Major Retailers Beat Earnings Expectations. Is There Room for Further Gains?

Retail stocks have recently delivered a slew of upbeat earnings reports, alleviating investor concerns about consumer spending amid persistent inflation.

$Target (TGT.US)$ posted a 2% rise in comparable sales for its second quarter on Wednesday, marking the first increase in over a year. The company raised its full-year earnings per share outlook to $9-$9.70. $TJX Companies (TJX.US)$, owner of discount stores Marshalls and TJ Maxx, also exceeded expectations with a 4% rise in comparable sales, lifting its full-year EPS forecast to $4.09-$4.13.

$Walmart (WMT.US)$ reported last week that its second-quarter revenue and earnings rose 4.8% and 4.2%, respectively, both beating estimates. The retail giant raised its full-year sales growth guidance by 75 basis points to 3.75%-4.75% and adjusted EPS to $2.23-$2.37.

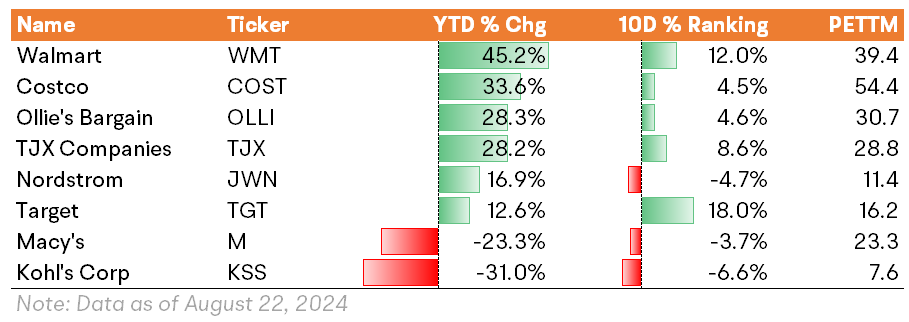

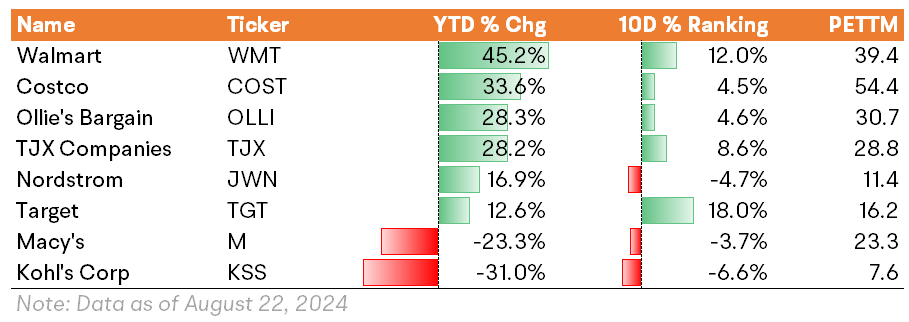

In the past ten days, Walmart, Target, and TJX shares have surged 12.0%, 18.0%, and 8.6%, respectively. Year-to-date, Walmart, Costco, Ollie's, and TJX have gained 45.2%, 33.6%, 28.3%, and 28.2%, significantly outperforming the $S&P 500 Index (.SPX.US)$ 's 16.79% rise.

1. Price Cuts on Essentials

In May, Target announced price reductions on about 5,000 items, including bread, fruits, vegetables, milk, and meat. In an earnings call in August, Walmart CEO Doug McMillon revealed the company is pressuring suppliers to lower prices to pass savings on to customers. Walmart's gross margin in Q2 was 25.11%, up 30 basis points from the previous quarter.

2. Wealthy Shoppers Fuel Retail Sales Growth

High-income shoppers are driving sales growth at discount retailers. Walmart's CEO Doug McMillon noted, "We are seeing increased engagement from customers across income levels, with higher-income households remaining a primary sales driver." These consumers are willing to spend more on discretionary and convenience items. Target management also highlighted improved discretionary sales trends, with apparel comparable sales up over 3% in the quarter.

3. Value-Oriented Consumer Focus

Department stores like Macy's and apparel retailers like Urban Outfitters posted less favorable results this week. Macy's saw a 3.3% decline in same-store sales and issued a cautious outlook, while Urban Outfitters is planning to overhaul its struggling stores.

However, large retailers such as Walmart and Target reported stable consumer spending environments in their earnings calls. Walmart CFO John David Rainey stated, "We have not seen any incremental fraying of consumer health. I wouldn't say strength, but lack of weakness."

Inflation and higher interest rates have dampened U.S. consumer spending compared to pandemic peaks, but there's no drastic decline. Instead, shoppers are being "discerning and very choiceful" about where they shop, according to Macy's CEO Tony Spring.

"In an environment where consumers are searching for value, it's challenging for Macy's to differentiate itself from competitors with more mindshare on value," wrote Citi analyst Paul Lejuez in a note Thursday.

"Mass merchants are key destinations for consumers during this period of stress," wrote UBS analyst Michael Lasser. "Consumers can capitalize on compelling values, find new and innovative products, and consolidate trips. We see no reason why this trend should end anytime soon."

UBS analyst Michael Lasser raised the firm's price target on Target to $200 from $185 and keeps a Buy rating on the shares. UBS sees Target's Q2 results as an initial but powerful first step in restoring the upside case on the company's stock, telling investors that here was much more to like than not to like from the release, highlighted by brisk traffic growth, healthy gross margin gains, accelerating other income growth, and the return of share buybacks. Target could build on what this quarter began, and not only could estimates move higher, but the multiple has a good chance to move to the higher end of its 5-year range, UBS argues.

Besides, UBS raised the firm's price target on TJX to $148 from $134 and keeps a Buy rating on the shares. UBS views TJX as capable of taking major market share from Department Store peers over the next few years and thinks its newer businesses such as HomeSense and Sierra Trading Post have big potential, as does its international operation, the analyst tells investors in a research note. The firm forecasts TJX delivering a 12.5% 5-year EPS compound annual growth rate and thinks the stock will move toward its price target as TJX continues to take share and deliver strong earnings reports.

Barclays analyst Adrienne Yih raised the firm's price target on TJX to $136 from $114 and keeps an Overweight rating on the shares following the Q2 beat. The firm believes TJX will continue to take share both domestically and internationally, as it continues to execute on its "read and react" model.

Source: Fortune, MarketWatch, Barron's, The Fly

by moomoo News Olivia

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Clauchen : Good earnings alleviate concerns of consumer spending? Doesn’t that mean people are still spending absolutely ridiculous