obsession, and to reach the end of life in peace and light.

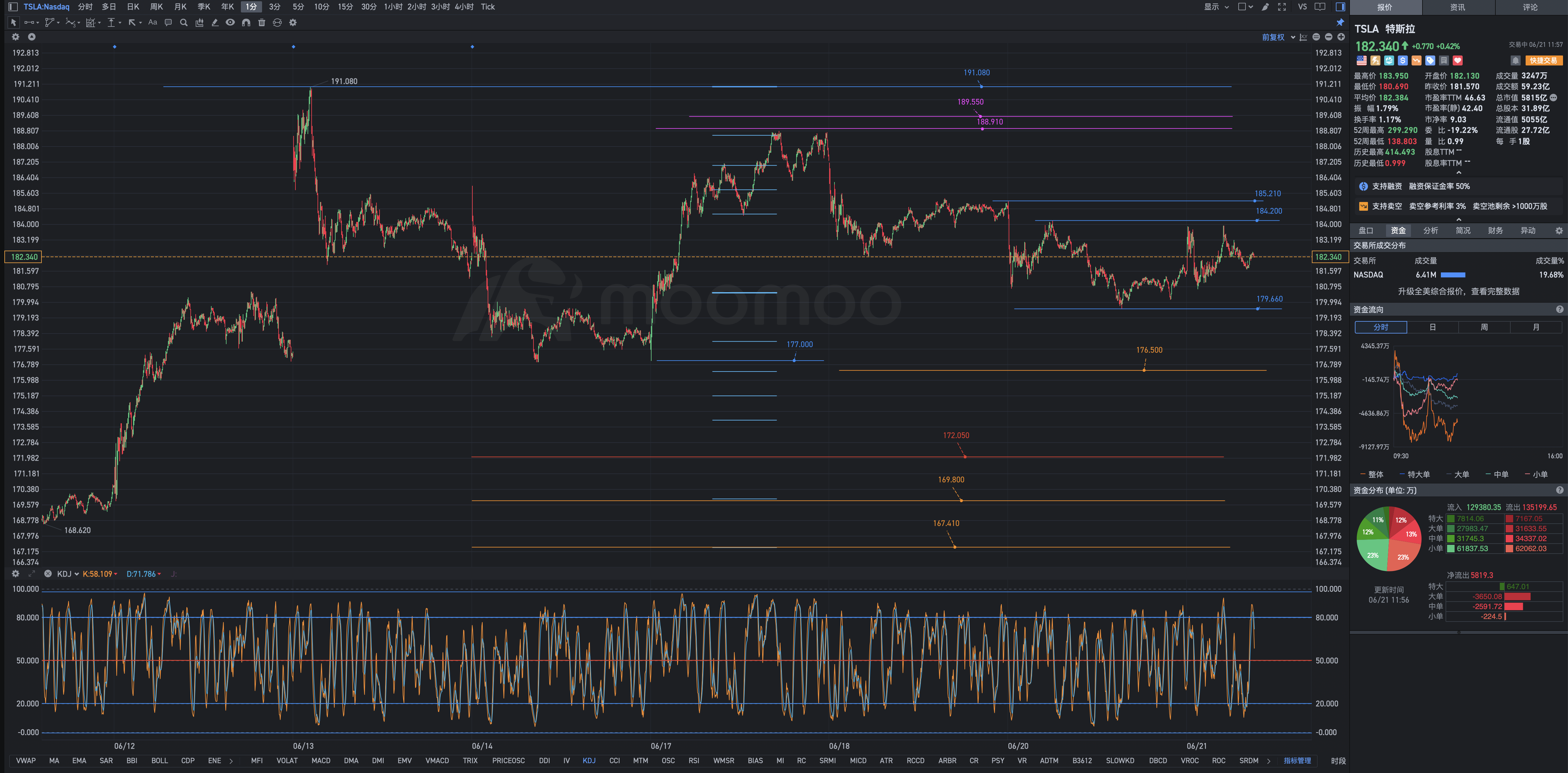

Once a person enters the stock market, it is like a missile that tracks heat sources with infrared characteristics. Seemingly smart and powerful, it is actually easy to be deceived by other heat sources with infrared characteristics deliberately set by opponents in the surrounding environment, and cannot achieve the intended arbitrage goals.

In the long history of US stocks, so-called unfathomable techniques used to investigate short-term or short-term arbitrage even include Renaissance Technologies LLC (Renaissance Technologies LLC), led by James Harris Simons (James Harris Simmons), the world's most powerful mathematician, cryptographer, philanthropist, and speculation god worth over 40 billion US dollars, and the more mysterious Medallion Fund (Medallion Fund) that only accepts company insiders Theoretical physicists, mathematicians, statisticians, computer software engineers, large-scale high-speed computers, and the most advanced armed to teeth arbitrage trading systems made up of a dedicated fiber-optic broadband network channel to the New York Stock Exchange are nothing more than small tricks. The speed and efficiency of their arbitrage is amazing, but they still can't beat the Rothschild family (Rothschild family) of Jews who follow God's “Bible” and the Berkshire led by Warren Buffett The absolute total value obtained by Hathaway (Berkshire Hathaway) arbitrage.

With the former, it is difficult for most of us to follow; in the latter, the vast majority of us can learn from it. This is the US stock market, which is long and short, not the A-share market, which is long and short. Chinese people are used to a bear market mentality and often mistakenly invest and trade US stocks as A-shares. What's the hurry? In fact, the securities market is already making profits very fast. George Soros, a financial magnate, immigrated to New York in 1956. At first, he only wanted to earn 50,000 dollars so he could live a comfortable retirement. He didn't expect it to get out of control. He became a world-class philosopher and philanthropist with a mansion in a private park in Manhattan, New York, where the highest net worth is over 30 billion US dollars.

Higher level feelings eventually form mentality and consciousness: lower level feelings can only be reduced to temper and emotion. It's important to manage your emotions.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Paul bin Anthony : very helpful thanks