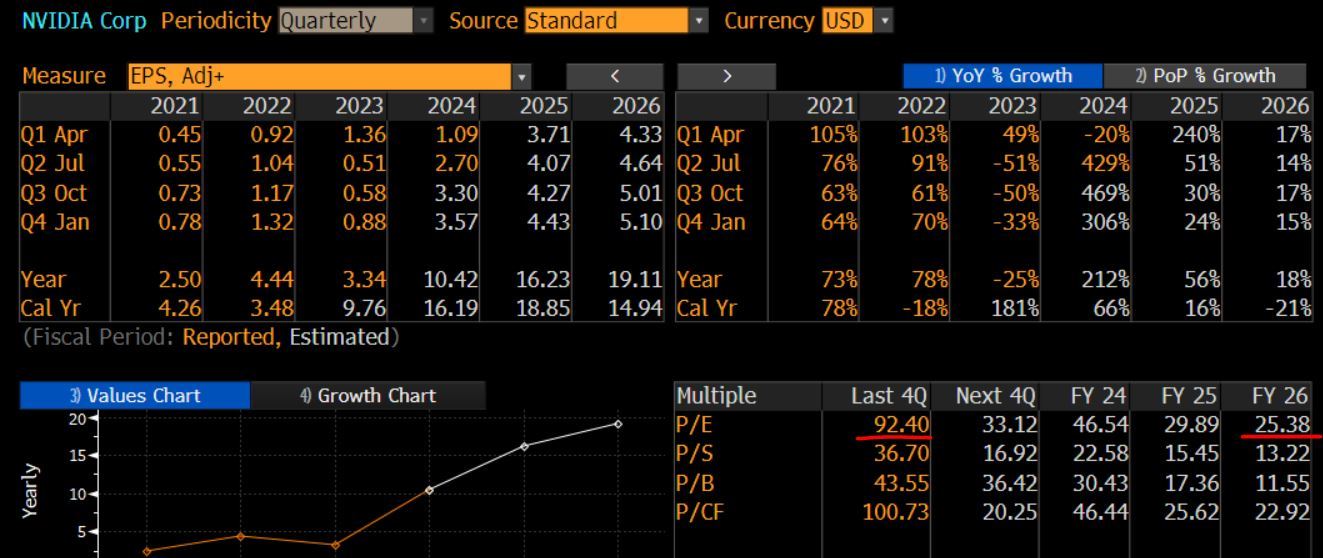

Let's look at PEG ratio first, PEG ratio is defined at P/E divided by Annual EPS growth. So if we look 3 years out, EPS for NVDA in 3 years is around $17 per share, current EPS is $5.25 per share, that's about 48% growth per year over the next 3 years. We then took 92.4/48 = 1.9. According to textbook, anything below 1 is a bargin and PEG of 1.9 certainly isn't cheap.

Haymaker78 : Look at the insider’s selling activity. The president of the company sold $110 million dollars of his stock last week.